Understanding Uber Money and its threat to the financial industry; plus 14 short takes on top developments

Hi Fintech futurists --

In the long take this week, I look at four different strategic lenses to analyze Uber's official entry into financial services with Uber Money. We discuss gig-economy focused neobanks, employer-provided personal finance management apps, car financing and insurance as a service, and of course the global super app competition. It doesn't seem that the financial industry will collapse from this announcement -- but there are fewer and fewer places for sleepy banks to hide.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

So maybe you can tell I am not terrified of this offering, as it relates to the position of banks in the world. But it would be a mistake to underestimate it, and in particular, to miss the various trends that are pulling this together. One lens to understand these developments is the Gig Economy theme. The 2008 Great Recession created high levels of unemployment across the world, and the technology sector was ready with solutions. It is expensive to have employees – they have all sorts or rights, like the ability to organize and the expectation of health and pension benefits. On the other hand, contractors have no such expectations and can be hired and fired at will. To that end, contracting gig websites – from home repairs, to deliveries, to driving pseudo taxis – sprouted like flowers after a fresh rain.

The issue with lots of part-time work, other than being a psychological nightmare for people that want full-time work, is that you lack the benefits and stability employers provide. In the nonsense world of the United States, employers are responsible for worker healthcare and retirement, and compete to provide such benefits. One could reasonably expect that such social benefits should come from society, but that’s a topic for another day. So when you take away employers, and replace them with venture blitz-scaling start-ups like Uber, the end result is a lot of people who have earnings volatility, a lack of access to traditional financial services, an inability to buy a home under a mortgage, a lack of affordable health care, and a variety of other monsters.

No good pain point is left unserved, however. A number of neobanks have been formed to help with exactly these problems, across categories. The examples below, including Oxygen and Joust, offer a full financial solution for contractors. This includes accounts and consumption smoothing through credit, but it also includes things like merchant gateways and other enabling small business and freelancer technology. Uber's entry point into finance is first and foremost competing with companies like this -- the teams trying to build good financial offerings for those with a contractor's set of problems. And these are more fully featured apps, though they are less tightly coupled and not integrated directly into Uber's experience.

If these targeted gig-banks are too niche from your point of view, we can then just highlight the US neobanks that focus on the same income/wealth demographic. The killer feature for those is credit, not information or aggregation. See Chime or MoneyLion below, with millions of customers each. Who doesn't want to get free money every week? The pro-Uber argument you could make is that Uber has advanced data on its drivers, like Amazon for its merchants. Amazon can better underwrite merchants, because it knows the web traffic to their pages on its own marketplace, and the conversion rates into purchasing a product. Similarly, Uber can project out the trips an individual driver will likely experience in their location based on the massive data set, and use that to adjust the underwriting model. But still, there is real competition.

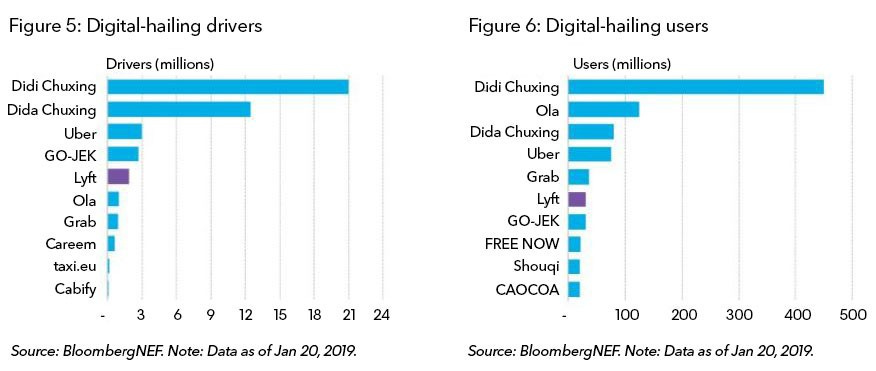

Another lens you can take to analyze the offering is by looking at personal financial management companies that focus on the employer. Two examples come to mind, though there are countless available. Hello Wallet was a fintech start-up focused on helping employers provide a Mint.com-like benefit to employees, with the concept that financially healthy employees are better at their work. You can see the screenshots below. The company was sold to Morningstar for about $50 million, and then sold off again to KeyBank. The largest analytics company was not able to sufficiently commercialize the data/analytics play, and divested to a bank, for whom PFMs are more core and strategic. Times change certainly (e.g., Plaid vs. Envestnet), but this commercialization challenge remains real. Further, Uber is just a single employer, albeit with 3 million drivers, while these PFMs had targeted a broader market.

Think also about Financial Engines. One of the original digital wealth management companies, FNGN was started in the early 2000s (way before you, Wealthfront) to target corporate workplace programs and sit on top of 401(k) retirement providers. It helped employees make better investment decisions, and focused on the place most of us actually make that investment decision. FNGN was eventually combined with the Mutual Fund Store (a store! of mutual funds!) and Edelman Financial to create a $200B+ assets under management player. Could Uber roll out a meaningful competitor? Can it offer a digital financial advisor that moderates between investments, banking, and credit to Uber drivers? Yes, but remember that for most of the drivers, the key issue is to have enough money for rent during the middle of the week.

Another banking service relevant to the Uber demographic is vehicle financing. As the number of drivers starts to hit millions and millions of people, the core thesis starts to erode. Originally, it was car-owning Americans with some spare time that were going to drive Ubers. Now, many people will rent a car and insurance package in order to provide on-demand transportation or delivery services. At first, traditional banks would take on this type of credit, but over time some like Santander have pulled out given what's actually involved on the ground. You are back in the taxi medallion business, though of course far less expensive.

People that need to borrow money to drive the car are likely to be your worst credit risk (i.e., cannot afford to buy the asset), and this adverse selection problem, and therefore credit contagion problem, prevents growth. A number of car financing and insurance start-ups have created packages for Uber drivers with an all inclusive price. Take for example Fair, which can get you a vehicle for $200 a month. The company just got a $500 million credit facility from Japanese financiers Mizuho and Softbank. That we are seeing venture-type risk assets finding their way onto the balance sheets of these start-ups is a symptom in itself. Still, Tesla offers its own smart car insurance -- perhaps Uber has a data advantage in such a line of business as well.

Finally, and perhaps most importantly is the strategic lens from the perspective of the Asian super apps. I have written about this consistently, so let's not belabor the point. By analogy, in the West, the operating systems of phones are a competitive marketplace of ideas mediated by the technology platforms of Apple and Google. Whichever point solution is most preferred by customers is the point solution likely to win an app icon location in your phone. Sort of like dog-eat-dog unbridled capitalist competition. In the East, however, super-apps are nested operating systems that pull features into themselves from the rest of the phone. They combine e-commerce, travel, taxi, money movement, savings, and wealth management -- among a dozen other things too. Sort of like a centrally planned utopia of functionalities. Uber and Facebook both have central planning envy.

Look, Western companies can do this too! In India, for example, Google is following this playbook aggressively with Google Pay. They have just powered 320 million transactions through the universal payment interface (an instant real-time payment system developed by National Payments Corporation of India) over the last few months -- twice more than Paytm! They've also aggregated various business lines into the app, which you can see below. Similarly, Uber has recently bought the Middle-Eastern Careem for $3.1 billion. The reason Careem beat out Uber and required this acquisition could in part be explained by its financial integrations around Careem Pay. In geographies where banks are too sleepy to build big brands and attention platforms, tech companies have the opportunity to bundle into finance much more closely and grab the consumer.

So to summarize, we have a few frameworks and comparisons to analyze Uber's official entry into finance:

Gig economy neobanks focused on credit

Employer personal finance management apps

Car financing and insurance as a service

The global super app competition

You are very likely to hear the story in that last option repeated over and over again, overlayed perhaps with the number of app users and something about Libra. But it isn't the only story. If I ran Uber, would I focus on the financial pain points of my captive drivers? Maybe. That's the most readily available customer segment, whose payments I already touch every day. But I would also focus on the financial pain points of my users, and perhaps try to enable other financial services categories with the type of infrastructure that drivers have received for transportation? Can we have gig economy financial planners, insurance experts, blockchain integrators, wealth managers? Uber already knows who needs the help.

Featured Interviews, Podcasts, and Conferences

Fintech used to be a back-office support function, now it's defining an industry. Check out my Op-Ed in Investopedia about the history and future of financial technology.

Interview with Blocks99. In this discussion, we focus on the financial crisis, entrepreneneurship, and why decentralized finance infrastructure is needed in the industry.

Are banks losing the brand war to tech firms? Great podcast with American Banker's Penny Crossman. We don't buy Tylenol from the Tylenol store. Why do we buy Wells Fargo bank accounts from Wells Fargo?

From Crypto to Decentralized Finance. Another great podcast with Will Beeson at Rebank: Banking the Future. Check out our conversation and subscribe here.

Short Takes

Even in advertising, digital advisors face an uphill battle. Personal Capital is using television ads to draw attention to its human advisors, in addition to its software. A decade is a long enough time for the finanical industry to catch up, and at least mimic technological innovation, such that customer acquisition costs for disruptors remain high.

Greensill eyes global expansion as it secures an extra $655 million from SoftBank. Digital lending for invoices is still rocking a $4 billion valuation in the UK markets. This is a real use case, but the scale is surprising.

There’s a Dark Side to Zero-Cost Investing You Can’t Ignore. Funds have fixed costs, largely in compliance and legal protections, and if we carve management fees to 0% hoping for cross-sell, we'll be the ones to lose. Maybe -- or maybe we don't need all these funds?

HSBC-backed fintech Bud to re-focus product stream after restructuring. Open banking isn't so easy. After laying off 20% of the team, the company is moving from helping financial firms embed more finance product into their offering, to helping non-financial firms embed more finance product into their offering.

German banks call for digital euro. The banks in question are part of the Association for German Private Banks, are are making a case for combining identity and a digital currency backed by the European central banks. The continent will leave our the UK, I imagine. This is a competitive issue. To double down on the point, read Tencent to Lead Drafting of International Blockchain-Based Invoice Standards.

Raiffeisen Among 18 Banks in First Global Tokenized Collateral Trial and Paxos to launch settlement of U.S.-listed equities after SEC's no-action letter. Both of these are pointing to incremental progress in digitizing institutional capital markets, with R3's Corda being used for a collateral management platform implementation, and Paxos' post-trade systems used for equities.

Starbucks to test digital asset app from Bakkt. If you're big, and part of the $50 billion market cap ICE exchange, pushing another corporate giant to roll out your payments platform is the right move. Important to note how closely the roles of payments, exchange, and capital markets are in crypto native companies.

Introducing: Activate by Codefi Networks - A new way of launching and participating in decentralized networks. If you think tokens are only tokens if they are on decentralized, public chains, and that they should be used for engagement instead of speculation, check out this project.

Twitter will be banning all political advertising — albeit with “a few exceptions” like voter registration. Dorsey understands that this isn't a free speech issue, it is a software fraud issue. To straight up quote: “Internet political ads present entirely new challenges to civic discourse: machine learning-based optimization of messaging and micro-targeting, unchecked misleading information, and deep fakes”.

JPMorgan Arms Coders With Trading Licenses as Quants Advance. The capital markets are for robots! If you are not a robot, you shouldn't be trading. Everyone else, buy that 0% management fee BlackRock or Vanguard fund and trade it on Robinhood, I guess.

Ola in talks with Microsoft for $200 million funding. Ola is India's version of Uber, with over 200 million of riders. This deal is about "connected vehicles", which I take to mean artificial intelligence and operating systems for smart cars. Also, given Uber now offers bank accounts, it can be an operating system for Indian banking too.

Google’s Coral AI edge hardware launches out of beta. Google is releasing hardware devices optimized for machine learning and computer vision, with cheap USB and Internet connected sensors. The name of the game is edge computing. Along the same vector, Microsoft furthers $5 billion IoT plan with new Azure features, targeting the 20 billion or so connected devices end of next year.

Also, Google to Buy Fitbit for $2.1 Billion to Boost Hardware. The acquisition is being done at a 70%+ premium and is purchasing 27 million users. This is a bit confusing -- Apple Watch isn't a crazy hit, and the Fitbit footprint doesn't seem massive. But the capability is important for Google, and the shares are still meaningfully down from IPO (from $20 to $7).

Facebook Reveals Computer Vision Research That Could Hasten Development of AR Smartglasses. I don't know -- the buzzwords are all blending together! But this article has a number of wild visualizations showing how image recognition leads to the ability to swap out real objects for 3D renderings.

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.