Web3: $5MM Yuga Labs and MoonPay lawsuit; Proof Of Reserves from Bybit and Crypto.com; Gnosis blockchain PoS merge

Also Starbucks, Coinbase, and more SBF

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

DEFI & DIGITAL ASSETS: Bybit Joins Trend, Releases Merkle Tree-Verified Proof Of Reserves

CRYPTOECONOMICS & PROTOCOLS: Gnosis Executes Its Own Merge In Shift To PoS In Boost For Staking

DAOs, NFTs & Metaverse: Yuga Labs, Moonpay Faces Lawsuit Over Celebrities NFT Promotion

This content is premium only — give it a share, and leave suggestions in the comments!

DeFi Protocols And Digital Assets

⭐ Bybit Joins Trend, Releases Merkle Tree-Verified Proof Of Reserves - Cointelegraph

1) Disclosing Bybit main users asset wallets (excluding other assets and non consolidated wallets are too many to list ~+20%). Around $1.9B. Bybit is also working on POR solutions such as Merkel Tree on UID level. portfolio.nansen.ai/dashboard/bybitCrypto exchange Bybit has launched a merkle tree-based proof-of-reserve system, meant to increase transparency and confidence in the exchange custodying user funds. This type of approach has been in the spotlight after the FTX collapse, which totally — to say the least — didn’t keep track of reserves very well. We've also previously highlighted Chainklink Labs unveiling its proof-of-reserve (PoR) product to force greater disclosure on centralized exchanges.

Bybit joins Binance, Kucoin, OKX, and Crypto.com by displaying holdings and assets deposited into the exchanges. Kraken, Bitmex, and Gate.io use similar approaches. Bybit also released its reserve wallet addresses on November 16, showcasing that the exchange has almost $2B worth of BTC, USDT, ETH and USDC.

Binance’s “proof of reserve” report doesn’t address effectiveness of internal financial controls, doesn’t express an opinion or assurance conclusion and doesn’t vouch for the numbers. I worked at SEC Enforcement for 18+ yrs. This is how I define “red flag.I'm sorry but no. This is not PoR. This is either ignorance or intentional misrepresentation. The merkle tree is just hand wavey bullshit without an auditor to make sure you didn't include accounts with negative balances. The statement of assets is pointless without liabilities.BREAKING: Binance Releases Proof of Reserves System Starting with BTC (Bitcoin), every user can verify the assets they own on Binance using a Merkle tree.Tree of Alpha @Tree_of_AlphaThat said, there’s plenty of pushback to the current implementations.

Kraken CEO Jesse Powell objected to the Binance numbers, since a complete proof of reserve audit must include not just assets, but also client liabilities, user-verifiable cryptographic proof that each account was included in the sum, and signatures proving the custodian's control over the wallets. Binance also came under fire as its proof of reserves show that it is 97% collateralized, excluding assets lent to users through margin accounts, indicating that Binance did not achieve the 1:1 ratio of reserves to customer assets. Grayscale is hesitant to release its information due to security concerns, and Gate.io came under scrutiny after showing that its reserves included loaned funds.

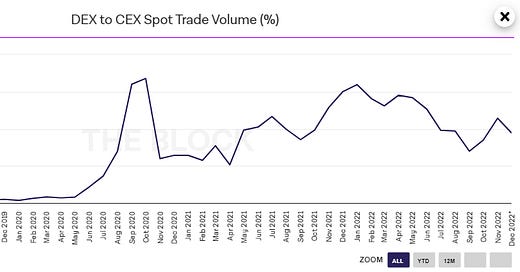

One day — and bear with us — maybe users will expect to actually put their assets on-chain, and then they can know exactly what they have! This is the actual point of having blockchains in the first place. But, for context, DEX share of total volume is still floating only around 10% of total volume.

⭐ Crypto.com Releases Proof-Of-Reserves Data Showing Client Assets Are Fully Backed - CoinDesk

⭐ Coinbase Offers Free Trades From USDT To USDC - The Defiant

Tranchess Launches qETH For Non-Custodial Liquid Staking On Ethereum - The Block

Why Some SushiSwap Stakers Are Jumping Ship - Decrypt

SushiSwap CEO Reveals DEX Lost $30MM On LP Incentives This Year - Cointelegraph

Grayscale DeFi Fund Starts Trading - The Defiant

Cryptoeconomics And Blockchain Protocols

⭐ Gnosis Executes Its Own Merge In Shift To PoS In Boost For Staking - The Defiant

The Gnosis Chain merge was almost as boring as the Ethereum merge. This is the best possible outcome! Huge congrats and thanks to @dapplion @nethermindeth, @URozmej, @jmederosalv, @mandrigin, @plato_gno and many many others!L1 network Gnosis Chain became the second blockchain to transition to a PoS consensus via a chain merge. Gnosis Chain was created in November 2021, when multi-sig safe provider Gnosis merged with Ethereum sidechain xDAI. Gnosis allocated 400,000 GNO tokens worth $200MM at the time to programs incentivizing development, with a priority on Gnosis dApps, such as Circles and DappNode.