Web3: Cracking the $18B UST stablecoin; Solana Pay NFT loyalty cards for merchants; Juno DAO's $35MM token confiscation from whale; Polkadot Cross-Chain Messaging

Gm Fintech Futurists —

Welcome to our Web3 newsletter, focused on covering the overall progress in the metaverse, NFTs, and DeFi. If you want to go deeper with our weekly long takes and develop a view on the space, check out our premium features below.

DeFi Protocols and Digital Assets

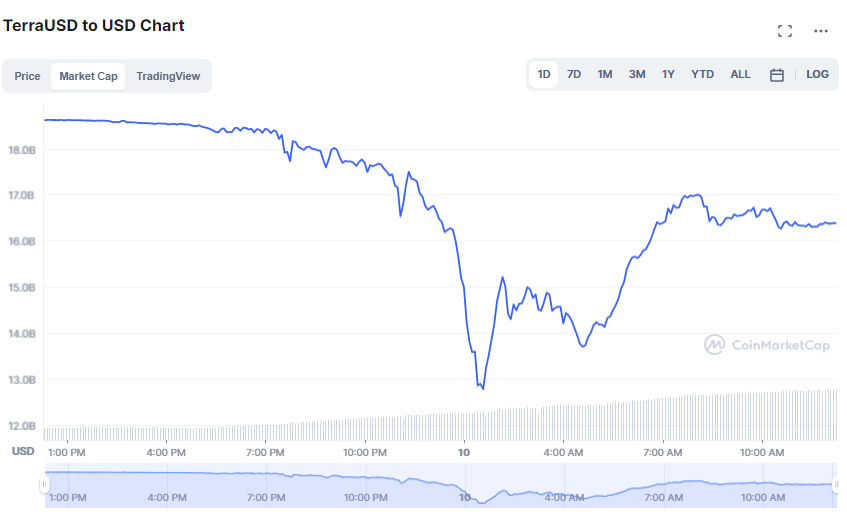

⭐ Terra’s UST Rebounds to About $0.90 After Depegging by 40% - The Defiant

We may end up doing a Long Take on this later, it’s that important. In the meantime, sort through the above thread to understand how $18 billion of stablecoin value can shed $5 billion off in a day. The core of it is that (1) UST is backed by a floating asset, which is (2) sort of like an equity correlated to the adoption of UST, and was (3) also cashed in for $1B+ of Bitcoin, which also fell hard. A run on the bank, and in particular on the concept of “Full Faith and Credit” as it relates to inflation-bootstrapped crypto protocols.

⭐ Hop Protocol Reveals Details of Hop DAO and Optimism-Style Airdrop - Coin Telegraph

Hop Protocol is a way to connect different scaling solutions, facilitating a better user experience when moving assets, and currently supports the transfer of funds ETH, USDC, MATIC, DAI, and USDT from and to the networks Mainnet, Polygon, Optimism, Arbitrum, and xDai. Cross-chain transactions are facilitated by Bonders who earn fees by providing liquidity on the destination chain. Users send tokens to Bonders on the source chain, who then send tokens to the user on the destination chain. Transaction fees are paid for in the origin chain’s token, meaning the $HOP token will be used exclusively for governance.

Early users are going to be airdropped tokens for their use. By airdropping tokens, L2s empower their communities to make impactful decisions and incentivize usage. The underlying roll-up or zero knowledge proof technology is often complex and hard to understand for regular users, so such incentives are necessary for growth. However, too much governance or DAO structuring may similarly inhibit participation.

How I Will Play The $ASTRO Wars - n1ce

Terra Peg Mechanism in Doubt as UST Crashes to $0.67 - Coin Telegraph

Tether Reserves: At It Again - Sun Zu Lab

PRISM: Liquidation-Free Collateralized Lending and Derivates - ConsenSys Cryptoeconomics

Cryptoeconomics and Blockchain Protocols

⭐ Polkadot Now Lets You Natively Send Tokens Across Parachains - The Block

One of the ways that blockchains are scaling is by splitting into multiple component chains — parachains, shards, supernets, subnets, and so on. This fragmentation powers performance, but hurts interoperability and liquidity. Polkadot, one of the largest such ecosystems, created a cross-chain mechanism for moving value around. Polkadot’s parachains inherit security from the central relay chain, meaning that the transfer of assets in DeFi, for example, would not rely on traditional bridges, which mint wrapped tokens on the source chain. Assets are therefore exposed to less risk, such as the hacking of bridges.

However, Polkadot’s nascent ecosystem still lacks the big-name protocols seen on other ‘layer-zeros’ such as Cosmos (e.g., Terra and Osmosis). If community engagement declines, will Polkadot’s unique architecture and XCM between parachains lead to a greater network effect and increased value accrual for users? Let us know your thoughts on our Discord.

Zero-Knowledge KYC, and the Potential of Secret.network - Recovering TradFi Chad

FIFA Announces Partnership with Blockchain Algorand - FIFA

Fintech and Institutional Adoption

⭐ Solana Pay Transaction Requests Bring On-Chain Interactivity To The Off-Chain World - Solana

Solana Pay is a payment processor for merchants. Whereas Paypal may charge 1-2% of a QR code transaction, here we can see fees at less than a cent per transaction. Sellers receive payments onchain rather than waiting for transactions to settle through the banking rails. The Solana-native Phantom wallet can use NFT and QR code functionality to enable loyalty discounts, which are automatically applied on check-out. Merchants can accept stablecoins, while also building modern community.

We find these developments interesting, though would point to the difficulty of bootstrapping go-to-market adoption (see Coinbase Pay as an example). Further, Solana’s occasional network downtime is a barrier as well.

What Does Binance’s Investment in Twitter Mean for the Social Network’s Future? - Blockworks

Block Reports $1.73 Billion in Bitcoin Sales via Cash App During Q1 2022 - The Block

DAOs, NFTs and the Metaverse

⭐ Juno’s DAO Votes to Confiscate $35M in Tokens From Whale in Messy Dispute - Blockworks

We are beginning to see an evolution of DAO politics into redistribution of assets, a concerning trend. In a previous edition, we saw Build Finance DAO suffer a ‘hostile takeover’ where a large token holder gained control of the DAO treasury leading to losses of $470,000. Here, the community did the opposite, voting to confiscate assets from a large holder that may have gotten them by breaking certain rules.

DAO are group of people, who have collective ideas about fairness. Blockchains are meant to be software-based property rights systems that enforce ownership, but groups of people can still ignore software and reboot the network or relaunch the token in a way that prejudices certain parties. Think of Taylor Swift re-recording her music to avoid paying the music labels. This highlights both the power and unregulated nature of social consensus in a DAO.

Coinbase NFT Draws Fire as a ‘Web3 Instagram’ - The Defiant

Why Avalanche Is The Killer App for NFT Games: Ava Labs President - Decrypt

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts