Web3: International Police in the Metaverse; Aave's GHO stablecoin on track, while Near's USN shuts down; Aptos tokenomics and inflation

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

DEFI & DIGITAL ASSETS: Aave Releases Technical Details Of GHO Stablecoin, and Near Protocol’s USN Stablecoin Shut Down After Suffering $40M ‘Collateral Gap’

CRYPTOECONOMICS & PROTOCOLS: New Blockchain Aptos Unveils Controversial Tokenomics, APT Incentive Plans

DAOs, NFTs & METAVERSE: Interpol Launches ‘First Ever Metaverse’ Designed For Global Law Enforcement

This content is premium only — give it a share, and leave suggestions in the comments!

DeFi Protocols And Digital Assets

⭐ Aave Releases Technical Details Of GHO Stablecoin and Near Protocol’s USN Stablecoin Shut Down After Suffering $40M ‘Collateral Gap’ — The Defiant

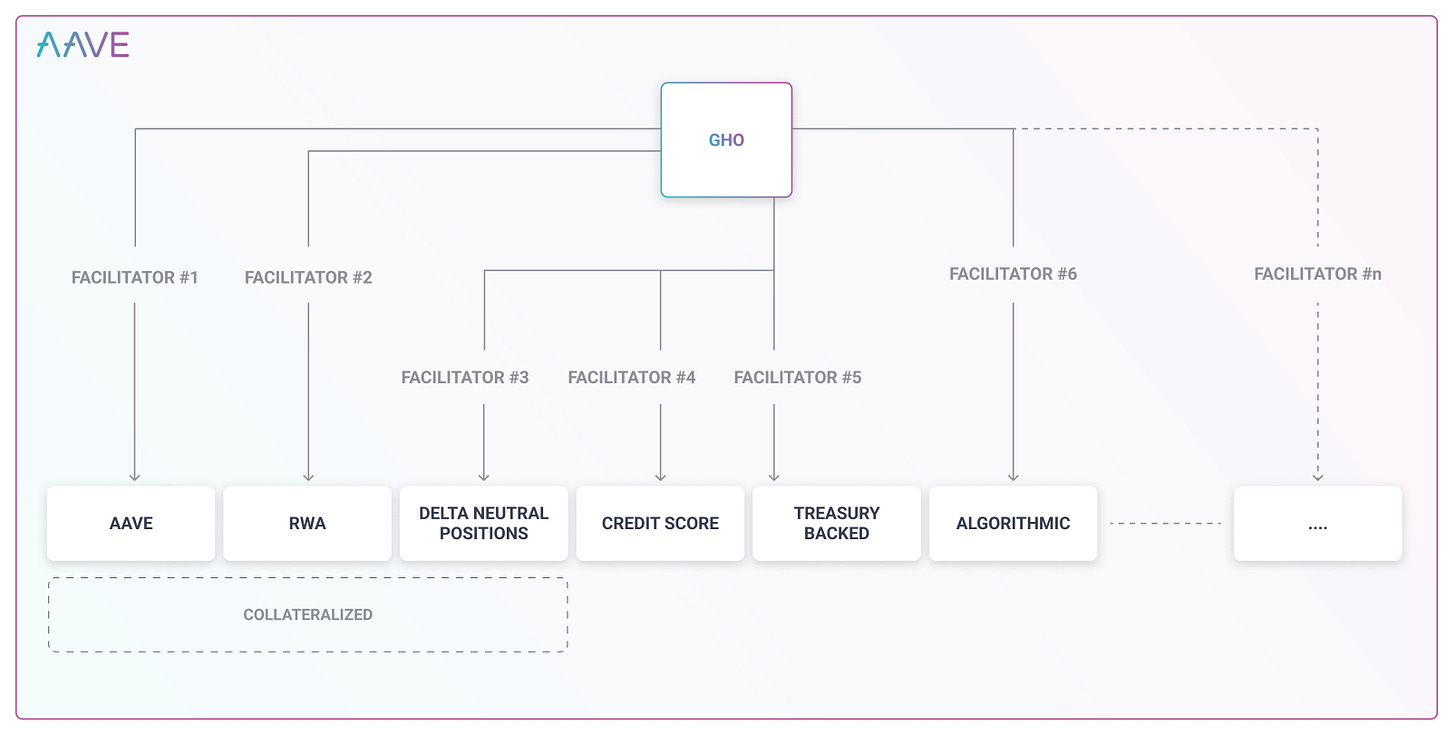

Here is all you need to know about $GHO, a flexible and decentralized stablecoin by @AaveAave. How does it aim to solve the stablecoin trilemma? Let's find out 🧵👇Aave, a DeFi protocol with over $5B in TVL, has released a technical paper on GHO, its upcoming decentralized stablecoin on the Ethereum Mainnet. Technical changes to GHO include using Aave V3 as GHO's facilitator as opposed to the Aave V2 market on Ethereum. Let's go over GHO generation and burning.

To mint GHO, borrowers / users must supply collateral, and when a borrower repays a borrow position, the GHO facilitator / protocol burns that user's GHO. The facilitators, of which there will only be one at launch, can also generate GHO and they are the only ones that can do so. For each facilitator, governance will approve a bucket, which is a a representation of the upward limit of GHO a specific facilitator can generate. That bucket level is updated to reflect the amount minted upon a borrow transaction — see here for the formula. When facilitators burn the original GHO supply, the bucket level automatically decreases. All the interest payments accrued will transfer to the AaveDAO treasury. Further, holders of stkAAVE (i.e., staked AAVE) can mint GHO at a discounted rate.

Aave V3 also has the following features such as (1) isolation mode, in which users can generate GHO with currently supported assets on the Aave Protocol while keeping the stablecoin collateralized; (2) eMode (Efficiency Mode), which acts as a stabilizing factor in market volatility due to its higher LTV; and (3) Portal, in which GHO can be distributed across networks whilst being minted on Ethereum.

There has been a lack of investor confidence in decentralized stablecoins post-Terra collapse, and for good reason. Purely financially engineered recursive assets will fail over a long enough time horizon. Aave will be in direct competition with MakerDAO's DAI stablecoin, as Maker undergoes a variety of governance challenges. Near’s USN stablecoin just shut down. And the US Congress is reportedly working on legislation prohibiting certain algorithmic stablecoins for two years. Finally, interest rates on dollar deposits outside of DeFi are higher right now than interest rates on stablecoins, which, you know, hurts demand.

👑 See related coverage 👑

Coinbase Removes Commission Fees For Customers Buying Or Selling USDC Via Any Fiat Currency - Blockworks

Coinbase To Significantly Benefit From $1.6B Transfer Of MakerDAO's USDC, Analyst Says - CoinDesk

CBCDs Can Work With Stablecoins, Central Bank Trial Finds - CoinDesk

Circle Partners With Axelar On Cross-Chain Initiative For USDC - The Block

What Is Comtech Gold (CGO) And How Does It Work? - Cointelegraph

Cryptoeconomics And Blockchain Protocols

⭐New Blockchain Aptos Unveils Controversial Tokenomics, APT Incentive Plans - CoinDesk

Aptos Labs launched its Layer-1 blockchain, the "Solana Killer," earlier this month. For context, see our analysis of the Move ecosystem and what remains of the Facebook Libra project, which is the precursor to Aptos. However, the whale-dominated token distribution and a TPS lower than that of Bitcoin unleashed some profound community backlash.