Web3: Limit order book blockchain Sei raises @$800MM; Avalanche Subnet for T. Rowe Price & Wisdom Tree FX trading

Also ETH unstaking and Uniswap in the Apple appstore

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

CRYPTOECONOMICS & BLOCKCHAIN: Sei Labs Raises $30MM To Build The Layer 1 For Trading

FINTECH & INSTITUTIONAL: T. Rowe Price, WisdomTree Join Avalanche Subnet For Forex Testing

CURATED NEWS

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Web3 Short Takes

⭐ Sei Labs Raises $30MM To Build The Layer 1 For Trading - Yahoo Finance

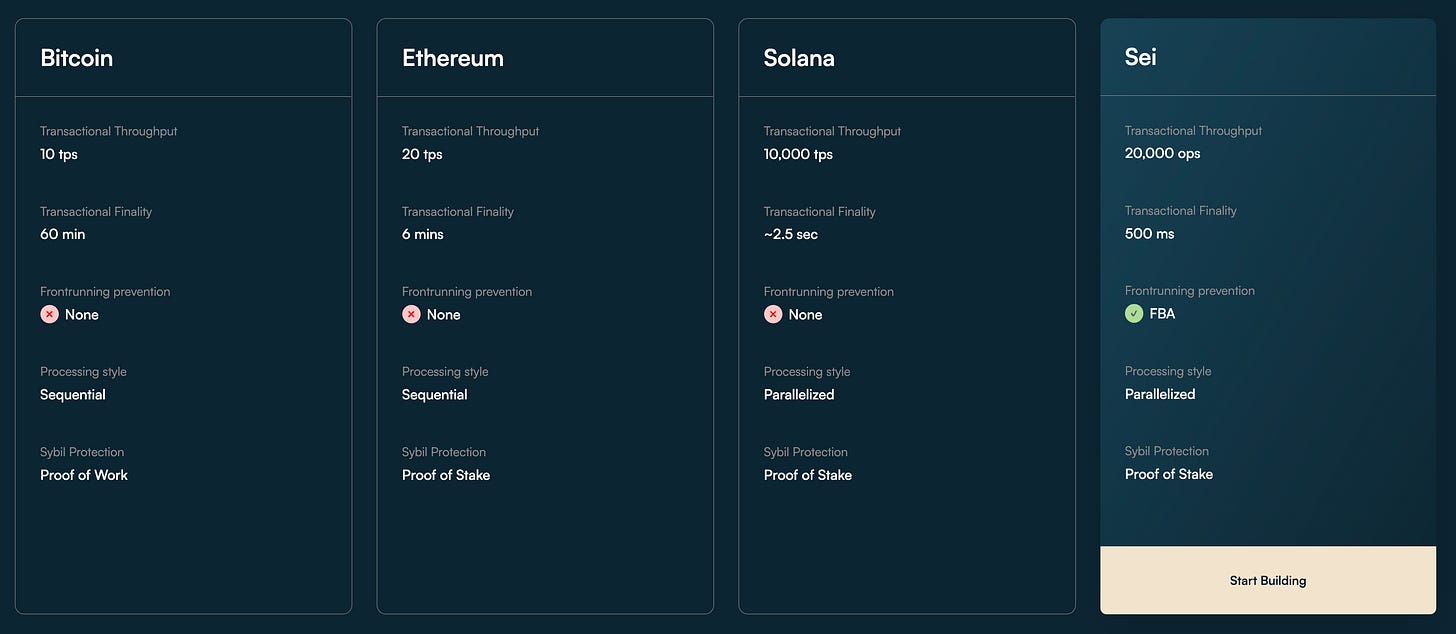

Sei, yet another Layer-1 blockchain, has raised $30MM from Jump Crypto, Distributed Global, Multicoin Capital, Asymmetric Capital Partners, Flow Traders, Hypersphere Ventures, and Bixin Ventures, valuing it at $800MM — twice the value rumored just a month ago. Mainnet launch is targeted to the second quarter of the year.

Sei is the first order book-specific L1 blockchain designed for crypto trading, enabling Central Limit Order-Books (CLOBs) on DEXes. CLOBs are the market clearing mechanism used by most global exchanges, displaying the current bid and ask prices, the number of shares or contracts available at each price level, and the aggregate size of orders waiting to be executed at each price level. Those variable change in real time as market participants come and go in real time.

In crypto markets, CLOBs have largely been available on centralized exchanges (CEXes), and in nascent form on alternative L1s like Solana. Bringing an order book on-chain is computationally intensive and cost-prohibitive. As a result, Automated Market Makers (AMMs), which assume more static market pricing, are the go-to trading method in DeFi. The opportunity cost is that CLOBs offer lower slippage and tighter spreads, whereas with AMMs, slippage may be low for small orders, but it rises exponentially with large orders.

This is the value proposition of the Sei blockchain, which intends to bring transaction ordering, block processing, and parallelization that are specialized for exchanges. If you want to read about how Sei uses the Cosmos SDK and Tendermint Core and leverages Twin-Turbo consensus to verify the validity of a transaction, see here.

Sei's Cosmos SDK enables validators to process blocks by configuring BeginBlock, DeliverTx, and EndBlock logic. Specifically, with Endblock parallelization, Sei handles all CLOB-related orders using its native order-matching engine, which processes independent orders in parallel at the end of the block, allowing for more orders to be dealt with while charging lower gas fees. Sei's native order-matching engine uses frequent batch auctioning (FBA) to match and fill trades. This matching engine allows DEXes building on top of Sei to deploy their CLOBs while maintaining their order books, providing the functionality to create markets and enable trading.

It's worth noting that Sei Network isn't the first to introduce CLOBs on-chain, with the DEX Serum giving it a shot on Solana pre-FTX fraud. A few years back, OneSwap tried augmenting CLOB and AMM elements into a hybrid exchange. And as of late, DEX GammaX launched its own CLOB-based model on testnet, attempting to offer a wider selection of perpetual trading pairs than other DEXes.

We are excited about applications that take advantage of the growing processing power of computational protocols, and order books are one of the low hanging fruit. That said, we wonder whether having a specialized venue, vs. a more general purpose venue, is the right answer.

⭐ T. Rowe Price, WisdomTree Join Avalanche Subnet For Forex Testing - Cointelegraph

Avalanche has launched its Evergreen Subnet called "Spruce" with T. Rowe Price Associates, WisdomTree, Wellington Management, and Cumberland.