Web3: SEC targets staking and stablecoins; Binance adds Zk-Snarks to Proof-of-Reserves; Brazil oldest bank powers crypto tax payments

Regulators seize the moment

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

FINTECH & INSTITUTIONAL ADOPTION: Brazil’s Oldest Bank Allows Residents To Pay Their Taxes Using Crypto

DEFI & DIGITAL ASSETS: Paxos To Stop Minting BUSD Stablecoins For Binance & Kraken To Shut US Crypto-Staking Service, Pay $30MM Fine In SEC Settlement

CRYPTOECONOMICS & PROTOCOLS: Binance Deploys Zk-Snarks On Proof-Of-Reserves System

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Fintech And Institutional Adoption

⭐ Brazil’s Oldest Bank Allows Residents To Pay Their Taxes Using Crypto - Cointelegraph

Banco do Brasil, Brazil's oldest bank, now allows Brazilian taxpayers to pay their tax bill with Bitcoin or Ethereum in a joint initiative with Brazilian-based crypto firm Bitfy. The option, for now, is exclusive to Bitfy users, which will act as a collection partner for the bank. The move comes after Rio de Janeiro started accepting cryptocurrencies as tax payments last October.

Bitfy's tax process involves selecting the cryptocurrencies to pay the tax, and capturing the barcode (i.e., the boleto approach, a popular payment method in Brazil). The tax information will appear to be validated before payment confirmation, and the conversion and settlement in Reals or the chosen cryptocurrency will occur instantly.

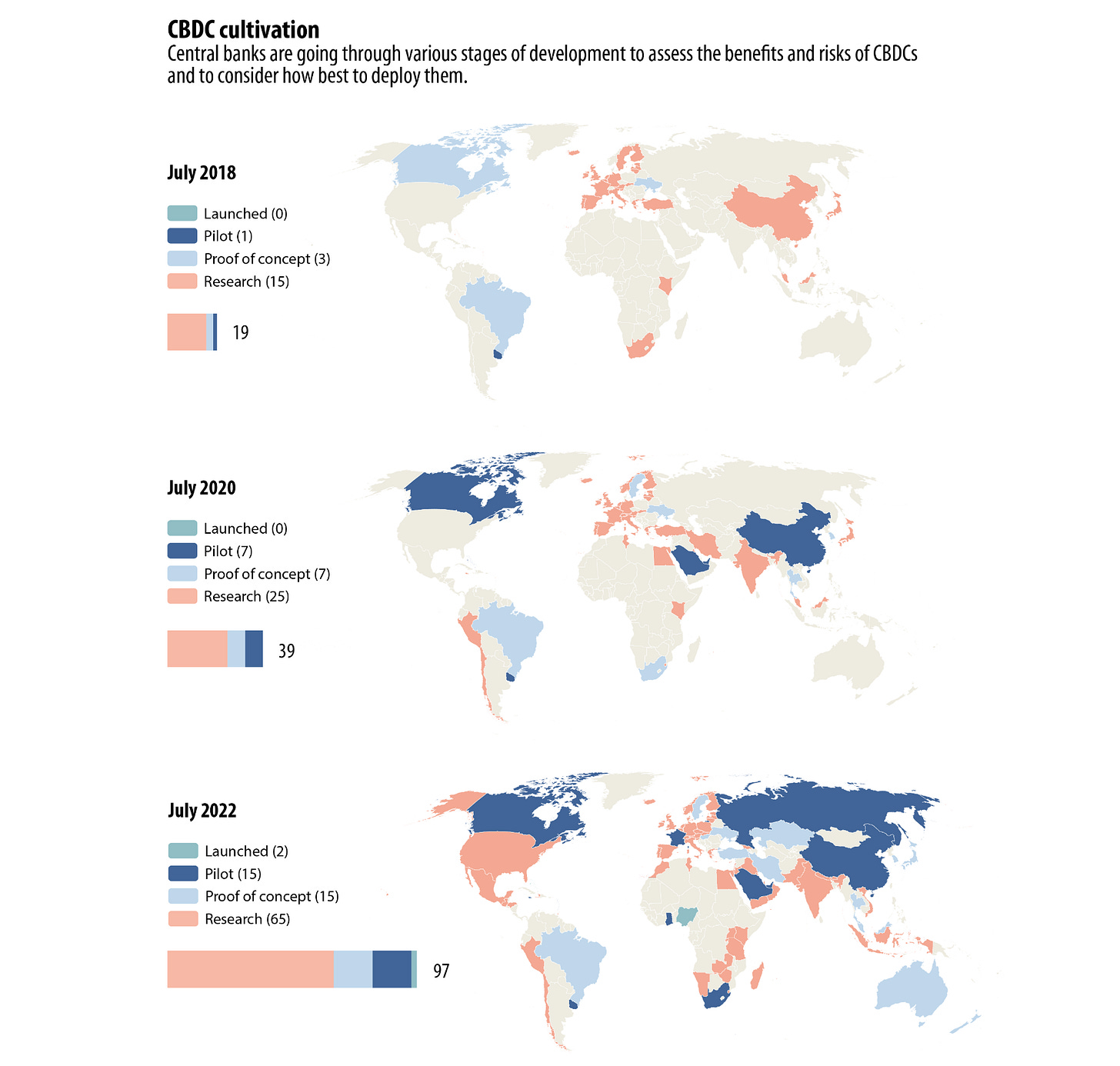

Banco do Brasil is the oldest bank in the country founded in 1808, with over 80,000 employees and a $20B marketcap. We are encouraged to see digital asset adoption from the top of the industry, even if this is targeted to shrink the $110B annual tax evasion in the country. We expect developing countries to benefit the most from novel financial infrastructure, including the whole range of experiments, from CBDC tests (e.g., China, USA, UK, Brazil) to adoptions of Bitcoin as a legal tender (e.g., El Salvador, Central African Republic).

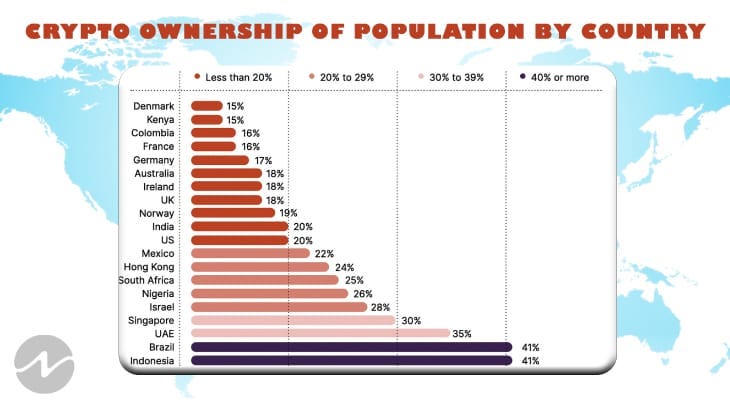

End of the day, banks will reflect customer demand, and according to Brazil has some of the highest crypto adoption on record.

⭐ Three Arrows Founders Roll Out Bankruptcy Claims Exchange—But US Residents Are Barred - Decrypt

Voyager Users Will Need Binance US Accounts To Get Their Money Back - Decrypt

China To Launch National Blockchain Research Center - Cointelegraph

German Dekabank Plans To Launch Tokenization Platform By 2024 - Cointelegraph

DeFi Protocols And Digital Assets

⭐ Paxos To Stop Minting BUSD Stablecoins For Binance and Kraken To Shut US Crypto-Staking Service, Pay $30MM Fine In SEC Settlement - Cointelegraph & CoinDesk

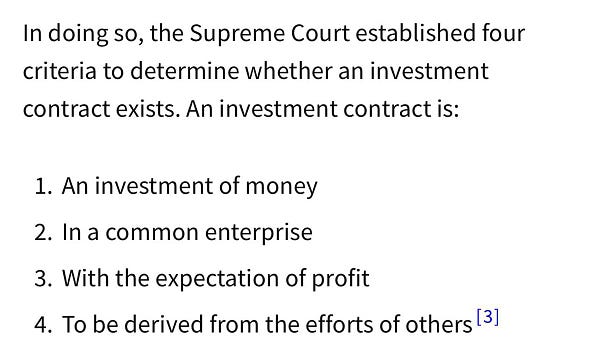

The SEC has labelled BUSD as an “unregistered security”, and is suing its issuer, Paxos. But how on earth is a STABLECOIN considered a security, when it clearly doesn’t meet the Howey Test criteria. No one has ever had “the expectation of profit” when buying $BUSD.The SEC issued a Wells Notice to blockchain infrastructure platform Paxos, alleging that BUSD is unregistered security. The New York Department of Financial Services (NYDFS) ordered Paxos to halt the issuance of new BUSD. Paxos highlighted that all existing BUSD tokens will remain fully backed and redeemable until February 2024. Customers can redeem their funds in USD and convert their BUSD tokens to another Paxos-issued stablecoin, Pax Dollar (USDP).

Important not to conflate self-staking with staking-as-a-service. I think @SECGov will only go after the latter, though IMO there are strong arguments that neither is a security.1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.Brian Armstrong @brian_armstrongThe SEC had also sued crypto exchange Kraken for failing to register the sale of its staking-as-a-service program before offering it to retail customers. Kraken will pay a $30MM fine and close its staking-as-a-service operations as a result. Besides Ethereum, networks such as Solana, Polkadot, and Avalanche also use staking to secure their blockchains.

4/5 The fact that these assets hold underlying treasuries, makes them a lot like a money market fund, exposing holders to a security, even if they don't earn from it. Making an argument (not one I agree with, but a reasonable enough one) that they can be a security.How on Earth does BUSD register as a security? Where is the expectation of profit? Are y'all buying BUSD because it's going to $2? Gary Gensler is on an unhinged, unchecked crusade against Crypto and will keep doing so as long as he is permitted to.Is the US government is on an "unhinged, unchecked crusade against crypto"? Gary Gensler has claimed a position where nearly all cryptocurrencies were securities last year.