Web3: Tokenized US treasuries DeFi yield; $450MM Blur token airdrop; Polygon mainnet zkEVM launch

Also a stablecoin from Curve

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

DEFI & DIGITAL ASSETS: Flux Finance Enables Borrowing Against Tokenized Treasury Bonds

CRYPTOECONOMICS & PROTOCOLS: Polygon to Deliver Zero-Knowledge Powered Rollup & zkSync Counters Polygon With ‘Mainnet’ Rollup

DAOs, NFTs & METAVERSE: NFT Market Gets A Boost From $400M Blur Airdrop & Opensea Implements 0% Fees To Win Over NFT User Base Lost To Blur

CURATED NEWS

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Web3 Short Takes

⭐ Flux Finance Enables Borrowing Against Tokenized Treasury Bonds - The Defiant

Flux Finance, a peer-to-pool lending protocol launched on February 8, has attracted $11MM+ worth of DAI and USDC stablecoins thus far. The protocol allows users to lend their stablecoins to borrowers using the OUSG tokenized ETF, which indirectly owns treasuries as collateral. OUSG holders can leverage their treasuries position by borrowing, and then selling their DAI or USDC for more OUSG, which can then be deposited again within Flux.

The tokenized ETF product was launched last month by Ondo Finance, which also built Flux, meant to be governed by holders of ONDO tokens.

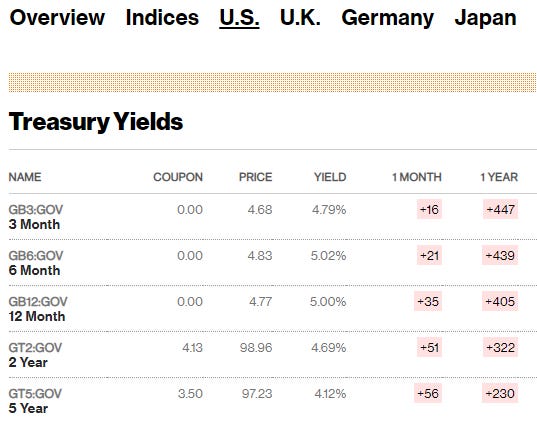

On Flux USDC has a supply APY of 4.3% and a borrow APY of 4.7%, significantly higher than yields offered on DeFi lenders Aave and Compound. The reason for this, we think, is because you would be willing to pay 4.5% to get access to 5.0% returns of the underlying investment instrument. Notably these rates float around with supply and demand for leverage, not necessarily targeting any particular outcome. Further, investors must pass KYC and AML procedures and invest a minimum of $100K to access the capital pools.

We like seeing DeFi integrate large fixed income categories onchain, and think that this is a more fruitful direction than tokenizing individual instruments. There is sufficient precedent — Goldman Sachs swapped a tokenized version of a US treasury bond for JPMorgan's stablecoin, and in 2021 Arca Labs created a fund that tokenizes US Treasury bonds via Ethereum after years of back and forth with the SEC.

Where we see risk is this particular permutation, however, is (1) the various derivative / wrapped repackagings of tokens, (2) the floating price of a fixed income ETF vs. the illiquidity and fixed yield of an individual note, (3) the rush to leverage.

⭐ Polygon to Deliver Zero-Knowledge Powered Rollup & zkSync Counters Polygon With ‘Mainnet’ Rollup - The Defiant

Polygon announced March 27 as the launch date for its zkEVM public mainnet solution. It embeds ZK-Rollup functionality into the Ethereum Virtual Machine (EVM) and uses Solidity as the programming language. Zero-knowledge proofs transmit knowledge without revealing the content of that knowledge — an essential algorithm to generate privacy in Web3.