Web3: Trading crypto exchange bankruptcy options/tokens; Optimism's new architecture; Ethereum Shanghai and liquid staking

Why does nobody ever learn?

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

FINTECH & INSTITUTIONAL ADOPTION: Crypto Investors Can Purchase Bankruptcy 'Put Options' to Protect Funds on Binance, Coinbase, Kraken

DEFI & DIGITAL ASSETS: All Eyes on Liquid Staking Derivatives As Shanghai Upgrade Nears

CRYPTOECONOMICS & PROTOCOLS: OP Hits Fresh Highs After Foundation Unveils ‘Bedrock’ Upgrade

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Fintech And Institutional Adoption

⭐ Crypto Investors Can Purchase Bankruptcy 'Put Options' To Protect Funds On Binance, Coinbase, Kraken - CoinDesk

NEWS: Cherokee Acquisitions announced a new suite of put option offerings to protect investors from crypto exchange bankruptcies. BREAKDOWN: Bankruptcy protection puts are available for #Coinbase #Binance and #Kraken, while investors carry a monthly fee for each hedge.Investment firm Cherokee Acquisitions offers "put options" to crypto investors to protect funds on crypto exchanges Binance, Coinbase, and Kraken in the event of bankruptcy. The product comes as many crypto companies filed for bankruptcy protection over the past year, freezing withdrawals and locking up (i.e., losing) investor holdings.

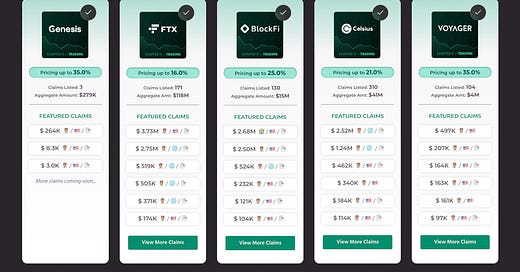

In late December, Cherokee enabled FTX customers whose funds were stuck on the exchange to sell their credit claims amid the bankruptcy process. Customers holding roughly $1B in credit claims have expressed interest in taking $0.08-$0.12 on every $1 of FTX deposit claims via Cherokee's marketplace. The FTX payout has now risen slightly.

Cherokee is also offering put options that protect account holders' deposits, paying back 100% of the assets in the account if the exchange files for bankruptcy protection within the contract period. The *monthly* options fees are (1) 0.25%-0.35% for funds on Coinbase; (2) 0.35%-0.45% for Kraken; and (3) 0.45%-0.55% for Binance. The pricing of the options is an estimate based on the firm's proprietary formula — i.e., sounds like a 5% annual chance of a crypto exchange going belly up.

We've seen a rise in bankruptcy claims platforms, with Xclaim listing $92MM in FTX user claims after pivoting its business to focus on crypto-related claims. Furthermore, the co-founders of failed crypto hedge fund Three Arrows Capital (3AC), Kyle Davies and Su Zhu, are currently raising a $25MM seed round for their new marketplace, GTX, which will enable users to trade bankruptcy claims from failed crypto firms, as well as use those claims as collateral.

You’d think with all this obvious losing of money, anyone, literally anyone, would learn a lesson.

⭐ Banking Startup LevelField Aims to Become First FDIC-Insured Institution to Offer Crypto Services - CoinDesk

Visa Eyes High-Value USDC Settlement Payments on Ethereum - Blockworks

Celsius Publishes List Of Users Eligible To Withdraw Majority Of Assets - Cointelegraph

Retail Giant Pick n Pay To Accept Bitcoin In 1,628 Stores Across South Africa - Cointelegraph

Sam Bankman-Fried Barred From Contacting FTX Employees Via Encrypted Messages - Decrypt

Feds Sanction Bitcoin, Ethereum Addresses Linked to Russian Arms Dealer - Decrypt

New Billion-Dollar Abu Dhabi Fund Will Look Far And Wide For Web3 Deals - The Block

DeFi Protocols And Digital Assets

⭐ All Eyes on Liquid Staking Derivatives As Shanghai Upgrade Nears - Blockworks

Ethereum has a much lower percentage of its token staked — less than 14% — than other blockchains, because currently there is only deposit functionality. People don’t trust one-way holes. With the Ethereum Shanghai hard fork less than two months away, liquid staking derivatives (LSD) are gaining momentum as users will be able to withdraw their staked ETH.