Weekly Fintech & Crypto Analysis: Varo, BlockFi, Kasisto, Facebook deepfakes, and Apple AR

Hi Fintech futurists --

The weekly key updates (with graphs and analysis) on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality, are below.

Over the next several weeks, I am evaluating whether the key updates provide enough value to you to be the anchor of a subscription version of this newsletter. Don’t worry, the Long Takes will stay free, and will continue to be delivered on Mondays. Shoot me feedback on this new format if you got it.

These opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Varo Money is poised to become a full-fledged bank, making it the first of a new wave of fintech upstarts to win that approval in the US. (link here)

Here’s the crazy thing. It took Varo 3 years and $100 million to become a bank. It is now allowed to print money by taking in deposits and net interest income, and to lend in all 50 States. It will take it another $100 million to build a brand and pay people out in referral fees, all while competing with Goldman’s Marcus, MoneyLion, Chime, and various other bank-as-a-service based providers. But maybe we will finally have sustainable economics on startups? Ask Monzo if the banking license in the UK changed the picture.

In opposite news, N26 is purportedly pulling out of the UK due to Brexit and the size of the UK economy (link here), and Starling Bank, the U.K.-based challenger bank founded by banking veteran Anne Boden, has raised another £60 million (link here).

N26 is leaving definitely not because of Revolut, Monzo, Starling, Tandem, Marcus, and their endless funding supply. Definitely not because expanding horizontally while losing incremental money on each customer makes it painful to grow. And definitely not because fixing LTV & CAC problems is more important for the business, but less important for the venture story.

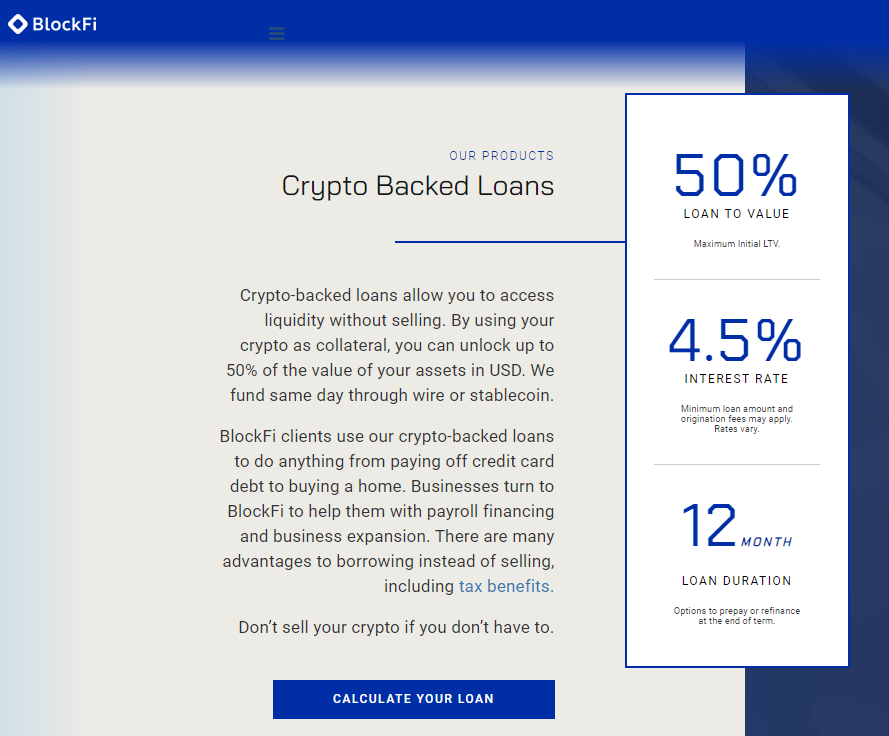

BlockFi announced today that it has raised $30 million in Series B funding led by Valar Ventures. (link here)

There’s some valuable lesson here about the integration of digital assets and DeFi into Fintech mobile apps. BlockFi builds out what looks like a roboadvisor or digital lender, but instead has exposure to crypto capital markets and protocols, which allow it to offer interest bearing accounts that annualize to over 8% in interest. I read it as souped-up margin trading, so there’s some downward price pressure from the fact that you are allowing short-sellers to borrow your assets. At the same time, you build out the institutional relationships to backstop retail flows, and derive information to the extent possible from your other users.

Inside Chainalysis’ Multimillion-Dollar Relationship With the US Government (link here)

Coindesk has figured out that Chainanalysis makes about $5 million from contracts with the US government. In particular:

the Federal Bureau of Investigation, the Drug Enforcement Agency (DEA) and Immigration and Customs Enforcement (ICE), from financial regulators in the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) and Financial Crimes Enforcement Network (FinCEN), from the IRS, the Secret Service (USSS), the Transportation Security Administration (TSA) – even from the Department of the Air Force.

I mean, it’s fantastic. This level of revenue isn’t going to justify (or shouldn’t) a $500 million valuation, but it is certainly a healthy, interesting, crunchy business. Of course, unless you are a crypto maximalist and think that government oversight is just there to censor your money movement (ok! ok!). Watch out for the IRS contract in particular.Maybe we need it? Crypto fraud, theft doubled to $4.5 billion in 2019, new report claims (link here) and Decentralized finance (DeFi) project bZx has suffered an attack in which a hacker successfully gamed multiple DeFi protocols to extract $350,000 from the platform, about 2 percent of the assets under management (link here).

So this is sort of interesting. I used to put together a similar report at Autonomous, and depending when you start counting the numbers get pretty astronomical. For example, take Mount Gox, adjust by capital gains, and you’ve got liftoff. Still, it is fairly stark to see $4 billion in scams happening in the ecosystem still. That amounts to maybe 1-2% of the market cap, but probably a much larger percentage of the active circulation of the top assets.

As an example, though not a hack, someone recently exploited a DeFi service to walk away with $350,000 in free money by manipulating the source of financial instrument reference pricing in an illiquid market. Hack? Fraud? Scam? Or bounty? That’s thankfully not a massive percentage of the $1 billion of assets now in DeFi — so that already is a great sign, given the foundational sin of the DAO hack (now about $1 billion of ETC market cap value having leaked out of ETH).

Voyager to acquire Circle’s retail trading platform in an all-stock deal (link here)

Circle is sort of falling apart. It got rid of its OTC trading desk to Kraken, then spun out Poloniex, and is now losing the retail trading side of the business. I guess there’a payments app in there somewhere, and a narrowing of focus on crypto banking-as-a-service tied together with stablecoins. I mean, all that language makes sense, but I always thought the pieces Circle had could be combined into something greater than the whole. Their alignment with Goldman was a recurring boogeyman. Maybe not. As for Voyager, I don’t necessarily see strong differentiation in retail crypto trading happening here, as Robinhood/SoFi/Square/Revolut all have crypto as a side gig embedded in their apps. Coinbase and Binance don’t need to be mentioned to cast a shadow.

Kasisto increases Series B funding round to $22m (link here)

Kasisto is an early chatbot company that works as a B2B2C model, powering the chatbots of various banks. I’ve always like the bet, and think that customer service and especially the training of customer service, is going to be meaningfully impacted. They work with DBS, Standard Chartered, JPM, Mastercard, TD, and Manufalife. Do I really think that bank conversational interfaces will generate $15 billion in revenue? Nope.

Facebook will pay Reuters to fact-check Deepfakes and more (link here)

So what’s sort of nuts is the idea that you are going to address the millions and billions of local disinformation points and bot activity with a team of a few humans fact-checking media. To me this seems like a deflection — sure, a highly skilled Reuters team will check the most important points of misinformation. But you simply can’t surf an ocean of machine chaos with a couple of people policing the truth. Doesn’t compute.

Square acquires Toronto-based machine learning company Dessa (link here)

Everyone needs a little machine learning in their life. Dessa is a startup that builds tools for machine learning practitioners — helping them launch models, and then helping them monitor the quality or degradation of the models. For example, you may be underwriting loans to your heart’s desire, but the quality of your number crunching is suffering due to junk or strangely shifting data. If I had to project where something like this sits in the Square portfolio, my guess would be KYC/AML or data mining for product recommendations.

RLI Transportation, a division of RLI Insurance Company, announced a partnership with Samsara, an Industrial IoT company that provides sensors and software to manage vehicle fleets and industrial operations. (link here)

Samsara provides trucks and other large industrial machinery sensors and other telematics that make it possible to analyze the behaviors of drivers and operators. This will lead to up to a 5% insurance premium reduction from RLI (the underwriter). Data from the real world is impacting the nature of risk, and the associated price of financial products rooted in the digital twins of these machines. Sansara also recently raised $300 million in capital — helps to grow with the real economy.The WIRED Guide to the Internet of Things. What you need to know about the promise (and peril) of networked lightbulbs, ovens, cameras, speakers and, well … everything. (link here)

A great overview of how the development of smart homes, minitiarization of our sensors and devices, and the appetite of the large tech companies (Google, Amazon, Apple) are driving this innovation vector. Hundreds of billions of dollars in spending are being put to work for this infrastructure to exist. The fight over 5G between China and the US are part of the narrative.

Apple now lets you shop directly in augmented reality: Customers can use Apple Pay in Quick Look (link here, and here)

Augmented Reality commerce is heating up. Apple integrates with retailers, which can provide a 3D model of a product via ARkit, which is then rendered by the phone into reality. A viewer is able to purchase the object directly through an integration using an Apple Pay prompt. Implementations with Home Depot, Wayfair, Bang & Olufsen and 1-800-Flowers are in place. At the extreme, this is a challenge to all eCommerce that isn’t packaged up into a hardware device; so helps Apple and hurts Amazon.

Looking for more?

Got this from a friend? Get it directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.