Weekly Fintech & Crypto Analysis: Credit Karma, JPM, German Roboadvisors, Square, Bird, and Decentraland

Hi Fintech Architects --

The weekly key updates (with graphs and analysis) on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality, are below.

This is the 3rd of 4 weeks where I am providing these updates for free to everyone on the newsletter list. Don’t worry, the Long Takes will stay free and continue to be delivered on Mondays. After the 4 weeks, this update will be set for premium only. Don’t miss your chance and get a 25% discount for the next 12 months. Click here or below to upgrade.

These opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

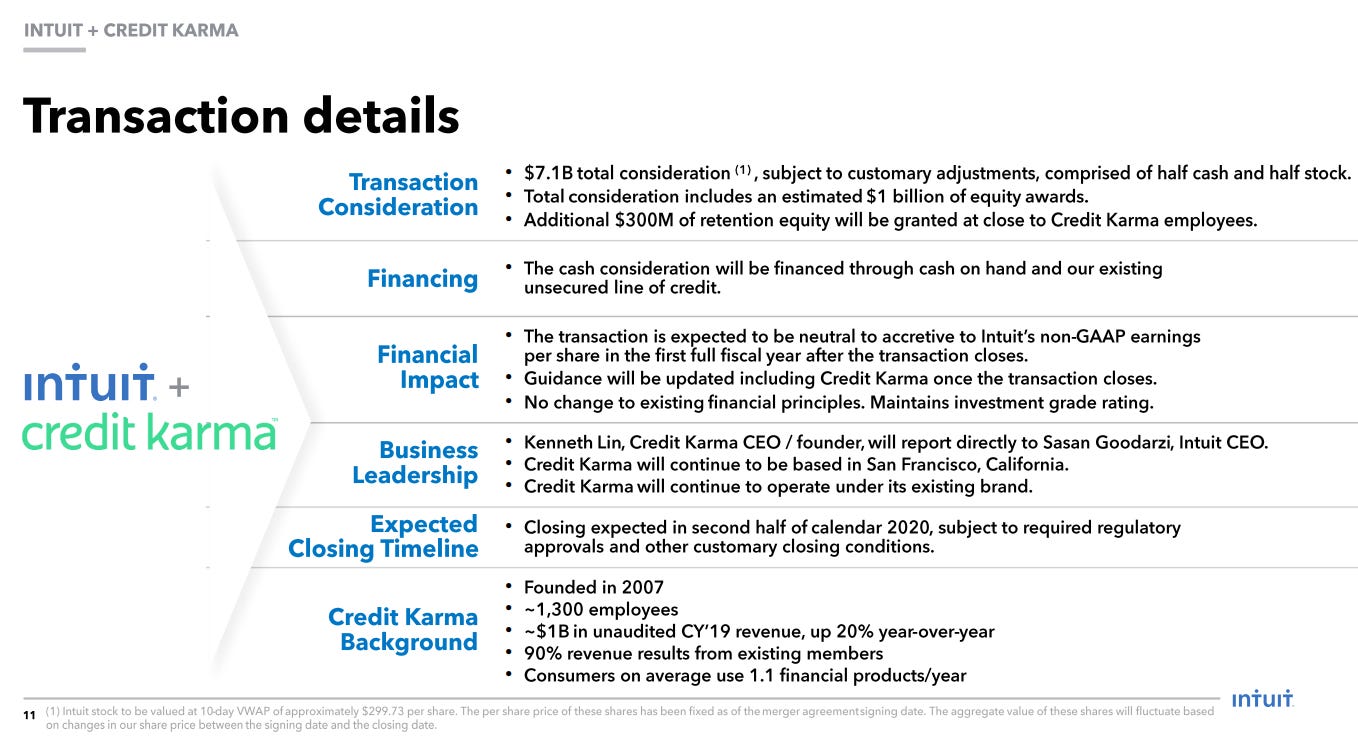

Intuit to buy Credit Karma for $7 billion in a bid to create a financial data giant (link here and presentation deck here).

This deserves a longer take one day. Credit Karma, the credit lead generator, is being bought by Intuit, the parent company of Turbotax and Mint, for $7.1 billion in stock and cash. Reminder that Intuit had also acquired Mint in the late 2000s for $170 million with a footprint of a bit over 1 million users. Credit Karma has over 100 million users, also known as “what could have been” for Mint, and is the leading destination to see your credit score for free and start engaging with personal financial management. It is notable that Intuit wasn’t able to grow Mint into a competitor of this size, even though it had the advantage. It’s also notable that this can compete well with LendingTree.

JPMorgan Chase to open UK digital bank by year’s end (link here)

JPM has joined Goldman Sachs’s Marcus and a gaggle of other neobanks in the race for UK digital banking market share. While N26 just recently pulled out of post-Brexit UK, JPM soldiers on despite a previous failure with US neobank Finn (closed down after just one year). Personally, I don’t think this is about economics, but about experimentation. In the US, neobanks are all about credit access, which JPM knows well enough. In Europe, something different is in the water and it is valuable to learn its truths.

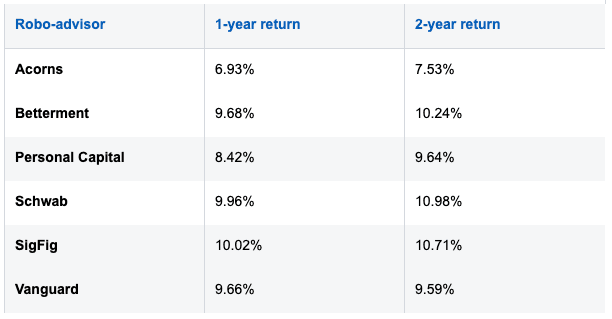

Deutsche Bank research indicates robo-advisors could manage €30 billion in 2025 (link here and report here)

Interesting Deutsche Bank report on roboadvisors and passive investing coming to the German market. Unlike the Americans, who long abandoned mutual funds for ETFs on the margin, Germans still own a lot of mutual funds. But those aren’t great for roboadvisors, which primarily invest in ETFs. German robo-AUM rose from €0.3 billion in 2016 to €4 billion in 2019, and DB thinks it may hit €25-35 billion by 2025. Good to finally see this theme spilling into continental Europe, which continues to believe that private banking is fancy and safe from digitization.

Why did Fcoin suddenly shut down and where is the $130 million in investors funds? Da Bing, a weekly round up on crypto China, investigates (link here)

Crypto exchange Fcoin finally shuttered its doors, as $130 million of investor funds have “gone missing”. The company used a variety of growth hacking to get users -- issuing its own coin to traders (not unlike Binance, but less real), paying people in Bitcoin, and highly engineered buyback strategies. Notably, peak trading volume was reached two weeks after its “transaction fee” mining program launched -- with transaction mining meaning you get paid for churning some trades. Now the founder has vanished, gone to that place of other vanished crypto exchange founders.

Square’s Cash App derived half of its fourth-quarter revenue from Bitcoin (BTC) services (link here) and Square Cash App Users Grow 60 Percent (link here).

Square’s Cash App is one fire in a good way. While Dorsey is getting harangued by activist investors to spend more time on being CEO of only one public company (Twitter, Square), the mobile payment app is the second most-used finance app on Google Play. It grew users 60% year over year, and notably Bitcoin trading accounted for more than half a billion dollars of revenue in 2019. In 4Q19, Bitcoin revenue was $178 million, with non-Bitcoin revenue being $183 million. I mean, this is sort of nuts, and puts Square in direct competition with Coinbase. Or maybe all that Square trading is just omnibused on Coinbase? The other Fintechs (Revolut, Robinhood, SoFi) certainly have taken notice.

Lost in Decentraland: My journey through a very ambitious, kind of buggy, kind of empty Ethereum-powered virtual world (link here) and Token of Intent from MetaKovan to RocketNFT. Agreement to acquire a Loan of 20,000 DAI from against $100,000 worth Decentraland LAND as Collateral, repaid monthly over a period of 6 months from the time of transfer of the NFT. (link here)

Okay, another one I would love to write up in full. Back during the crypto Ice Age of 2017, a project called Decentraland raised a bunch of money to create a Second Life clone with a land ownership model on the Ethereum blockchain. You can use native tokens to acquire that land, and then build various rendered objects on top. I guess it’s like the 2020 version of the Million Dollar Homepage, where each pixel was up for sale, except you can teleport into it and walk around, and also it is run globally by a distributed network of computers. Further, financial transactions are being performed to create loans against the underlying land -- like a crypto digital home equity loan on video game assets. I like it, and hope people build this economy out like Eve Online.

ING has teamed up with Tradeteq, an AI-driven platform that makes trade finance accessible for institutional investors (link here)

Trade finance is an enormous fixed income asset class, and it is quite difficult to get exposure unless you are a giant bank. ING recently partnered with Fintech Tradeteq to try and change that, with a long-term view of unlocking the distribution of other wholesale and retail banking lending portfolios. The software helps with: (1) portfolio management and trading automation, (2) risk analytics for greater transparency and (3) securitisation-as-a-service. The artificial intelligence bit goes into credit scoring and trying to understand credit exposure in a complex environment.

Thought Machine, a cloud-based technology for core banking, is announcing an $83 million Series B that the company plans to use to continue investing in its platform and growing its customer base (link here).

Here’s a story — a non-financial services entrepreneur keeps making high-tech startups and selling them. Then he makes software for banks that supports checking accounts, savings accounts, loans, credit cards and mortgages, all in the cloud. The banks in the US generally protest that it is too expensive to transition from core banking platforms like Fiserv, FIS, and Jack Henry. The Europeans and Asians, however, are much more interested — they are tech-forward around payments and banking, and are trying fight Americans on innovation. And that’s how you raise $80 million for your banking infrastructure startup.

Artificial intelligence reads CT images to diagnose coronavirus in seconds (link here) and Alibaba designs new AI tool to diagnose coronavirus; it’s 96% accurate (link here).

It’s great when frontier technology does something real and helps people be safe and happy. Ping An — the Chinese insurance company — developed an AI radiology software that can diagnose scans of lungs in seconds, rather than require doctors to do so manuaally. Alibaba, its AI and Fintech rival, did the same. This is a big step. However, the WSJ has also written that the lack of data for what “good” and “bad” look like means the results can end up being junk despite the speed. Regardless, it is an interesting point for an insurance company to develop AI capabilities generically, and then apply those capabilities to activities that prevent the spread of disease (and therefore lowering insurance payouts).

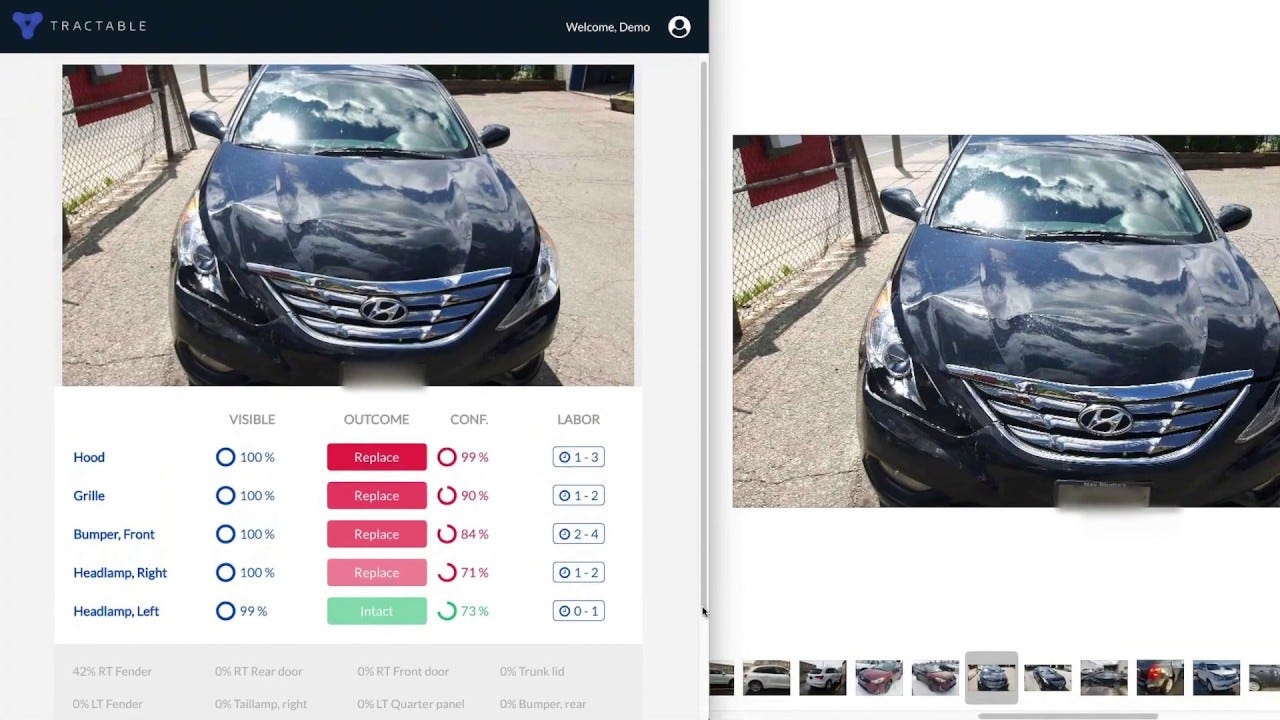

Tractable raises $25 million in Series C (link here)

I am a big fan of Tractable, which is machine vision software used to appraise accident damage from auto accidents. It’s great to see a product which can be understood with a single picture. What’s also great about the company also is that it isn’t overfunded and continues to progress on a reasonable valuation path.Toyota invests $400m in Pony.ai with latest driverless tech bet (link here)

Pony.ai saw its valuation reach £2.3 billion after a £300 million investment from Toyota. Pony.ai’s self-driving vehicle system will be integrated with Toyota’s vehicle platforms and technologies — which I assume means that Toyota wants to have lots of self-driving cars. The car manufacturer previously made a number of investments in this space, including £385 million in Uber’s autonomous car initiative and £460 million in Did Chuxing, a China-based ridesharing company.

Silicon Valley-based micromobility startup Bird is launching an in-app payments feature that enables its electronic scooter (eScooter) riders to buy from local merchants (link here)

The scooter company is adding payments functionality to its app. Users are already using their phone and GPS to find scooters, and adding an overlay of local merchants and payments options could potentially add a monetization layer. Very, very unlikely, but it could work. The transactions would happen through QR codes, which is a nice nod to Asia, where super-apps are more widely adopted.

Looking for more?

Got this from a friend? Get it directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.