Weekly Fintech & Crypto Analysis: Lending Club, Libra, Apple, Sweden, Behavox, and DeFi

Hi Fintech architects --

The weekly key updates (with graphs and analysis) on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality, are below.

This is the 2nd of 4 weeks where I am providing these updates for free to everyone on the newsletter list. Don’t worry, the Long Takes will stay free and continue to be delivered on Mondays. After the 4 weeks, this update will be set for premium only. Don’t miss your chance and get a 25% discount for the next 12 months. Click here or below to upgrade.

These opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

LendingClub CEO Heralds ‘Transformative’ Radius Bank Buy (link here and here for the deck).

Lending Club is paying $185 million in stock and cash for the bank, and is excited about the prospect of saving $40 million per year in funding expenses. To me, the above chart is the key one. Yes, owning a bank gives you all sorts of opportunities. You can hold deposits, and not pay third parties for the privilege. You are not reliant on fickle hedge funds and private equity. Your own credit standing as a company does not reflect on the cost of capital for your borrowers. But you know, there’s a sadness in there. P2P lending was supposed to be the community coming together, to save each other. Now we’re back to being a bank, taking deposits, and lending those out in a mobile app.

CBInsights released a report on fintech investment trends in key financial verticals, partnership activity, public company earnings call transcripts, and overall deal funding across the world (link here) and Investment in Fintechs Hits All Time High in 2019 but Drastic Drop in New Fintechs Founded: Deloitte Report (link here).

This is actually pretty surprising. Yes, there’s about $70 billion of venture in Fintech per year globally. A large chunk of that is Asia. But what is more notable to me is that the Fintech class is aging out, and not being replaced by fresh blood, and not IPOing or exiting at pace. There are over 60 VC backed unicorns worth $240 billion. I mean, they think they are worth $240 billion. Lots of stuff is being funded, but newly formed companies look to blockchain and AI, not raw B2C fintech. That’s probably a good thing. Word of warning to also be skeptical of the data source — I am sure that more than 70 fintech companies were being built in 2018, though perhaps the labels have changed.

Apple Pay is on pace to account for 10% of all global card transactions (link here).

According to a recent equity research report, Apple may increase its share of contactless card transactions from 5% to 10% by 2025. Lots is at play, but most at risk are companies like PayPal, which used to be the only on-ramp in town for eCommerce. Now that we are moving from the web platform to the mobile platform, and to proximity payments, it is strategic to own the hardware of the phone. This allows you to integrate NFC into your software by default, and create an experience that is hard to rival for third parties. It’s like Internet Explorer, for payments, by Apple! This generates many billions in revenue, and is the perfect strategic position from which to launch a digital bank and wealth manager.

Sweden’s central bank starts testing its digital currency e-krona (link here).

The good news is that there is continued forward momentum in exploring digital currency by central banks. Sweden’s particular proof of concept is being put together by Accenture and built on R3’s Corda enterprise solution. The bad news is that we are unlikely to see native crypto or DeFi integrations into these nodes, but perhaps that is the point. Also the point is that consumers will be trained to use digital wallets and crypto currencies in day-to-day life.

Lots of DeFi Drama. Arbs Exploit DeFi to Make $900k in Seconds; Provoke Soul-Searching in the Process (link here) and Fulcrum had a $2.5m vulnerability over a month ago and still hasn’t told anyone (link here). Even Matt Levine wrote about it (link here).

I highlight great visuals from the Defiant, which is linked and does a fantastic walk-through explaining what happened. In short, market manipulation: borrowing a whole bunch, then going short in a market with low liquidity, which moved prices and impacted assets in a different market entirely, which allowed the manipulators? hackers? traders? to close out positions and walk aways with $300k+ and $600k+ profits twice. And you know, the teams programming these protocols weren’t totally psyched to pay bounties for bugs other people found, and just sat on them for a while to avoid embarassment. It’s all fine when you’re building video games, but not so much with space shuttles. If you’re a consumer, use some risk management tools please. If you’re lending out money, putting some expensive guardrails in place might be a good idea.

10% of Chinese cities will start using digital currencies by 2023, IDC says (link here)

I wasn’t able to sleuth the underlying report, but these high level takeaways are somewhat interesting. In particular, IDC isn’t some crazy crypto native researcher and Twitter champion. I mean, their stuff on AR/VR is always a bit too aggressive, but still. That they are projecting such near term change implies they could be seeing some near term developments. The impact on SWIFT of 40% of financial institutions moving away to central bank infrastructure is aggressive.

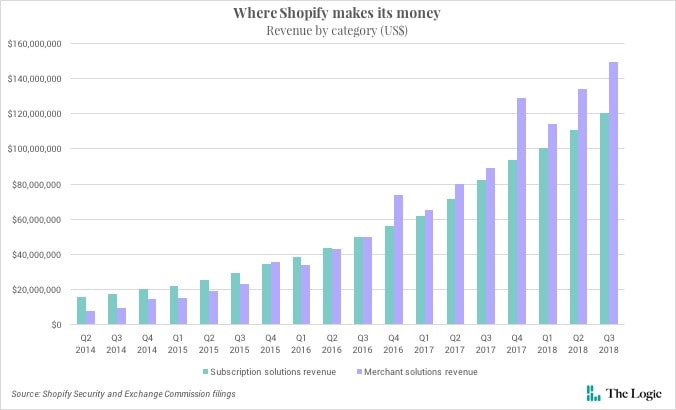

After eBay, Visa, Stripe and other high-profile partners ditched the Facebook -backed cryptocurrency collective, Libra scored a win today with the addition of Shopify. (link here)

What makes financial incumbents scared of the Web is that they are bad at the Web. Sure, they might bank web native companies, and they might give them loans, or invest their treasuries. But it’s not an easy truce. Shopify powers distributed eCommerce over the world, and grows like a weed. That it may accept Libra’s currency in its stores is a big win for the consortium.

Softbank's second Vision Fund is on the verge of investing $100m in Behavox, a UK startup which uses AI to monitor employees' behaviour at financial services companies. (link here)

Softbank is going B2B! I’ve always been a fan of Behavox, which has a reasonable and appropriately Orwellian solution for financial firms that want to use AI to watch their own employees. This makes sense if you have a problem with rogue traders or other non-compliant goblins. Using machine learning to scan through the billions of inane but dangerous emails people write sounds like fair punishment for a robot.

Who owns artificial intelligence? A preliminary analysis of corporate intellectual property strategies and why they matter (link here).

It’s not going to surprise anyone that the tech firms hold the most machine learning patents. Since 2015, I imagine there are quite a few more going to Uber, Google, Facebook, and Apple. But the more interesting point of this academic paper is that tech firms have a game theory choice ahead of them about IP ownership. The field is too complex and global to undergo closed development - thus much of the core intellectual property is open sourced and available on Arxiv. On the other hand, these firms are patent-farming to create a potentially defensible competitive position. For blockchain, we know that collaboration and consortia are the unavoidable requirements to success. For AI, however, sitting on the largest data lake is still an advantage.

Transforming Paradigms - A Global AI in Financial Services Survey (link here).

Really fantastic 128 page report from the World Economic Forum and Cambridge about the current state of AI adoption in the financial services. The headline takeaways are that while many R&D departments are spending just a bit of money today, within 2 years AI is expected to be much more important as a driver of profitability. Capital Markets and Payments seem to be the industry sectors expected to be hit the hardest.

China’s e-commerce giants deploy robots to deliver orders amid coronavirus outbreak (link here). And lots of interesting other color here.

As people are forced to increasingly stay indoors due to horrible apocalyptic diseases, several Chinese food delivery services are starting to use remotely controlled and autonomous vehicles to support commerce. In a normal world, perhaps these devices and their efficiency would be widely ridiculed. In our extreme circumstances, people are likely thankful to transact with non-infected machines. Will this finally give rise to IoT digital currency? (just kidding!) This is both fascinating, and awful.

Global spending on smart city initiatives will total $124 billion (£95bn) in 2020 at an increase of 18.9% year over year, according to new research from IDC. (link here) and The global market for augmented reality (AR) and virtual reality (VR) continues to grow. With both consumer and commercial applications, AR/VR products combined for $6.1 billion in revenue in 2018 (link here).

Have some numbers! The Internet of Things dwarfs Virtual and Augmented Reality, by a factor of 20x in fact. It is easy to forget that because AR/VR connects into the B2C markets, media, and entertainment, while IoT is all about massive industrial rigs generating operational data. But if you have to assess one over the other today, $6B is a lot less than $120B.

Virtual reality (VR) headsets could be the next form of technology to drive the way mortgage brokers process applications (link here).

Clickbait headline with an interesting takeaway. A person at a mortgage brokerage used a VR headset to launch a web browser in the VR interface and go through the Halifax and Nationwide websites to complete an application. It’s not sexy — strapping on a computer hat and filling out forms — but you can do it today! I don’t see how this is a better experience, or why somebody would want to do regular computing on a rendered monitor. But when there’s a will, there’s a way.

Looking for more?

Got this from a friend? Get it directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.