What Uber's IPO means for Fintech and Banks, plus 13 short takes on top developments

Hi Fintech futurists --

Today, a longer take building a Fintech view of Uber's IPO, exploring fundraising and tokenization, the role of super apps, and the capabilities of large banks vs. tech companies. The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below.

Thanks for reading and let me know your thoughts by email or in the comments!

Long Take: Looking at Uber's IPO from a Fintech lens

The world is on fire with talk about Uber going public. The company is raising around $8 billion, is valued at over $80 billion, and is minting a wave of SV millionaires who will keep the private company start-up party going by angel investing. I wonder how many of them will buy Bitcoin! Rather than focus on the deal particulars, which you can get from Bloomberg, the Guardian, Business Insider, and Forbes, I want to think through some corollaries of an event like the digital-first transportation company hitting the retail markets.

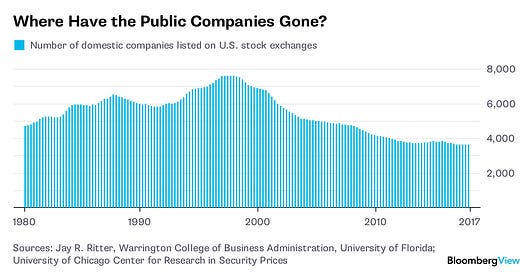

First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

To counter this trend, the only answer I see is tokenization. The barrier to entry into the private markets is not just existing regulation -- which can change with legislation like the JOBS Act. It is also the market structure itself. If you are selling $10 million chunks of stock to growth equity investors, the form factor for that stock is multiple bespoke legal contracts over 50 pages long, costing at least $50,000 in legal fees. This makes ownership by 10,000 people impractical. Even when shoe-horned into a platform focused on crowd-funding, the end result is still more paper, building a special purpose vehicle to legally aggregate individuals, while limiting their rights. If, however, we earnestly moved venture capital onto tokenized rails, ownership could be fractional and distributed. This is hard, primarily because private start-ups would rather deal with one large institutional investor than an army of angry Twitter trolls.

A second issue worth considering is the role of Uber in the smartphone. In the West, companies like Uber and Lyft are digital taxis. This is no small feat! They may aspire to be more and own the entire category of transportation. All of a sudden, scooters and bikes are pouring out of your phone into every crevice of San Francisco. Within this framing, it is important to understand the actual trend enabling Uber. The trend is not "mobility", or some idea of more efficient transportation, or peer-to-peer economy. Those are mere symptoms. The underlying cause is GPS in your phone, and therefore the root of the Internet of Things. GPS is a magnificent human achievement, built by the US government and provided as a public good (for free, other than taxes) to the entire US personal and commercial sector. Any device can look for special satellites in the sky, and triangulate its own location on Earth based on how it hears the radio signals. To do this, nuclear powered clocks had been launched into space on rockets, to locations calculated using Einstein's most complicated Relativity math.

Knowing where stuff is allows Uber to be valuable. Connecting the stuff efficiently -- passengers, food, hospital patients, cars -- is their proprietary software asset. The two-sided human network benefiting from the software is their proprietary business asset. But if you look more globally at the Ubers of China and the Middle East, their value proposition is quite different. Venture investors call such players "super Apps", because they don't just sell you taxis. They sell you everything by being the remote control of your life. Once you aggregate a massive multi-sided human network that benefits from software solutions into a business asset, you have their attention. And once you have their attention, you can use it for texting, payments, savings, investments, wealth management and insurance. This is why Chinese ride-sharing company Didi is looking more like Ant Financial and Tencent's WeChat. This is why Uber's acquired Middle Eastern competitor Careem is talking about bank accounts for the region's millions of unbanked consumers who are now plugged into the digital network.

Stepping back once more, it has become hyper clear to me that tech companies are just as good if not better than banks at being banks, from a functional perspective. All over the world, where banking is immature, the tech or telecom industries have stepped up to fill in the gaps. Nothing is special about finance products, infrastructure, or legacy learnings. Regulation in the West largely prevents tech and telecoms from reaching their Fintech potential, but even that is becoming noise and nonsense over time. From T-Mobile, to Apple, to Facebook, to Google, and Amazon, all the tech companies are brimming with financial services offerings camouflaged by third parties. It is only a matter of time. What will matter more, as we move decades forward into the future, is the ability of platforms to retain and satisfy users, while creating ethical business models that replace the micro-theft of data with privacy and respect. The ability to create and control massive scale Artificial Intelligence clouds will be a pre-requisite for any sort of competition.

I can allow that some of this will be done by the likes of Goldman, JP Morgan, and BlackRock. But, it seems to me, much more will be done by Uber, Ant, Tencent, Google, Square, Stripe, and the rest. Data from the Internet of Things has not yet exploded in the retail sphere, and that revolution will overwhelm the banks entirely. Car manufacturers are now wrestling with the advent of electric and self-driving cars -- both capabilities best created by Silicon Valley and its Chinese manufacturing capacity. Some are smartly taking ownership stakes in the very firms that could displace them. But for a handful exceptions, I do not see the banks similarly fighting for the consumer's heart, building new networks and functionality, and innovating non-product focused value propositions. The tune will change when it is all open-source and free.

Featured

Excited to be a guest on Accenture’s latest podcast, #InsuranceInfluencers. We talked disruption, AI and the future of insurance. Check out the three parts here.

Short Takes

OP has entered into a pilot with Canadian Wealthtech company Responsive AI to provide a Next Best Action solution to selected OP wealth advisors. The Next-Best-Action providers are going to be their own category soon. Interesting how software is smart enough to create a factory assembly line for the complex system of human interaction.

Investor Interest in Freetrade Crashes Crowdcube Site as Investments Per Second Overwhelm Servers. A European Robinhood-clone called Freetrade ran a crowdfunding campaign and blew up the platform.

SoFi launches gig-focused ETF. Ah yes, digital lender for student debt launches investment product. There is a sub-advisor involved, and this is fairly opportunistic stuff related to Uber, but still. Target audience won't know the difference.

Binance Security Breach Update. The largest crypto exchange has been hacked for 7000 BTC, or about $40 million. The attack targeted the exchange's hot wallet, so far no customer funds are impacted. Theft is not endemic to crypto -- people have been robbing banks since the beginning of banks. What we do about is what matters.

Blockchain Technology Can Give Billion Dollar Gaming Industry A Decentralized Leg Up. There is a plethora of gaming efforts build on crypto roots, but this article describes the MMO Taurian, which I didn't know. It's supposedly built like a DAO, and I'm curious as to how it will manage the internal economy.

Forgers Are Forcing a $9 Trillion Business Into Digital Age. If you need more rationale as to why digital signatures, and in particular blockchain-based digital signatures embedded into a workflow are needed, the paper-based world of trade finance is a good one.

Application of FinCEN’s Regulations to Certain Business Models Involving Convertible Virtual Currencies. Read for yourself, but seems that FinCEN sees a lot more money transmitters out there that we'd like in DeFi.

How Practical AI Can Accelerate Your Transition Away From LIBOR. Good article on how a political process like LIBOR, subject to manipulation and limited information, could be scaled up and improved with an AI that reads legal contracts.

Tech sees insurtech Naked gain market share. Car insurance from your AI underwriter phone app in 90 seconds in South Africa.

Banks should welcome fee-busting AI, fintech says. If you have the American Banker subscription, check out the link. Otherwise, the gist is that personal financial assistants are creating automated ways to fight bank fees, save money on subscriptions, maximize deposit interest, and fight parking tickets. Still not enough to build a business.

Google won't release an Oculus Quest VR competitor anytime soon. Unlike Facebook, which sees VR as a way to enter hardware, similar to how XBox helped Microsoft enter gaming, Google has shifted focus back to data. It sees current value in media on YouTube and in gaming -- but not in new devices.

‘High Fidelity’ Refocuses on Enterprise Market, Lays off 25% of Staff. This company is the second iteration of the massively popular virtual world Second Life, which ran its own economy for millions of players. The company is pivoting into the enterprise market as consumer demand falls short.

How to set up and use Garmin Pay – and all compatible watches. It has taken longer than expected, but wearables are becoming a legitimate player as a channel for financial products.

Looking for more?

Get this writing directly in your Inbox by subscribing here

Fully updated website here, and LinkedIn over here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.