Why ConsenSys Codefi is the bridge to blockchain-based manufacturing for commerce and finance; plus 12 short takes on top developments

Hi Fintech futurists --

It's a big week for me. On the rare occasion, I use this platform to share what I am working on, and today is one of those days. Now don't worry, the latest short takes on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are still below -- so you can get your usual dose of Fintech under the fold.

We at ConsenSys have launched Codefi, the project that I co-lead with Patrick Berarducci. Codefi is the blockchain operating system for commerce and finance, built to optimize business processes and digitize assets and financial instruments. We are combining elements of enterprise finance blockchain, digital assets and tokenized securities, crypto payments processing, and the emerging frontier of decentralized finance to build a global software enabler for the new financial infrastructure. Think Twilio, for blockchain-based finance. No marketing spiel below, but rather (1) the macro observation leading to the venture, and (2) since I can be indulgent, a walkthrough of how we built the brand using generative art and design.

Thanks for reading and let me know your thoughts by email or in the comments!

The Business Take

The last decade has seen a Fintech boom unlike anything in the industry's history. Financial start-ups grew from a footnote in venture capital (at around 5% of total), to the fair share of GDP at over 15%. Private capital doubled, and then doubled again. As a result, Fintech vertical champions sprouted like mushrooms across payments, banking, lending, investments, and insurance. As you well know, they are converging into the same financial super-apps that we see in the East, with competition from financial incumbents and tech companies driving pricing down 50% or more. Squint, and everyone looks the same.

But nothing feels fundamentally different. Yes, we have some new brands that live on our phones. But when sliced across deposits, volume, or assets under management, the public companies still do the lion's share of the financial work. With open banking, incumbents are likely to win even more, powering Apple's credit card for example. The core reason for this, I think, is that Fintech has democratized access to existing financial products. It has not really changed how those products are manufactured. Only by transforming how things are made and the value chains to deliver them can you build the Google, Netflix, Spotify, or Uber of the next generation. If interested in this line of reasoning, check out my interview with New Money Review.

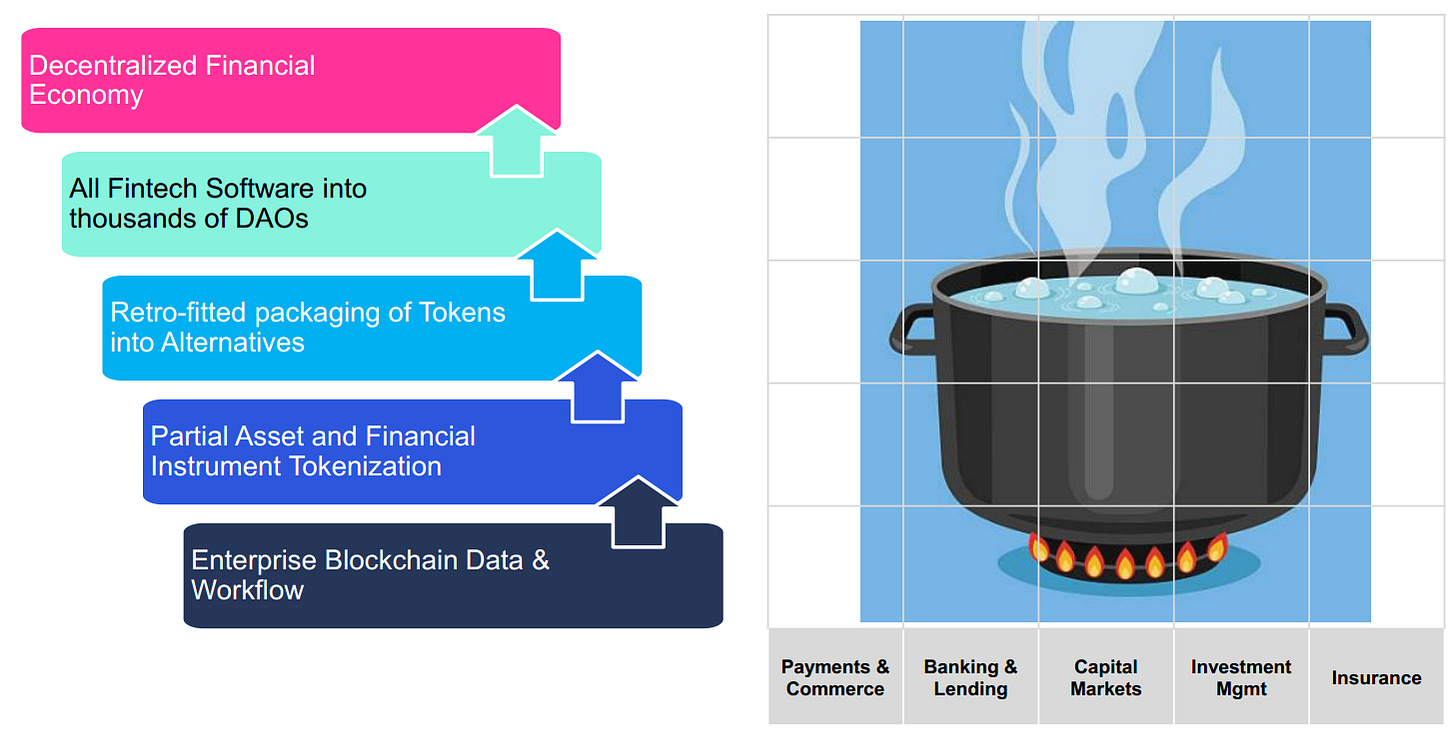

Blockchains are good for building financial products -- whether powering core banking, turnkey asset management, payments processing, or financial instruments themselves. They come with so many native features out of the box that the industry should love, from deep audit, to native reconciliation, to programmability and cyber-security. And yet, it's been hard to get things really going at scale, despite the proof. Since 2015, Ethereum developers have routed payments, helped people save money, created investment vehicles, built lending and insurance machines, and still we are sceptical! I've boiled it down to a blockchain maturity curve problem -- early adopters see only the tip of the spear, and not the full potential.

At the very beginning, the starting point is for companies and operators to agree on shared data standards. For organizations that have spent centuries thinking about how to compete against each other, letting go of even back-office costs is difficult. Yet there is no competitive advantage in making industries less efficient by creating information friction – something that has become absurd in the land of data science and emerging artificial intelligence.

Once industries, whether in supply chain finance, banking and payments, or capital markets, agree on shared data standards, the next step is to mutualize certain workflows that derive from the data itself. Examples include standard software procedures for negotiating legal documents and the terms of financial instruments, or reconciliation and settlement of securities trading. We have seen meaningful digital transformation benefits from these efforts, lowering operating costs, speeding up arcane human processes, and generally improving the customer experience. For this digitization, look to enterprise blockchains, like private deployments of Ethereum with built-in privacy, permissioning, and scalability. And yet, embedded industry rule-sets and shared software functions are still at the early stages of what this technology can accomplish.

Once companies are sharing data and performing common workflows, there needs to be a substantive object to which the software applies. Tokenization is the next step in the DLT maturity curve. We can turn any piece of captured data into a token, secured by world-class cryptography and thereby creating a digital asset. Such digital assets can represent any number of real world financial and commercial instruments, from currencies, to securities, bonds, commodities, real estate, or physical goods. They can also be extended to more speculative units of value, like human attention, medical data, or corporate identity. In the beginning, these tokens capture a very small percentage of information about the outside world, like a hyperlink that points you to a PDF of a printed book.

Over time, we see deeper functionality being embedded into these digital assets, and into the networks on which they travel. When looking at financial services for example, smart programmable financial instruments begin to emerge. Bonds will have software covenants that are triggered automatically by data events. Equities will issue their own dividends and split automatically in an investment accounts. Commodities will have digital twins and equilibrate in price. Increasingly, the software that used to effect real-world assets will begin to have a digital analog, and be part of the digital assets themselves.

One day, all such software may live in distributed networks, hosted and powered by the companies within particular sectors and industries. Their products will be rigorously permissioned and tracked, flowing through digital versions of today’s value chains. New types of markets and networks will emerge to enable this interconnected, global commercial web. The same underlying software rails could be used across commerce, payments, banking, lending, and insurance. Just like we use the Internet today to see our bank account web apps, trade stocks, or e-sign legal agreements, we will use blockchain-based Web 3.0 to transact, maintain, and engage with digital commerce and finance.

ConsenSys has been in this game since the beginning, with Joe Lubin being one of the founders of Ethereum. It takes iron will and a lot of vision to see the distance between crypto kitties and a new financial economy. But here we are, and the bet we are making is called ConsenSys Codefi. The product is structured like an API-first enabler, like Twilio or Stripe, with options for private label UI/UX or bespoke build if needed. It incorporates digital assets, blockchain payments, public networks and DeFi, and dynamic analytics as the initial modules. I'll leave you with the Codefi website and the below, hoping you'll poke around and send me your thoughts!

The Art Take

I always try to explore both the art and the business of a Fintech story, and we’ve already talked about the business of Codefi. So let’s talk about the art! When we started exploring color schemes and brand identities for the project, a few concepts needed to be reflected. First, it had to be clear that innovation and decentralization were at the core of the brand. Second, we needed to capture a set of visuals that could be interesting to both mature financial institutions and pioneering entrepreneurs. And last, we wanted to reflect the evolution of financial primitives that are being designed into Blockchain-based finance. We needed order — and also chaos.

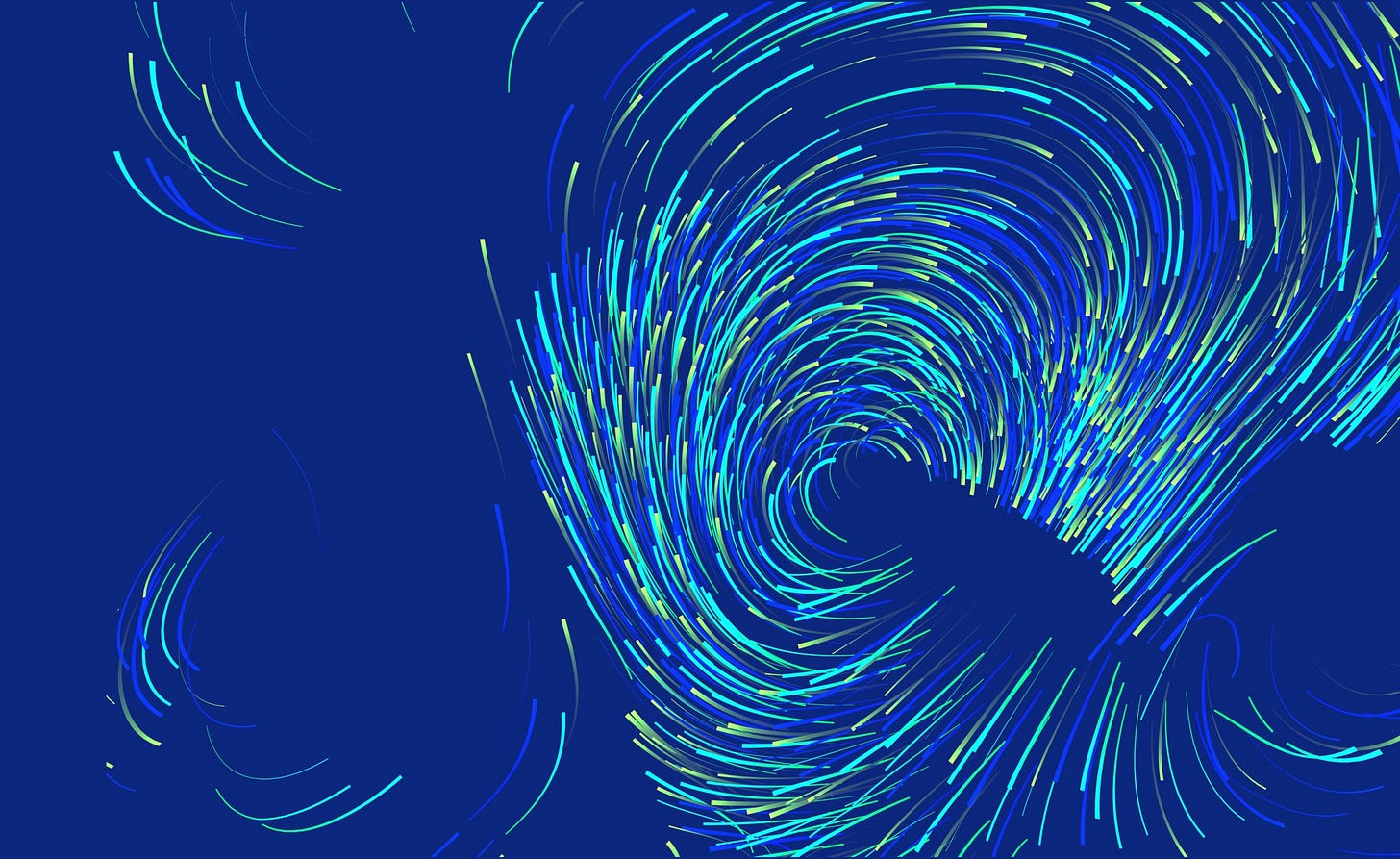

To push forward our ideation, we worked with four great designers — Sarah Carlson, Michael Shillingburg, Raven Kwok, and Reza Ali. Michael has a killer eye for playful style, motion, and 3D rendering, and we used his work for inspiration. Raven and Reza are both code artists, building generative systems that make parametric art. I found Reza’s work to be an elegant representation of flow and magnetism, the way that financial assets accrue around networks, or the way small changes in systemic design (e.g., regulation) echo across the economy like a butterfly effect. They also remind me of how financial APIs from open banking interconnect into a powerful, global software network. You can see his original work and our branded adaptation below.

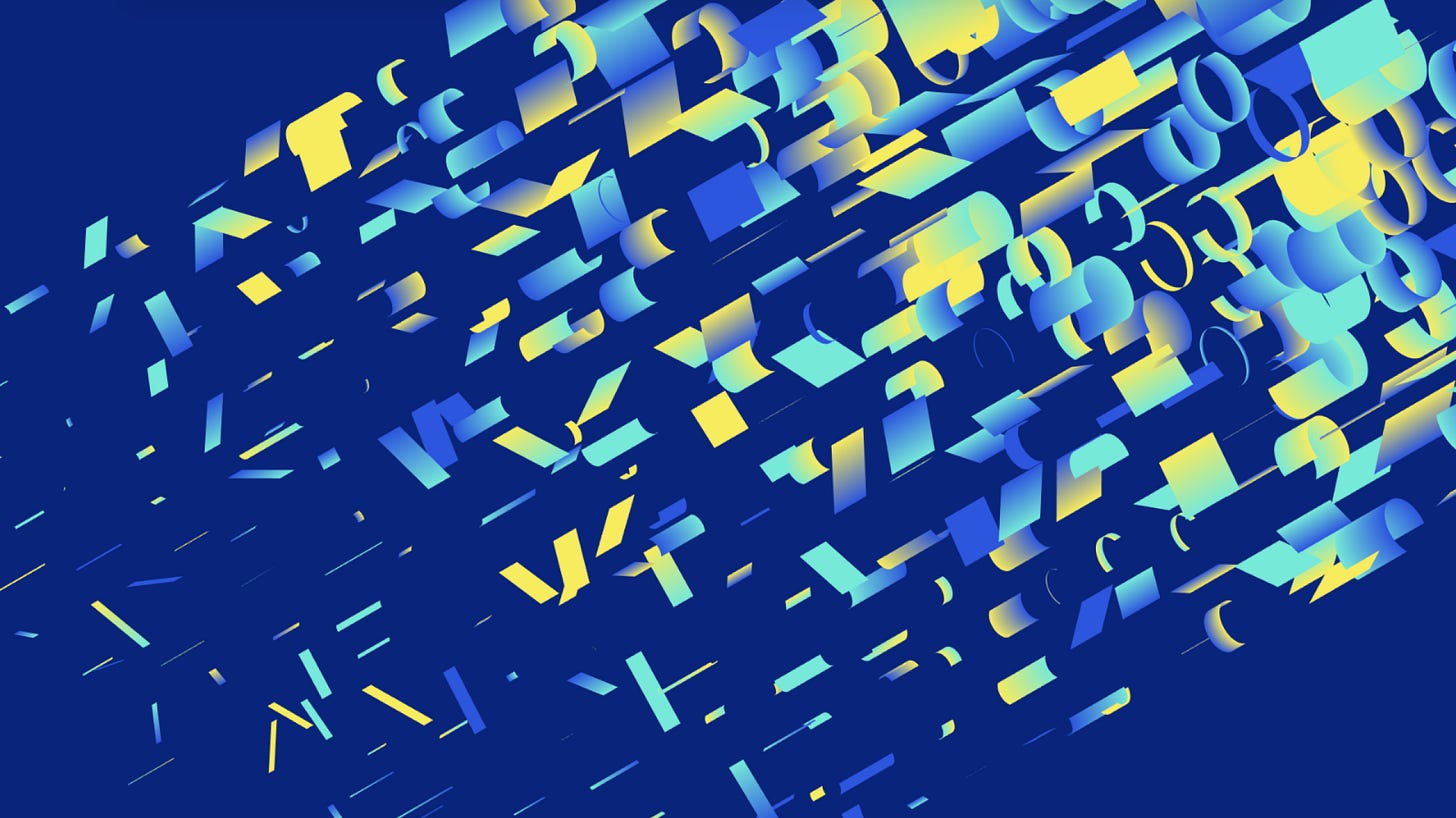

Raven’s design is similarly compelling — but the system we chose from him was focused more on order and operations. It is structured, like the basic instruments of the financial industry, but also clearly digital, like the programmable smart contracts to which financial software is transitioning. It reminds me of payments and analytics, though when pushed, it can generate complexity as well. Further, we were able to use it to brand the sub modules of the software. Whereas the top level of Codefi is a Blockchain operating system — all wires and connections — the modules are living products that can be plugged into a business. And as you can see, by tilting the color scheme, we are able to create sub-brands, similar to that of Adobe Cloud, Microsoft Office, and the Google suite.

The final piece I want to highlight is the work around the logos. Sarah had the hard task of lifting a logo design language from the underlying generative images. We went through countless iterations evoking the Bauhaus movement (squares, triangles, and circles), digital and analog ramps (think square bits in curved objects), and lastly the chosen flow system. The circular shapes are visually connected to the parent ConsenSys logo, but also echo the cylinders and circular paths of the banner designs. Each letter is hand-crafted to be composed of the bending curves from the operating system concept, and is housed in its respective product color scheme.

Hope you enjoyed some of the flavor behind the launch, and a preview of what is to come. Of course if any of these ideas are things you are exploring commercially — from digital assets, to crypto cash flows, to decentralized finance — do not hesitate to reach out at lex.sokolin@consensys.net.

Short Takes

Wealthfront cash accounts help platform explode to $20 billion in assets. Getting those deposits and charging that interest rate -- the best customer acquisition strategy? Just don't call it AUM.

Jack Dorsey's Square Is Testing a New Free Stock-Trading Service. This is both the best and the worst. Obviously they built it. But also, can people stop speculating on stocks already?

Happy Money raises $70 million. Fintech, meet credit unions and paying off debt.

Santander Settles Both Sides of a $20 Million Bond Trade on Ethereum. If you need real world examples, this is a good one. Today, both sides of the trade were Santander. But with clearer regulation and industry risk appetite, other players can step in.

Staked Automates the Best DeFi Returns With Launch of Robo Advisor. This is the direction of travel for all DeFi -- and the underlying advisory entities will register as RIAs.

First-Ever SEC-Qualified Token Offering in US Raises $23 Million. This took ten months and was registered undr Reg A+. Don't say the SEC doesn't do anything for you!

From Communism To Coding: How Daniel Dines Of $7 Billion UiPath Became The First Bot Billionaire. The best example of robotic process automation, and the founding story to get there.

Oculus founder Palmer Luckey scores $1 billion-plus valuation for his virtual border wall start-up. Copying Chinese surveillance machinery, this company plans to create a border wall enabled with facial recognition.

120 million workers will need to be retrained due to AI, says IBM study. When I dug into the topic, the answer was that there was $1 trillion of cost alone in financial services for reconfiguring.

Snapshot Paper - AI and Personal Insurance. I collaborated on this interesting dive into how artificial intelligence will change the insurance industry, published by the UK Government's Centre for Data Ethics and Innovation.

Google Brings Persistent Content Support to Cloud Anchors, Expands Augmented Faces to iOS. Now you can save AR content tied to locations. Persistent digital artifacts with financial features yet to come.

Daqri, which built enterprise-grade AR headsets, has shuttered its HQ. Nowhere is safe, not even the enterprise. The virtual reality winter seems to be continuing, so better save up a long runway.

iOS 13 Points Towards Existence Of Apple’s Supposedly-Canceled AR Headset. Big hitters like Apple, Google, and Facebook will keep slugging away at this sector until it works. Too much is at stake!

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.