Will Open Source business models rule the world, as Enterprise Ethereum Pantheon joins Hyperledger; plus 14 short takes on top developments

Hi Fintech futurists --

In the long take this week, I explore ConsenSys contribuing its enterprise Ethereum project Pantheon to Hyperledger, and the implications for public and private chains. In the discussion, I look at various Open Source software business models and try to figure out where value can accrue in Open Finance. Reflections on human nature are used as punctuation.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

Have you read The Elephant in the Brain? You should! The book takes an insightful journey across the hidden primate motives hard-wired into our minds, explaining human behaviors that seem to break rational economic utility maximization. Why do we give to charity or make art? From a single agent point of view, none of that makes sense -- these are just quirks that behavioral finance uses to suggest that Economics is broken. But from a tribal or societal point of view, our evolution gives a solid explanation for why altruism (or the perception of it by others, and our belief in its authenticity) is a function of our communities. A stellar Wait But Why article is in progress on this topic as well.

First, it helps our macro-organisms, such as families, corporations, or political entities survive and thrive relative to other macro-organisms (their families, their corporations, their political entities). And second, it creates powerful signaling -- the charitable giver has enough resources to give, the artist has enough livelihood and liberty to make art. For reference, below is a picture of bowerbird, making blue nest art to demonstrate how rich it is in time and skill to other (female) bowerbirds. Further, Elephant in the Brain would suggest that we humans purposefully block awareness of our own motives in these actions in order to more fully believe the reasoning behind them, and therefore improve the signaling. Weird, fractal stuff.

I bring up this framing for giving, because many people do not understand the strength of Open Source software. The traditional Peter Thiel model of Silicon Valley is inshrined in Zero to One, a book on how to create a venture-backed monopoly, guard it with razor sharp competitive moats, and retire a billionaire. The secret is to find a *secret* -- and then build around it extremely quickly, burning acquisition costs to create network effects and enterprise value. As part of the journey, you can use the law, property rights, pricing power, business networks, and all other sorts of tribal powers to kill the competitor. This action plan has worked wonders in the Internet Age, and gave us Amazon, Google, PayPal, and Facebook. It has stripped the world emotionally raw in the process.

You would think, based on the enterprise value of those companies, that the valuable thing to do with intellectual property is to lock it down and build commerce around it. You would think that the nice things we get to use can never be free. You would think that developing something for "nothing" wouldn't work at all. Of course, you would have missed the largest operating system for mobile phones in the world -- open sourced Android. You would have missed the power of making art.

With this background in mind, I am excited to see ConsenSys contributing its enterprise Ethereum codebase Pantheon to the Hyperledger project. In practice, this means that the Linux foundation now has a public blockchain client -- in addition to the permissioned IBM-sourced Fabric and Intel Sawtooth. The current landscape in enterprise blockchain adoption is largely focused on community and consortia building, trying to re-imagine multi-billion dollar value chains and workflows on a new infrastructure. Big enterprise consulting companies, like IBM, have made free their core source code and sell advisory services on top. By adding an Ethereum alternative into the mix, Hyperledger adds a bridge to the public chain of Ethereum, and the promise of decentralized finance applications being built there. Similarly, public Ethereum now has a bridge into the enterprise.

From a financial incumbent point of view, if you are going to mutualize infrastructure, you need to actually mutualize the infrastructure. This means solving the game theory problem of accidentally giving away the value of your back office systems to your biggest, best-funded bank competitor -- not a competitive equilibrium. To that end, technology companies are a natural place for maintaining crypto systems. However, note that public chains today already have the benefit of billions of dollars in cyber-security spending (i.e., mining) and the dedicated engineering of thousands of open source developers. By choosing to use a public chain, you get this out of the box. With a proprieraty solution, even if the end-results are open-sourced, community is impossible to replicate. Maybe this is why IBM bought Red Hat for $34 billion, and Microsoft bought GitHub for $7 billion.

A nagging question -- can free really be free? What is the business model for Open Source, especially as people are beginning to refer to the post-Fintech generation of financial start-ups as Open Finance. Here is a business model cheat sheet from Wikipedia:

It is true that some of us will be driven to make art for art's sake. The process of building things and seeing them work in the real world is motivation enough. Think, for example, of the early days of YouTube with creators uploading millions of videos. Why do people do it? For the same reason that we breathe -- it is a trait of the human psyche, explained by the discussion in the beginning regarding social status and signaling. Or perhaps the mere pleasure of craft.

Meaningful art can also be funded by donations and patronage. The beautiful chapels of the Renaissance and cathedral spires of the Gothic grew out giving. Such giving can be motivated by the guilt we experience after receiving a gift (i.e., the social concept of reciprocity), by shared beliefs (i.e., a religious conviction, a philosophy, a corporate slogan), or by implied peer pressure. Most of us don't seem to be inhabiting this world anymore.

Another approach is adjacent monetization. For Red Hat, much of the underlying software was freely available to be copied and remixed. But it was complex, and needed deployment, integration, support, and maintenance. These professional services are not the sexy Peter Thiel product revenues that you would expect from an Uber -- but money is money. And if you get enough of the adjacent revenues in place, the company no longer needs a venture capitalist's approval. Similarly, adjacent products could be built and sold on top of the open source infrastructure.

Today, you can see this split in the crypto space with many protocols having an established Foundation for protocol sustainability, and a for-profit private company that is building out paid tooling on top. Founders can both (1) sit in the for-profit company, and (2) hold a massive amount of protocol tokens, playing both start-up entrepreneur and capital gains tax-collector. But such allocations are common place in human history -- consider the ability to squat on land in the United States under Manifest Destiny in the 1800s. This actual landgrab does not preclude us today from availing ourselves to the orderly economic and legal systems in the country.

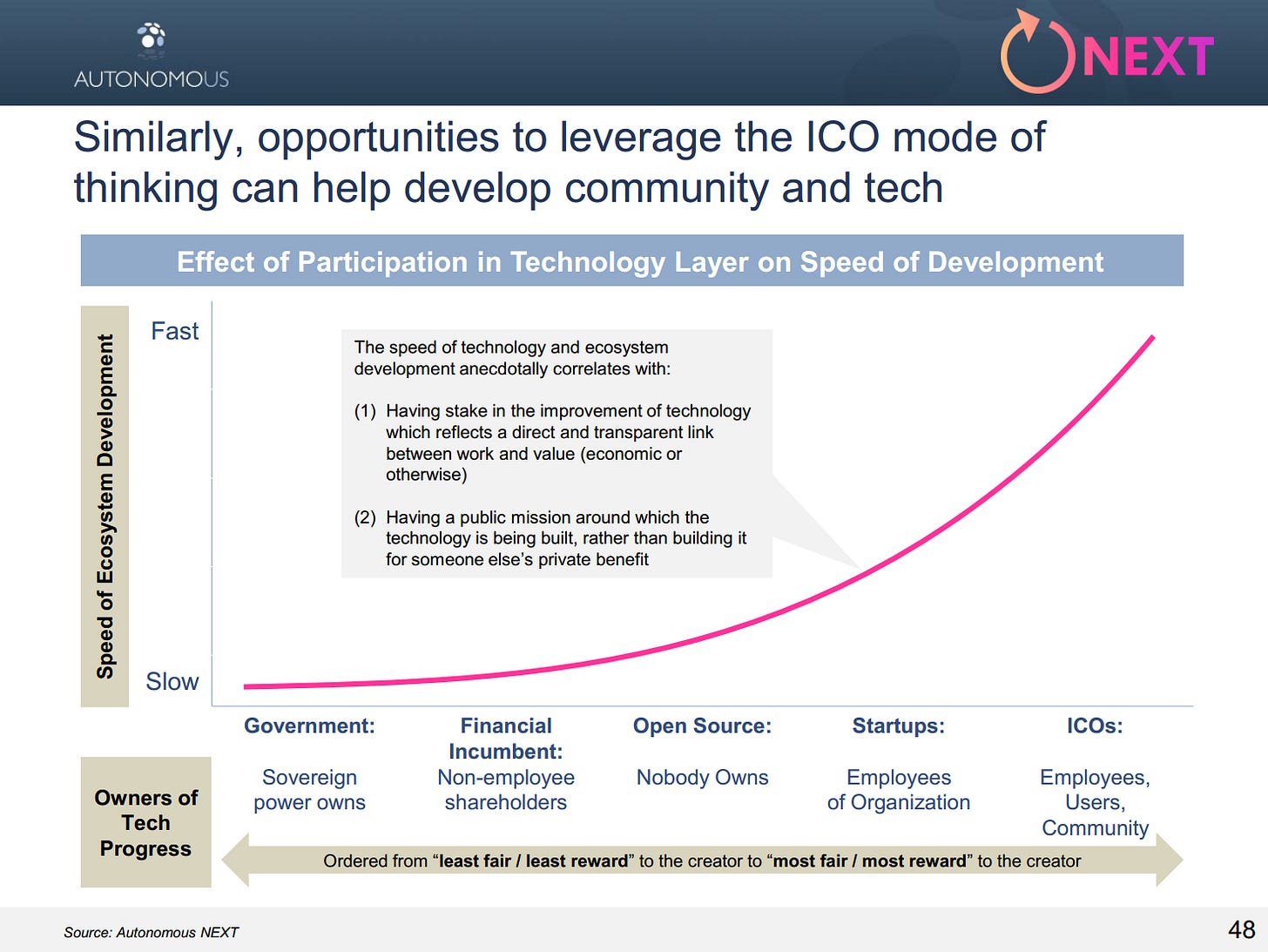

This is a very powerful incentive set, and I had written about it somewhat naively in 2017 below. At the time, Initial Coin Offerings were new and did not have a negative connotation. I believe that the overall conclusion still stands -- if the developer owns their equity and the community owns the protocol, driven by a public mission, such a combination grows faster than any venture-only structure.

End of the day, there is always some "tax" that is inherent in the Thing in order to finance its progress. In traditional businesses, we see that cost priced explicitly. In companies building around open source software, the tax translates into freemium or adjacent value propositions. For Internet companies, free content led to the creation of attention black-holes and algorithmic advertising. Some of you may remember a world where YouTube did not have ads playing every 5 minutes! When Google bought the streaming service for a cool $2 billion, many people did not understand the industrial logic. Today, YouTube generates $3 billion of advertising revenues per year. We offer its movie player our attention, and it taxes our time with content we are forced to watch.

So the question I am left with is what tax will come with Open Finance. The token protocol funding model accrues to those protocols with network effects -- I have trouble seeing beyond Bitcoin, Ethereum, and perhaps a handful of others over time. It is increasingly unlikely that Open Finance can be permanently funded by token offerings. However, it does consume our capital, as we use its decentralized banking, payments, and investments software. Today, it primarily consumes our capital to create Speculation. If you are lending out a digital asset, most likely you are enabling some other party to make a trade. With collateral staking soon to be more wide-spread, you will be committing capital in order to secure systems and accrue voting power. Will Open Finance then secure an emergent economic system, or continue to spiral out into crypto derivatives nonsense?

This has always been the question with Financial Services. On the one hand, a developed banking system with high population penetration and easy access to credit is a pillar of all developed economies. You can see below that GDP per capita and credit card ownership are highly correlated with a large explanatory power, though I am not making a claim about which one causes which. It is just true that financial products and wealth go together. So from that perspective, having Open Finance create globally accessible consumer products is a clear good.

On the other hand, finance has a way of self-dealing and breaking systems. When you sit next to the watering hole, chances are you get to drink first. As a society, we can build arcane systems and regulatory contraptions to try and change human nature. Yet I strongly believe these are not individual problems, but systemic attributes of our collaborations. So to bring it back to the beginning, and my friends at ConsenSys -- maybe letting others go first, open-sourcing your solutions and inviting collaboration, leading others by giving, maybe that is how you show true strength.

Featured Interviews, Podcasts, and Conferences

So, You Wanna Tokenize: ConsenSys’ Lex Sokolin Explains How to Begin. Check out my interview with Finance Magnates about some of the things ConsenSys is focused on today.

See you at the DeFi Summit, September 10th, London.

Check out my Keynote at the RoboInvesting Summit. September 11, London.

Very excited for my first ConsenSys event in Tel Aviv, September 15th.

SIBOS, 23-26th of September in London. More to come about this one.

Short Takes

Next-generation core banking platforms: A golden ticket? If I had time at Autonomous, I would have loved to do this research. The key conclusion is that there are 3 approaches to modernizing the core of the bank, each of which costs $50-250 million. Am sure McKinsey is at least $10 million of that.

Robo-advisers are dead. Long live digital advisers. A smart article discussing the trend of digitization within 401k (i.e., retirement plans) and the integration of retirement, investment, and other financial product automation with human problems. The headline is misleading, but the examples should you the direction of future travel. Also in a similar vein: Ethos, “the company making simple, ethical life insurance,” announced a $60m Series C.

Why 84 Percent Of Paycheck-To-Paycheck Gig Workers Want Early Pay. If you want to build solutions that are needed by customers, target segments that have new types of problems. This interesting report sheds light on the financial needs of people who use Uber and other gig work as a source of income.

The pan-European savings marketplace Raisin is acquiring fairr, Germany’s leading fintech for retirement savings. And now Europe's largest interest rate comparison shopping bot has bolted on a roboadvisor. Execution will be very hard, but consolidation was inevitable.

6 Thoughts Following Our Crypto Derivatives Conference Call. Did you know that more than 75% of trading activity for crypto assets is taking place in Asia? Or that crypto derivatives are the home to most of the liquidity. This is both not surprising, and frustrating from the perspective of someone trying to build operational and economic activity into a real (rather than merely financial) crypto economy.

Alibaba, Tencent, Five Others To Receive First Chinese Government Cryptocurrency. I wrote about this last week, so won't repeat the arguments. But this is a big deal, and should be watched closely as a global reaction to Facebook Libra, and a way to challege the dollar as the reserve currency. Imagine if the Federal Reserve built Libra, and then permission Goldman, JP Morgan, Amazon and Facebook to run it.

Binance Launches Crypto Lending With Up to 15% Annual Interest. Anything you can do we can do better, is the Binance slogan. Their allocations to high yield crypto accounts sold out in a blink. Between Binance and Coinbase, very little room for a distribution play by someone else. I guess there is always Bitfinex, printing Tethers, now also in Yuan flavor.

Numerai’s prediction marketplace Erasure arrives on Ethereum. Weird, beautiful, and science-fiction like. This crowdsourced artificial intelligence hedge fund keeps building arcane software automata. Not sure if they make money, but maybe one day they will power the world's performance benchmarking.

UBS and HSBC Robots Push Into Bond Sales Frontier. Machine learning bots are helping bond traders find the best counterparties for their trades, as well as recommending potential transactions that fit the trading style. To me, this is the same thing as "Next Best Action" for financial advisors, or more broadly, the same thing as the "Next" button on YouTube and Netflix. You do you, more of you, with the thinking on rails from a machine.

Ping An Group is selected in Next Generation Artificial Intelligence Open Innovation Platform to empower inclusive finance. The Chinese Ministry of Science and Technology likes what the insurance company is doing with artificial intelligence.

Meet the Researchers Working to Make Sure Artificial Intelligence Is a Force for Good. More things like this should happen. A research institute is developing these four pillars to protect humans against a malignant software world: (1) rights and liberties; (2) labor and automation; (3) bias and inclusion; and (4) safety and critical infrastructure.

Teens Are Using Instagram To Cast Each Other In Fake Broadway Shows. Slightly off topic for AR/VR, but on the ball for attention economy. Instead of using school organized plays for musical theater, people are using software platform in a peer-to-peer way to self actualize. This reminds me of Decentralized Finance, and its capacity to be a platform where both the attention and the imagined financial products live. If you don't get this behavior, you won't get how these teens will bank.

Home insurtechs partner for proactive maintenance. We can take the IoT lens here -- an insurance provider is working with a company using smart home sensors, apps, and maintenance services to prevent damage before it happens. In this way, increased metrics and data are lowering uncertainty and the need for claims. Down the line, this could reduce the demand for the financial product itself.

A new survey of 900 active AR/VR devs provides some surprising clarity into the technology's constraints. Interesting conclusions from a recent survey in the industry: HTC and Oculus are the key platforms going forward, and Education and Training are the key growth use cases. This is, of course, in addition to the largest use case today, which is gaming. But most things in pop culture start with gaming.

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.