Worldline's $8B acquisition of Ingenico's $3B revenue would barely pay for Robinhood or Revolut's valuations -- a case of Identity Economics

Hi Fintech futurists --

In the long take this week, I look at how spending $8 billion can either buy you $3 billion of revenue from Ingenico, or the private valuation of Robinhood and/or Revolut. Would you rather have a massive cash-flow machine, or a venture bet on a Millennial investing meme? To articulate this question in more detail, we walk through the impact behavioral finance has had on economic rational actor theories, and why quantitative financial modeling often similarly fails to capture the underlying tectonic plates of industry. It may not be wrong to bet on Millennials. We talk about what identity economics (ala identity politics) means for market value and how to think about generational change.

These opinions are personal and do not reflect any views of ConsenSys or other parties. Still, you should check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments here.

Thanks for reading and let me know your thoughts here!

Long Take

I started to study Economics in the late 1990s, and more in earnest in the early 2000s. Macroeconomics and the modeling of financial markets always seemed more like political science rather than accurate mathematics. While certain short-hands about the nature of crowds (i.e., if supply goes up, price goes down) are useful rules of thumb, different schools of economists keep churning through factual events with different conclusions. Just have a Keynesian talk to an Austrian!

Microeconomics, on the other hand, felt rooted in human nature. If we could only figure out the atomic unit of the economy -- a firm, an individual, some product -- we could model policy and behavior bottoms-up. As computers have become more performant, companies like Simudyne do just this, building AI agents with preference curves driven by assumed utilities, and modeled in the millions. You might remember how exciting Freakonomics was at the time, stretching applied micro-economic thinking to topics of sociology and human nature. But this too, as all things, is fuzzy and not quite right.

The model of rational automatons making optimizations across a two dimensional curve between pizza and shakes is under routine pressure from fields like behavioral economics, compexity theory, and evolutionary psychology. The more we learn about people and their neurology, the clearer it becomes that human utility functions are more idiosyncratic, correlated to group preferences, and overall mammalian. (See Elephant in the Brain). I am not saying it's impossible to have a fully deterministic view of a person's behavior; but rather, that the tools of spreadsheets and simple logistic regressions are not up to the task.

Similarly, when I started in earnest to work in Finance, my McKinsey-trained supervisors said not to take too "academic" of an approach to problems. Instead, we should be using "business math" to make quick, order-of-magnitude estimates around quickly moving problems. As a reader of this newsletter, you are by now familiar with how I rely on quick calculations to prove some particular profitability point, or assess the quality of an investment decision. Moving to deeper research on the stock of public companies, you similarly know that the fundamental financial attributes of companies are modeled mathematically, and then benchmarked against comparisons as they trade in some market. The market is said to be the aggregate price-setting mechanism, which will combine growth trajectory, earnings per share, and narrative into a P/E or revenue multiple. And so we can behave as if we are mathematically rigorous.

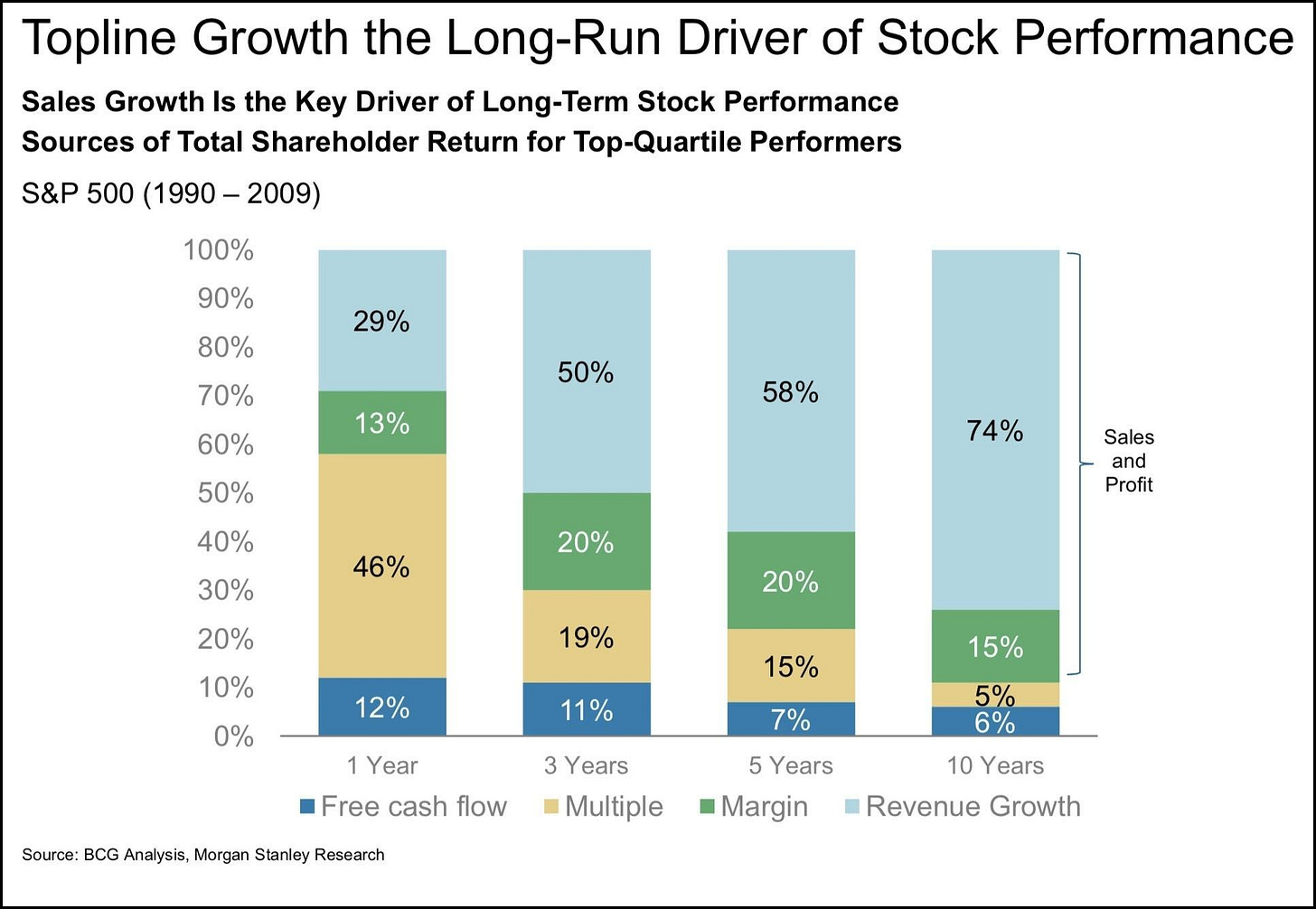

Look, of course Sales and Profitability are what make a company. But those attributes are outputs, not inputs. You don't start a company saying, "I want to have some profitable sales". The input into the company is a multi-variate mess of human narratives, generational changes, platform shifts, and fickle fashions. I am not referring here to Keynes' "animal spirits", that rollercoaster trading psychology across stock markets. Instead, I am referring to the causal vectors of change that are precedent to the creation of companies and their potential financial success (i.e., you don't have Amazon without the Internet, times a billion).

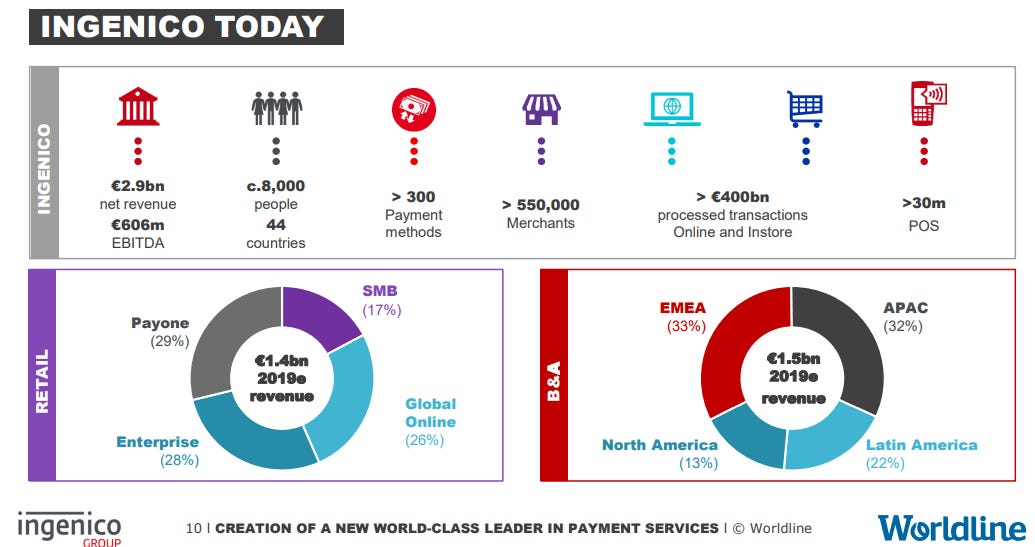

I am going on about this to think about two data points -- (1) Wordline buying Ingenico for $9 billion, and (2) Revolut and Robinhood's private valuations in the $5-10 billion range. In the first case, we have a recent transaction to pull apart (see deck). In the second case, we have a unicorn American free trading app and a European neobank grabbing for more air. While unsubstatiated, rumors that Revolut is trying to raise $3 billion are not a far cry from its previous attempt to raise $1.5 billion. Similarly, Robinhood had previously raised at a $7 billion valuation, and will likely need to do so again.

Worldline and Ingenico are payments infrastructure. You go to a store in Europe, tap your contactless card on their devices, and pay them a fee. The combined business will generate over $5 billion of revenue, across hundreds of billions of dollars in transactional volume, and millions of point-of-sale devices. The underlying narrative in this case is payment industry consolidation, following the Fiserv / First Data and FIS / Worldpay acquisitions. Networks win only at scale, and then use network effects (i.e., competitive moats) to defend their business and drive down prices to exclude upstarts from the industry.

Importantly, this combination is a strict financial modeling exercise. Nobody out there is going out having emotions about Ingenico, First Data, and Worldpay -- despite their sticky year-over-year growth and well-designed PowerPoint slides. Well, maybe hedge fund managers (do they really count?).

What's remarkable is that for the cost of Ingenico's $2.5 billion in revenue and $300 million in free cash flow, you could instead acquire Robinhood or Revolut. Why are supposedly rational venture capitalists putting a hole in their pocket? Is micro-economics breaking? Are markets wrong?

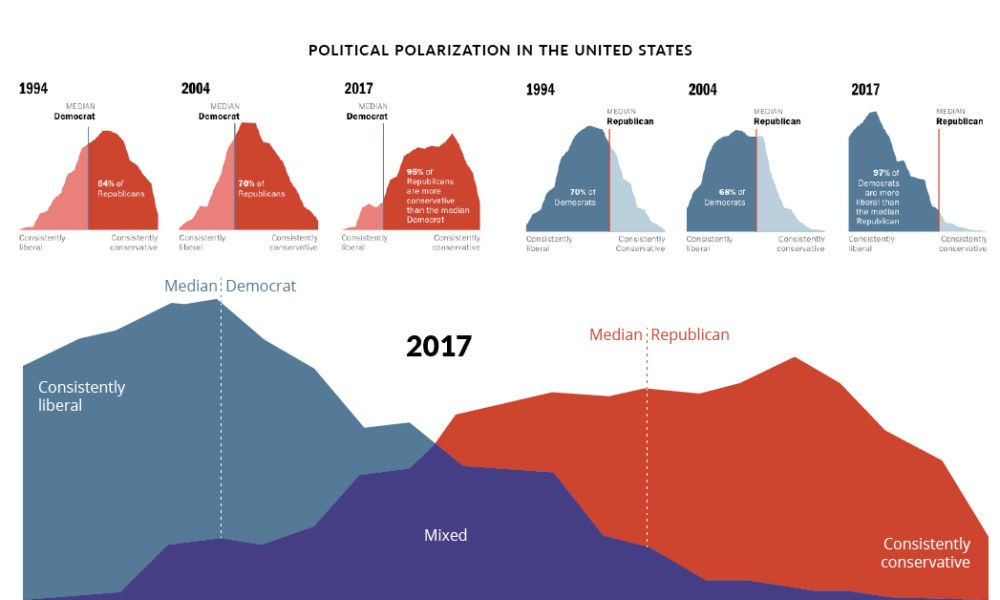

I think it boils down to thinking with a spreadsheet vs. thinking about human nature. This is not just about the demonstrated growth trajectory of young Fintech startups. You might be familiar with identity politics -- the concept that people from similar tribes band together to achieve tribal political outcomes. As the world has become more connected and our opinions have become public and instantly accessible, people have moved more deeply into the articulated extremes of their positions. To reaffirm what you know is to congratulate yourself on who you are.

With the increasing polarization in identity and amplification through attention platforms, like Twitter, iOS, and Google, we have arrived at something called identity economics.

Maybe this is just the natural result of successful branding and consumerism. Certainly, the MTV generation was branded with the name of a service they consumed. But what is happening now is more atomized -- it's not just generational, but behavioral and specific to digital niches. Just as the TV networks shifted from mainstream (i.e, broadcast) to cable (i.e., 100s of channels) to YouTube (billions of individual videos recommended by algorithm), financial services are re-constituting themselves to become fashions. Whether you use Wells Fargo or TD Ameritrade or Betterment or Robinhood is not about features and which online app is more convenient. It is about who you are as a person.

Some of the best articulation on this topic comes from Tom Lee at Fundstrat in discussing generational change. He expertly explains the macro demand for housing, gold, growth stocks, and crypto assets through the lens of generational identity. I quote liberally from this deck below. The core argument is to watch what the generations are doing, and when their top income generating years occur. Based on the preferences of these generations -- economic identity, and otherwise -- we can understand what happens to asset prices, because those generations will deploy earnings into preferred assets.

The argument goes that the Silent Generation used gold as a store of value, Boomers looked to traditional equities, Gen X fueled the expansion in hedge funds, and now Millennials are determining the shape and outcomes of the asset management landscape. Anecdotally, you know this to be true with the shift to ETFs and indexing, social impact funds, and crypto assets like Bitcoin. We do not know the quantitative impact from the qualitative discussion, but we are a little bit smarter than just complaining that Revolut has less revenue than Ingenico.

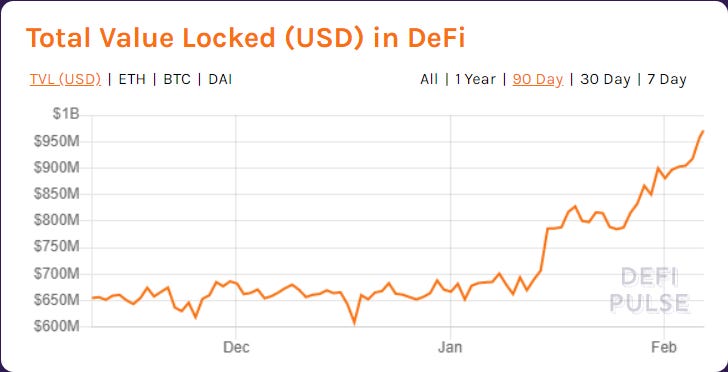

Further, growth can also be a reflexive phenomenon. To the extent social and economic identity becomes tied together with using a particular Fintech mobile app, or playing video games that have blockchain-anchored digital assets, their adoption becomes a self-fulfilling truth. As social animals, we compare what we are doing to what other versions of us are doing. I don't care if a Silent Generation investor is still buying gold. I do care if other Millennials have crypto on their phones, and whether people are talking about it on YouTube. So, for example, having $1 billion of value associated with Decentralized Finance is far more meaningful to my economic identity (and that of other crypto entrepreneurs) than the incremental $100 billion of payments volume added to Ingenico.

My argument has gotten fuzzy at times, but that's part of the point. We have seen strict modeling approaches fall apart, because either they are not statistically accurate, or because they simplify the world in a way to lose core information about correlations, social changes, and platform shifts. For an early stage investor evaluating systemic themes, you have to understand how the tectonic plates underneath our industries move before they generate companies, sales, and profits.

Like it? Share it!

Weekly Fintech & Crypto Developments

Change in program!

The weekly 12 key updates (with graphs and analysis) on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality, are moving to a separate day — so make sure you are subscribed to this newsletter if you got it from a friend.

If you’re already subscribed, just pause to enjoy the gradient of the button, and the clouds passing overhead as the Earth spins onwards around the Sun. Over the next several weeks, I am evaluating whether the key updates provide enough value to you to be the anchor of a subscription version of this newsletter. Don’t worry, the Long Takes will stay free, and long.

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.