AgentFi 101: The Definitive Guide to Decentralized Financial Agents

Lending, Farming, Arbitrage AgentFi’s First Real Use Cases

Gm Fintech Architects —

We are lucky today to have a guest post today from 0xjacobzhao, an independent researcher focused on the intersection of finance, AI, and Web3 systems. This is sophisticated content for builders looking to create new services at this intersection.

Summary: We explore the evolution of DeFi from basic automation to fully autonomous financial agents, “AgentFi”, capable of perception, strategy generation, and on-chain execution. We outline three phases: rule-based Automation Infrastructure, intent-driven Copilots (e.g., HeyElsa, Bankr), and intelligent AgentFi systems (e.g., Giza ARMA, Theoriq). The most compatible use cases for AgentFi are yield-generating strategies like lending and liquidity mining, due to their optimization potential and dynamic conditions. Projects like Pendle, Brahma, and Almanak are pushing the frontier by integrating modular strategy engines, multi-agent orchestration, and AI-driven decision loops. While still early, AgentFi marks a new phase in DeFi, moving from reactive tools to adaptive financial intelligence.

Topics: Giza ARMA, Theoriq, Olas, Almanak, HeyElsa, Bankr, Griffain, Symphony, HeyAnon, Brahma, Axal, Fungi.ag, ZyFAI, Gelato, Mimic, AFI Protocol, Pendle

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

The Intelligent Evolution of DeFi: From Automation to AgentFi

By 0xjacobzhao and ChatGPT-4o. This piece benefited from the insightful suggestions of Lex Sokolin (Generative Ventures), Stepan Gershuni (cyber.fund), and Advait Jayant (Aivos Labs), along with valuable input from the teams behind Giza, Theoriq, Olas, Almanak, and HeyElsa. While every effort has been made to ensure objectivity and accuracy, certain perspectives may reflect personal interpretation. Readers are encouraged to engage with the content critically. You can also see this article on X/Twitter here.

Among the sectors in the current crypto landscape, stablecoin payments and DeFi applications stand out as two verticals with verified real-world demand and long-term value. At the same time, the flourishing development of AI Agents is emerging as the practical user-facing interface of the AI industry, acting as a key intermediary between AI and users.

In the convergence of Crypto and AI, particularly in how AI feeds back into crypto applications, exploration has centered around three typical use cases:

Conversational Agents: These include chatbots, companions, and assistants. While many are still wrappers around general-purpose large models, their low development threshold and natural interaction—combined with token incentives—make them the earliest form to reach users and attract attention.

Information Integration Agents: These focus on aggregating and interpreting both on-chain and off-chain data. Projects like Kaito and AIXBT have seen success in web-based information aggregation, though on-chain data integration remains exploratory with no clear market leaders yet.

Strategy Execution Agents: Centered on stablecoin payments and DeFi strategy automation, these agents give rise to two key categories: (1) Agent Payment and (2) DeFAI. These agents are deeply embedded in the logic of on-chain trading and asset management, with the potential to move beyond speculative hype and establish sustainable, efficient financial automation infrastructure.

This article focuses on the evolutionary path of DeFi and AI integration, outlining the transition from automation to intelligent agents, and analyzing the underlying infrastructure, application space, and core challenges of strategy-executing agents.

Three Stages of DeFi Intelligence: From Automation to Copilot to AgentFi

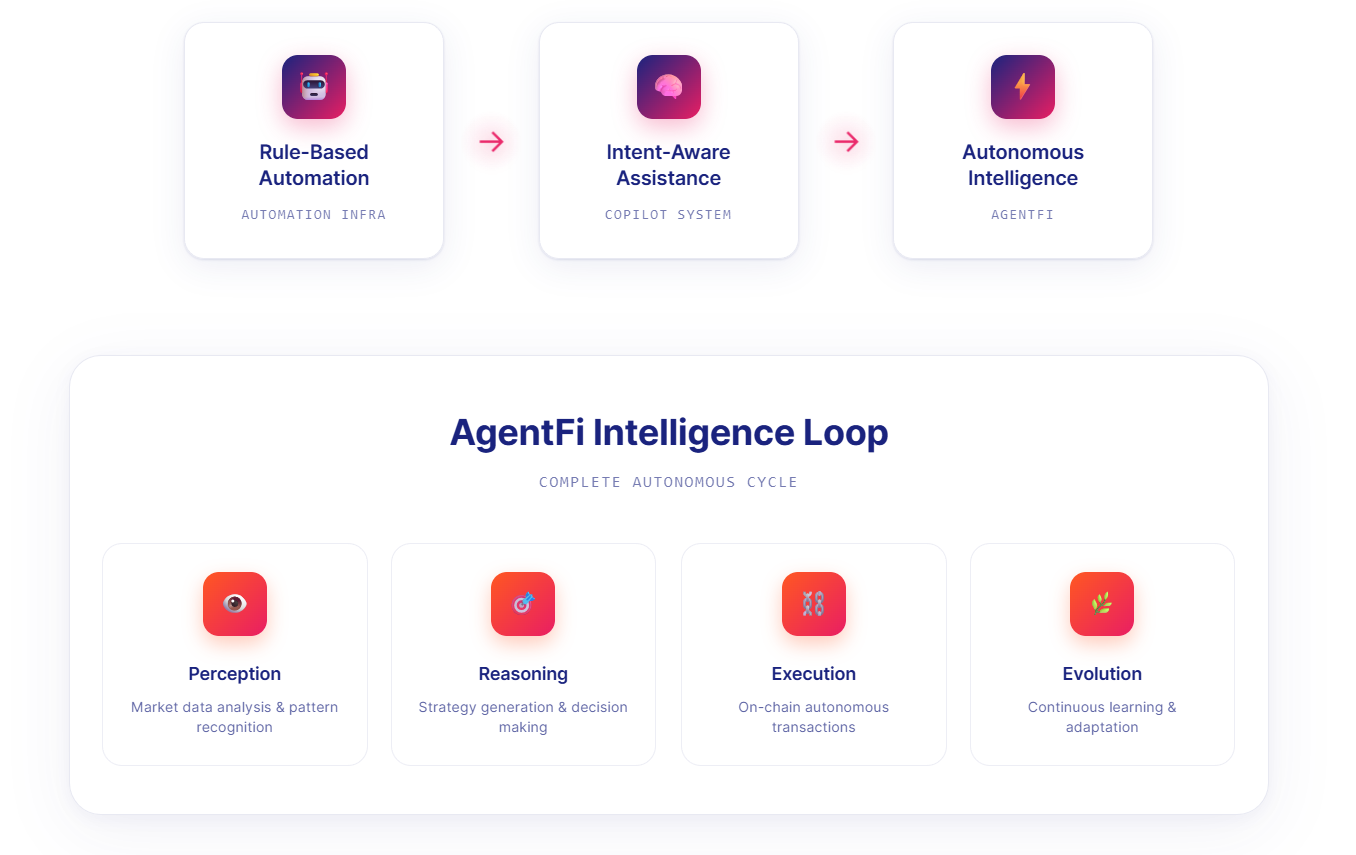

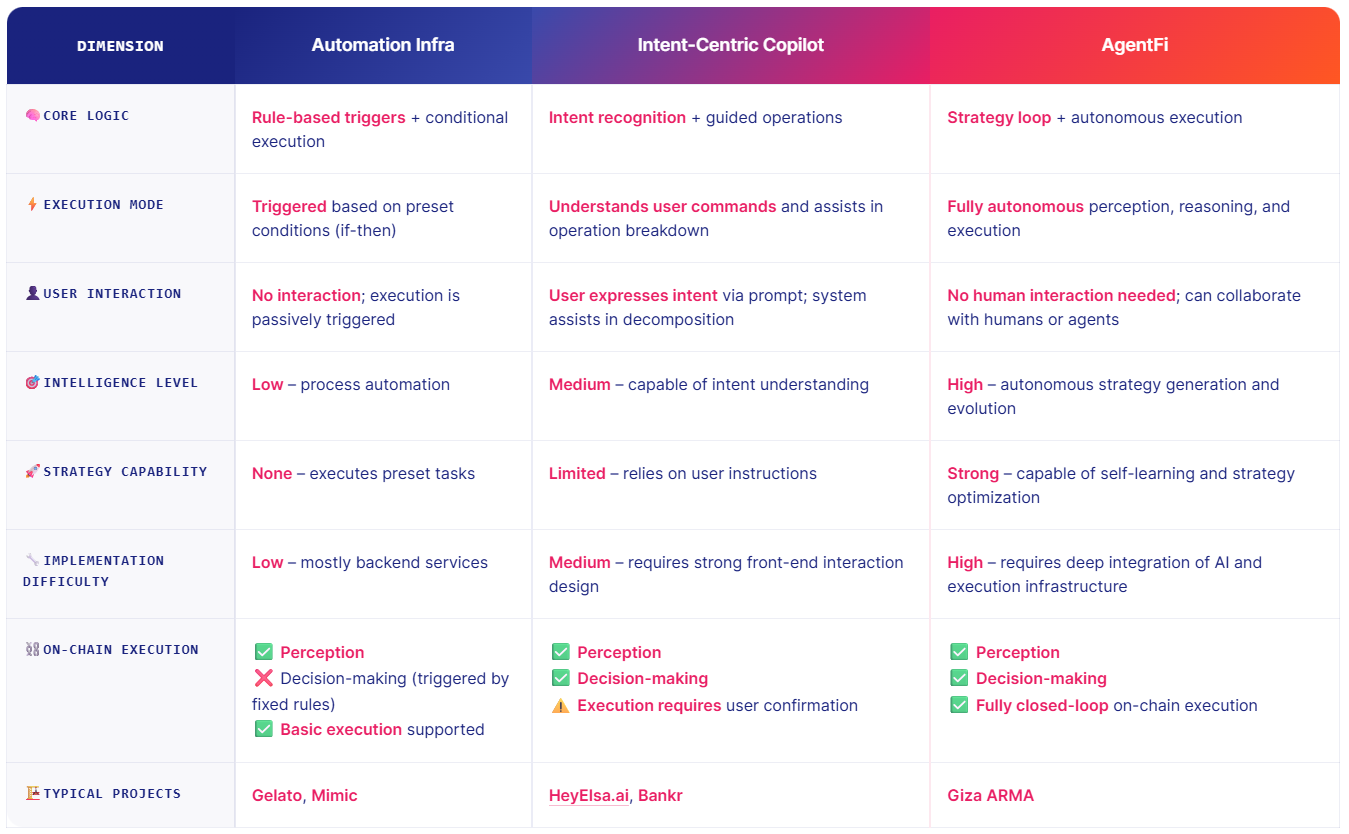

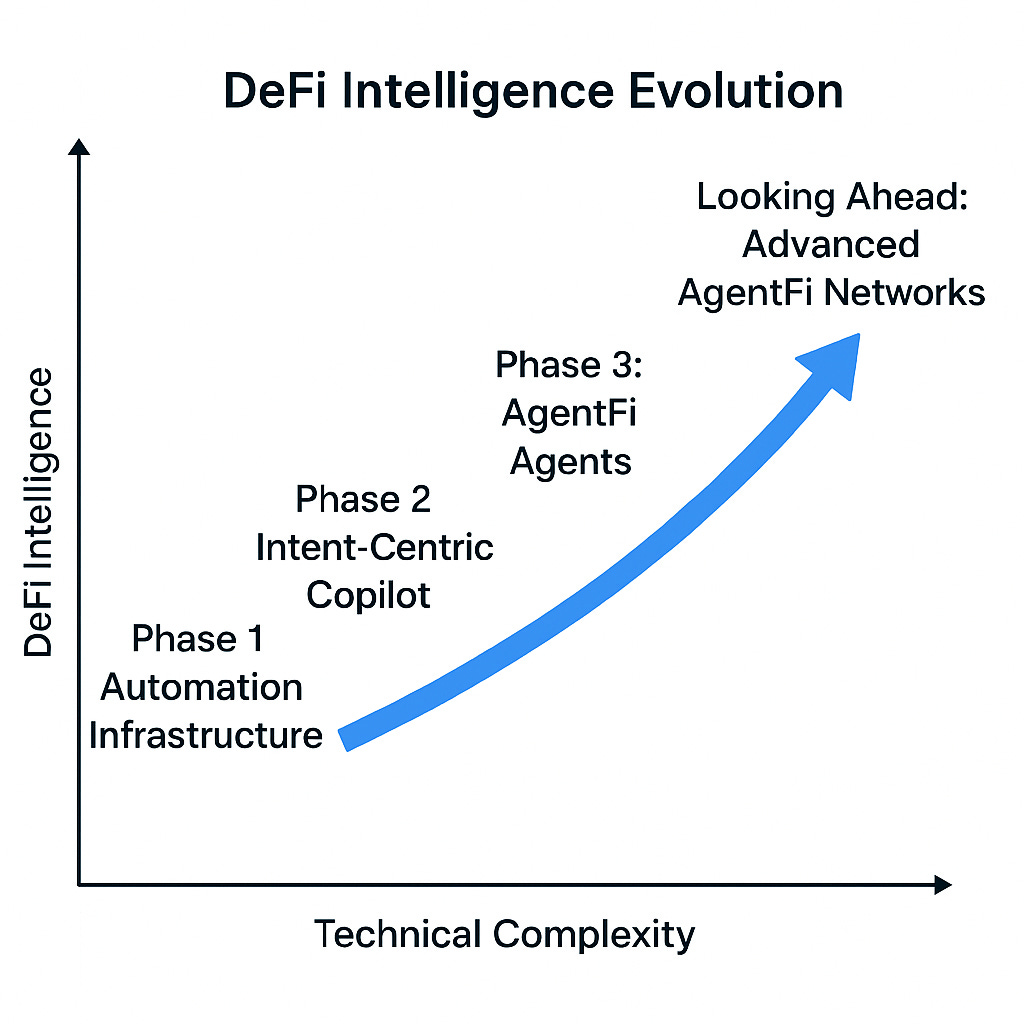

The evolution of intelligence in DeFi can be categorized into three progressive stages:

Automation (Automation Infra) – These systems function as rule-based triggers, executing predefined tasks such as arbitrage, rebalancing, or stop-loss orders. They lack the ability to generate strategies or operate autonomously.

Intent-Centric Copilot – This stage introduces intent recognition and semantic parsing. Users input commands via natural language, and the system interprets and decomposes them to suggest execution paths. However, the execution loop is not autonomous and still relies on user confirmation.

AgentFi – This represents a complete intelligence loop: perception → reasoning/strategy generation → on-chain execution → continuous evolution. AgentFi embodies on-chain agents with autonomous execution and adaptive learning, capable of closing the loop and evolving with experience.

To determine whether a project truly qualifies as AgentFi, it must meet at least three of the following core criteria.

They are as follows:

Autonomous perception of on-chain state/market signals — Not static inputs, but real-time monitoring

Capability for strategy generation and composition — Not just preset strategies, but the ability to create contextual action plans autonomously

Autonomous on-chain execution — Able to perform complex actions like swap/lend/stake without human interaction

Persistent state and evolutionary capability — Agents have lifecycles, can run continuously, and adjust behavior based on feedback

Agent-native architecture (dedicated Agent SDKs, specialized execution environments, and intent routing or execution middleware designed to support autonomous agents

In other words, automated trading is not a Copilot, and certainly is not AgentFi. Automated trading is merely a rule-based trigger system. Copilots can interpret user intent and offer actionable suggestions, but still depend on human input. True AgentFi refers to agents with perception, reasoning, and autonomous on-chain execution, capable of closing the strategy loop and evolving over time without human intervention.

DeFi Use Case Suitability Analysis

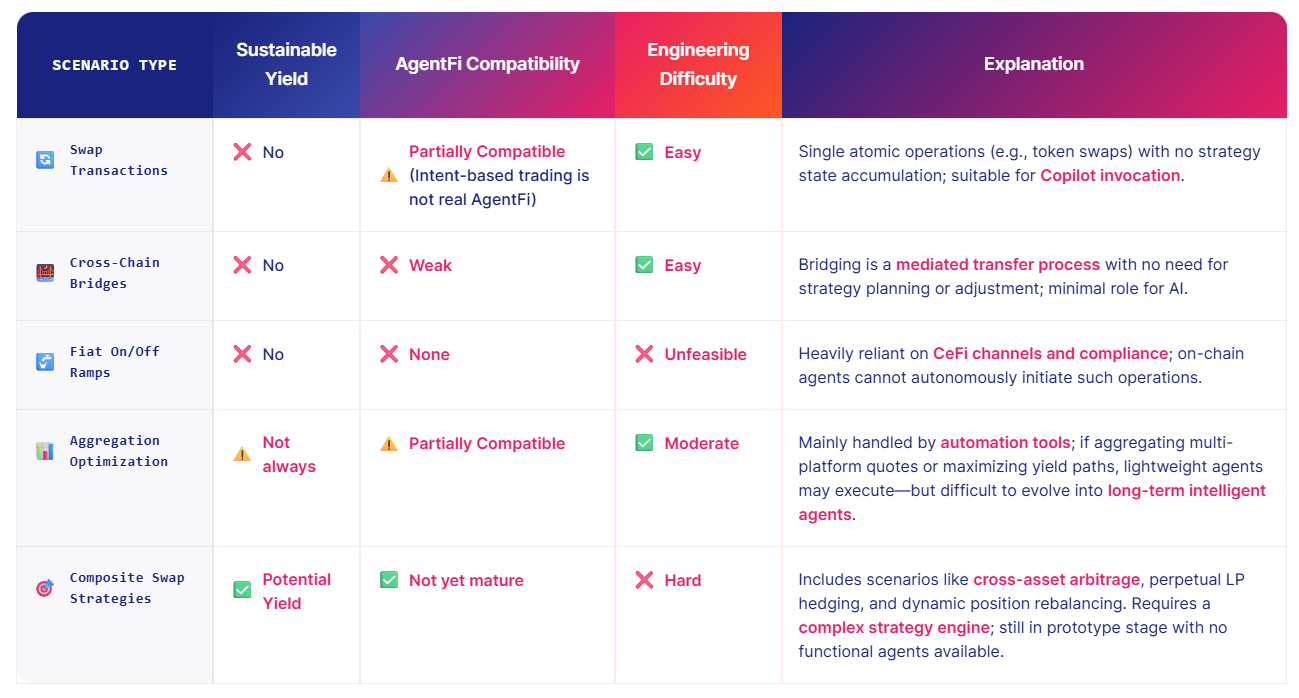

Within decentralized finance (DeFi), core applications generally fall into two categories:

Token Capital Markets: asset circulation and exchange

Fixed Income: Yield-generating financial strategies

We believe these two categories differ significantly in their compatibility with intelligent execution:

1. Token Capital Markets: asset circulation and exchange

This category involves atomic interactions, such as Swap transactions, Cross-chain bridging, and Fiat on/off ramps.

Their core characteristics are "intent-driven + single-step atomic execution", and they do not involve yield strategies, state persistence, or evolution logic. Thus, they are better suited for Intent-Centric Copilots and do not constitute AgentFi.

Due to lower technical barriers and simple interactions, most current DeFAI projects fall into this category. These do not form closed-loop AgentFi systems.

However, more advanced swap strategies — like cross-asset arbitrage, perpetual LP hedging, leverage rebalancing — may require the capabilities of AI Agents, though such implementations are still in the early exploratory phase.

We can imagine well-articulated trading or investing strategies with different time intervals and various requirements that are run by agents in reference to price, volume, and other indicators. To date, these are largely still in development, with an early example being Brahma.

2. Fixed Income: Yield-generating financial strategies

Yield-generating financial scenarios are naturally aligned with the AgentFi model of “strategy closed-loop + autonomous execution,” as they feature clear return objectives, complex strategy composition, and dynamic state management.

Key characteristics include:

Quantifiable return targets (APR / APY), enabling Agents to build optimization functions;

A wide strategy design space involving multi-asset, multi-duration, multi-platform, and multi-step interactions;

Frequent management and real-time adjustments, making them well-suited for execution and maintenance by on-chain Agents.

Due to multiple constraints such as yield duration, volatility frequency, on-chain data complexity, cross-protocol integration difficulty, and compliance limitations, different yield-generating scenarios vary significantly in terms of AgentFi compatibility and engineering feasibility.

The following prioritization is recommended:

High-Priority Implementation Scenarios:

Lending / Borrowing: Interest rate fluctuations are easy to track, with standardized execution logic, ideal for lightweight agents.

Yield Farming: Pools are highly dynamic with broad strategy combinations and volatile returns. AgentFi can significantly enhance APY and interaction efficiency, though engineering implementation is relatively challenging.

Mid-to-Long-Term Exploration Directions:

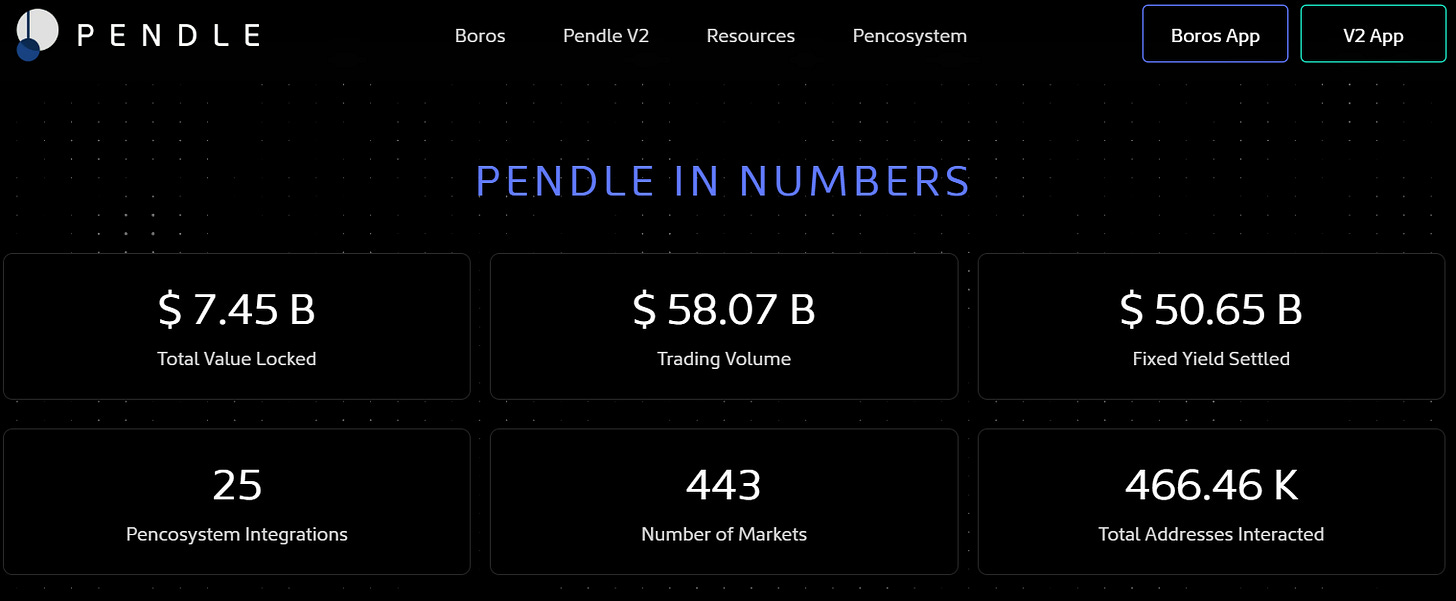

Pendle Yield Trading: Time dimensions and yield curves are clear, making it suitable for agents to manage rollovers and inter-pool arbitrage.

Funding Rate Arbitrage: Theoretical returns are attractive but require solving cross-market execution and off-chain interaction challenges—high engineering complexity.

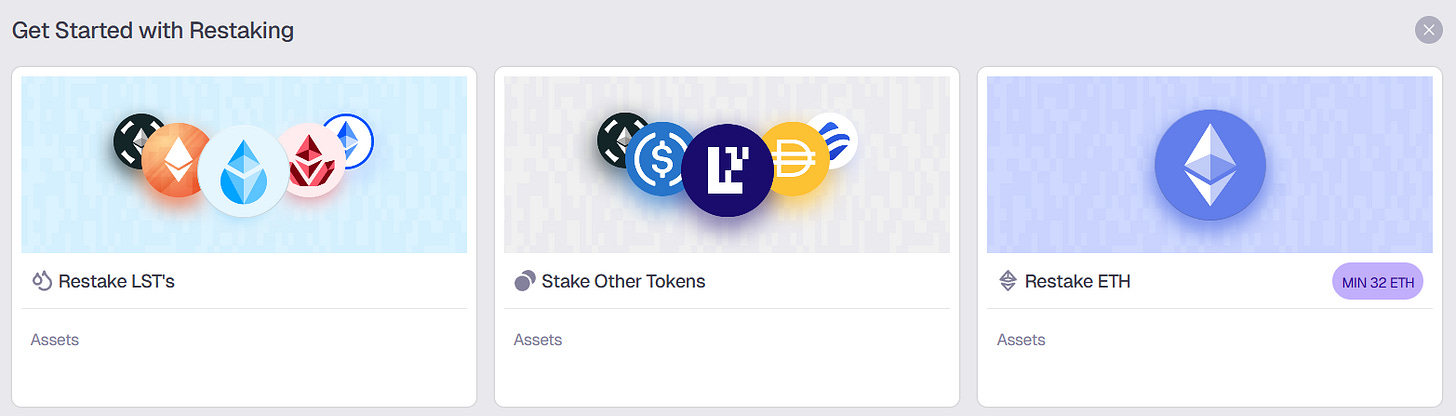

LRT (Liquid Restaking Token) Dynamic Portfolio Management: Static staking is not suitable; potential lies in combining LRT with LP, lending, and automated rebalancing strategies.

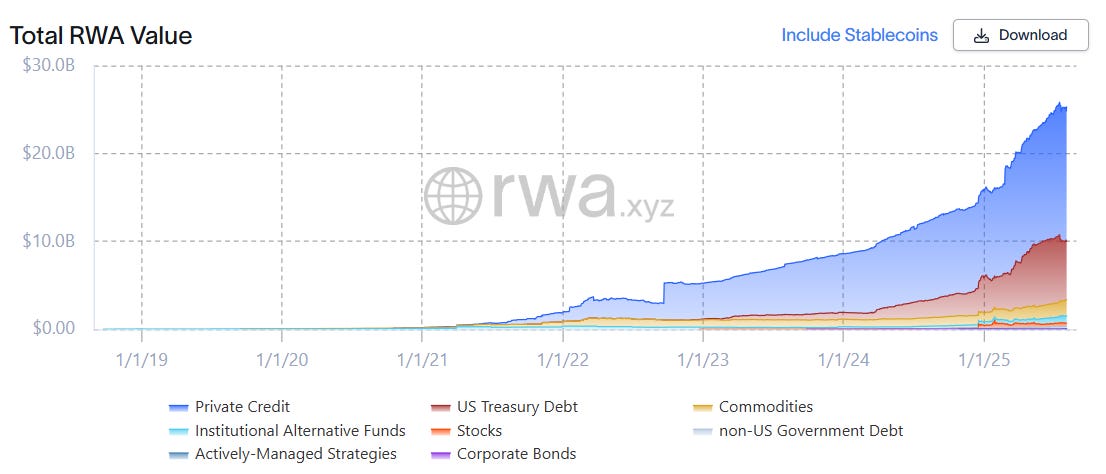

RWA Multi-Asset Portfolio Management: Difficult to implement in the short term. Agents can assist with portfolio optimization and maturity planning.

Intelligentization of DeFi Scenarios:

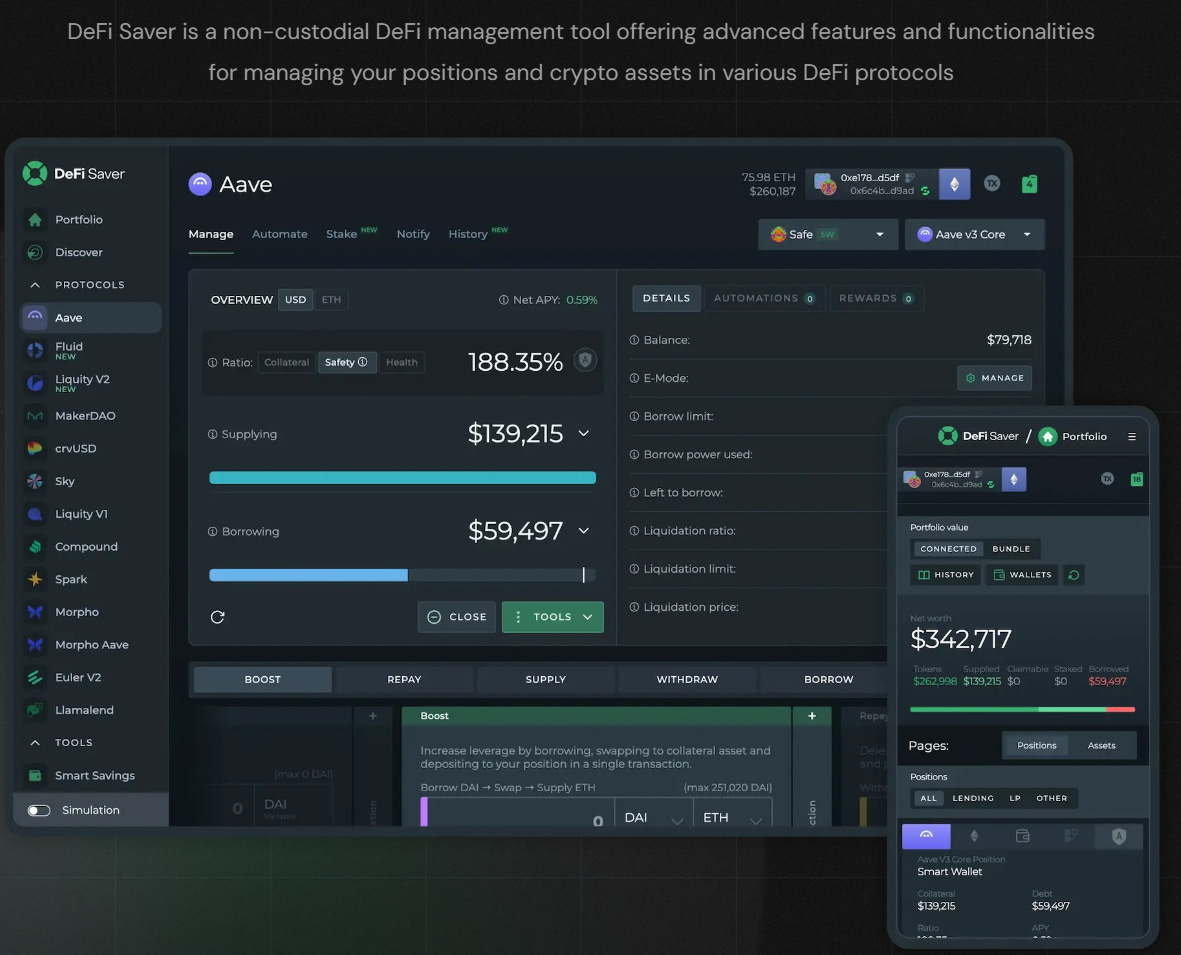

1. Automation Tools: Rule Triggers and Conditional Execution

Gelato is one of the earliest infrastructures for DeFi automation, once supporting conditional task execution for protocols like Aave and Reflexer. It has since pivoted to a Rollup-as-a-Service provider.

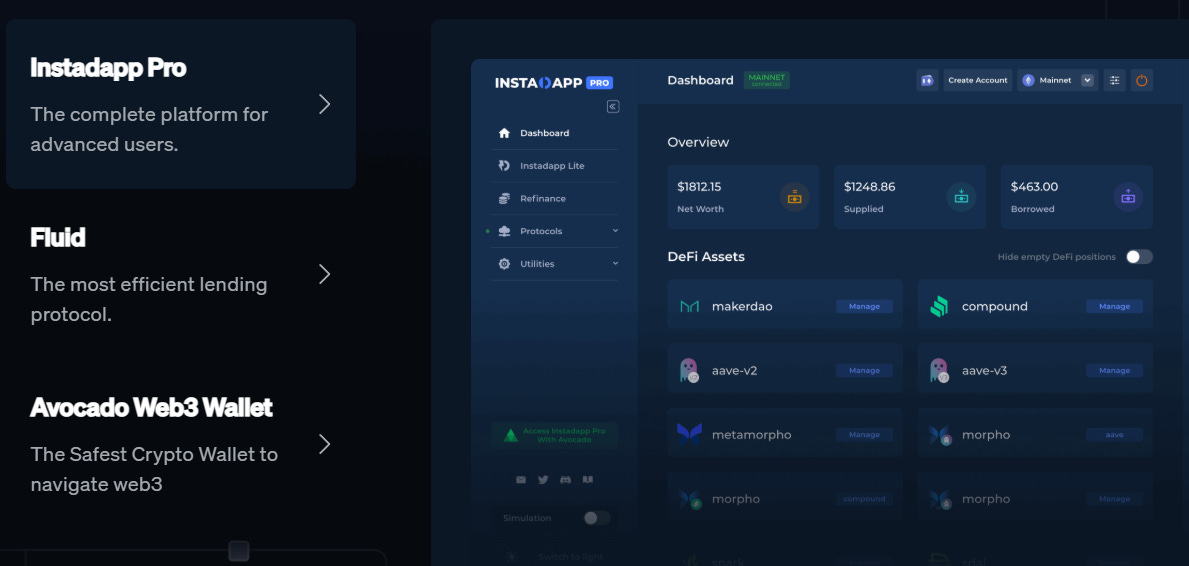

Currently, the main battleground for on-chain automation has shifted to DeFi asset management platforms (e.g., DeFi Saver, Instadapp) and smart wallets (Avocado Wallet), which offer standardized automation modules like limit orders, liquidation protection, auto-rebalancing, DCA, and grid strategies.

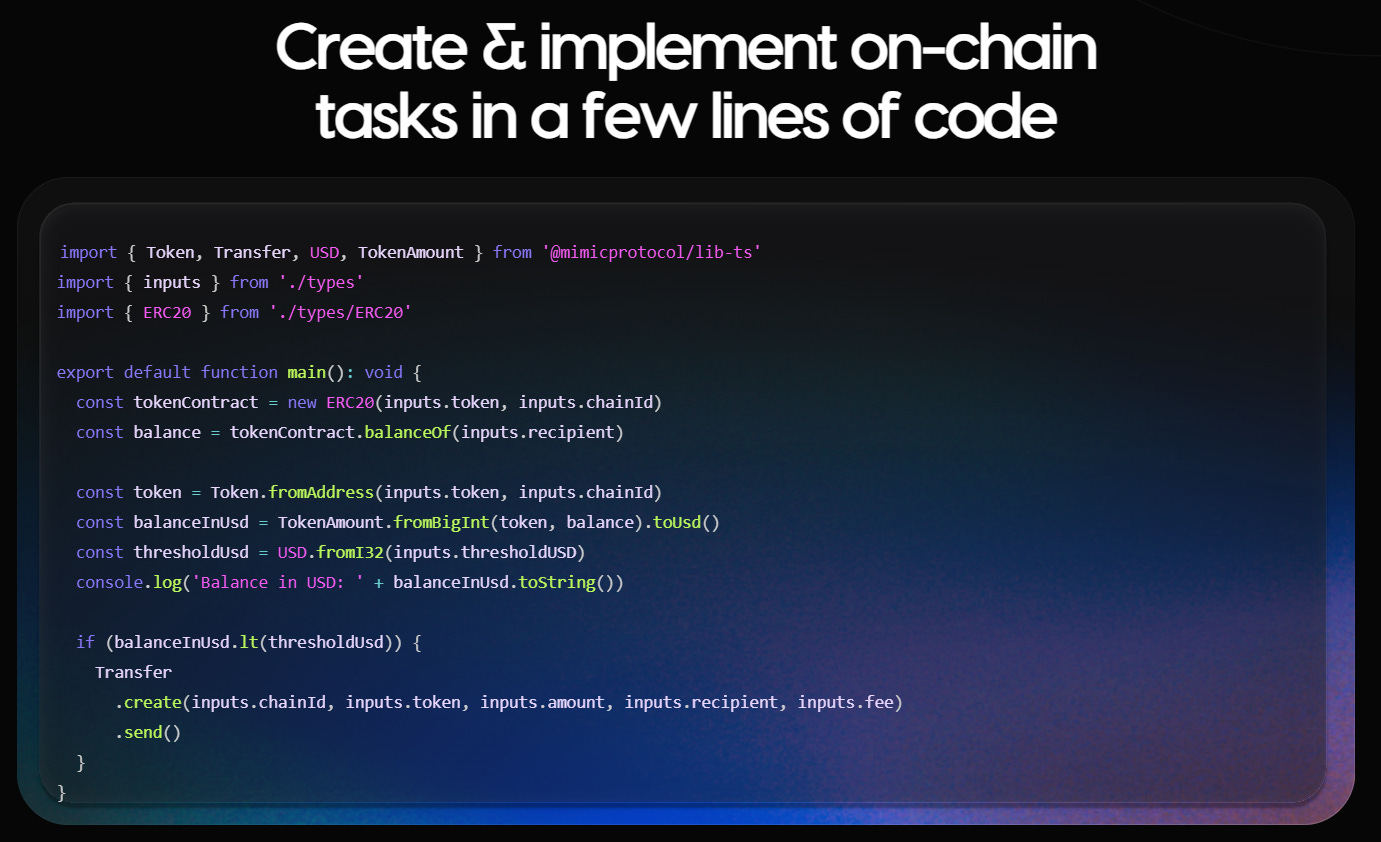

Some more advanced DeFi automation platforms include Mimic.fi, an on-chain automation platform for DeFi developers and projects, supporting programmable automation across chains like Arbitrum, Base, and Optimism. The protocol has processed $4B on volume and automated millions of transactions for large wallets.

Its architecture includes: Planning (task and trigger definition), Execution (intent broadcasting and competitive execution), and Security (triple verification and risk control). Currently SDK-based and still in early-stage deployment.

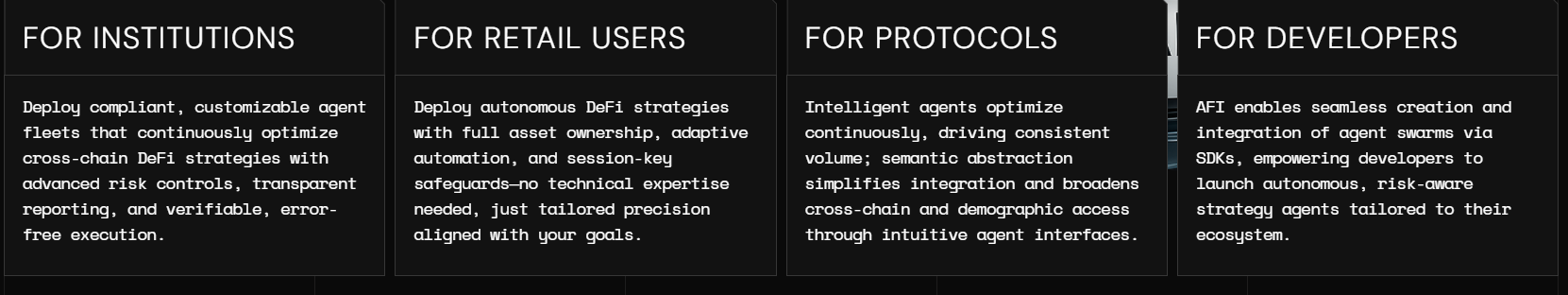

Another player is AFI Protocol, an algorithm-driven agent execution network supporting 24/7 non-custodial automation. It targets fragmented execution, high strategy barriers, and poor risk response in DeFi.

It offers programmable strategies, permission controls, SDK tools, and a native yield-bearing stablecoin afiUSD. Currently in private testing under Sonic Labs, not yet open to the public or retail users.

2. Intent-Centric Copilot: Intent Expression & Execution Suggestions

The DeFAI narrative that surged in late 2024, excluding speculative meme-token projects, mostly falls under Intent-Centric Copilot, where users express intent in natural language, and the system suggests actions or performs basic on-chain operations.

The core capability is still at the stage of: “Intent Recognition + Copilot-Assisted Execution”, without a closed-loop strategy cycle or continuous optimization. Due to current limitations in semantic understanding, cross-protocol interaction, and response feedback, most user experiences are suboptimal and functionally constrained.

Notable projects include:

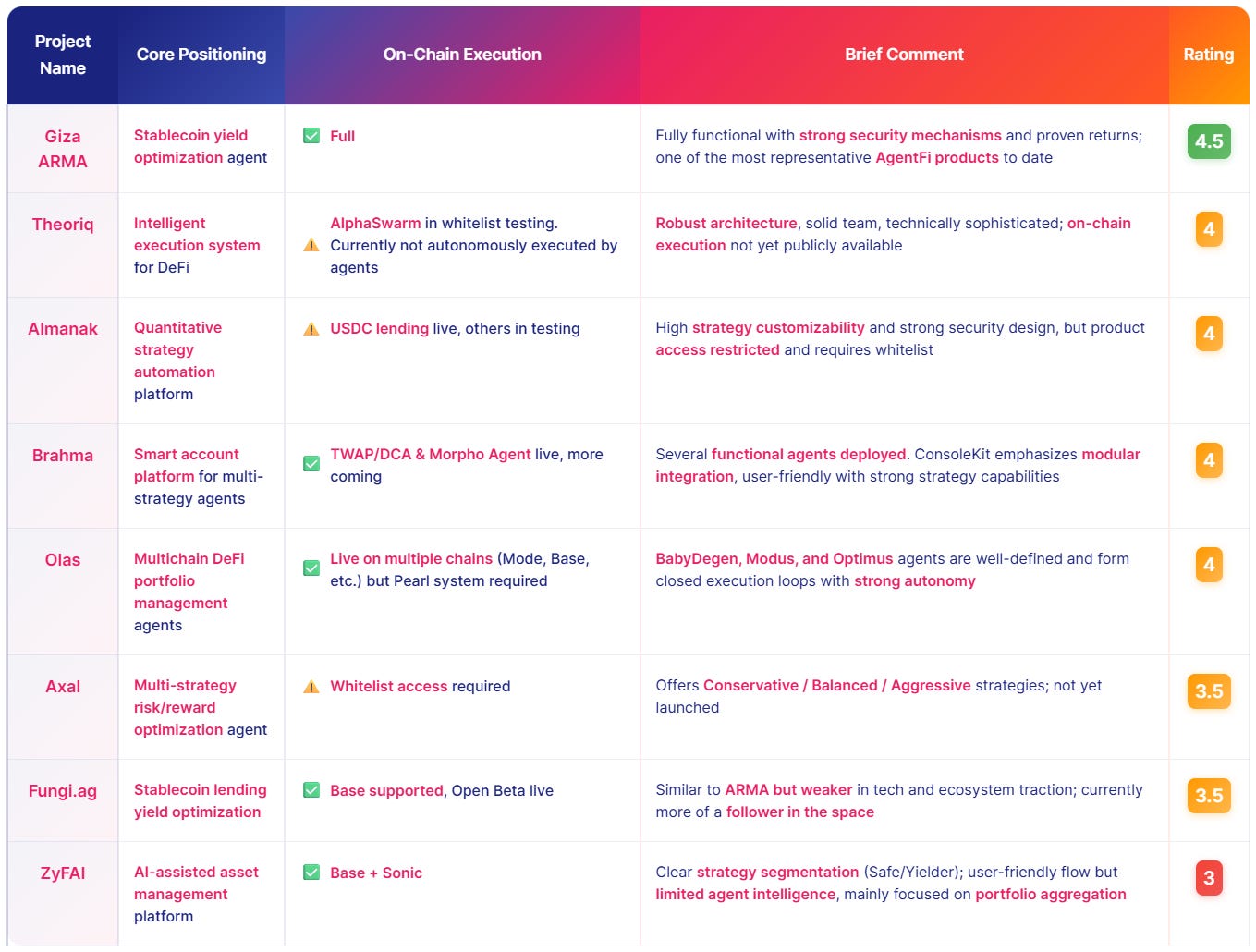

The above scoring system is primarily based on the usability of the product at the time the author reviewed it, the user experience, and the feasibility of the publicly available roadmap. It reflects a high degree of subjectivity. Please note that this evaluation does not include any code security audits and should not be considered investment advice.

We go into more detail below.

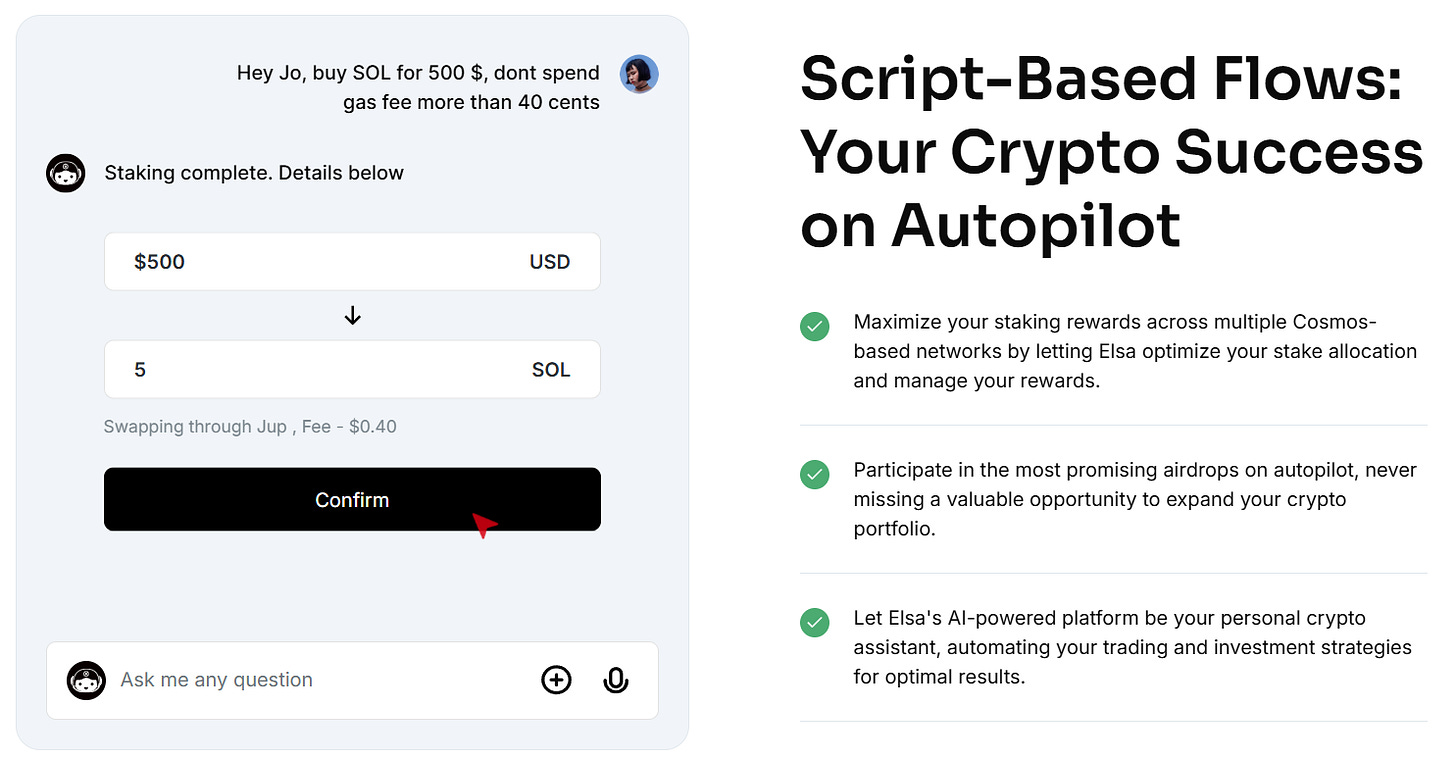

HeyElsa – https://app.heyelsa.ai/

HeyElsa is the AI Copilot of Web3, empowering users to execute actions like trading, bridging, NFT purchases, stop-loss settings, and even creating Zora tokens—all through natural language. As a powerful conversational crypto assistant, it targets beginner to super advanced users as well as degen traders and is fully live and functional across 10+ chains. With 1 million in daily trading volume, 3,000 to 5,000 daily active users, and integrated yield optimization strategies alongside automated intent execution, HeyElsa establishes a robust foundation for AgentFi.

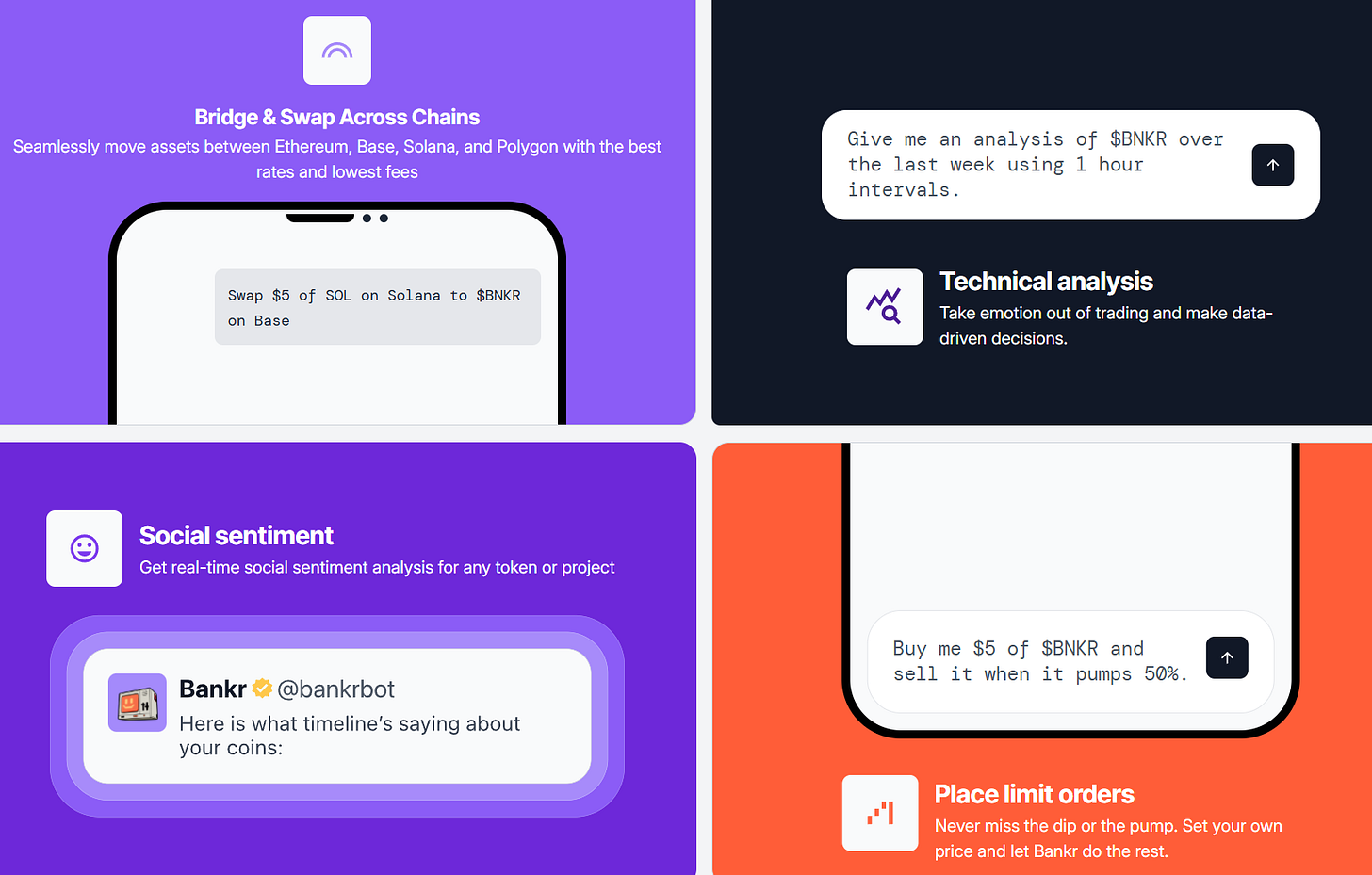

Bankr – https://bankr.bot/

An intent-based trading assistant integrating AI, DeFi, and social interaction. Users can issue natural language commands via X or its dedicated terminal to perform swap, limit order, bridging, token launches, NFT minting, etc., across Base, Solana, Polygon, and Ethereum mainnet. Bankr builds a full Intent → Compilation → Execution pipeline, emphasizing minimal UI and seamless integration within social platforms. It uses token incentives and revenue sharing to fuel growth.

Griffain – https://griffain.com/

A multifunctional AI Agent platform built on Solana. Users interact with the Griffain Copilot via natural language to query assets, trade NFTs, manage LPs, and more. The platform supports multiple agent modules and encourages community-built agents. It’s built using Anchor Framework and integrates with Jupiter, Tensor, etc., emphasizing mobile compatibility and composability. Currently supports 10+ core agent modules with strong execution capabilities.

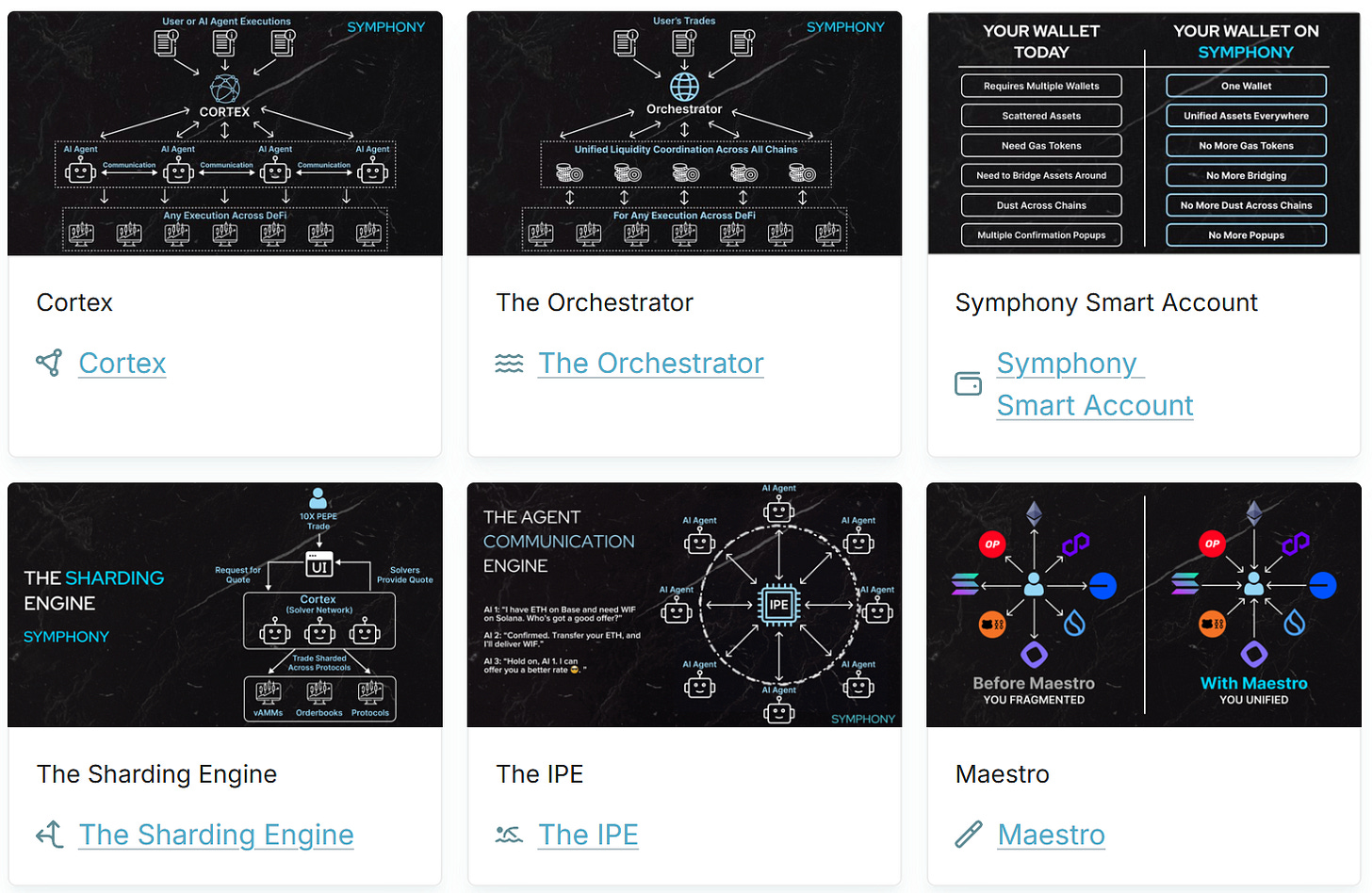

Symphony – https://www.symphony.io/

An execution infrastructure for AI agents, building a full-stack system with intent modeling, intelligent route discovery, RFQ execution, and account abstraction. Their conversational assistant Sympson is live with market data and strategy suggestions, and execution is available on perp trading. Symphony provides the foundational components for AgentFi and is positioned to support collaborative agent execution and cross-chain operations in the future.

HeyAnon – https://heyanon.ai/

A DeFAI platform that claims to combine intent interaction, on-chain execution, and intelligence analysis. Supports multi-chain deployment (Ethereum, Base, Solana, etc.) and cross-chain bridges (LayerZero, deBridge). Users can use natural language to swap, lend, stake, and analyze market sentiment and on-chain dynamics. Despite attention from founder Sesta, it remains in the Copilot phase, with incomplete strategy and execution intelligence. Long-term viability is still being tested.

3. AgentFi Agents: Strategy Closed-Loop and Autonomous Execution

We believe AgentFi represents a more advanced paradigm in the intelligent evolution of DeFi, compared to Intent-Centric Copilots. These agents possess independent yield strategies and on-chain autonomous execution capabilities, significantly improving execution efficiency and capital utilization for users.

In 2025, we are excited to see a growing number of AgentFi projects already live or under development, mainly focused on lending and liquidity mining. Notable examples include Giza ARMA, Theoriq AlphaSwarm, Almanak, Brahma, the Olas agent series, and more that we highlight below.

As stated before, the above scoring system is primarily based on the current usability of the product, user experience, and the feasibility of the publicly available roadmap. It reflects a high degree of subjectivity. Please note that this evaluation does not include any code security audits and should not be considered investment advice. Your understanding is appreciated.

We highlight the projects in more detail below.

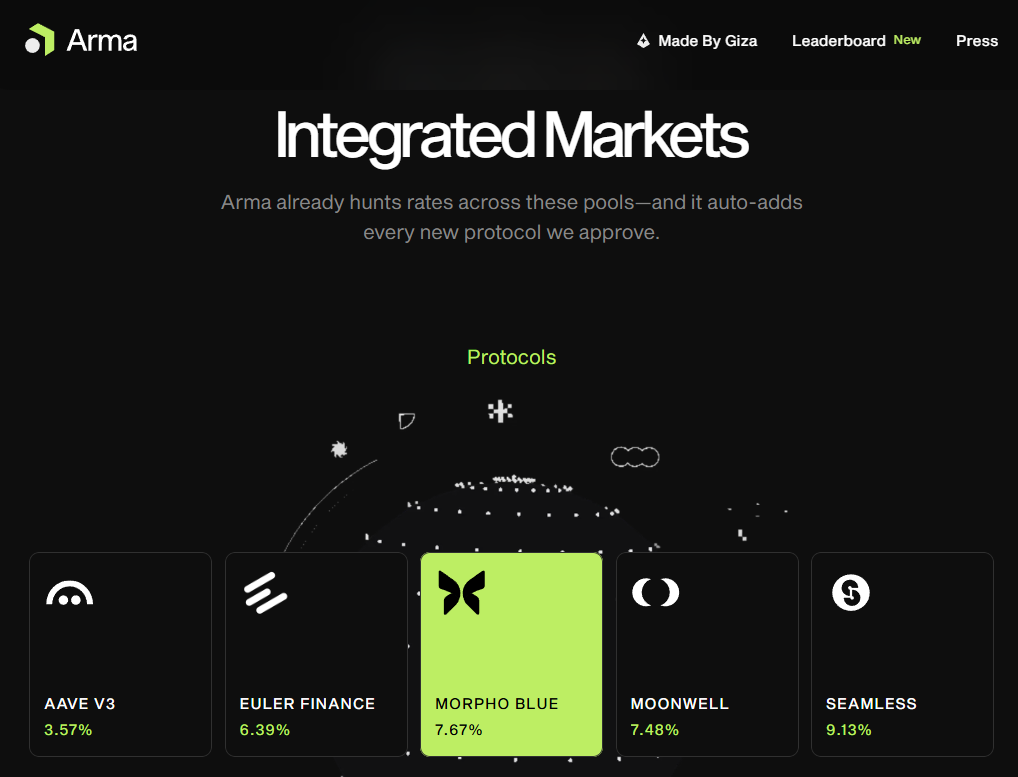

Giza ARMA – https://arma.xyz/

ARMA is an intelligent agent product launched by Giza, designed for cross-protocol stablecoin yield optimization. Deployed on Base, ARMA supports major lending protocols like Aave, Morpho, Compound, and Moonwell, with key capabilities such as cross-protocol rebalancing, auto-compounding, and smart asset switching. The ARMA strategy system monitors stablecoin APRs, transaction costs, and yield spreads in real time, adjusting allocations autonomously—resulting in significantly higher yields compared to static holdings.

Its modular architecture includes: Smart accounts, Session keys, Core agent logic, Protocol adapters, Risk management, Accounting modules. Together, these ensure non-custodial yet secure and efficient automation. ARMA is now fully launched and iterating rapidly, making it one of the most practical AgentFi products in DeFi yield automation. You can read more about it here: 📚 A New Paradigm for Stablecoin Yields: AgentFi to XenoFi

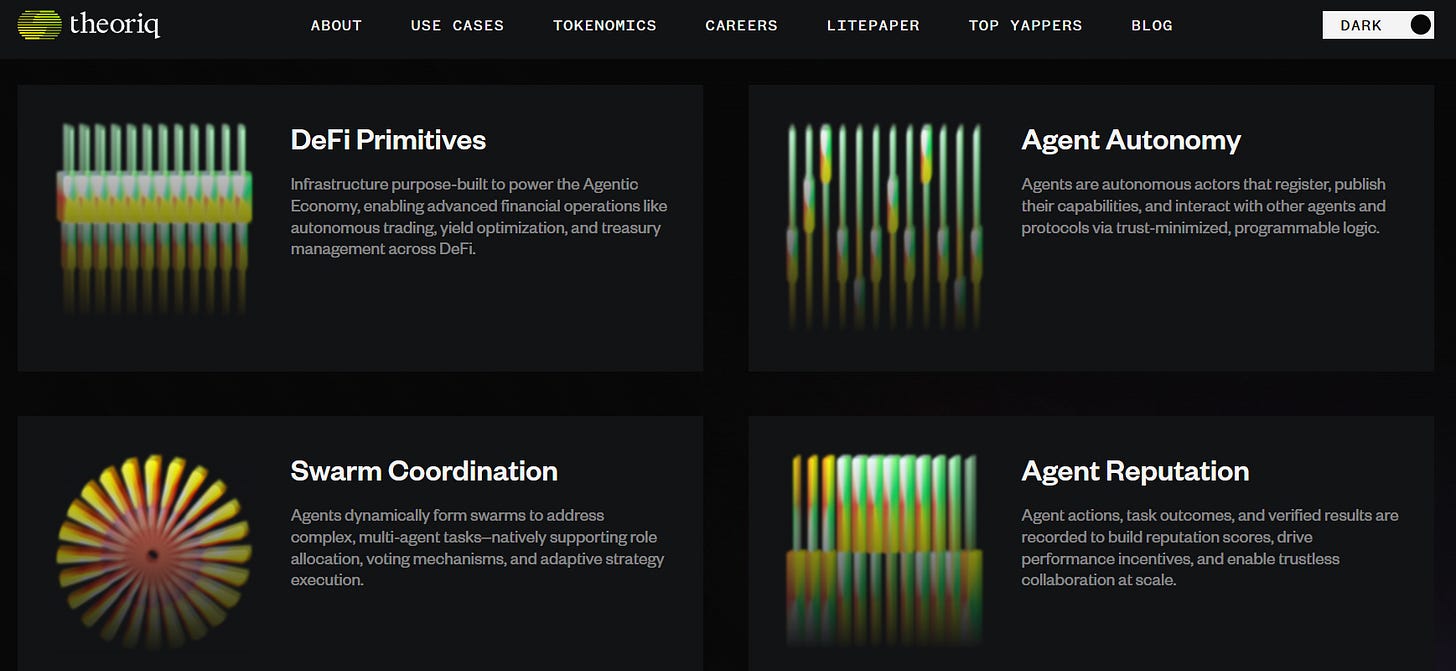

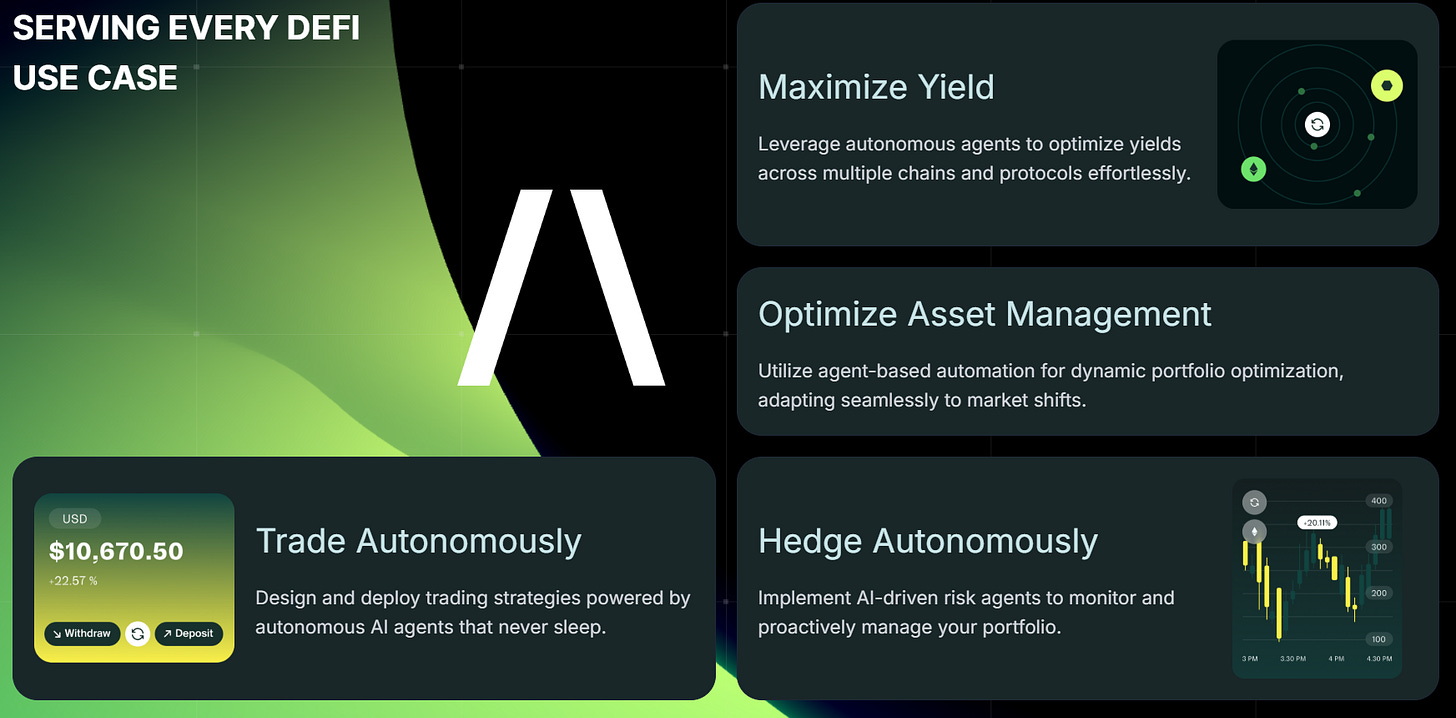

Theoriq – https://www.theoriq.ai/

Theoriq Alpha Protocol is a multi-agent collaboration protocol focused on DeFi, with AlphaSwarm as its core product, targeting liquidity management.

It aims to build a full automation loop of perception → decision-making → execution, made up of Portal Agents (on-chain signal detection), Knowledge Agents (data analytics and strategy selection), LP Assistants (strategy execution). These agents can dynamically manage asset allocation and optimize yield without human intervention. The base-layer Alpha Protocol provides agent registration, communication, parameter configuration, and development tools, serving as an “Agent Operating System” for DeFi. Via AlphaStudio, users can browse, invoke, and compose agents into modular, scalable automated strategies.

Theoriq recently raised $84M in community funding via Kaito Capital Launchpad and is preparing for its TGE. The AlphaSwarm Community Beta Testnet is now live, with mainnet launch imminent. Read more about it here: 📚 Theoriq: The Evolution of AgentFi in Liquidity Mining Yields.

Almanak – https://almanak.co/

Almanak is an intelligent agent platform for DeFi strategy automation, combining non-custodial security architecture with a Python-based strategy engine to help traders and developers deploy sustainable on-chain strategies.

Its core modules include: Deployment (execution engine), Strategy (logic layer), Wallet (Safe + Zodiac security), Vault (asset tokenization). It supports yield optimization, cross-protocol interactions, LP provisioning, and automated trading. Compared to traditional tools, Almanak emphasizes AI-powered market perception and risk control, offering 24/7 autonomous operation. It plans to introduce multi-agent and AI decision systems as next-gen AgentFi infrastructure.

The strategy engine is a Python-based state machine—the “decision brain” of each agent—capable of responding to market data, wallet status, and user-defined conditions to autonomously execute on-chain actions. A full Strategy Framework enables users to build and deploy actions like trading, lending, or LP provisioning without writing low-level contract code. It ensures privacy and safety through encrypted isolation, permission control, and monitoring. Users can write strategies via SDKs, with future support for natural language strategy creation. Currently, a USDC lending vault on Ethereum mainnet is live; more complex strategies are in testing (whitelist required).

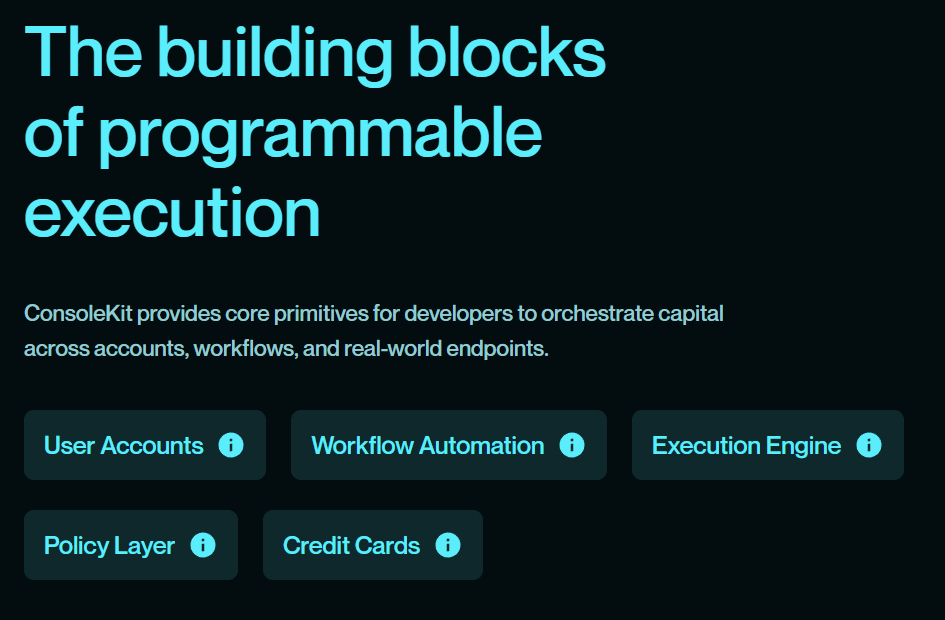

Brahma – https://brahma.fi/

Brahma positions itself as "The Orchestration Layer for Internet Finance," abstracting on-chain accounts, execution logic, and off-chain payment flows to help users and developers manage on/off-chain assets efficiently. Its architecture includes: Smart Accounts, Persistent On-Chain Agents, Capital Orchestration Stack. This enables a backend-free smart capital management experience.

Deployed agents include: (1) Felix Agent: Optimizes feUSD vault rates to avoid liquidation and save interest, (2) Surge & Purge Agent: Tracks volatility and executes auto-trading, (3) Morpho Agent: Deploys and rebalances Morpho vault capital, (4) ConsoleKit Framework: Supports integration of any AI model for unified strategy execution and asset orchestration.

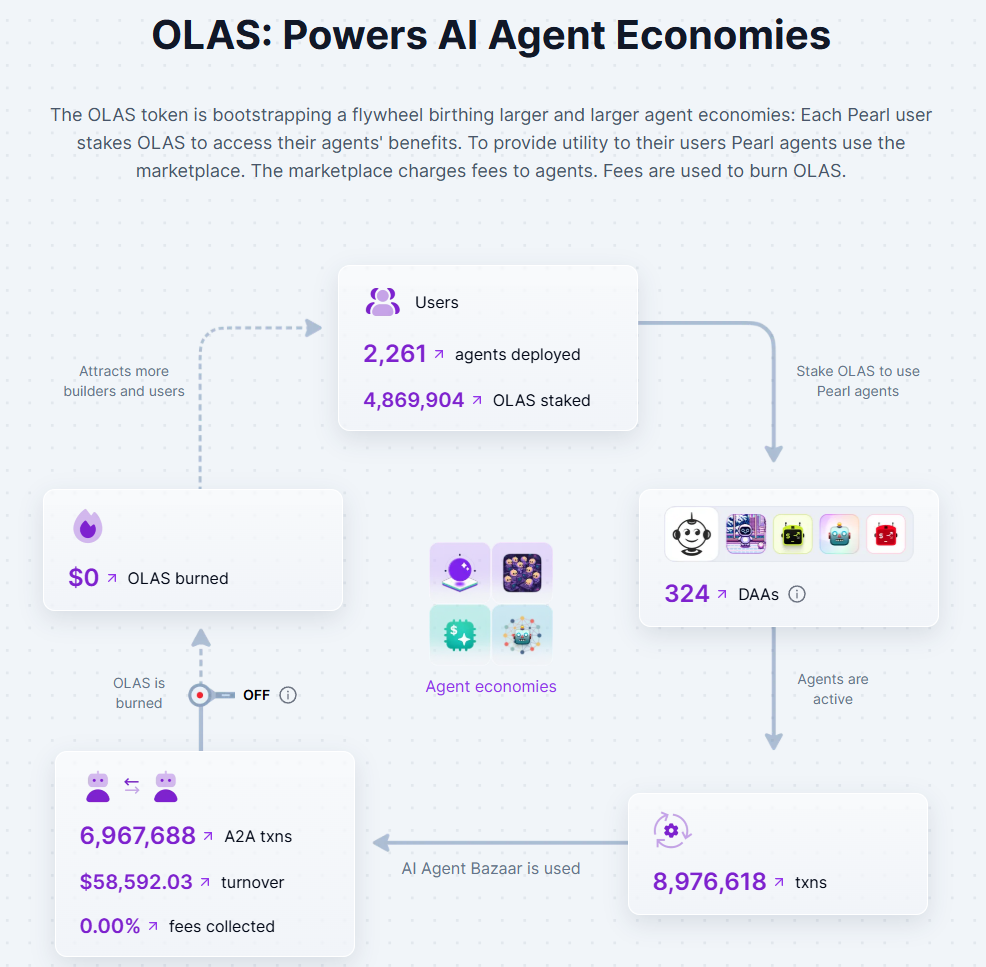

Olas – https://olas.network/

Olas has launched a suite of on-chain AgentFi products across chains like Solana, Mode, Optimism, and Base. Each supports full on-chain interaction, strategy execution, and autonomous asset management.

The agents are (1) BabyDegen: An AI trading agent on Solana using CoinGecko data and community strategies to auto-trade. Integrated with Jupiter DEX and in Alpha. (2) Modius Agent: Portfolio manager for USDC/ETH on Mode, integrated with Balancer, Sturdy, and Velodrome, running 24/7 based on user preferences. (3) Optimus Agent: Multichain agent for Mode, Optimism, and Base, supporting broader protocol integrations like Uniswap and Velodrome, suitable for intermediate and advanced users building automated portfolios.

Axal – https://www.getaxal.com/

Axal’s flagship product Autopilot Yield provides a non-custodial, verifiable yield management experience, integrating protocols like Aave, Morpho, Kamino, Pendle, and Hyperliquid.

It offers on-chain strategy execution + risk control through three tiers:

Conservative Strategy: Focused on low-risk, stable yield from trusted protocols like Aave and Morpho (5–7% APY). Uses TVL monitoring, stop-losses, and top-tier strategies for long-term growth.

Balanced Strategy: Mid-risk strategies with higher returns (10–20% APY), using wrapped stablecoins (feUSD, USDxL), LP provision, and neutral arbitrage. Axal dynamically monitors and adjusts exposure.

Aggressive Strategy: High-risk strategies (up to 50%+ APY) including high-leverage LPs, cross-platform plays, low-liquidity market making, and volatility capture. Smart agents enforce stop-loss, auto-exit, and redeployment logic to protect users.

This resembles the structure of a traditional wealth management risk assessment product.

Fungi.ag – https://fungi.ag/

Fungi.ag is a fully autonomous AI agent designed for USDC yield optimization, auto-allocating funds across Aave, Morpho, Moonwell, Fluid, etc. Based on APR, fees, and risk, it maximizes capital efficiency with no manual interaction—just Session Key authorization.

Currently supports Base, with plans to expand to Arbitrum and Optimism. Fungi also offers the Hypha strategy scripting interface, enabling the community to build DCA, arbitrage, and other strategies. DAO and social tools foster a co-built ecosystem.

ZyFAI – https://www.zyf.ai/

ZyFAI is a smart DeFi assistant deployed on Base and Sonic, combining on-chain interfaces with AI modules to help users manage assets across risk preferences.

Three core strategy types are (1) Safe Strategy: For conservative users. Focused on secure protocols (Aave, Morpho, Compound, Moonwell, Spark) offering stable USDC deposits and safe returns. (2) Yieldor Strategy: For high-risk users (requires 20,000 $ZFI to unlock). Involves Pendle, YieldFi, Harvest Finance, Wasabi, supporting complex strategies like LPs, reward splitting, leverage vaults, with future plans for looping and delta-neutral products. (3) Airdrop Strategy (in development): Aimed at maximizing airdrop farming opportunities.

Practical Paths and Advanced Horizons

Lending and liquidity mining are the most valuable and most readily implementable business scenarios for AgentFi in the near term. Both are mature sectors in the DeFi ecosystem and naturally well-suited for intelligent agent integration due to the following common features:

Extensive strategy space with many optimization dimensions:

Lending goes beyond chasing high yields —it includes rate arbitrage, leverage loops, debt refinancing, liquidation protection, etc.

Yield farming involves APR tracking, LP rebalancing, auto-compounding, and multi-layered strategy composition.

Highly dynamic environments that require real-time perception and response: Fluctuations in interest rates, TVL, incentive structures, the launch of new pools, or the emergence of new protocols can all shift the optimal strategy, requiring dynamic adjustments.

Significant execution window costs where automation creates clear value:

Funds not allocated to optimal pools result in opportunity cost; automation enables real-time migration.

Lending-based agents are more feasible due to stable data structures and relatively simple strategy logic. Projects like Giza ARMA are already live and effective.

In contrast, liquidity mining management demands higher complexity: agents must respond to price and volatility changes, track fee accumulation, and perform dynamic reallocation — all requiring high-fidelity perception, reasoning, and on-chain execution. This is the core challenge tackled by projects like Theoriq.

Mid-to-Long-Term AgentFi Opportunities

Pendle Yield Trading:

With clear time dimensions and yield curves, Pendle is ideal for agent-managed maturity rollover and inter-pool arbitrage.

Its unique structure —splitting assets into PT (Principal Token) and YT (Yield Token)—creates a natural fit for strategy composition. PT represents redeemable principal (low risk), while YT offers variable yield (high risk, suitable for farming and speculation).

Pain points ripe for automation include:

Manual reconfiguration after short-term pool expiries (often 1–3 months)

Yield volatility across pools and reallocation overhead

Complex valuation and hedging when combining PT and YT

An AgentFi system that maps user preferences to automated strategy selection → allocation → rollover → redeployment could drastically improve capital efficiency.

Pendle’s characteristics — time-bound, decomposable, dynamic — make it ideal for building a Yield Swarm or Portfolio Agent system. If paired with intent input (e.g., “10% APY, withdrawable in 6 months”) and automated execution, Pendle could become one of the flagship AgentFi applications.

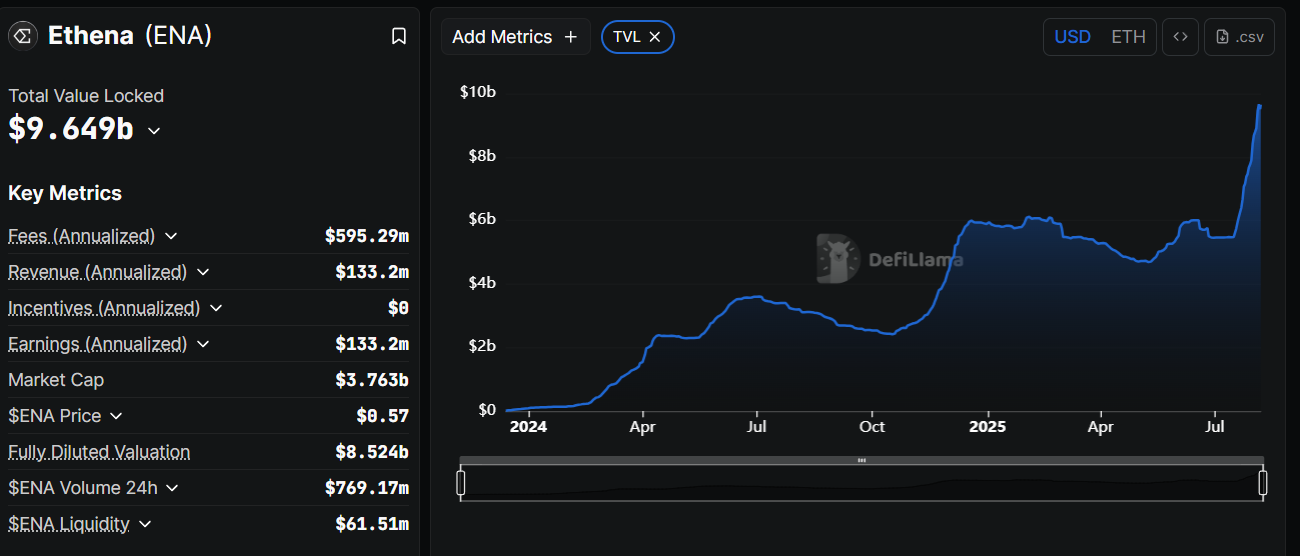

Funding Rate Arbitrage:

Consider automating an Ethena-like strategy that leverages the funding rates on exchanges for certain assets and hedges out risk.

This is a high-theoretical-yield strategy, yet technically difficult due to cross-market and cross-chain coordination. While the on-chain options sector has cooled due to pricing and execution complexity, perpetuals remain a highly active derivative use case. AgentFi could enable intelligent arbitrage strategies across funding rates, basis trades, and hedging positions.

A functional AgentFi system would include:

Data module – real-time funding rate and cost scraping from both DeFi and CEXs

Decision module – adaptive judgment on open/close conditions based on risk parameters

Execution module – deploys or exits positions once triggers are met

Portfolio module – manages multi-chain, multi-account strategy orchestration

Challenges:

CEX APIs are not natively integrated into current on-chain agents

High-frequency trading demands low-latency execution, gas optimization, and slippage protection

Complex arbitrage often requires swarm-style agent coordination

Although Ethena is not AgentFi-native yet, it could open up its modules and agentify the logic to evolve it into a decentralized AgentFi system.

Staking & Restaking:

Not inherently suited to AgentFi, but LRT (liquid restaking) dynamic composition offers some promise.

Traditional staking involves simple operations, stable yields, and long unbonding periods — too static for AgentFi. However, more complex constructions offer opportunities:

Composable LSTs/LRTs (e.g., stETH, rsETH) avoid dealing with native unbonding complexity

Restaking + collateral + derivatives enable more dynamic portfolios

Monitoring agents can track APR, AVS risks, and reconfigure accordingly

Despite this, restaking faces systemic challenges: cooling hype, ETH supply-demand imbalances, and lack of use cases. Leading players like EigenLayer and Either.fi are already pivoting. Thus, staking is more likely a component module than a core AgentFi application.

RWA Assets:

T-bill-based protocols are poorly suited for AgentFi; multi-asset portfolio structures show more potential.

Current RWA products focus on stable, low-variance assets like U.S. Treasuries, offering limited optimization space (4–5% fixed APY), low frequency of operations, and strict regulatory constraints. These features make them ill-suited for high-frequency or strategy-intensive automation. However, future paths exist:

Multi-Asset RWA Portfolio Agents – If RWA expands to real estate, credit, or receivables, users may request a diversified yield basket. Agents can rebalance weights, manage maturities, and redeploy funds periodically.

RWA-as-Collateral + Custodial Reuse – Some protocols tokenize T-bills as collateral in lending markets. Agents could automate deposit, collateral management, and yield harvesting. If these tokens gain liquidity on platforms like Pendle or Uniswap, agents could arbitrage price/yield discrepancies and rotate capital accordingly.

Swap Strategy Composition: From intent infra to full AgentFi strategy engines.

Can capital markets also be automated in an intelligent way?

Modern swap systems mask DEX routing complexity with account abstraction and intents, allowing simple user inputs. However, these are still atomic-level automations, lacking real-time awareness and strategy-driven logic.

In AgentFi, swaps become components in larger financial operations. For example:

"Allocate stETH and USDC for highest yield" ... could involve multi-hop swaps, restaking, Pendle splitting, yield farming, and profit recycling, all autonomously handled by the agent.

Swap plays a key role in (1) Composite yield strategy routing, (2) cross-market arbitrage / delta-neutral positions, (3) Slippage mitigation and MEV defense via dynamic execution and batching.

Truly AgentFi-grade Swap Agents must support (1) strategy perception, (2) cross-protocol orchestration, (3) capital path optimization, and (4) timing execution and risk control. The swap agent’s future lies in multi-strategy integration, position rebalancing, and cross-protocol value extraction.

This is a long road ahead from where we are today. Self-driving trading agents are not here just yet.

Summary of The DeFi Intelligence Roadmap

We are witnessing the step-by-step evolution of DeFi intelligence — from automation tools, to intent-driven copilots, to autonomous financial agents.

This is a look ahead to the future in 2030, although the initial seeds are already being planted today.

While most of the onchain financial markets today feature simple automation, there is a path towards injecting intelligence and goal-seeking into the process. We have higlighted a growth path like this —

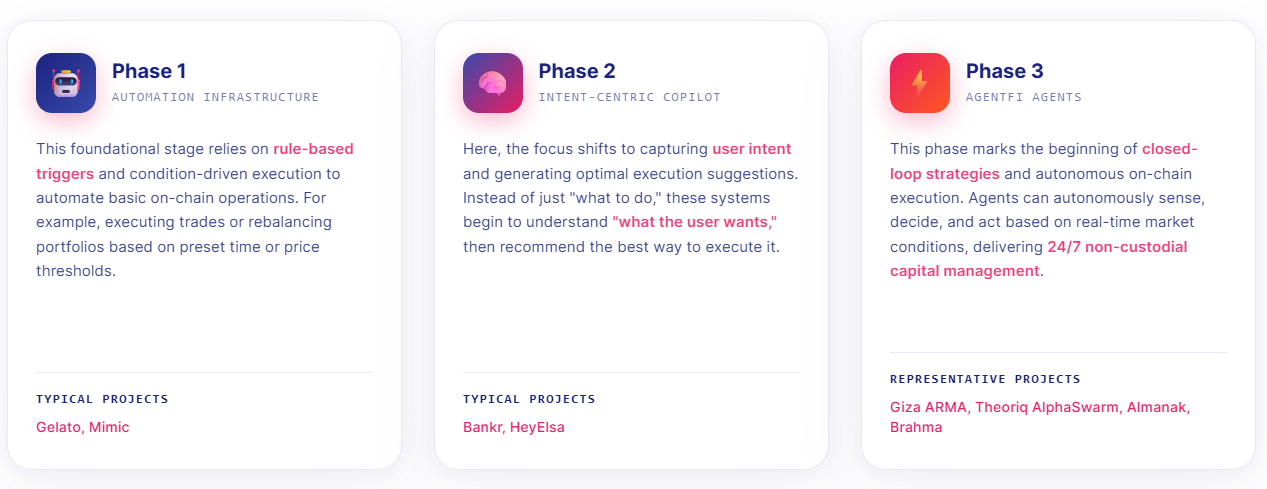

Phase 1: Automation Infrastructure

This foundational stage relies on rule-based triggers and condition-driven execution to automate basic on-chain operations. For example, executing trades or rebalancing portfolios based on preset time or price thresholds. Typical projects in this category include Gelato and Mimic, which focus on building low-level execution frameworks.

Phase 2: Intent-Centric Copilot

Here, the focus shifts to capturing user intent and generating optimal execution suggestions. Instead of just “what to do,” these systems begin to understand “what the user wants,” then recommend the best way to execute it. Projects like Bankr and HeyElsa exemplify this stage by reducing DeFi complexity through intent recognition and improved UX.Phase 3: AgentFi Agents

This phase marks the beginning of closed-loop strategies and autonomous on-chain execution. Agents can autonomously sense, decide, and act based on real-time market conditions, user preferences, and predefined strategies—delivering 24/7 non-custodial capital management. At the same time, AgentFi enables autonomous fund management without requiring users to authorize each individual operation. This mechanism raises critical questions around security and trust, making it an essential and unavoidable challenge in the design of AgentFi systems. Representative projects include Giza ARMA, Theoriq AlphaSwarm, Almanak, and Brahma, all of which are actively implementing strategy execution, security frameworks, and modular products.

The next frontier lies in building advanced AgentFi agents capable of autonomously executing complex cross-protocol and cross-asset strategies. This vision includes:

Pendle Yield Trading: Agents managing PT/YT lifecycle rollovers and yield arbitrage for maximized capital efficiency.

Funding Rate Arbitrage: Cross-chain arbitrage agents capturing every profitable funding spread opportunity.

Swap Strategy Composability: Turning Swap into a multi-strategy yield engine optimized through agent coordination.

Staking & Restaking: Agents dynamically balancing staking portfolios to optimize for risk and reward.

RWA Asset Management: Agents allocating diversified real-world assets on-chain for global yield strategies.

This is the roadmap from automation to intelligence, from tools to autonomous, strategy-executing DeFi agents.

Lex’s Note

If you made it all the way to the end of this, congratulations on your curiosity, interest, and patience.

I just have to say, wow.

In 2009, I founded a roboadvisor in New York after the collapse of Lehman Brothers. It was my first bite at watching technology “robots” look after asset allocation and investment management. By 2016, with the rise of Ethereum, many of us saw the promise of a new financial infrastructure that could be natively digital. And here we are.

Never in my wildest imagination could I have prepared myself to see the development of an industry like the one we’ve described above. Self-driving money is either here, or around the corner, depending on your risk preference.

I am glad you are here with me.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

Great appreciation for Lex Sokolin's support on my article!

fantastic guide, thank you so much.