Fintech 101: Money Movement reimagined with Stablecoins

How stablecoins are rebuilding global finance and commerce

Gm Fintech Architects —

Today, we share a new 50-page stablecoin primer called Money Movement 2.0 that we put together in partnership with Marc Baumann of 51 Insights. This work builds on our previously published Practitioner’s Guide to Stablecoins.

We highly recommend this as a free resource to get up to speed on the space and share with others who are interested in the topic. The report zooms out to provide the history of the space, segment competitors, and highlight the most important recent developments.

Grab a copy 👉 here, or download the full report below.

Money is moving — and this time, it’s real

Stablecoins are no longer a crypto experiment. They are now an active, growing infrastructure layer of the global financial system.

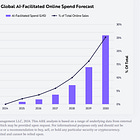

As of mid-2025, over $250 billion in stablecoins circulate globally, facilitating more than $2.3 trillion in monthly volume. Once dismissed as speculative or peripheral, they’re now enabling critical financial functions at companies like Stripe, JPMorgan, PayPal, Visa, and Circle. For the first time, we’re seeing blockchain-based money being used at institutional scale and in enterprise-grade contexts.

After a decade in crypto, we’ve watched countless promises of "mainstream adoption" come and go. And this is the first time we can say, with conviction, it’s different. We're witnessing true institutional adoption at scale, beyond crypto capital market settlement towards the real economy. The integrations are not coming from crypto natives, but from Fortune 500 giants and modern Fintechs rebuilding their financial infrastructure.

For years, crypto remained an isolated industry with its own culture. While this was fascinating for participants, it was separate from real business operations and economic activity. In 2025, Crypto is no longer siloed. Stripe has launched stablecoin accounts in 100+ countries. Shopify has integrated native USDC payments. Circle has completed a landmark IPO. Traditional finance companies are scrambling to respond to avoid being left behind.

Stablecoins aren’t just a better way to move money. They are a core primitive for programmable internet-native money and agentic commerce. You can build on them today, and launch financial features immediately and in a permissionless manner. Everything that open banking and embedded finance had wanted to be, stablecoins provide to entrepreneurs already.

And as the AI giants take an even larger share in the world of labor and productivity, stablecoins become the modern rails for the machine economy.

That’s why we made this report. It is designed as both a strategic primer and an actionable guide for financial institutions, enterprises, fintech operators, and policy leaders. Stablecoins are not the endpoint. But they certainly are the entry point into a broader transformation that will reshape commerce, capital markets, and economic coordination at large.

Five use cases that matter

Let’s look at some of the largest use cases from a commercial perspective —

International business payments represent a $60T opportunity by 2030, with companies currently wasting $120B annually on cross-border fees while losing millions in trapped liquidity during 3-5 day settlement windows. Stablecoins processed $6T in cross-border payments in 2024, offering 90% cost reductions and instant settlement.

Visa partnered with Circle to enable instant global stablecoin settlement.

PayPal processes cross-border B2B payments using PYUSD, reducing fees by up to 90%

Stripe embedded USDC payouts across 50+ countries, letting businesses pay international suppliers instantly

Mastercard teamed up with MoonPay to support global stablecoin payments.

Worldpay is enabling stablecoin payouts to 180+ countries, powered by BVNK.

JP Morgan’s Kinexys Digital Payments enables 24/7 , cross-border stablecoin transactions.

DP World (global logistics) deploys stablecoin payment rails for international suppliers

Corporate treasury operations are parking idle cash in yield-bearing stablecoins for 4%+ returns while maintaining instant payment capabilities. BlackRock holds $2.9B in their BUIDL tokenized Treasury fund.

Citi launched 24/7 tokenized cash service to help businesses move money instantly across global branches

Modern Treasury launched stablecoin payouts via partner Brale, enabling 24/7 global money movement

BlackRock holds $2.9B in their BUIDL tokenized Treasury fund

Circle works with 300+ banks to provide instant treasury settlement capabilities

Capital markets settlement eliminates the T+2 bottleneck that ties up billions in unnecessary capital, with Goldman Sachs, UBS, and Standard Chartered all testing blockchain settlement.

JP Morgan’s JPM Coin allows blockchain-based payments by wholesale clients and handles $1B transactions daily

Goldman Sachs uses blockchain settlement for select institutional trades

DTCC pilots distributed ledger technology and tokenized collateral, including for U.S.

Societe Generale-FORGE launched a US dollar stablecoin on Ethereum and Solana for trading and cross-border payments. BNY Mell

Standard Chartered partnered with Animoca Brands and HKT to issue a HKD-backed stablecoin.

Global payroll is seeing 65% of crypto transactions already using stablecoins, with companies like Deel processing millions for 35,000+ companies across 150+ countries, achieving 60% cost reductions and 48-hour time savings.

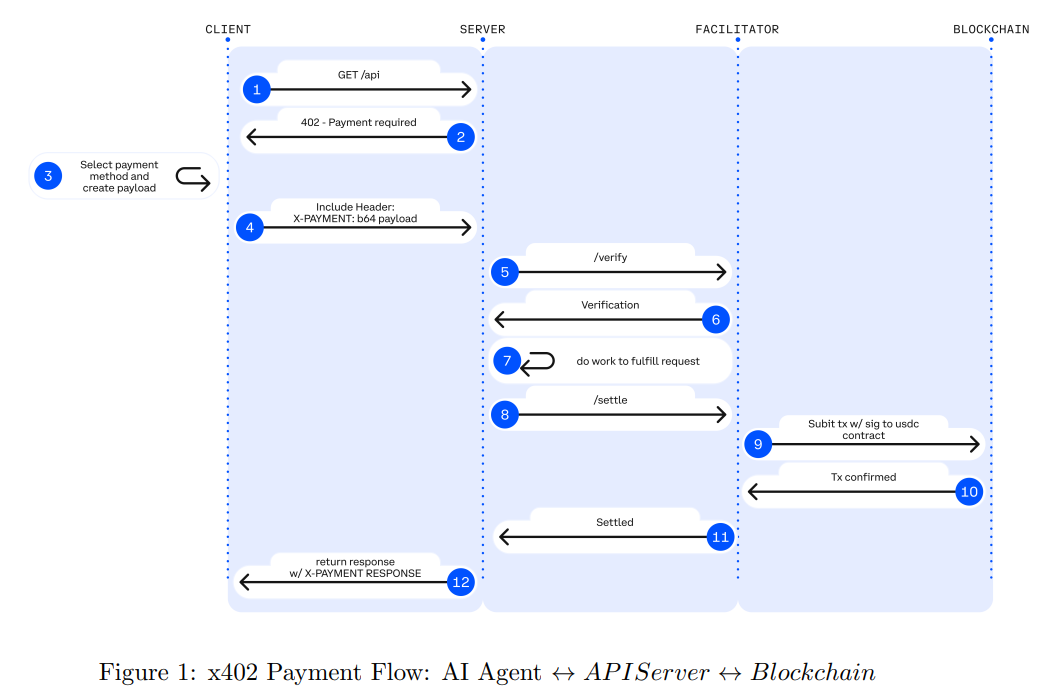

Finally, AI agent commerce is emerging as software needs money that moves at internet speed—Coinbase's x402 protocol embeds payments directly into HTTP requests, enabling autonomous transactions without human intervention.

What's In The Full Report

Sections

Why Now

Stablecoin 101

The Stablecoin Ecosystem 2025

Stablecoin's Killer Use-Cases

4 Ways Stablecoins Are Quietly Transforming Business

Money, at Internet Speed: How Stablecoins Are Disrupting Commerce

What to Do Now

What we cover:

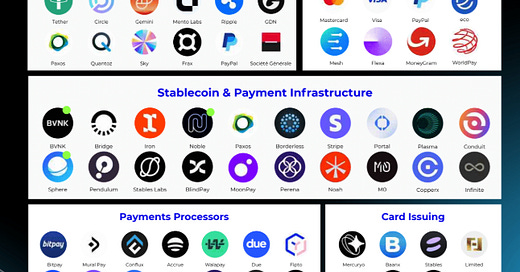

Stablecoin ecosystem map with 200+ vendors and our proprietary 51 Trust Score rankings

Circle's 6x IPO surge and what it signals for institutional adoption

Why Amazon & Walmart are secretly building corporate stablecoins

Stripe's $1.1B Bridge acquisition strategy to own payment rails

Tether's $5B profit machine and surprise AI infrastructure play

Coinbase's x402 protocol embedding payments directly into HTTP

How Google's Gemini 2.5 just killed traditional e-commerce checkout

The 5 killer use cases already saving enterprises 60%+ on costs

90-day implementation playbook from pilot to scale

Strategic vendor selection framework and compliance roadmap

Key Takeaways

What’s happening in payments resembles the early Internet: obvious in retrospect, overlooked by incumbents, transformative for early movers. Circle and Stripe aren't building incremental improvements to SWIFT. They're constructing a parallel financial infrastructure that bypasses traditional payment rails entirely.

The $250B in stablecoin circulation represents early stages of fundamental replatforming: programmable money replacing static account balances, instant settlement replacing batch processing, global accessibility replacing correspondent banking networks. Winners will be technology platforms embedding stablecoin functionality and early enterprise adopters building supplier network lock-in, while losers face margin compression as companies control financial infrastructure directly.

If you are interested in exploring any of these initiatives for your business, 👉 reach out to us to learn how we support institutions and enterprises in their stablecoin journey.

Related Research

For a deeper dive on the topics discussed above, consider upgrading to our paid subscription and reading our deep dive analysis on the companies below.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

Amazon would be amazing, one of the largest for sure.

To help educate the masses, I see real adoption and understanding in the real world in real time, not just e commerce.

Face to face to kickstart the real movement.

With a little business help from the ground up and team effort we can get more traction and inside number analytic knowledge etc.

There’s a billion ways to play this and help make it rock n roll.