Analysis: Can the financial industry replicate Klarna's AI-led cost-cutting?

50% staff reduction due to AI and a shift away from enterprise SaaS.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Klarna, the BNPL leader, is making bold claims about how AI is transforming its operations and reshaping the future of enterprise software — reduce Klarna’s workforce by 50%, cut customer service resolution times from 14 minutes to just 2 minutes, move 66% of customer support to OpenAI chatbots, boost profitability by $40 million annually. Klarna also plans to move away from traditional enterprise SaaS tools like Salesforce and Workday, instead leveraging generative AI to build internal applications. This strategy reflects the growing trend of "disposable software," where AI-generated applications quickly meet short-term needs without the complexity of traditional software development. We explore whether Klarna’s focus on AI will apply to other financial institutions, or if the broader pressure from interest rates and economic conditions may be the true driving force behind these changes.

Topics: Klarna, OpenAI, Salesforce, Workday,

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Advertise with the Fintech Blueprint

If you want to reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Long Take

Klarna’s AI claims

BNPL leader Klarna has been the loudest of all Fintech companies about generative artificial intelligence in the financial media.

Klarna CEO Sebastian Siemiatkowski has talked about the application of generative AI to his business since the commercialization of GPT in 2022, and has publicly put the company into cost-cutting mode. The only other corporate AI advocate on the same scale is probably Aaron Levie, the CEO of Box, an enterprise data storage company that underpins many of the companies that could benefit from generative AI implementation.

The most interesting claims about AI productivity from Klarna are:

66% of customer support is going through OpenAI chatbots

700 jobs were replaced by AI

The company will reduce staff by 50% — from 4,000 staff to 2,000 — also due to automation

The next frontier of cutting is getting rid of SaaS software providers, including Salesforce and Workday

We can dig a bit deep on the substance in this podcast from Sequoia on the topic.

A few key notes from the conversation.

Klarna partnered with OpenAI to use their AI models in customer service workflows after Sebastian was impressed by ChatGPT in late 2022.

"I tried it out and I was blown away... I was like, wow, this is amazing. I've never seen anything like this... so I got a pitch to him [Sam Altman] that working with this European bank fintech is going to be a great client to test OpenAI products on."

The AI co-pilot helped Klarna reduce the backlog in dispute resolution and improved the speed and quality of decision-making.

"Within two months they were demoing internally to us and others that they had managed to build a co-pilot that basically helped accelerate the process and also increase the quality of the decision-making."

Klarna’s customer service AI co-pilot reduced average resolution time from 14 minutes with human agents to 2 minutes.

"The average time of resolution of a customer service chat is about 14 minutes. And when we move to AI, it's 2 minutes."

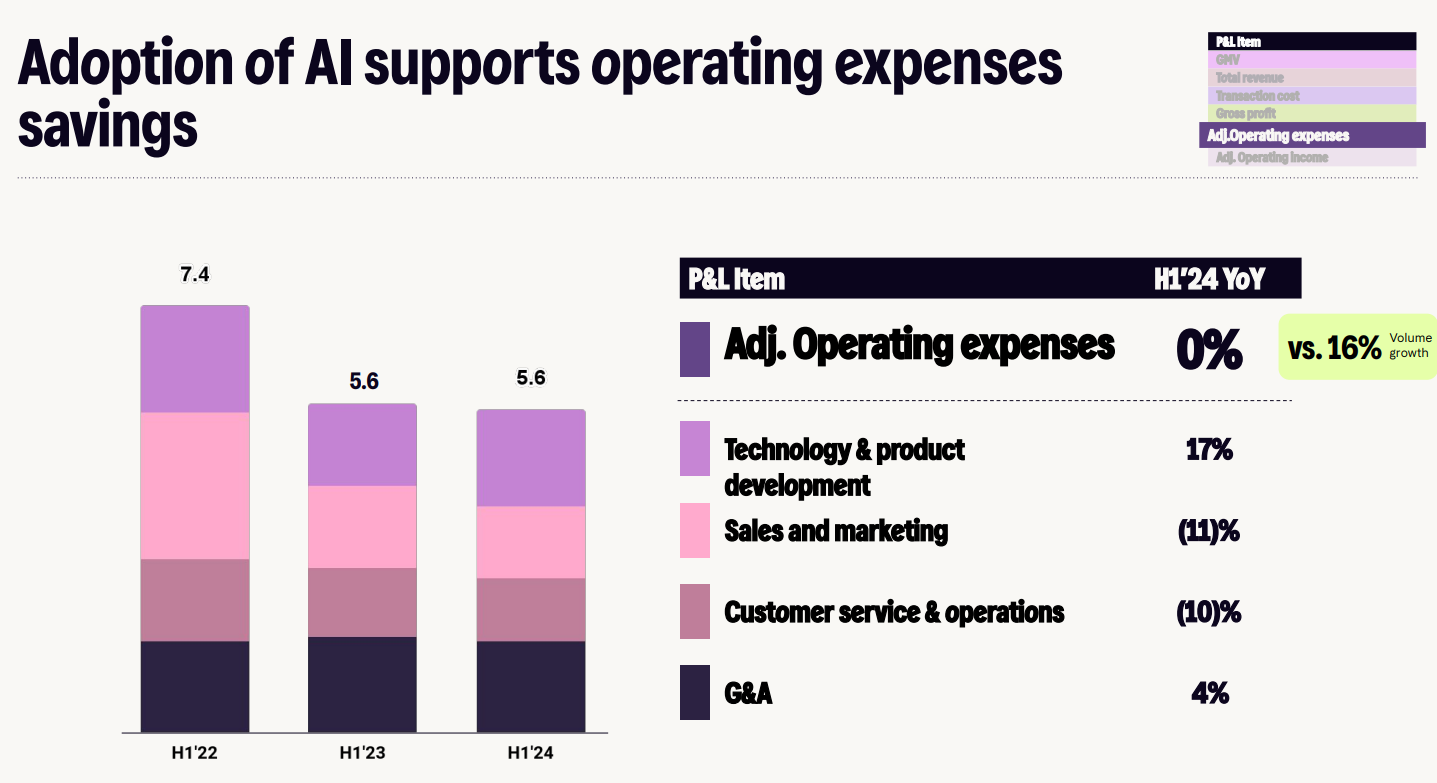

AI at Klarna has improved profitability by $40 million annually, and 700 full-time customer service employees were no longer needed as a result of AI efficiency.

"It’s about $40 million of improved profitability for the company on an annual basis."

"Kiki" is a chatbot that interacts with Klarna’s internal knowledge graph, improving productivity and centralizing information across the company.

"Kiki is basically our own internal chatbot based on that growing internal knowledge graph... it has created tons of value for us."

Klarna is building a customer service AI system that will soon advise customers on various services, which Sebastian expects to be highly disruptive.

"We have some stuff that's going to go live in a few weeks... it will be the customer service assistant on steroids."

Klarna's marketing teams are already using AI to produce personalized campaigns and assets faster and with better quality than before.

"We've already seen internal examples where something like that historically may have taken a month or two months... now a few individuals go from idea to having a marketing campaign live in a week."

Klarna is focusing on using AI for services that help people save money, time, and improve financial control.

"We want to be that AI digital financial assistant that helps you save time, save money, make you feel more in control of your finances."

That sounds like a lot of benefits.

And surely, the numbers line up with what the consultants — McKinsey, Bain, and BCG — have been telling us all along. We have also been guilty of expecting 50%+ cost cuts across (1) the distribution of financial firms due to conversational interfaces, (2) the value chain of connective software between various data sets, and (3) the manufacturing of financial products.

So is this then the promised land of cost savings and automation? At least on the surface, you would think the answer is *yes*.

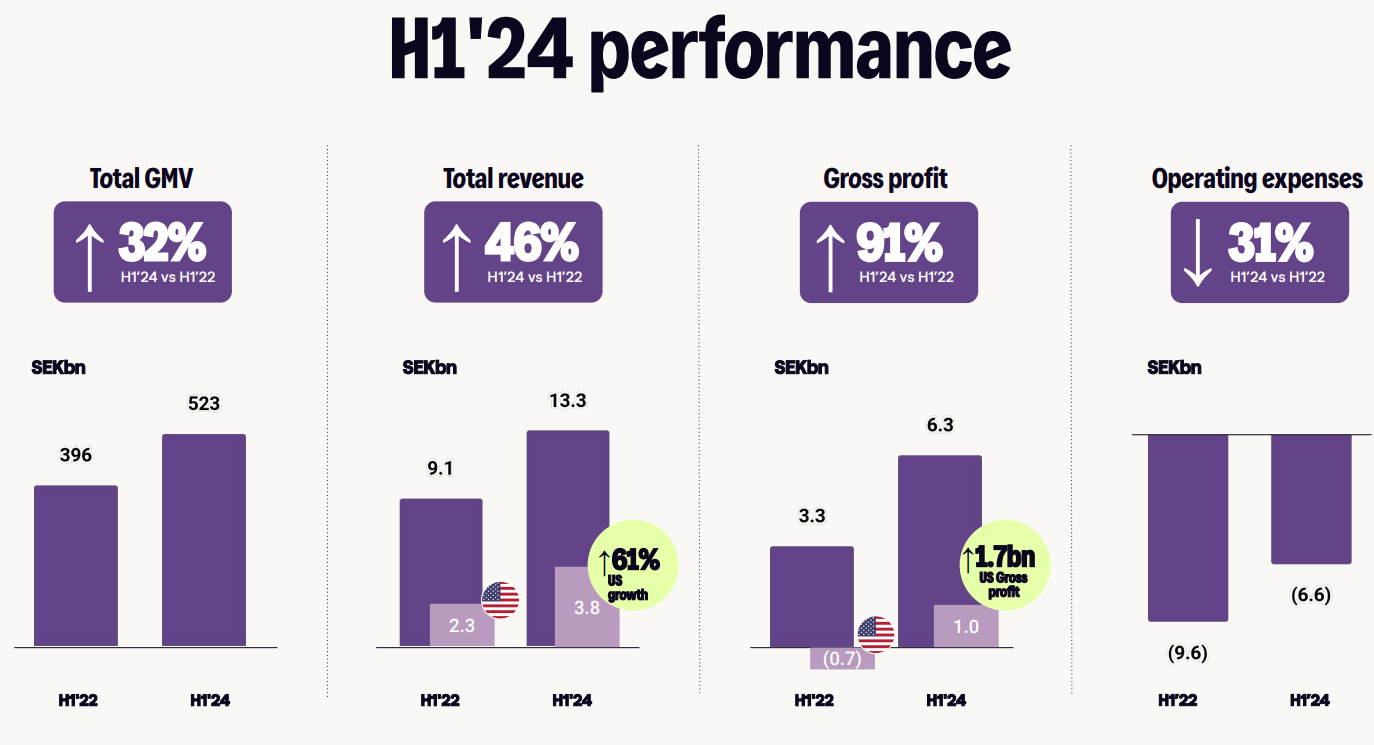

Consider Klarna’s recent financial performance —

In 2022, Klarna had invested heavily into (1) scaling its US presence and (2) diversifying its revenue streams into commerce-adjacent products. This includes bank accounts with net-interest revenue, various merchant payment solutions, and eCommerce-related technologies. As a result, we saw unusually poor economics in the middle of 2022, which the market overall interpreted as a failure of the fintech model. Klarna’s valuation collapsed from $45B to a humble $7B on over $1B in revenue.

Check out our deep dive below to get a sense of the financials at the time.

Deep Dive: Can Klarna, the BNPL category creator, rise to its market challenge?

Gm Fintech Architects —

We were especially critical of three risks: (1) Klarna’s growing operating costs were a key reason for losses, due to aggressive hiring in the ZIRP environment, (2) Klarna also faced growing losses on its lending portfolio, due to starting from scratch in the US and the broader macro climate, and (3) a weak BaaS sector created a risk to access funding in the near-term.

If you look through their most recent public disclosures, the company has addressed each of these issues. But the one most interesting to us is the point around AI. Klarna was quick to remedy their over-hiring by introducing layoffs and public signaling to correct things further. However, these signals are wrapped in the language of productivity and innovation — something any investor is hungry to believe in.

Or, maybe it is all just interest rates?

Let’s look at the main source of cost savings that Klarna is targeting next and whether it can be a lifeline for the rest of the financial industry as well.

Enterprise SaaS.

Will Generative AI Kill Enterprise SaaS?

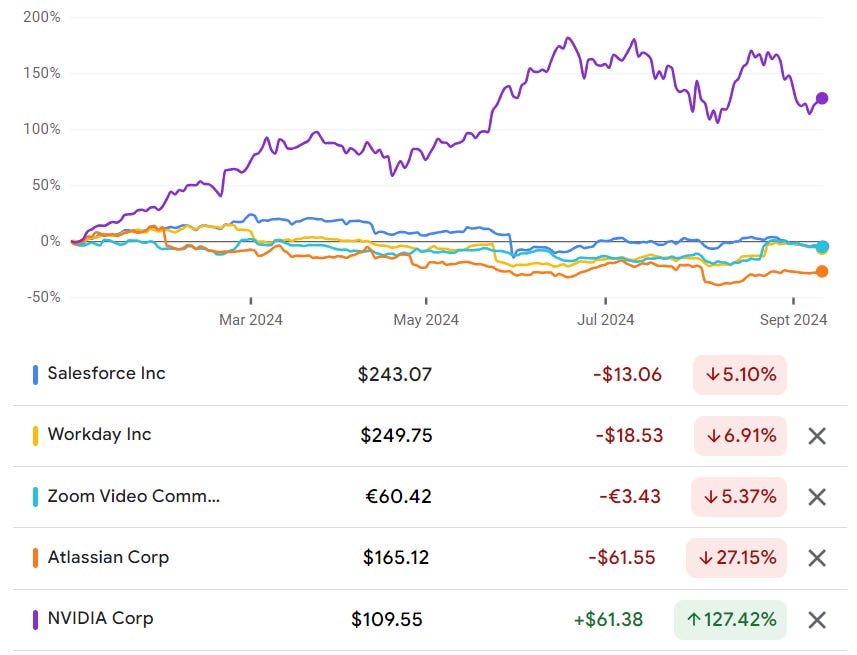

In saying that Klarna is moving off Salesforce and Workday, the company is pointing to a Silicon Valley mega-trend. The thesis is that the deployment of generative AI will materially injure and defeat the enterprise SaaS business model.

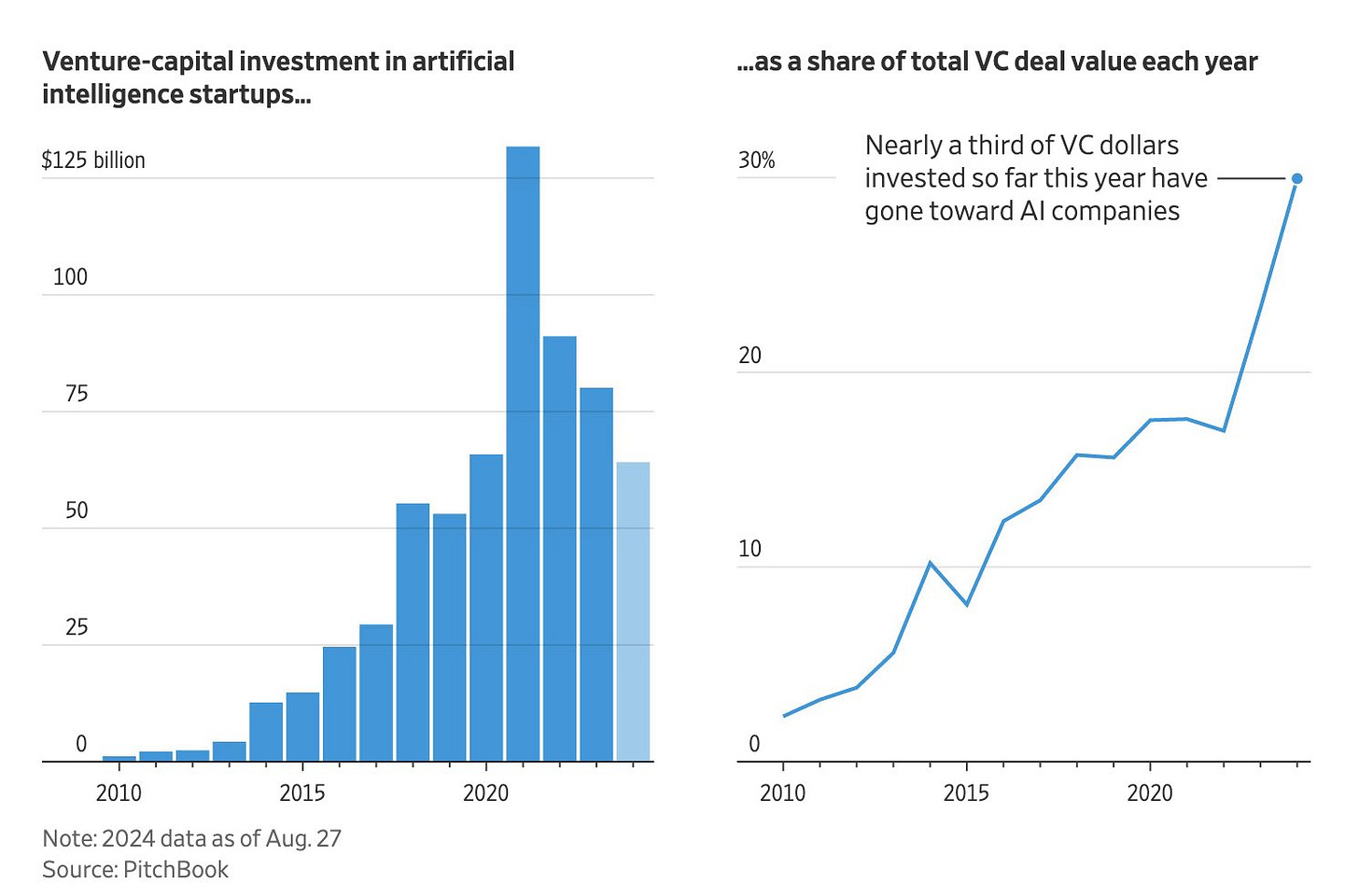

Here is the story in a chart:

Why has this idea become a consensus in Silicon Valley?

The concept goes like this. First, AI is able to perform inference tasks on whatever underlying data set it has, whether that is text, images, sound, or otherwise. That means that assistants like GPT can create low- to middle-quality outputs within a particular data set. Many of you have been making images, summaries, and other AI artifacts over the last year. It certainly is part and parcel of our workflow.

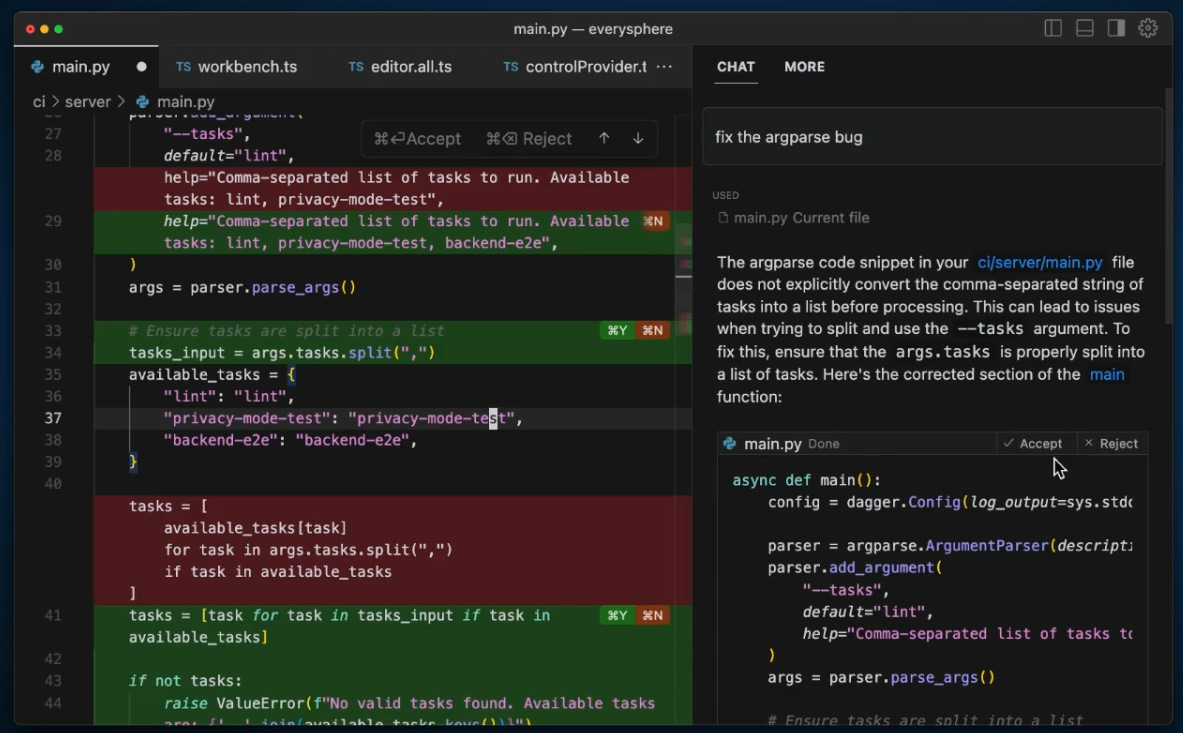

Second, we are now entering a phase where AI can generate code. Software developers use tools like Replit, Cursor, Devin, and Github Co-Pilot to create software. Some of these are designed as editing tools, while others are full-on agents that can deploy finished applications. We recently covered these here:

This means that it is much easier for any individual to create a fully functional application. Consider the analogy—

Anyone, not just a website designer, can create a website using a platform like Squarespace.

Anyone, not just a painter or photographer, can now generate an image of an object from their imagination by using AI.

Similarly, anyone, not just a software developer, will be able to create an application to fulfill some particular automation task for themselves or their customers.

In an enterprise context, this means that instead of hiring and retaining a large staff of software developers, businesses can have many more non-specialized people create custom-purpose software. In the case of Klarna, that might mean getting rid of Salesforce and instead building directly on the Klarna data lake.

In the transcript above, Sebastian talks about KiKi, the GPT that is connected to the entirety of Klarna’s structured and unstructured data. Today, a user may ask simple queries to retrieve qualitative and quantitative information about that data. In the future, a user may wrap their requests in an on-demand application that is custom-built by a generative AI code-generator.

Some of you may think that we are talking science fiction, and that software will never be able to write more software in a coherent way. Dear reader, we present to you the following exhibit.

But still, perhaps you are unconvinced. Let’s explore some counter-arguments.

Devil’s Advocate and Disposable Software

One fair push back is that the value will flow to consultants and big tech firms. Instead of a large competitive field of mid-size software firms, we will instead have enormous hyperscaler AI manufacturers (i.e., Meta, Google, OpenAI) who own the models, and then integrators and consultants like E&Y and Accenture that deploy the models as business use cases.

Perhaps the banks will not trust their own employees to make ad-hoc software apps, and instead require outside “professionals” who are certified. We have seen this pattern with consultants deploying and managing Salesforce and others complex SaaS platforms, and thus a similar outcome could land for AI. In this case, high multiple enterprise value accrues to the tech firms, and low value services revenue accrues to consultants.

Another failure mode would be to mirror the no-code / low-code movement, and robotic process automation.

While these tools are certainly behind some large companies, they are not a platform shift akin to the Internet. The average employee is not able to spin up Oracle enterprise apps.

We also don’t think that building software is yet a well-established personal behavior. Most people are scared to do it, and it will take a while before people get comfortable with the idea that they can spin up robots that generate applications leveraging their live personal data.

In fact, the entire category of robot-built software is probably quite different from the hand-crafted vertical SaaS that is now being discussed. The former is low-level and generic, while the other is hand-crafted and integrated across the value chain. Especially in finance, the middleware software is extremely stick.

Think about core banking, portfolio management and trading, payments networks, lending underwriting software. These things are *not* generic application gateways into some large data lake, but rather finely sculpted hyper-structures that capture the workflows of an entire industry. On top of that, they are highly regulated and often non-sensical, reflecting human behaviors over a long period of time.

Rather, we think the first place that AI-generated software will triumph is as “disposable software”.

Permanent, crafted, and highly integrated software — meaning enterprise SaaS — is hard to update and remove. It is welded to the business, and there are literal costs to switch. Migrating from one core banking platform to another may cost a bank $10 million.

However, disposable software is automation that we can spin up, use up, and throw away. It is not valuable or precious. This is the thing that robot software factories can do — create quick solutions that are not meant to be the final, production-grade answer to all of the world’s problems.

We think of them as disposable plates rather than fine dinner plates.

This is generous to SaaS, but it works as a metaphor.

Soon enough, disposable software will be extremely cheap, highly accessible, and made by everyone. It will be trivial to do so. In that case, as people get used to the idea that everything is flexible and can be re-configured by robots, culture and behaviors inside organizations may change too. That will lead to AI-software becoming sturdier than anything else made of human craft.

As a result, the main advantage that Fintech middleware has is in distribution and integration.

Banks today are too risk-averse to lead in this area. Klarna — a fintech with much less to lose — is committed to exploring how to use disposable software throughout its business. However, we think that Klarna had to cut costs regardless. The combination of a positive interest rate environment, public market pressure, and conclusion of one-time spending on US scaling is the main driver for their financial performance.

The AI story is fun and innovative, but we do not think that other financial institutions can get the same results without the pressure cooker that Klarna experienced at the end of 2022. Necessity is the mother of invention.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, here.

Read our Disclaimer here — this newsletter does not provide investment advice