Analysis: Carry On? How the Yen Trade Rattled Tech, Crypto, and Fintech

Despite the temporary shock, long-term prospects for fintech, AI, and crypto remain positive with potential catalysts from US macroeconomic easing

Gm Fintech Architects —

Today’s write-up is available to everyone as a preview of our premium offering and given the importance of the market turbulence.

We are diving into the following topics:

Summary: We discuss the recent market volatility triggered by Japan's interest rate hike, which led to significant market reactions including a 25% drop in the Japanese stock market and a 10% fall in the Yen's value against the dollar. This volatility was exacerbated by the unraveling of the yen carry trade, where investors borrow yen at low rates to invest in higher-yielding currencies like the USD. The resulting deleveraging caused widespread sell-offs in risk assets like tech stocks and cryptocurrencies. Despite the temporary shock, the long-term outlook for fintech, AI, and crypto remains positive, with potential catalysts from US macroeconomic easing and ETF demand.

Topics: Bank of Japan, Prime Minister Shinzo Abe, Jump Trading, Coinbase, Robinhood, NVIDIA, Bitcoin, Ether, Mt. Gox

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Advertise with the Fintech Blueprint

If you want to reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Long Take

It is OK to not know

Maybe you were taken by surprise by the recent market volatility.

Maybe you sold in fear or bought in greed.

It is OK to not know why or how this happened, and it is fair to have been caught off guard. The financial systems of the world are vast, complex, interwoven, and reflexive. It is impossible to know each and every lever across every possible market sector, jurisdiction, and asset class. It is even more difficult to know how every other market participant will react in anticipation of the reactions of everyone else.

Unless you are a massive GPU cluster artificial intelligence trained on all that financial data.

Who knows how the butterfly will flap its wings and the tornados that spawn?

It could have been Chinese real estate, or European government debt, or an energy price shock, or some off-handed remark from a politician that sent the markets plummeting. This time, however, it was Japan.

Eventually, we all saw this.

The Japanese stock market fell 20% in a day crash, extending losses to 25% from a recent peak. This collapse followed what seemed to be positive news coming from the Bank of Japan about being able to raise interest rates in response to a strengthening local economy.

Japan’s aging population, slow growth, and negative rates have been a recurring bogeyman for Western economies. But in July, the country’s stock market *finally* reached the previous 1989 high. And so the Bank of Japan raised the interest rates from 0.10% to 0.20%.

Yikes?

And yet, it was enough.

The USD fell over 10% in value against the Japanese Yen.

Does that look like an overreaction? Perhaps as a standalone data point, but let’s put things in context. Around the same time, in the United States, unemployment data started to tick up for the first time in a while, up to 4.3% from 4.1% — an increase of 20 bps.

Yikes? Not yet, really.

What these trends meant, however, was that Japan was starting to tighten rates while the US was expected to start loosening them to avoid further recessionary pressure. And it didn’t matter that the absolute units were not particularly large. The direction of travel was that the spread between the Japanese rates and US rates was going to start closing.

This mattered because of *leverage* and the Yen carry trade. And so we all got scared, and volatility shot way, way up.

Don’t Hate the Players

Let's consider how the yen carry trade operates.

Investors borrow yen, a currency with super-low interest rates, and convert it into currencies like the USD, which offer higher yields. They then invest in bonds or money market instruments in these higher-yielding currencies. Annualized returns from such trades can be around 5% to 6%, driven by the interest rate differential between Japan and other countries, with additional gains if the yen depreciates during the trade period.

This strategy originated in 1999 when Japan reduced rates to zero and surged in 2013 under Prime Minister Shinzo Abe's quantitative easing policies, reaching new heights in 2022-2023 as the Federal Reserve raised rates to combat inflation while the Bank of Japan maintained negative rates.

Estimates suggest that Japanese banks' short-term external loans account for at least $350B in yen-funded trades, but the actual size is likely much larger when considering leverage and domestic Japanese investments. As of March, Japan's foreign portfolio investments stood at ¥666.86 trillion ($4.5T), primarily in interest rate-sensitive assets.

However, as we showed previously, this trade is unraveling. The BOJ's rate hikes and expected Fed rate cuts have strengthened the yen, narrowing the yield gap. As major leveraged investors unwind their loss-making positions, they are forced to deleverage, shedding other stock and bond holdings, thereby amplifying market volatility.

When someone has to deleverage it means they have to pay back the loans that they took out, or your collateral will be seized and sold off.

If you are a large hedge fund that has been arbitraging Japan against the United States and this levered-up trade went the wrong way for you, amplifying a 10 bps move here and 20 bps move there into losing real money, then you have to sell off your other positions to stay whole.

And what you are most likely to sell off are other Risk-On assets that made you money, like tech stocks and crypto.

You might be mad at all these investors trading on leverage, amplifying their speculation into flash crashes and margin calls. But that is just yelling into the wind. Everything in this world — from financial services to our governments — runs on credit.

Money is an illusion, and we print it and borrow it from thin air.

Whether it is trillions in mortgage-backed securities, bank credit, derivatives, or government fiat, the entire system is built from leverage.

Our ethical opinion of it just depends on who takes out the debt! When it is you and me borrowing to buy a home, then that’s OK. When it is a bank aggregating our mortgages, then it is dangerous. When governments issue money for social services, that’s great. When institutional lenders issue debt to too many corporations or asset managers, people get upset.

And god forbid you have crypto protocols letting regular people print this stuff! Then it is time for Elizabeth Warren’s anti-crypto army.

The Impact on Risk

Alright, so the game is leverage, and the lever is a collapsing Yen carry spread that brought panic to markets.

Here are our risk assets, acting as the piggy bank for risk-seeking speculators.

There are many stories floating around about NVIDIA’s revenue quality and challenges to generating the requisite revenue to justify the current infrastructure spend. Those concerns, comparing Cisco of yester-year to NVIDIA of today, are valid and interesting. At the same time, mega tech companies have hundreds of billions in cash on their balance sheets that they have committed to spend on Artificial Intelligence as a platform.

See our exploration of those ideas below. We find them inconclusive, rather than decisive.

But as a result of the Japanese blow-up, NVIDIA has taken a nearly 40% haircut.

Bitcoin and Ether have faired even worse, losing all progress for the last 6 months in the case of the latter. Unlike Gold, whose value has been steady through the volatility, crypto assets took an immediate nose dive. No amount of ETF support — expected assets coming from traditional finance — was sufficient to buttress a profound meltdown of the crypto markets.

Correlation is a funny thing. You would expect the assets themselves to “contain” the correlation as an internal attribute. For example, the fundamentals of equities are rooted in cash flow and the economy, and so should go up if economic progress is good. Or, the fundamentals of bonds are rooted in rates, and rates are set by the government, and when they increase in order to tighten a growing economy, older bonds with lower yields are less valuable and therefore go down in value.

Yet, correlations go to 1 in cases of crisis, because the *holders* of the assets are one and the same. If you have a portfolio where equities are down, you might panic and sell equities and bonds together. So the market participant creates movement in all the assets they hold, especially when things are irrational.

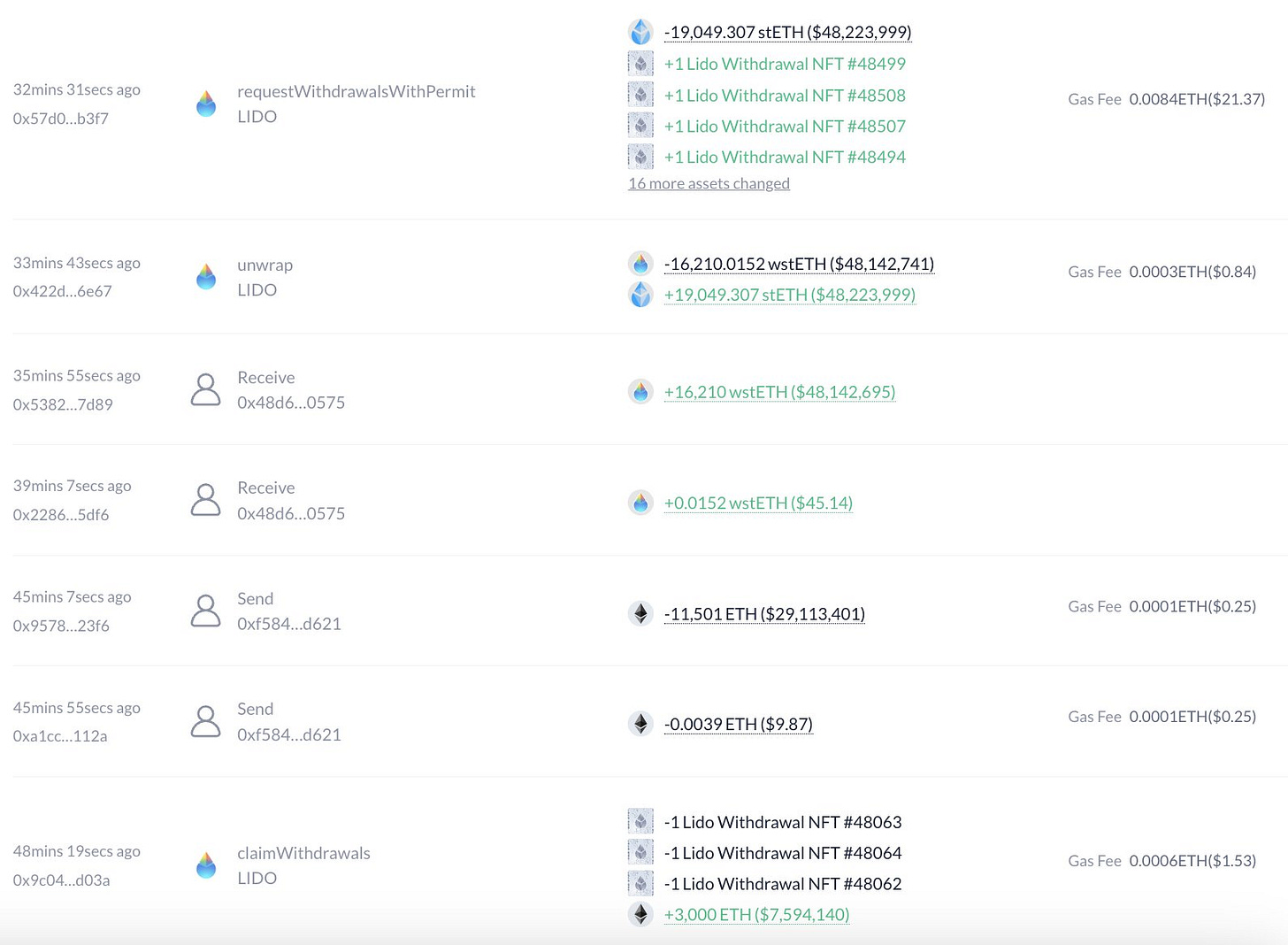

One such participant, Jump Trading, is a market maker and algorithmic trading firm. It has been observed selling an inordinate amount of crypto over the meltdown weekend.

Jump is one in a series of governments and corporations (e.g., Germany, Mt. Gox) that the crypto ecosystem thinks are selling assets mechanically. Once these sales are complete, morale will improve, ETFs will bring inflows, and the garden will grow.

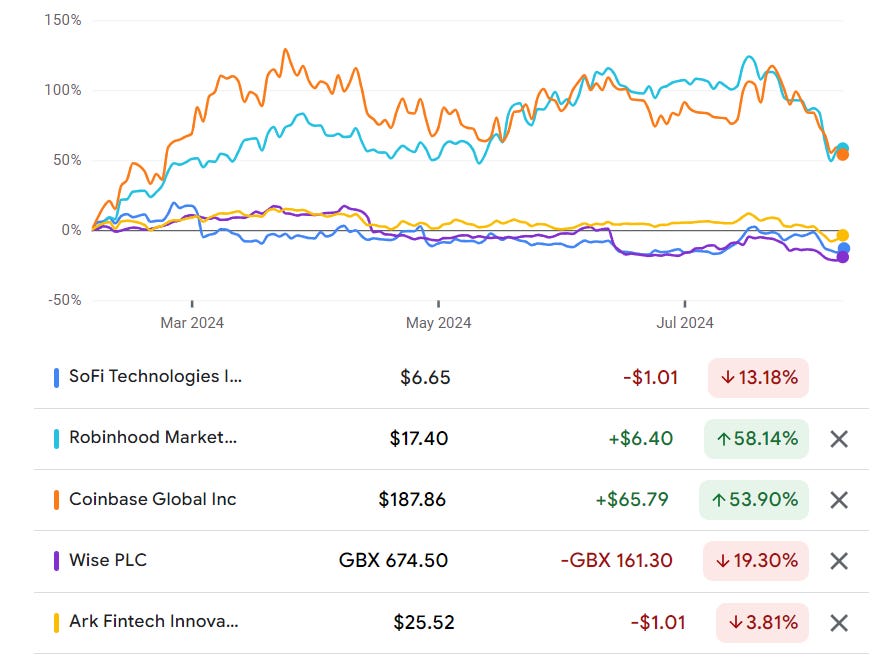

If we look at the Fintech names, it is the same lackluster story.

The trading names of Robinhood and Coinbase took a sharp nose dive at the end of July, while the neobank proxies have been sliding down in valuation despite reasonable performance. Much of this is also related to interest rates, and the perception of lower future profitability.

Key Takeaways

As we see it, the Japanese shock is temporary.

It has led to an unwinding of a huge financial arbitrage. This arbitrage carried no deep meaning about anything — just numbers on the global stage. As the numbers shifted, so did the capital. In the process of that movement, a whole bunch of leverage got washed out of the market.

Already, there has been a bounce back in a number of more traditional sectors. However, for high Risk-On assets like Fintech, AI, and Crypto, the pain is deeper. It will take time to recover and grind back up with traction and fundamentals. The potential macroeconomic easing in the US and the latent ETF demand remain positive catalysts. The bubble-like awe for frontier technology remains a negative one.

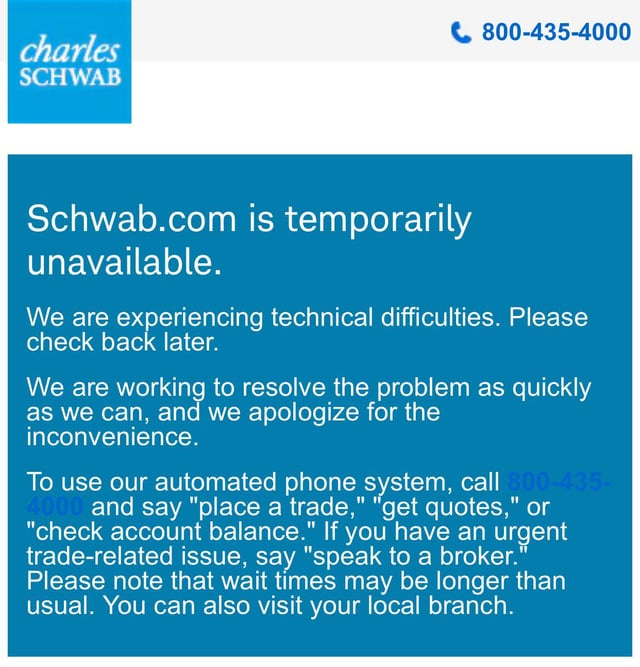

That said, we also saw pretty much every old-school broker-dealer freeze up over the volatility

Meanwhile, Web3-based decentralized finance continued to function without any downtime. Even if that means liquidating $250MM of positions in a day.

Pick your poison, Futurist.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

Enjoyed the article? Make sure you are subscribed to the Premium distribution.

Love your analyses and your work in general.

In this case, it appears you got the movement of the USD/JPY wrong.

The yen rose due to the deleveraging.

Before: 1 USD > 160 JPY (strong USD)

After: 1 USD < 150 JPY (less strong USD)

All other assets fell indeed