Analysis: Coinbase's Super App to swallow Crypto, like Google ate the Internet

Free finance, infinite choice, and the rise of closed-loop financial fortresses.

Gm Fintech Architects —

Today’s analysis came out really well. I do hope you check it out. It integrates my thinking over the last decade with recent evidence from Coinbase trying to swallow DeFi and become the “everything app”.

Worth the subscription.

Summary: We examine why modern fintech companies are racing to become super apps, arguing that the real prize is not feature breadth but defensibility through distribution, engagement, and collapsing marginal costs. Using Coinbase as the central case study, it shows how blockchain-based financial primitives have turned finance itself into a digitally manufactured good, enabling an “Everything Exchange” that aggregates stocks, crypto, prediction markets, derivatives, payments, wallets, AI advice, and developer infrastructure into a single closed loop. The essay situates Coinbase’s strategy alongside historical platform winners like Google, Spotify, and Uber, emphasizing that monopoly-scale outcomes only emerge once production becomes cheap, abundant, and programmable. It contrasts self-directed, hyper-engaged financial platforms with delegator models like roboadvisors, concluding that attention and addiction—not prudence—drive modern fintech economics.

Topics: Coinbase, Robinhood, Stripe, Ant Financial, Google, Spotify, Uber, Facebook, Napster, BitTorrent, Ethereum, Solana, Jupiter, Kalshi, Polymarket, Binance, Bybit, Kraken, Wealthfront, Betterment, Personal Capital, Aave, Consensys, MetaMask, Farcaster, Lens Protocol

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Ecosystem: Generative Ventures | AI Research | Lex Linkedin, X, YouTube | Sponsors

Long Take

The Super App

Why does every company want to be a super app?

The answer is — it wants to project defensibility and network effects. If all the things are in this one app, then users don’t have to go anywhere else. And once you connect all the financial flows between the different parts of the things, switching costs become very high.

Super apps can be built in different industries, and on top of different foundations.

They are, in effect, prisons built on abundance.

Or, you can call them platforms with aggregation theory, or attention economies, or operating systems, or search engines. A super app needs some magnificent bounty from which to capture and divert users into a closed loop. And of course, the user will be *made to feel happy* to be in that closed loop.

Consider, feeling good about getting credit card rewards but getting locked into a payment rail. Or, feeling good about clicking buttons and watching videos in a social network. Or, feeling good about finding websites you like and tolerating the advertisements as payment for your workflow. Or, feeling good about holding an exchange token and getting airdrops in various project.

This is, in effect, the feeling of being lost forever in a store full of things that you (have been taught you) like. Both Costco, a super market, and a casino share this quality. It is infinite choice and full loss of agency.

Look at Ant Financial or Stripe as modern financial super apps from our prior coverage. They do it all, no need to ever leave.

This is sticky positioning, and creates diversification and margins. It creates fantastic, long-lasting, dynastic companies.

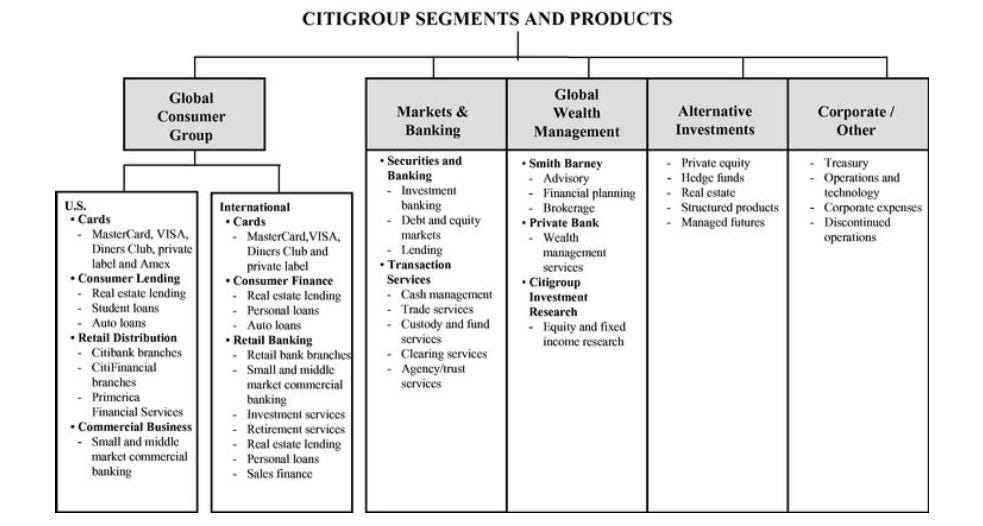

It has also been the playbook for the retail and investment banks in the 1980s and 1990s. How many lines of business and services does Citigroup offer? Here are its products in 2007.

Let us not be confused by modern words for old things. Super App. Super Market. Super Bank. Platform this, finance that.

Welcome, dear reader, to the Everything Exchange.

And that’s the new Coinbase.

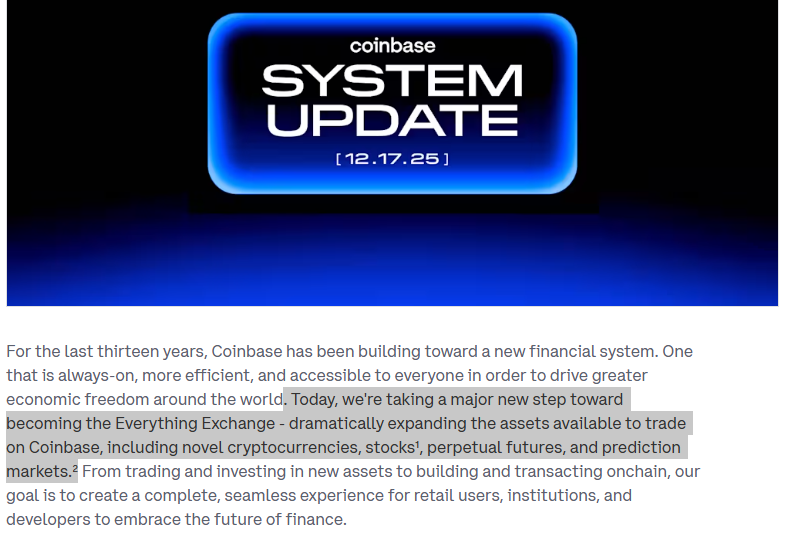

We wrote about Coinbase’s competition with Robinhood in detail earlier this week, highlighting how both of the companies have been racing to offer every modern financial product within a single digital storefront. Our lens then was focused on the tokenization of stock, which put Coinbase (crypto broker offering stocks) straight on a collision course with Robinhood (stock broker offering crypto).

But yesterday, Coinbase announced a new slate of features that move it further along the product roadmap.

So today, we want to dive under the hood.

The interesting part is not the collection of features and their individual economics, but rather the underlying reason for what is happening at a structural level, and what the potential long-term outcome looks like when analyzing similar macro-structures.

Think Napster, BitTorrent, and the Internet. Not deposits in a neobank.