Analysis: Google, Shopify, and the Infrastructure Layer for AI Shopping

Exponential growth and power laws explain why Big Tech keeps winning

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We analyse why recent advances in AI and digital commerce feel so disorienting and why human intuition consistently fails in the face of exponential growth, power laws, and positive returns to scale. Going deeper, we explore how these forces produce extreme concentration, where large platforms become faster, stronger, and more defensible as they grow. Using Google and Shopify’s Universal Commerce Protocol as an example, AI-native commerce standards shift power to discovery, routing, and personalization layers rather than individual products.

Topics: Google, Shopify, Amazon, OpenAI, Anthropic, Microsoft, Apple, Gemini, Google Pay, Google Wallet, Android, Shopify CheckoutKit, Claude, Claude Cowork, Vertex AI, Lowe’s, Michael’s, Poshmark, Reebok

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

AI & Robotics Industry Encyclopedia

At the end of last year, we collated all the meaningful companies across public equities, private equity, and digital assets related to the machine economy in this 158-page report. It is the chassis for our 2026 views.

There are 13 sections of company types, and profiles of each company in detail. You can get this report as a download as an existing paid subscriber here, or by purchasing it for $149 as a standalone product.

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

Long Take

Why Things Are Surprising

As things get weirder and weirder with AI and digital assets, I want to point to a handful of ideas that are important for the current state of technological change.

They are (1) exponential growth, (2) power laws, and (3) returns to scale.

Like most people, we walk around expecting that our intuition about the world is generally correct. Our intuition is built up from experiencing the world and creating rules of thumb around the average outcome. Unlike slow and logical reasoning, our “gut” helps us make decisions very quickly. It is efficient to stereotype and assume, because it saves mental energy, which in turn saves calories, which then allows our attention to flow to more important topics.

Having a stable and quick model of the world is really great! We can use up all of our scarce attention on new threats and opportunities, and update our mental model to stay sharp. But this means that most of the things inside the mental model are unexamined assumptions and various machinery from experiences long past.

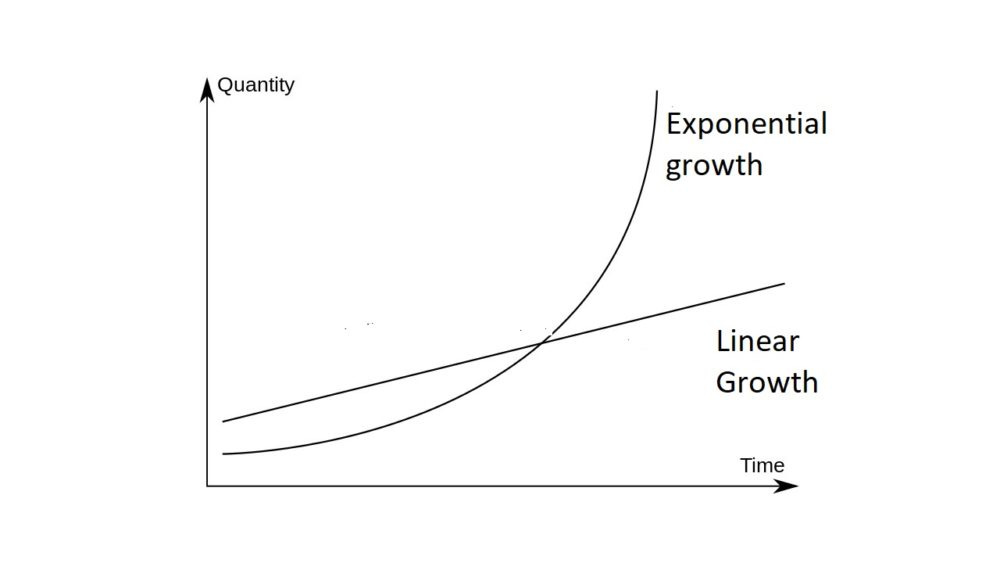

One of the things that intuition is pretty bad at grasping is exponential returns. A lot of human-scale things are very linear. You walk step by step. You work with your hands. You carry what you can see.

Technology, however, grows exponentially, or at an even faster mathematical power. Warren Buffett has famously pointed out the wonders of compound interest.

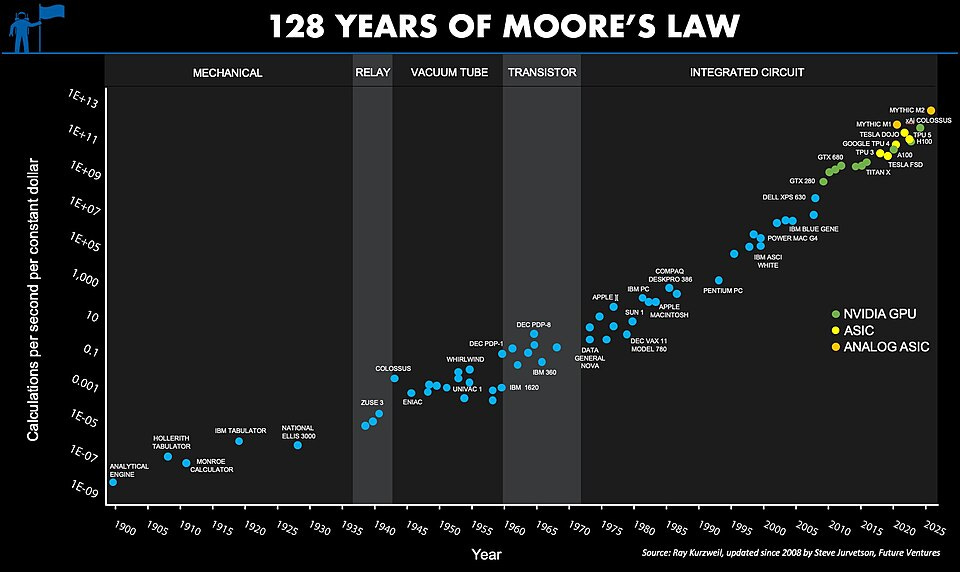

With exponential growth, you get nothing for a while, and then everything suddenly all at once. The chart can be inverted to show an exponential decrease in cost as well, which we see in both Moore’s law for computing and Jensen’s law for GPUs/AI. Note that the below graphic looks like a straight line because the vertical axis is logarithmic (i.e., visually reverses the exponent).

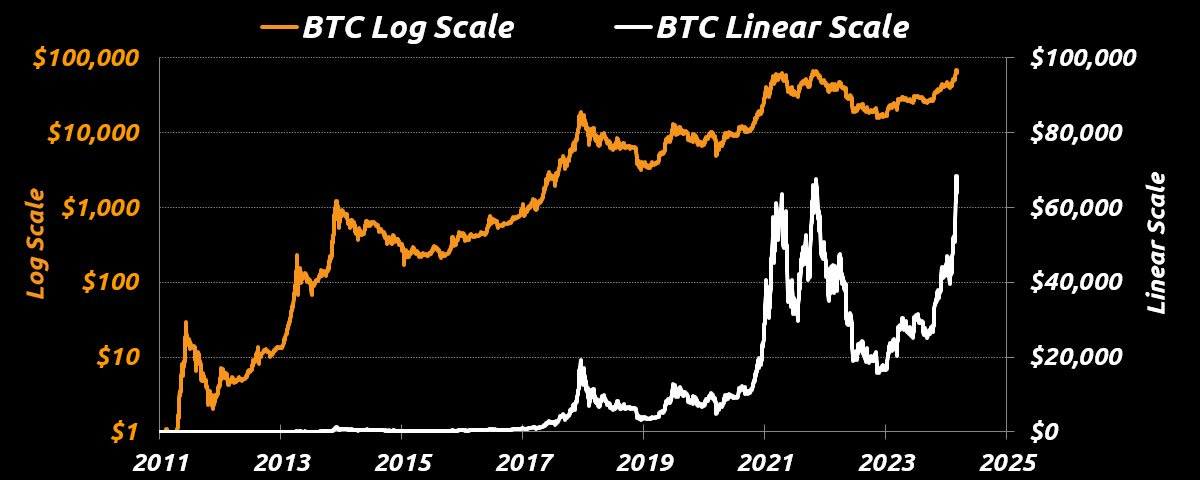

This is also why the Bitcoin people love log charts. The exponential price growth looks a lot more stable and predictable when you look at it as a next-order mathematical process.

We will try to avoid a side discussion about S curves and adoption. Let’s just say that exponential growth often finds a ceiling and reverts to population-level adoption. Once ownership of BTC is 100% of every entity, things are topped out for good. Once the entire planet Earth is terraformed into computronium that runs AI inference, there is no more exponential growth.

So, the first point is that we continue to be surprised by processes that grow faster than what our intuition would predict.

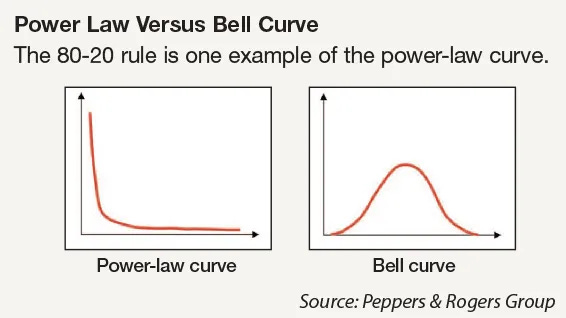

The second point is about power laws.

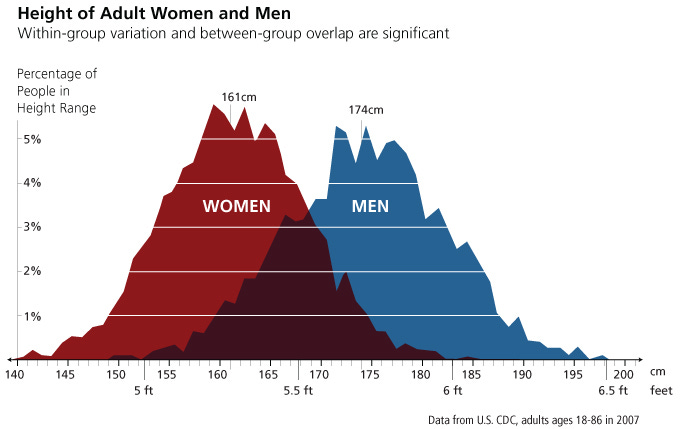

Here we have to nod towards statistics. There exists a thing called “the normal distribution,” which neatly maps to a lot of organic and biological phenomena. Take, for example, the chart below, which shows what percentage of men and women are of a certain height. The visualization creates a hill. Most people are at the top of the hill, and then fewer and fewer people are at the two bottoms of the hill, called “the tail”.

Pretty average stuff.

But now, let’s look at a thing called a “Power Law” distribution.

Instead of a big average hill with reasonable equality around the edges, you get pretty much most of the observations at the very bottom of the population, and then a thin, long tail that reflects much higher values. This is extreme inequality, and it resembles the outcomes of systems such as capitalism or social media.

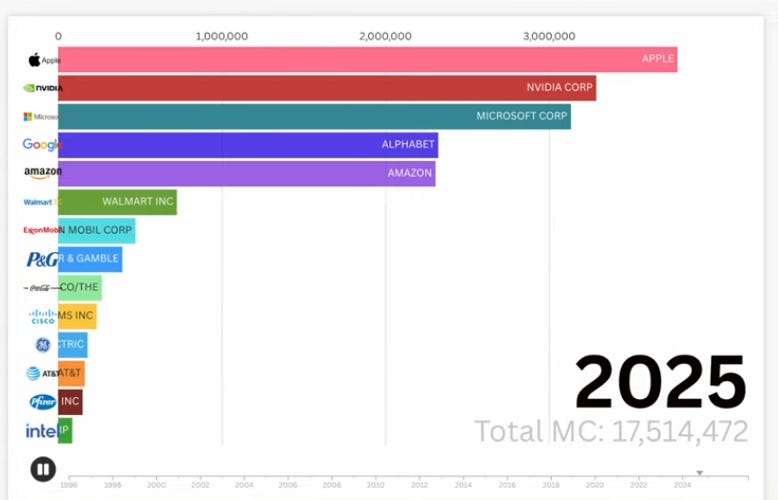

Here’s a good example — the top market caps within the S&P 500.

If we plotted the next 400 companies, they would look like a long, irrelevant tail compared to the mega concentration of value in the Magnificent 7.

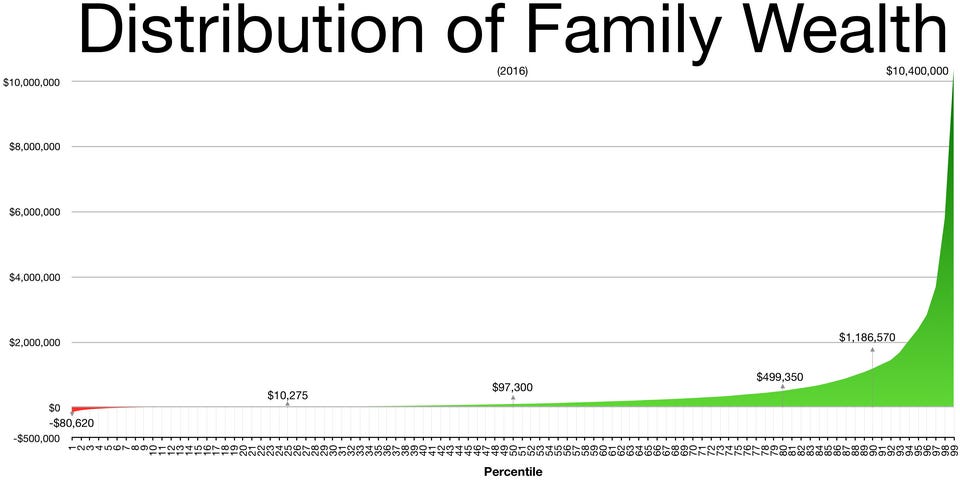

Here’s another good example — distribution of wealth by percentile.

Power laws are just as naturally occurring as normal distributions. They are the outcomes of freely executed sorting algorithms that deliver positive outcomes to society, but concentrate power and resources. While our intuition might say that the big fish have more relative control than the small fish, we are usually very wrong about the order of magnitude of that inequality.

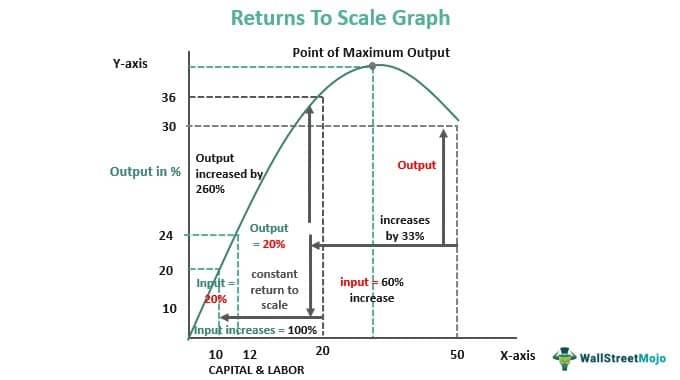

And finally, let’s talk about returns to scale.

One counter-balance to the concentration result is that when things get bigger, they get more fragile. A structure may start out innovative and flexible, achieve its goals and grow into a large super-organism (like a corporation or cultural artifact), and then ossify into a hierarchy that focuses on monopolization, rent-extraction, corruption, and inefficiency.

This cancerous corporate disease of inefficiency can be called decreasing returns to scale.

We are going to skip a bunch of math and point indirectly at the answers. Most firms, as they add capital and labor, can generate more output. But as they add increasingly more resources, the marginal benefit from doing so goes down, and so does the output. Eventually, you can overload things with inputs to the point where you are actually making less stuff overall.

When applied to a real-life scenario, just think about a start-up attacking an incumbent. The start-up will be faster and better incentivized. IBM loses personal computing to Apple. Microsoft loses search to Google. Facebook loses AI to Anthropic. And so on.

However, certain attributes make larger-scale companies stronger, rather than weaker.

For example, a trading market venue will be a better product to its customers the larger it gets, because of network effects related to capital, liquidity, and the number of counterparties on the platform. A social media site will be more defensible and popular when it has more users. An industrial company building robots may get better pricing from its suppliers and can achieve stronger vertical integration when it has billions to spend on R&D.

Positive returns to scale are rare, and create extremely sticky monopolies.

And this, dear reader, is against our intuition. We expect the enormous corporate colossi to move around like dinosaurs or elephants. Fast-moving, zippy critters lap around the behemoth.

Instead, the Big Tech companies are super-fast killer robot tigers the size of a skyscraper, with a hyper-responsive AI brain controlling an infinite number of tentacles plugged into our phones, data, and machines.

It is from this perspective, integrating the failure of our assumptions and intuitions, that we will take a look at Google and Shopify’s launch of the Universal Commerce Protocol, and Google’s attack on OpenAI with Personal Intelligence.

The Universal Commerce Protocol

The Universal Commerce Protocol (“UCP”) is a collaboration between Google and Shopify that lays down infrastructure rails for AI-driven commerce.