Analysis: Learning from 2025 to win big in the 2026 machine economy

The machine economy year in review

Gm Fintech Architects —

Thanks to everyone for your support and confidence this year. I hope you have a fantastic holiday season! Over the next few days, we will publish several podcasts that we want you to enjoy. For more analysis, we will see you back in 2026.

I am going to share with you the update I sent to my venture fund investors as a wrap-up to 2025. Our key topics:

Crypto Market Structure Challenges

Machine Economy Value Accrual

2026 Positioning from Generative Ventures

Key Takeaways for All

Premium Report (download 158 page deck)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

If you want to pitch us or discuss the fund, just reply to this email or reach out here.

Generative Ventures 2025 Review

Crypto Market Structure Challenges

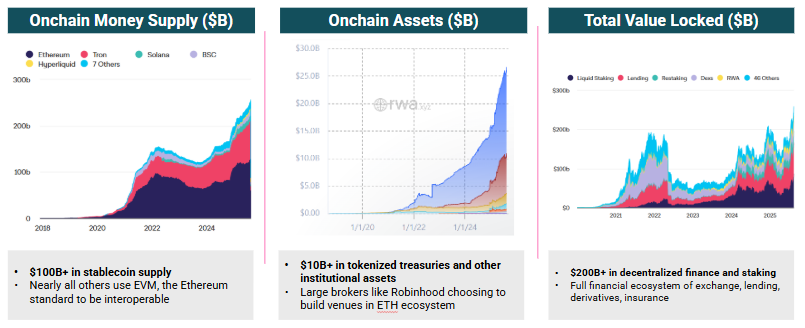

Adoption of onchain financial instruments and machine economy trends is booming.

Over the last year, we have seen a tremendous expansion of blockchain-native finance across (1) stablecoins, (2) decentralized lending and exchange, (3) perpetuals, (4) prediction markets, and (5) digital asset treasuries. Regulation has been extremely favorable in the United States, and this has led to expansion in the number of projects and their risk posture. A forgiving macro environment, putting aside the uncertainty from tariffs and market structure, had also created a fertile soil for crypto innovation to take root.

No need for us to demonstrate these well-known trends with data.

And yet, 2025 has been a profoundly challenging year for long-term investors of tokens and crypto assets outside of Bitcoin. It was not too bad to be a trader or a banker — we saw a record level of fees for bringing DATs to market, and huge rents flow to exchanges like Binance for listing new projects. But for those of us with a 3-5 year horizon, the market structure has been awful.

We are squarely trapped in a negative Prisoner’s Dilemma, where token holders sell anything and everything in anticipation of future selling pressure, and the market makers and exchanges supporting the overall crypto economy have taken cynical positions that power short-term games. Vesting schedules and launchpad prices drag down projects before they can find revenues or product-market fit.

Additionally, a market structure failure on October 10th of this year has clearly blown up several players in the market, and the unwind from this event continues despite the damage remaining private. Correlations across all crypto assets have moved to effectively 1, suggesting deleveraging by an industry-wide participant, despite the underlying fundamental theses being quite different amongst them.

It would be easy to retrench and become cynical.

But we prefer to mark-to-market as clearly as possible, so that we can plan for how to position for the future. A drawdown in this part of the investment world in 2025 is information, but not dispositive. It can very well be that 2026 will see a large unwind in private company secondaries, and we will be analyzing how people had issued so many SPVs in marked-up valuations while crypto booms.

Meanwhile, the promise of programmable finance and robot money continues to get implemented, and we must continue to work to find the best positioning for its inevitable climb. For context, consider this chart below. It zooms out to the last decade in market capitalization creation across several geographies and industries.

When we look at this history, the value creation in both crypto and AI has been staggering compared to everywhere else in the world.

There is almost nothing happening in the European capital markets ($2-3T per country), but maintenance of the past. You might as well have invested in a treasury note and let it ride at 3% per year, and you would have created more value. As we move to the right, India and China are showing 5-10% CAGRs, and net market cap created over the time period is about $3T and $5T in value. Now that you understand the scale, consider what we categorize as robot money — (1) the magnificient 7 companies, representing technology and AI, have added about $17 trillion of marketcap at a rate of 20% per year, (2) the crypto asset market, representing modern financial rails, has added $3T over the same time period, at a 70% CAGR.

This is the financial center of the future.

You can explore our ideas about 👉 robot money in more detail here.

But being correct on the thesis is not enough. One has to get specific and clever about which parts of the value chain to target, especially when the value chain is not fully visible to the world. Consider talking about roboadvisors in 2009, about neobanks in 2011, or DeFi in 2017. The words and connections weren’t quite there, and it was still 2-5 years before the outcomes hardened into clear conclusions and commercial opportunities.

With that, we attempt to map 2025 to a machine economy value chain across public, private, and token companies below.

Machine Economy Value Accrual

As an exercise in masochism, we have put together a 158-page collated report of the most relevant 2025 participants in the machine economy.

You can access the report as a paid subscriber at the bottom of this email.

One should treat it as a reference rather than a story. But it is helpful to see the shape of the industry.

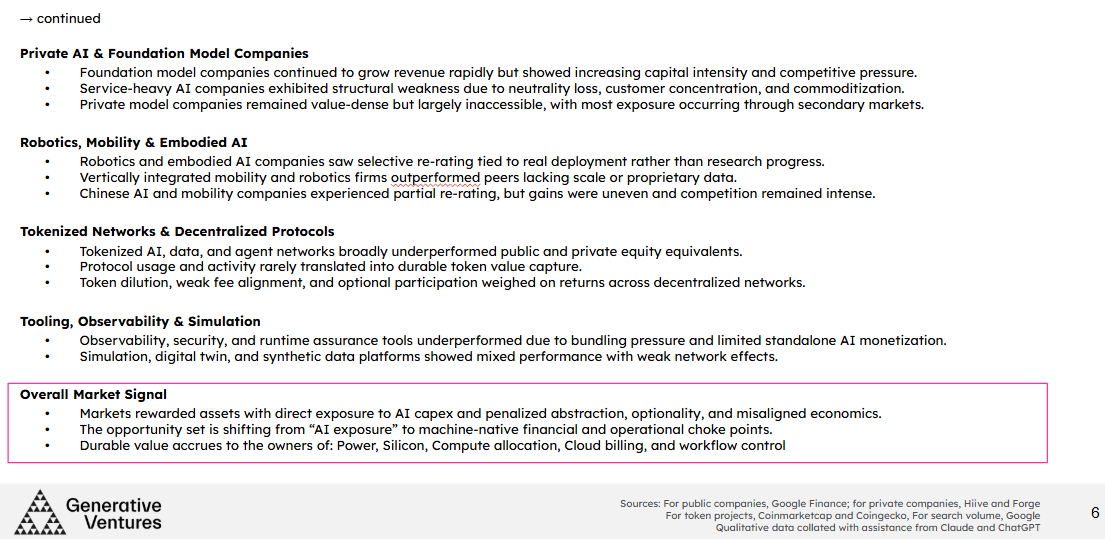

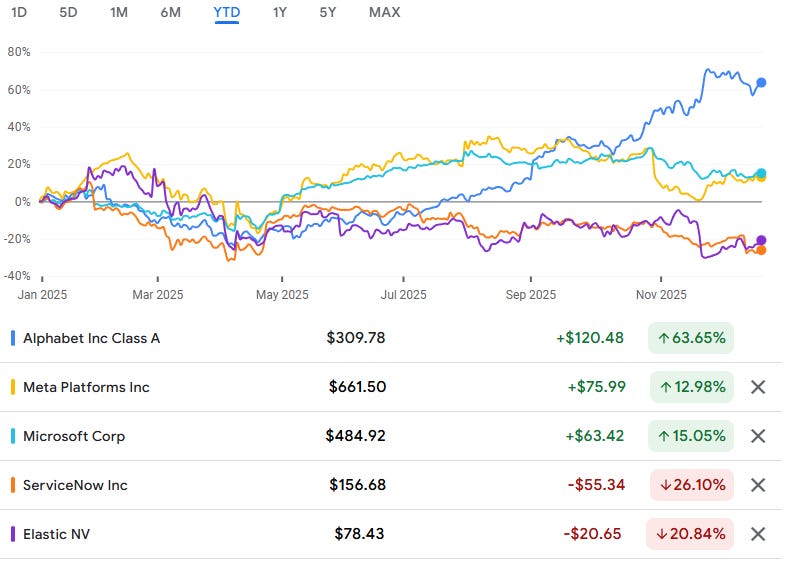

In the public markets, 2025 has been a year of separating the winners from the laggards. The clear winners are owners of physical and financial bottlenecks: power, semiconductors, and scarce compute. Bloom Energy, IREN, Micron, TSMC, and NVIDIA all materially outperformed, in some cases dramatically, as capital followed assets that machines are already forced to clear through. Bloom and IREN are emblematic: both sit directly in front of AI capex and convert urgency into revenue. By contrast, colocation and legacy infrastructure like Equinix underperformed or lagged, reflecting the market’s growing view that generic capacity is less valuable than purpose-built, power-secured, high-density compute.

In software and data, performance splintered along a different dimension: (1) compulsion versus (2) optionality. Platform-like enterprise systems with embedded workflows and forced renewals (Alphabet, Meta) continued to compound, with Alphabet and Meta both up YTD as AI spend reinforced existing distribution moats. ServiceNow and Datadog, despite strong products, struggled as valuation, bundling pressure from hyperscalers, and slower AI monetization weighed on returns. Elastic illustrates the downside case: technically strong, but squeezed by cloud-native substitutes and deteriorating unit economics.

Private markets show a similar sorting mechanism.

Foundation model companies are the key story, but there is growing fragility. OpenAI and Anthropic are scaling revenue quickly, yet neutrality, capital intensity, and margin compression are now explicit risks. Scale AI is the cautionary tale of the year: Meta’s partial acquisition collapsed its neutrality and triggered customer flight, demonstrating how quickly a services-heavy business can unwind once trust breaks. By contrast, companies that control value (Applied Intuition, Anduril, Samsara, and emerging fleet operating systems) look better positioned, even if value realization remains mostly private.

Tokenized networks were the weakest segment overall. With few exceptions, decentralized data, storage, agent, and automation protocols underperformed as usage failed to translate into token value capture. Chainlink remains strategically important but struggles to align protocol revenue with token economics; Bittensor is the biggest Crypto AI bet but is not a material threat to Web2 Labs companies; Giza and similar agentic protocols show real activity yet remain trapped by dilution and thin fees. Markets are no longer rewarding coordination narratives without enforced tolls.

Value is accruing where machines already pay — power, silicon, compute contracts, cloud bills, and regulated balance sheets — not where they might one day choose to.

2025 rewarded ownership of choke points and punished ideals without power over cashflows or compute. The future is about correctly identifying where economic force already exists, and backing the assets that machines cannot bypass. The main takeaways are:

AI value is being realized one layer lower than most people expected

Neutrality is now a first-order economic asset (e.g., see Scale AI)

“Platform” only works when tied to a control point, not a feature

AI software is deflationary (pricing pressure); AI infrastructure is inflationary

Vertical integration matters only when it locks in data or economics

Token networks are failing the same market structure test repeatedly

AI exposure is no longer enough; positioning quality dominates

Almost every company we cover is “AI-exposed,” yet outcomes vary wildly based on position in the value chain. Robotics hardware and software are the next hype cycle, and we are likely to see a similar wave of investment and selective winners.

2026 Positioning

Over the last 2 years, we have established a core portfolio of companies with exposure to the key themes discussed here. As we look to 2026, our positioning and investment implementation will tighten further.

I am going to talk my book for a bit.

While the long-term vision of autonomous agents, robotics, and machine-native finance remains directionally correct, the market is in a phase where valuations are outlandish in private AI and robotics.

Aggressive secondary liquidity and $100B+ implied valuations signal a transition from discovery to exit.

As an early-stage fund with a Fintech angle, we have to look downstream from this spend and target:

Machine Transaction Surfaces: Layers where machines or their operators already host economic activity, such as payments, billing, metering, routing and orchestration of capital or compute, compliance, custody, and settlement primitives. Returns accrue through volume, acquisition, or regulatory posture rather than speculative narrative. Walapay and Nevermined are examples of this in our portfolio.

Applied Infrastructure With Budgets: Infrastructure that is already being purchased today by enterprises or platforms, like compute aggregation and optimization, data services embedded in workflows, tooling with recurring spend and switching costs. Emphasis is on budget ownership and integration depth. We highlight Yotta Labs and Exabits as examples.

High Novelty Opportunities: A smaller allocation to rare opportunities where the upside is asymmetric but timing is uncertain: foundational research, frontier science, cultural or IP platforms adjacent to AI. Our recent investment in Netholabs, a lab focused on deriving full digital minds for mice, fits this profile.

In addition, we will more actively look to invest in equity until the market structure issues with tokens are resolved. Historically, our exposure has been 80% to both tokens and equity, and 10% to each separately. We believe there is 12-24 months of hangover in token-land that needs to be resolved.

Thankfully, there is no shortage of ambitious builders on the horizon, and we are excited and optimistic for the year to come.

Key Takeaways

You don’t have to be a venture investor to learn from the dynamics in this market, and find a way to benefit.

The huge glut of CapEx spend is moving from Big Tech into energy and component suppliers. A handful of companies are being projected to become multi-trillion-dollar public winners, but are staying private while shedding off SPVs. The public companies are doing their best to defend. Political power is centralizing and nationalizing these initiatives — Musk and Trump, and Xi and DeepSeek — rather than supporting their decentralized alternatives in Web3. Robots are intertwined with national manufacturing and the war industrial complex.

There is a backlash against AI in the creative industries, from gaming to movies and music. People who practice the craft of being human are repelled by the robot pretending it can do the same.

In the software, science, and mathematics industries, people are lionizing AI as an incredible achievement that can help with discoveries and in building massively productive business architecture.

We need to stop believing in the *shared hallucination* and focus on the truth. There are dozens of companies making $100MM+ ARR serving users. And at the same time, a lot of stuff is fake or a scam. Multiple things are true at the same time.

The next year will bring destruction across the board, and it will also be possible to become wildly successful by walking the tightrope of opportunity. See you on the other side!

Premium Report (download 158 page deck)

As promised, the link to download the full encyclopedia of the machine economy value chain is below: