Analysis: Monetization of financial data at $4B Envestnet, $170B Intuit, and $7B SoFi

Why Envestnet's Data Potential Falls Short Amid $3.5B Sale

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We examine Envestnet's potential sale to Bain Capital for $3.5 billion, with a detailed review of the economics of Envestnet, Intuit, and SoFi. Despite significant assets, Envestnet's relatively low valuation prompts questions about its unmet potential. We compare Intuit's recent layoffs and SoFi's acquisition strategy, emphasizing the monetization challenges and declining importance of data aggregation. The analysis highlights how different approaches to leveraging financial data impact growth and profitability, suggesting that touching the consumer directly, as Intuit and SoFi do, proves more effective than purely B2B models.

Topics: Envestnet, Bain Capital, Yodlee, Intuit, Mint, Credit Karma, SoFi, Galileo, Finicity, Mastercard, Plaid, Stripe, Marqeta

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

In Partnership

Join us and over 40 million users who love Revolut. Sign up with 👉 our link here.

Long Take

Data, Oil, and Category Mistakes

Our friends at Envestnet are looking at a potential sale to Bain Capital for $3.5 billion.

Envestnet is one of the original fintech success stories, riding several important waves. The first is the digital transformation of financial advisors from salespeople to fiduciaries. The second is the multi-custodial investment management landscape. And the last is data aggregation through their prior acquisition of Yodlee for about $660MM. If data is the new oil, surely Yodlee — the granddaddy of data aggregation — is valuable.

Unlike most private Fintechs, this is a company with clients and about $1B in revenue. So why is it exiting at what seems like a low valuation? Why did it not capitalize on the full potential of its core assets?

Another loosely connected piece of news is that Intuit, the small business software and tax preparation company — the one that bought Mint for $170MM and Credit Karma for $7B — is laying off 10% of its workforce, or about 1,800 people. It plans to re-hire the same amount of people, but with a profoundly different skillset.

Intuit is no stranger to cutting off its own limbs. You may enjoy our obituary for Mint.com below, which traces the path of how all these data aggregation and personal financial management companies were early to explore consumer fintech. And of course, how Intuit killed the one that wasn’t making any real money and lacked a business model.

The company controls a large data engine, which powers Credit Karma and happens to be highly profitable. Will the Generative AI service offering take full advantage? If you consider what Intuit is saying about its new big bets, engineering AI-powered customer experiences — whether coupled with human experts or delivered separately — seems to be the main focus.

Last, let’s look at SoFi.

The digital lender has suffered since its SPAC launch, but is now trading around $7B in marketcap on around $2-2.5B of revenue, most of it lending-related. In 2020, SoFi acquired Galileo for $1.2B, most of which was an earn-out we understand. Galileo is also a data connector, plugging into everything from banks to payments to crypto. It used to be an aggregation infrastructure on which SoFi was delivering its own services, so the acquisition can be seen as a vertical integration.

Is it fairly captured inside of SoFi’s numbers?

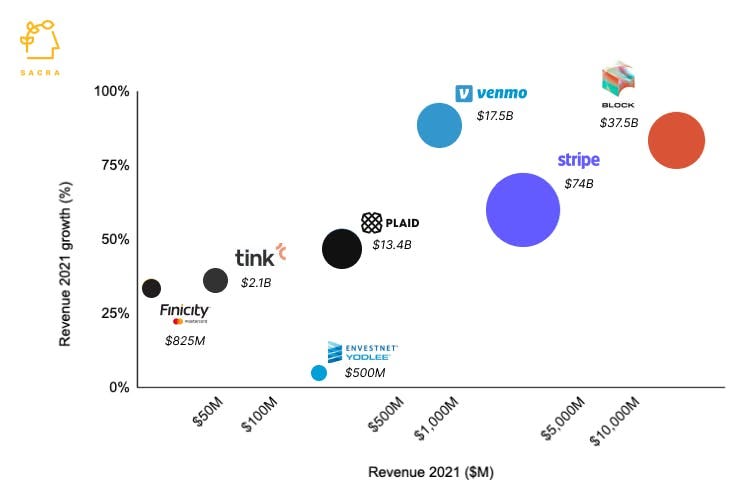

There are many other comps. Finicity was acquired by Mastercard for $825MM and Plaid remains private, but had flirted with acquisitions at $5B+ values. What we want to explore here is how well some of these companies are actually monetizing the underlying data infrastructure.

We will also give you a rhetorical question — is this last-generation stuff? Is the problem of getting data and execution across banks and brokers not important anymore, when we have open, decentralized, transparent blockchains for financial transactions? Maybe the ice cube is melting, and it just happens to be a really, really big ice cube.

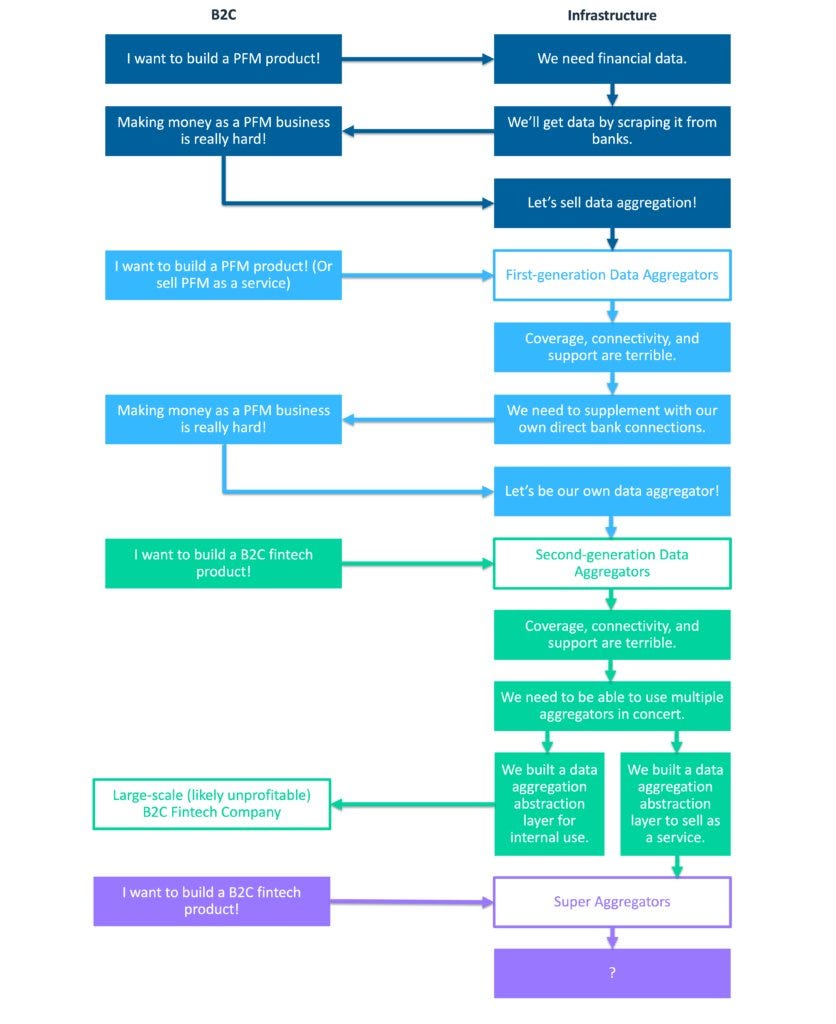

PFM Heartache

has put together a fantastic infographic on the startup mistakes of trying to vacillate between B2C and B2B2C aggregation companies. Call them PFM, data aggregation, embedded finance, banking as a service, or whatever you like. As a result of this circular cycle, we continue to have different companies recreating large data ledgers of financial data repeatedly. The interesting thing is that they are coming at the problem from multiple industries — some in payments, others in banking, and others in investments. Since the financial infrastructure in these industries is non-standard and often ancient, there is value in rolling-up integrations into various connectors.

Venture investors who don’t want to take a direct consumer bet will fund these approaches over and over again — they are a vampire attack on the traditional financial industry. The problem, however, is that the product and the go-to-market are different. Just because you are rolling up banking data does not mean you need to sell to neobanks. Or, just because you are aggregating investment data does not mean you should sell it to financial advisors.

This is what embedded finance realized.

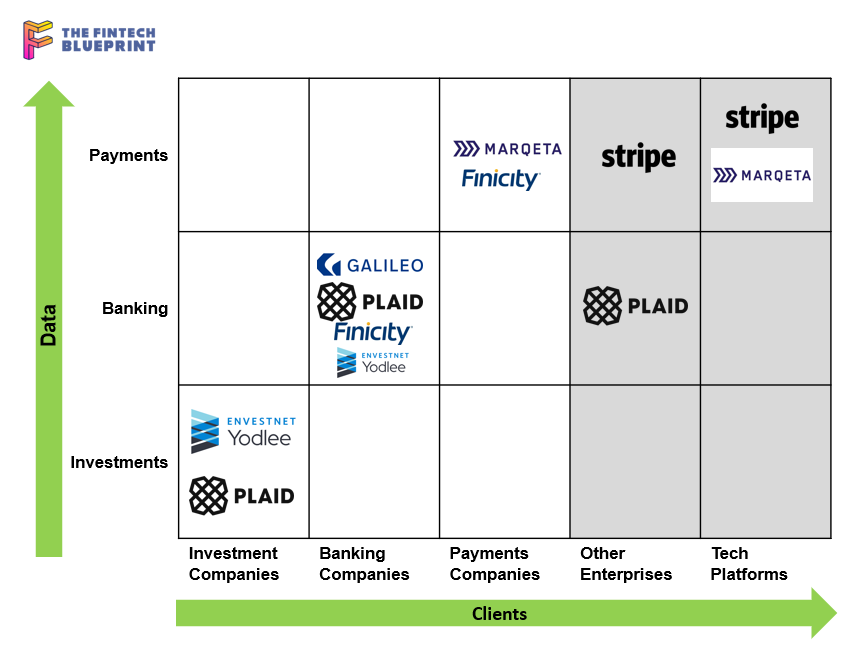

This framework isn’t exactly right, and we certainly are getting the categorization of products a bit wrong. But directionally, it should help you connect the dots.

Yodlee started out as a bank data aggregator for banking-oriented fintechs, but then was acquired into an investment management context to help financial advisors. Plaid had a break-out early by becoming the authentication layer for large tech start-ups, like Uber, to connect payments and banking capabilities into the apps. Stripe didn’t aggregate, but rather embedded payments into large tech platforms and online businesses. Marqeta created payments infrastructure that lived within tech platforms and other payments services.

So you can see that limiting your data vertically to the financial sector from which you come can be an obstacle to growth. Unless you build out AI from it that cannibalizes all your B2C customers.

The interesting thing to us is — what is valuable? So far, the market has punished pure banking and investment aggregators like Yodlee and Galileo, while rewarding companies like Plaid that touched payments, commerce, and tech.

Let’s keep this lesson in mind and dive into the financials.