Analysis: Our eToro IPO Primer, a global neobroker with $300MM in profit

With $300M in EBITDA, eToro’s IPO may rival Webull, Robinhood, and Coinbase.

Gm Fintech Architects —

I am traveling with the family for school holidays. Hoping you are taking the time to check in on the important things in the midst of all the chaos and disorder.

A numbers-rich analysis today that we really enjoyed putting together.

Summary: We explore eToro’s journey from a 2007 forex platform to a global neobroker now preparing for a long-awaited IPO. After abandoning a $10B SPAC deal in 2022, eToro rebounded with $820MM in net revenue and $300MM in adjusted EBITDA in 2024, showing solid financials and strong international user acquisition, particularly in Europe and the Middle East. The firm boasts 40MM registered users and has doubled its funded account conversion rate to 9–10%, supported by diversified product lines and efficient cohort monetization. While its core business remains "risk-on," the IPO valuation could range between $8–12B, in line with peers like Robinhood and Coinbase. Unlike U.S.-centric platforms, eToro’s global reach may provide long-term resilience, though it may not experience the same IPO frenzy seen with Webull’s $30B valuation spike

Topics: eToro, FinTech Acquisition Corp V, Coinbase, Robinhood, Trade Republic, BitPanda, Kraken, Binance, Webull, SoFi, Circle

To support us and access the full archive of IPO primers, financial analyses, and guides to building in the Fintech & DeFi industries, see subscription options below. The current price is a $2/week if you subscribe annually.

Long Take

The Neobroker’s Promise

Founded in 2007 by brothers Yoni and Ronen Assia, eToro began as a foreign-exchange trading platform for retail investors. The fintech was part of an early wave of Web2 companies bringing financial products online, which today has matured into a set of global champions of neobanks, roboadvisors, digital lenders, and neobrokers.

eToro expanded beyond forex to offer commodities, indices, and equities, and eventually went deeper into crypto assets. The company's early products emphasised social interaction between traders, enabling them to observe and replicate the trades of others, a concept called "copy trading". By allowing novice traders to directly copy the moves of more seasoned market participants, the platform quickly gained traction, especially among retail investors lacking professional trading experience. This social-trading feature defined eToro’s early identity and laid the foundation for its subsequent international expansion.

The emphasis on community-driven investing differentiated the firm from other plays — though a number of early companies like KaChing! (now Wealthfront) and Covestor (now dead) have tried similar approaches with little success. At the time, this idea was to implement social media into the financial industry.

Another unique thing to eToro in those early days was offering trading through *contracts for difference*, rather than through ownership of the underlying assets, which allowed the broker to appear to offer far more investment universe coverage. CFDs are exotic products, and not allowed in many jurisdictions, but were a smart growth hack for an Israeli company with little regulatory footprint at that time. And, unlike Robinhood, which sold free trading by getting paid by market makers, eToro charged fees for the services it provides.

Below is our conversation with Yoni about founding and growing eToro.

In 2021, eToro announced plans to go public via a $10B merger with FinTech Acquisition Corp V, a special-purpose acquisition company chaired by Betsy Cohen. That’s as good as it gets. After repeated delays and a collapsing SPAC market, the proposed transaction was eventually abandoned in July 2022. The cancellation marked a setback for eToro’s ambitions to enter public markets. Falling brokerage and crypto revenues during this time period also meant the financials would look worse and made exits unlikely.

Now, in 2025 and after a trading boom recorded on the P&L, eToro is back on the market and filing for its IPO. You can see the full F-1 here, and we will highlight the key economic points below.

IPO Financials

Let’s start with the company P&L and open things up from there.

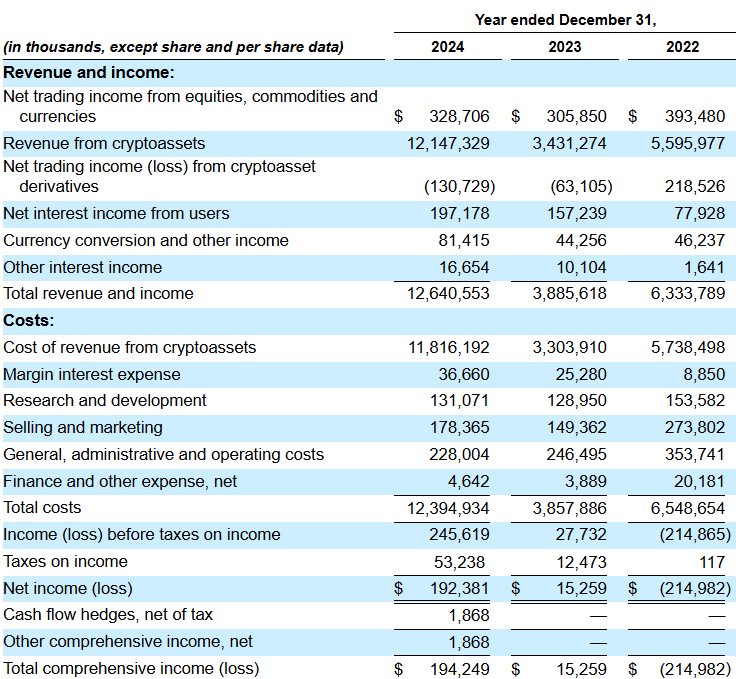

In 2024, total revenue was $12.6B, up drastically from $3.8B the year prior, and $6.3B in 2022. What you will notice, however, is that the economics associated with cryptoassets have both a high revenue number and a high cost. This is due to eToro accounting for these sales as bringing the entire fair value and customer liability into the P&L together — this approach captures “volume” or “gross merchandise value” rather than just the revenue associated with the business.

Let’s net things out for our analysis going forward, while also bringing in historic numbers from the SPAC economics.

We remind you that Coinbase has an ARR about $10B, so eToro may have a good reason to try and comp itself to a firm that size with thinner profitability. However, if we take the more conservative approach of netting crypto revenues out, the picture looks more consistent and is still a pretty fantastic business.

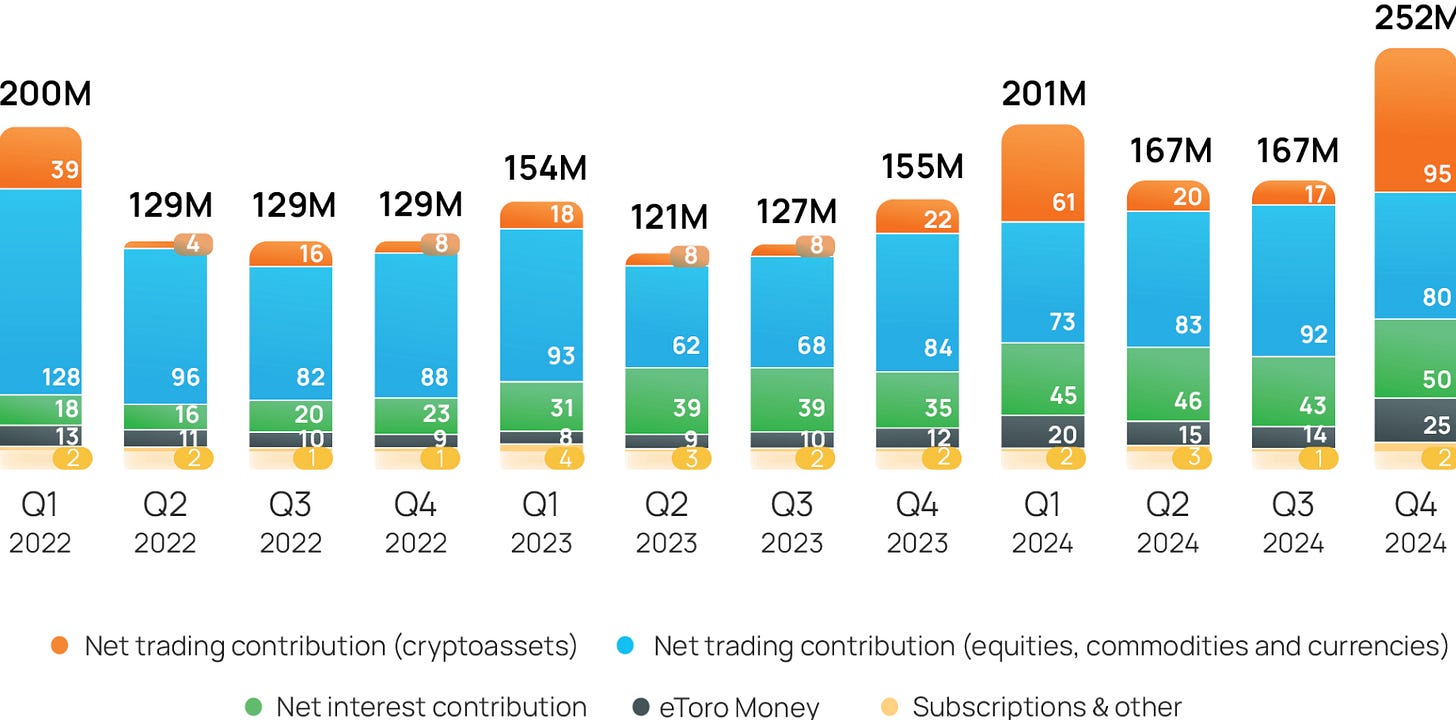

You can see the same numbers plotted in the a chart above. The separation in 2021 is the line between SPAC financials and the IPO documents, which may differ somewhat in their reporting. Revenue peaks at $550MM in 2020 and then resumes at $600MM in 2022, $580MM in 2023, and $820MM in 2024. Profitability as measured by adjusted EBITDA floats around 20-30% of revenue, rising to $300MM in 2024.

We might be losing some measure of momentum in pulling volumes out of the revenue data, but this feels more informative. If we say that revenues are around $1B per year, that can yield a valuation of $8-12B on a 10x revenue multiple. Here is a quick sanity check against Robinhood and Coinbase.

Robinhood printed $3B of revenue last year and $1.5B of EBITDA. It trades at $36B in marketcap, which is a 12x multiple. Coinbase did $6.3B of revenue and $3.3B in EBITDA, while the current marketcap is $44B — this is a 7x revenue multiple. Both the valuation range and the intuition about comps checks out.

Unlike these other US neobrokers, however, eToro has played from a more difficult starting position.

Americans have larger amounts of investment assets and are more well-educated — or at least socialized — about investing in general. While the above metrics showing geographic footprint are somewhat dated, they are still directly useful as to how eToro has grown. Most of the user base has come from Europe, with a footprint in Asia and the Middle East as well. That means the Fintech also competes with companies like BitPanda ($4B, private) and Trade Republic ($5B, private), not to mention Kraken, Binance, and the rest of the crypto exchanges.

Financial Analysis: Will $5B Trade Republic, Germany’s Robinhood, win the race for European wealth?

We do think, however, that being a local leader in a market is a very sticky competitive position, and eToro has earned its throne.

The last point to make on revenue is diversification. As fintechs have grown, they have availed themselves of multiple revenue sources — market makers, payments interchange revenues from card programs, net interest on cash accounts for licensed players, lending and margin revenues, various fees for usage and FX, and so on. The rise in interest rates has saved the wealth management firms, for example, from poor economics on its asset allocation products. Similarly, options and crypto revenues have helped SoFi and Robinhood reach higher profitability.

eToro has similarly tried to move toward diversification of its revenue base.

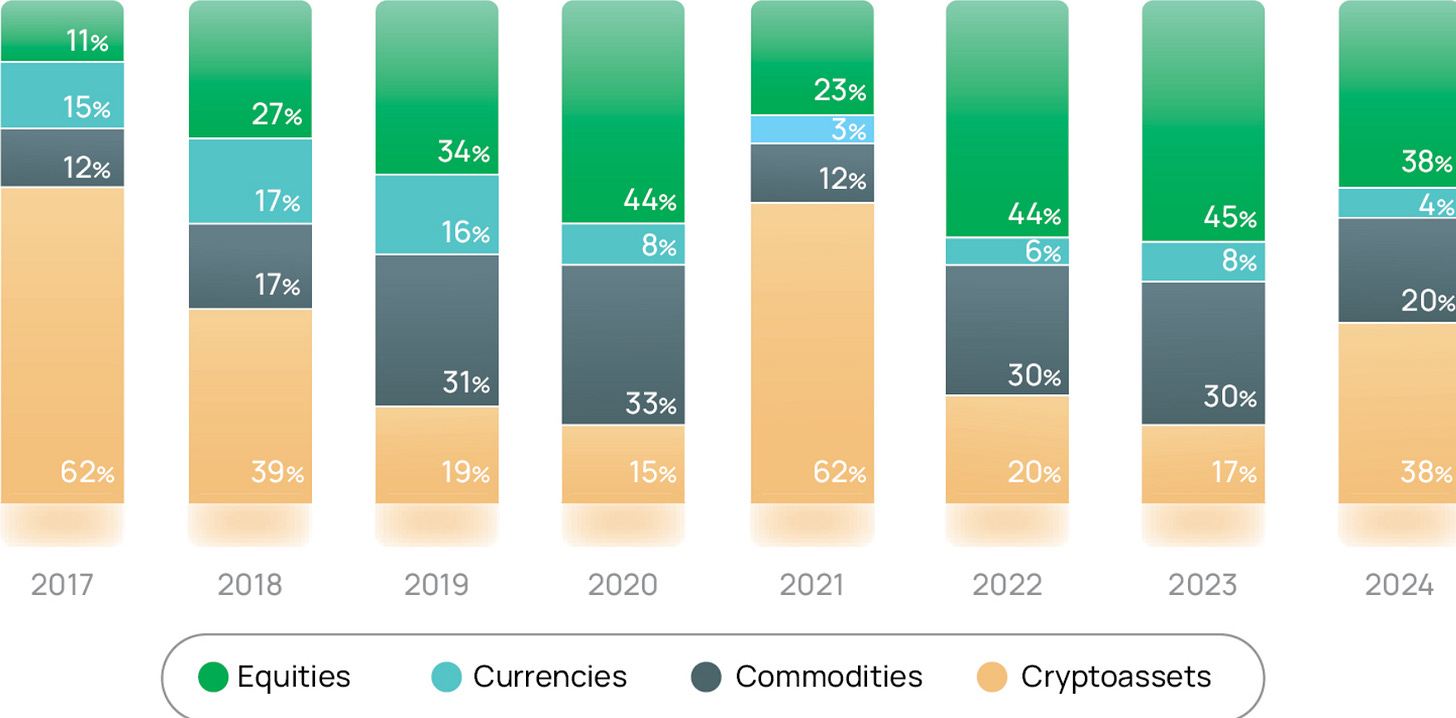

The charts above highlight that cryptoassets, equities, commodities, and currencies each contribute differently to the P&L over a reasonably long time frame. It is good to see this composition, and there is initial diversification in the works. The company is a global broker with multiple product lines — though most of them are still in the “risk on” category. As they continue to scale up, we would expect new business lines to generate more revenue, something that Coinbase has been able to do since the FTX crisis.

For Coinbase, the most successful diversification has come from USDC, effectively owning 50% of the Circle business activity, and blockchain rewards like staking. Here is a similar chart for Robinhood, highlighting the importance of cash.