Analysis: Programmable money comes to Fiserv and Shopify

10,000 Banks Could Soon Use FIUSD on Solana

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Programmable money is evolving. We examine Shopify’s integration of USDC payments via Coinbase’s Base Layer-2, leveraging programmable payment flows like escrow-based captures and refunds that mirror legacy e-commerce logic. Meanwhile, Fiserv’s upcoming launch of FIUSD on Solana, backed by Paxos and Circle, shows how core banking infrastructure is bridging to blockchain, with 24/7 settlement and embedded compliance tools. The broader trend is clear: the future of money lies in programmable logic and real-time interoperability, with stablecoins acting as the foundational layer for both fintechs and legacy players.

Topics: Bitcoin, Circle, Coinbase, Shopify, Base, Seaport, OpenSea, Visa, Stripe, Bridge, Privvy, Fiserv, Paxos, Solana, Finxact, PayPal, Mastercard, Arbitrum, Optimism, Solana Foundation

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

We also have a very special deal going on right now — reply to this email and I’ll send you the link.

Market Comment

Exponential growth always looks impossible from the bottom. But here we are! What used to take decades now happens in 18 months in terms of revenue.

Replit’s ARR went from $5MM in 2022 to $100MM+ today based on AI coding

NVIDIA’s quarterly revenue hockey-sticked past $25B based on AI chips

The last chart is the AI intelligence lift-off from WaitButWhy from 2015

What used to take years of human labor now takes about 10 seconds to render. We are in the part of the curve where growth stops being linear.

Is this the escalator to AGI?

We are all so bored by the incredible progress happening every day that we miss it.

Long Take

Programmability is the next question

There are two parts to programmable money — (1) programmable and (2) money.

The financial markets have clearly been rewarding things that have some sort of moneyness. Despite a barrage of stressful global news and macroeconomic uncertainty, both Bitcoin and Circle, proxies for digital gold and the digital dollar, have held up spectacularly.

We have all finally gotten together and said that it is time to upgrade the money.

Let’s buy things that issue the money! Let’s invest in the financial wizards who can perform the miracle of money printing!

Hooray for charts that go up!

Anyway, that leaves behind the other important part, which is *programmability*. People refer to these themes in many other ways, too —

Self-Driving Money, if you are into Fintech and Teslas

Business Requirements, if you are an enterprise software developer

Workflows, if you are in operations

Applications, if you come from Web2

Smart Contracts, if you make your profits in tokens and DeFi

Intelligence, if you have been reading enough science fiction

All of this is just rules and patterns of behavior in a deterministic fashion. The logic behind the different structured permutations comes from people trying to map reality and create constructs that intermediate and accelerate the needs and demands of different parts of the social web, comprised of human individuals.

This person needs this from this other person, and so on.

At some point in the past, we would do everything manually. Then we would hire people to do things for us. Then we would create bylaws, regulations, and management rules for systems to persist beyond individuals. With time, we have been able to codify those systems into software machines that need only a bit of maintenance. In the next phase, you guessed it, the machines drive themselves.

That means they both maintain their own logic against required goals, and they also create new parts of themselves in order to attain those goals. The money is part of a program, and it can also extend its own functionality through the generation of software and participation in market venues of choice.

Stablecoins are programmable, because they are a native token on a computational blockchain. The token is an object that can be manipulated by programs on the “blockchain computer” or “virtual machine”. It can be manipulated and transformed along any dimension we desire to specify.

Money on older digital ledgers, meaning databases belonging to companies rather than blockchain protocols, is not programmable in the same sense. The databases are localized to particular actors, they are closed source, don’t sync with other databases unless a person in-between creates some sort of connector, and are prone to breaking and lose all the change — like in the case of Synapse and Evolve.

No amount of Fintech scotch-tape can fix that. No amount of wishful thinking will make core banking software the same as payments rails or portfolio management.

Therefore, as stablecoins ramp up to become the technological money layer that we all wanted, this will become less interesting to us, because the initial achievement is already over. Yes, there is underlying default risk and details to resolve in regards to collateral. However, the form factor is solved. The more interesting problem is — what will people do with it now?

What are the patterns and constructs to be created?

Shopify and Coinbase Commerce on Base

Shopify is now enabling merchants on its Payments platform to accept USDC on Coinbase’s Base Layer‑2 network, without any additional integrations or gateways.

Merchants toggle the option in the admin dashboard, and transactions flow through the existing Shopify Payments infrastructure, using Base as the settlement layer. USDC is accepted at the standard domestic Shopify Payments rate, with payouts on the usual schedule.

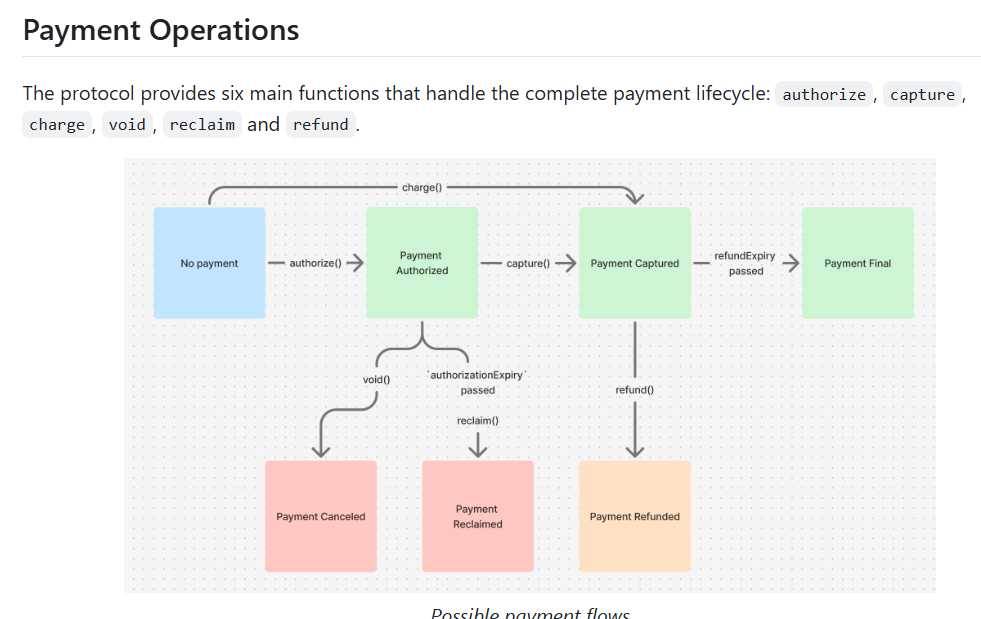

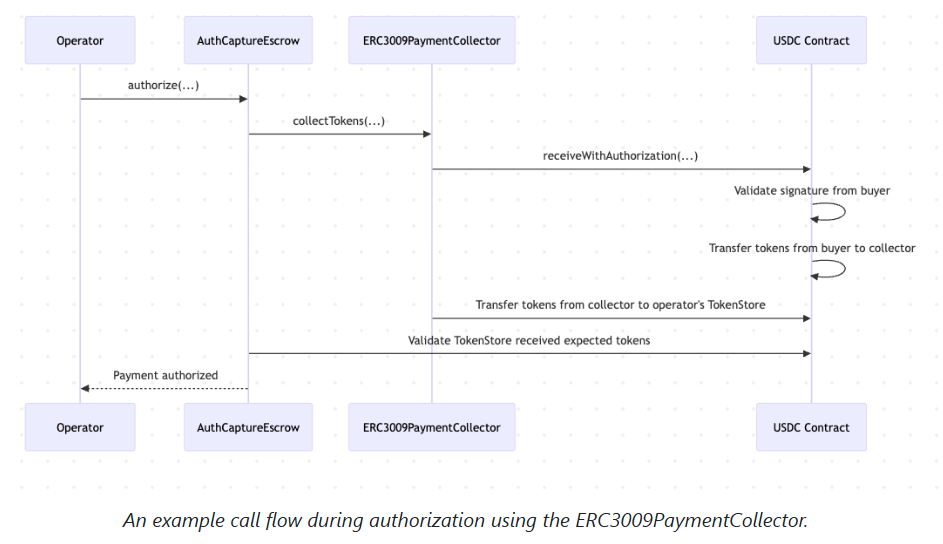

Underneath the hood is the Coinbase Commerce Payments Protocol, which implements escrow-based payment mechanics specifically designed for onchain commerce. The protocol introduces six core operations (authorize, capture, charge, void, reclaim, refund) that enable traditional e-commerce payment patterns like delayed capture and authorization holds through smart contracts on Base.

This is a more merchant-friendly design than simple token transfers, because it provides two-phase payments with separate authorization and capture phases. It mirrors traditional “authorize and capture” flows: first funds are locked into escrow, then the merchant can trigger capture, release, or refund actions. The protocol supports fee parameters, time‑based expiry, and reclaim logic to protect both payer and merchant.

Notably, it doesn’t look like the commerce stack that OpenSea developed for transacting in NFTs in 2022, called Seaport. We thought NFTs would be the core primitive for onchain shopping, but there is a clear difference.