Hi Fintech Architects,

We have a very special, insightful edition for you today.

Lex interviews Sankaet Pathak, the former CEO and founder of Synapse, and CEO and current founder of Foundation. We discuss what happened at Synapse, the issues around its bank partner Evolve and others, and the overall lessons from the BaaS space.

We recommend you read the fill transcript below as it will be a learning opportunity for the entire industry. We welcome feedback and comments on what is likely to be an eye-opening conversation. Our goal was to highlight the relevant issues for all to see and avoid similar contagion in the future. We appreciate Sankaet’s willingness to share his perspective.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

Sankaet is a technologist and entrepreneur with an academic background from the University of Memphis, where he earned degrees in Computer Engineering, Mathematical Sciences, and Physics. Early in his career, he worked as a research assistant, co-authoring over 25 papers on topics including the coronal loop controversy in physics. He also held roles as a tutor and student assistant, where he provided instruction in circuits, chemistry, astrophysics, and various programming languages such as Java, C++, and C.

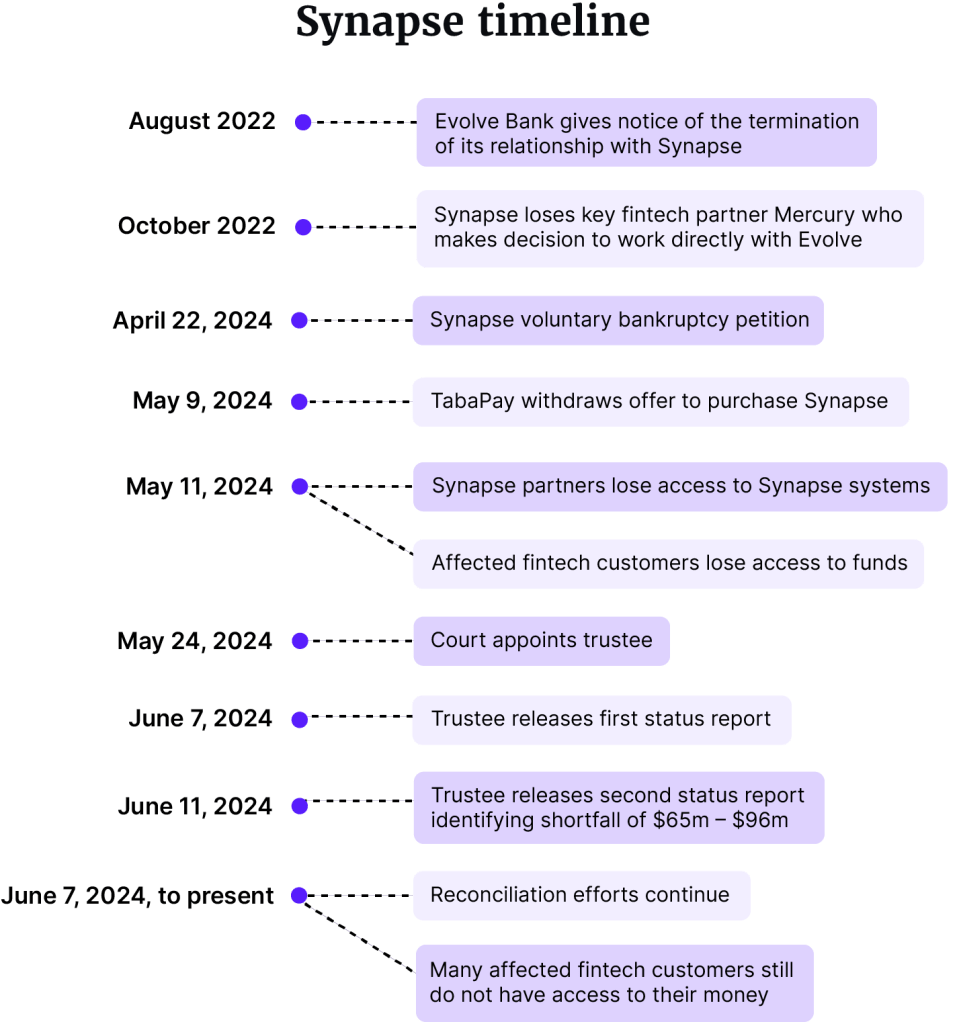

Pathak went on to found Synapse, a banking-as-a-service (BaaS) platform that aimed to facilitate the connection between nonbank companies and licensed banks to provide financial services. Synapse offered products such as deposit and credit solutions through a native processor. Despite raising over $50 million in funding, the company encountered significant issues related to regulatory challenges and disputes with its banking partners. These difficulties culminated in Synapse filing for bankruptcy in 2024, with nearly $160 million of customer funds inaccessible. Pathak attributed these problems to Synapse's banking partners, though others pointed to systemic issues in the BaaS business model itself.

Following Synapse's bankruptcy, Pathak launched Foundation, a robotics startup focused on developing humanoid robots to address labor shortages. The venture secured $11 million in pre-seed funding from investors, including Tribe Capital. Foundation aims to create AI-driven robots, reflecting Pathak's shift from fintech to robotics.

👑Related coverage👑

Topics: BaaS, API, Open Banking, payments, banking, Fintech, Embedded Finance, regulation, Synapse, Foundation, Evolve Bank, Mercury Bank, TabaPay, Yotta, FDIC

Timestamps

1’06: Synapse and the Evolution of Banking-as-a-Service: Sankaet Pathak’s introduction

3’26: The Synapse Story: Inside the Banking Infrastructure and Its Collapse

6’17: Behind the Rise and Reliance: How Evolve Bank Became Synapse’s Key Partner

9’16: Uncovering Reconciliation Issues: How Synapse Detected Problems with Evolve Bank

11’05: Tracking Customer Funds: How Synapse Managed User-Level Data with Pooled Bank Accounts

14’41: Uncovering Payment Breaks and Fee Issues: The Challenges Synapse Faced with Evolve Bank

21’16: Tracing Missing Funds: Synapse’s Financial Breakdowns and Evolve Bank’s Alleged Deception

24’44: From Billion-Dollar Valuation to Fire Sale: The Synapse Collapse and TabaPay Deal

29’04: Missing Millions: How a Migration Error with Mercury Led to a $49 Million Discrepancy

33’37: Lessons from Synapse’s Collapse: Reflecting on What Could Have Been Done Differently

39’10: Reflecting on Mistakes: Scaling Too Fast and the Complexities of Synapse’s Brokerage Service

43’11: Rethinking Financial Oversight: The Need for Bank Accountability and Direct Regulation of Bank-Adjacent Companies

45’59: Addressing the Critics: Sankaet Pathak on Misunderstandings and Missed Opportunities in the Synapse Collapse

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. We have with us Sankaet Pathak, who is the CEO and founder of Foundation as well as the former CEO and founder of Synapse. And we are going to explore what happened with Synapse, with the banking as a service industry as a whole and try to learn from everyone's experience. Sankaet, thank you so much for having this conversation with me.

Sankaet Pathak:

Yeah. Thanks for having me.

Lex Sokolin:

So things are going to get super complicated, I expect so let's just start with the foundation. What was Synapse?

Sankaet Pathak:

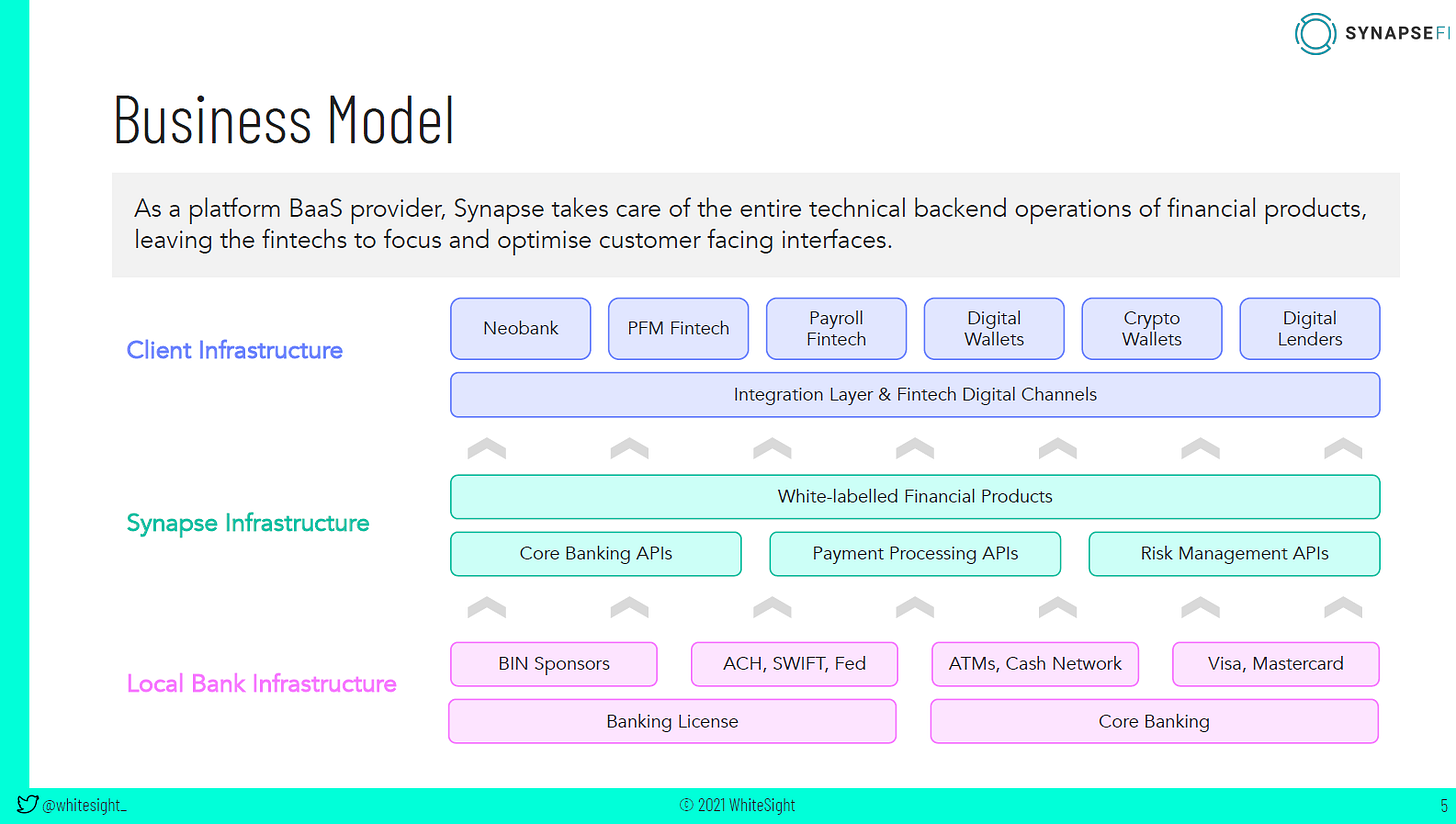

I started Synapse before the whole banking as a service, as the term or phrase even existed. To me, Synapse was building out the infrastructure for financial services because at the core of it, my personal experience was the financial services was not accessible to a huge majority of people, especially if you were credit-invisible financial services just weren't working for you. And initially my goal was to build something similar to what Revolut is now, but I quickly realized that the underlying technology just didn't exist. So started spending a lot of my time building out the core foundations of onboarding, so computer vision, government ID verification, then payment processing, then mentoring. And then what most people what most people know Synapse of which was like 2017, 2018 post was this API layer for banking. So, at the core of it, that's what it was. I still don't like the phrase banking-as-a-service. I think it's infrastructure for banking.

Lex Sokolin:

For everybody who's listening you and I had a long and deep conversation about the founding of Synapse that I recommend everybody check out.

The thing that I retained from that conversation is that originally you were trying to build B2C and payments experiences like bank-to-bank experiences and hit this frustration of there not being a banking infrastructure that was modern and ended up pivoting to B2B as part of trying to solve a problem of building the consumer side.

And so, you're really hands-on with all of the difficulties of integrating into the core banking systems — FIS and Fiserv and Jack Henry — and you're trying to solve your own problem. And so, my impression was always that you were very detail-oriented around this stuff. Can you tell us what happened with Synapse? Why are we talking about it now? Why is it relevant?

Sankaet Pathak:

So I was in the process of selling Synapse. We had a buyer, TabaPay. Before we were selling Synapse, we had found some irregularities in the general ledger accounts, which are like the pooled accounts that sit at a bank. Specifically, with Evolve. We had notified Evolve of those irregularities and in retaliation they withheld $50 million of our balance sheet.

Lex Sokolin:

So before we get to the numbers, why did you need to have a relationship with the banks and what was that relationship like?

Sankaet Pathak:

In the US, you don't have access to the payment networks or in most cases you're also not allowed a store record for funds unless you're a bank.

So, Synapse had built out pretty much all the processing software, all the ledgering software, all the KYC software, but what Synapse didn't have was a bank charter that would give us access to the Fed accounts, which would let us do ACH and wires. So, we were highly, highly reliant on bank partners to be able to essentially enable that for us. So that's at the core of why we needed the banks.

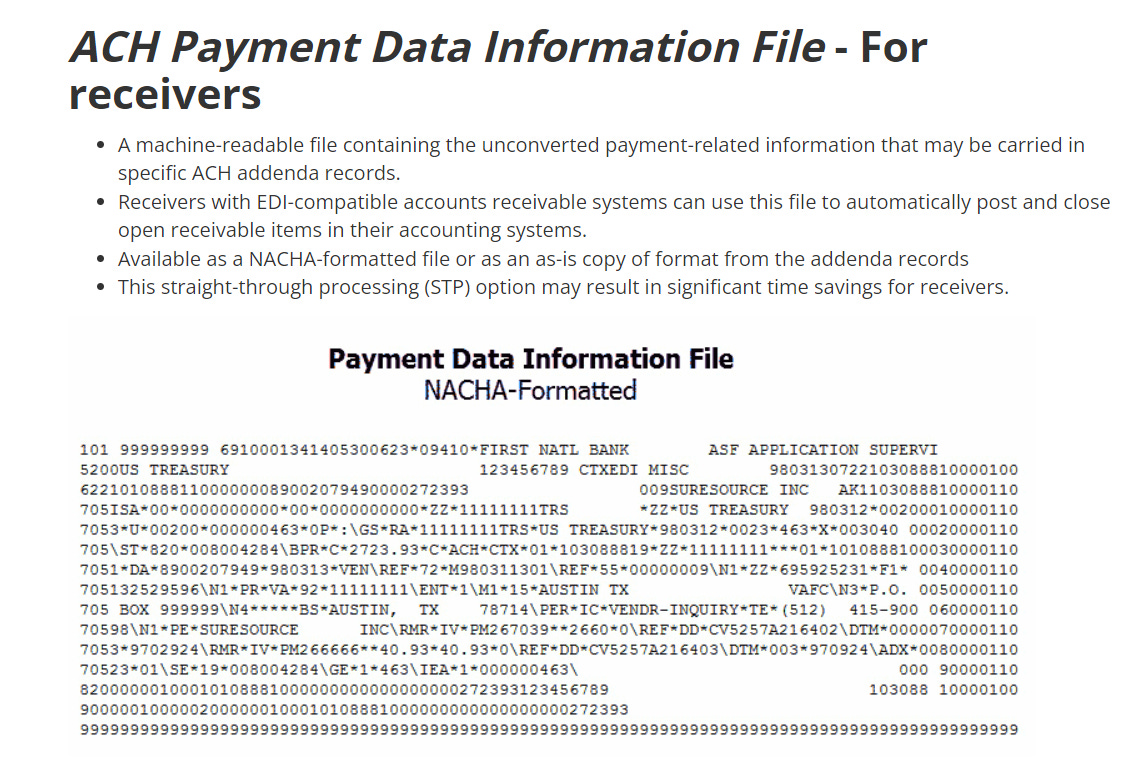

The way we worked with the banks was we would have our own software and system that would interface with the bank through what we called payment files. So, the banks would send us all the transactions that had happened in last few hours onto an SFTP. And an SFTP is for people similar to Dropbox. So, Google Drive. It's not that different except slightly more technical.

Lex Sokolin:

How would the banks generate this? So, nuts and bolts, was there somebody in their IT department running a Jack Henry process to create a CSV that then they would drop on an FTP? How did that work?

Sankaet Pathak:

So it depends.

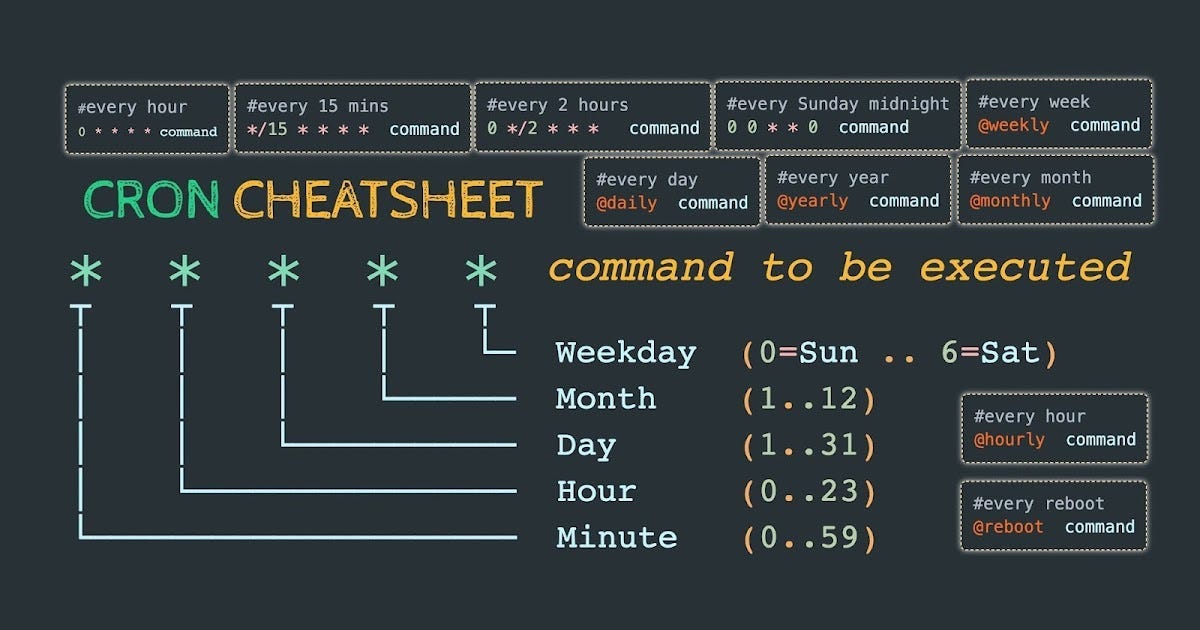

We had some bank partners that were doing exactly what you said. Evolve was one of them, which is my sense is they had a cron job that was taking data from Jack Henry and dumping that on our SFTP. While we had other banks ... So, AMG is a good example of this, Lineage is a good example of this, where they would just forward us the Fed files because we had a dedicated routing number there. So, it really depends on exactly what the arrangement is with the bank.

Lex Sokolin:

What's a Fed file?

Sankaet Pathak:

A Fed file is just like the NACHA file or the Fedwire text file.

So, they would just send you all of the activity directly from their Federal Reserve account associated with the routing number that you are running the program on.

Lex Sokolin:

That wouldn't touch their core banking systems?

Sankaet Pathak:

No, they would in parallel also upload that in their core banking system, but we would get a pure clean file where all the tracking numbers and everything ... It was much easier when you just got a Fed report out because there was no likelihood that some transaction was missed somewhere. You're just giving us the output that you're getting from the Fed.

Lex Sokolin:

How many banks in total were on the partner side for you that were sending you data?

Sankaet Pathak:

Four or five.

Lex Sokolin:

And so some of them were just like, "Okay. Here's the information from the Fed that we simultaneously upload to our core banking system and then can also route to Synapse as a shadow core."

And then in the case of Evolve, it was first hitting Jack Henry and then something out of Jack Henry was getting automated to you. Were there other core banking systems from which you were getting data dumps?

Sankaet Pathak:

We've done FISERV, FIS stuff and also CSI with different bank partners at different times, but the biggest reliance ended up being Jack Henry with Evolve.

Lex Sokolin:

I'm assuming that Evolve became an asymmetrically large part of your business. Is that right or was it split?

Sankaet Pathak:

No. That's correct. Evolve was like majority of our business. It was public, we were trying to divest from them, and they were trying to divest from us, but that never ended up happening.

Lex Sokolin:

Why did they grow to be so important?

Sankaet Pathak:

I think for Synapse they grew to be that important is because I think they had the ambition to grow while the bank partners we had before ... I wouldn't name who, but before Evolve we had another bank partner.

We went from a million dollars average deposits to about $10 million with them and they were freaking out about that in itself. So, there were a lot of banks if you can really rewind seven, eight years ago that were not pretty savvy and sophisticated in deposit suite networks that Evolve had set up later, et cetera. But Evolve had the desire to essentially grow while others that we worked with didn't.

So, I think this business now it's changing, but when I had started Synapse was more so supply constraint, not as much demand constraint. I think it seemed that way. Now I have some thoughts about that whole assumption. But it seemed that way and most banks were reluctant to get into it while was pretty eager to get into it given, they wanted to grow in deposits.

Lex Sokolin:

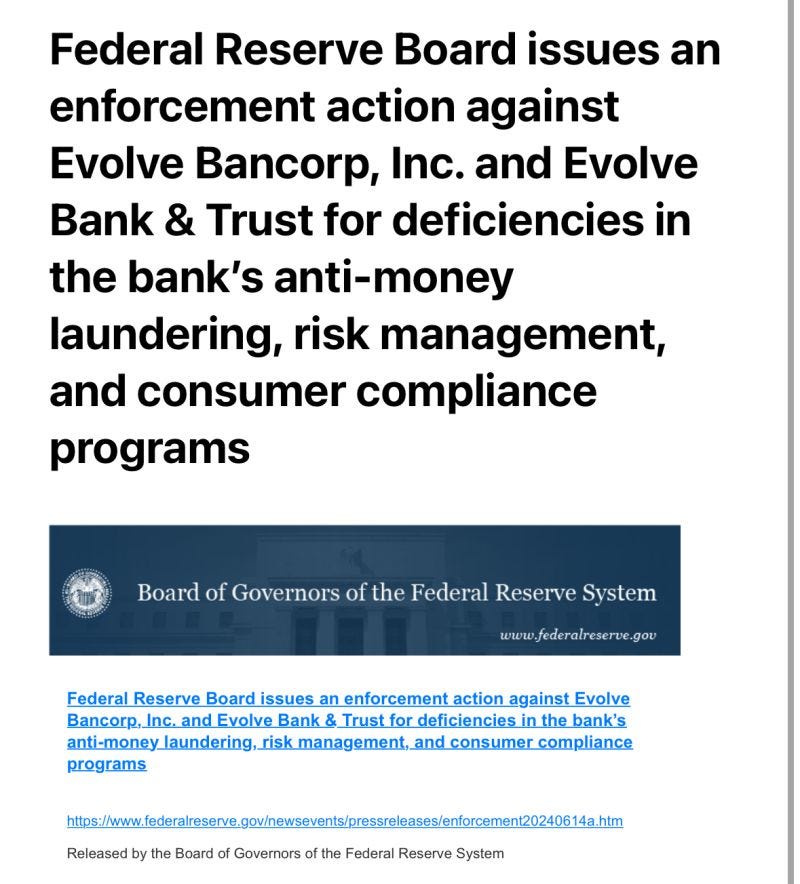

I was really surprised when looked up Evolve because in context it's still like a tiny little baby bank. It's like one and a half billion of assets. I think something like $20 million in interest income through I think maybe half the year or something like that. I could be getting this wrong, but this isn't Fifth Third. It's not even Cross River.

Sankaet Pathak:

When I started working with Evolve, I think there were 200 million in net deposits, so much, much smaller even.

Lex Sokolin:

How and when did you realize that there was a reconciliation problem with Evolve?

Sankaet Pathak:

We knew for a fact there was reconciliation problem with Evolve in late August, early September.

Lex Sokolin:

Of '23?

Sankaet Pathak:

Of '23. Yeah. Yeah.

Before that we had an operational problem with Evolve, which was we would have these payment issues or something and then we would not get as much help with them. But we were still under the assumption that the payment files we were getting were accurate and then sometimes there would be an instance where they weren't accurate, but we would be told that, oh, that was an incident and we've resolved it after you notified us and you should have all the transactions, etc. So, we were always concerned about that part of it.

Lex Sokolin:

Let's say you're seeing a CSV file come through and it has one set of information.

How did you know that something was off and that there was a difference? Was it customers calling, I don't know, Mercury and then Mercury calling Synapse. How did you know that there was something off?

Sankaet Pathak:

This mostly happened when people did not ... Like somebody's deposit was missing. So, they would reach out to the fintech, the fintech would reach out to us, we would reach out to Evolve and then long behold you'll find that okay, there were quite a few payments that didn't make it to us that by the way, we covered. Already posted on the core, already were posted on the GL.

So, then a lot of our discussions and work with Evolve was, okay, how do we make sure that we get the entirety of what's posted in your core and there's no issue of this ever happening, but we never ended up resolving that.

Lex Sokolin:

That. Well, I think we covered that. Fintechs are working with Synapse, the fintech has the customer relationship. They might have their own ledger, or they might have only Synapse, or they might mirror Synapse in some way, but regardless, there's some friction there. There's a customer that says, "I opened my account. Where's my money?" They call the fintech. The fintech says, "Let's figure out with my infrastructure provider, Synapse." That gets to you and then you go down to the bank.

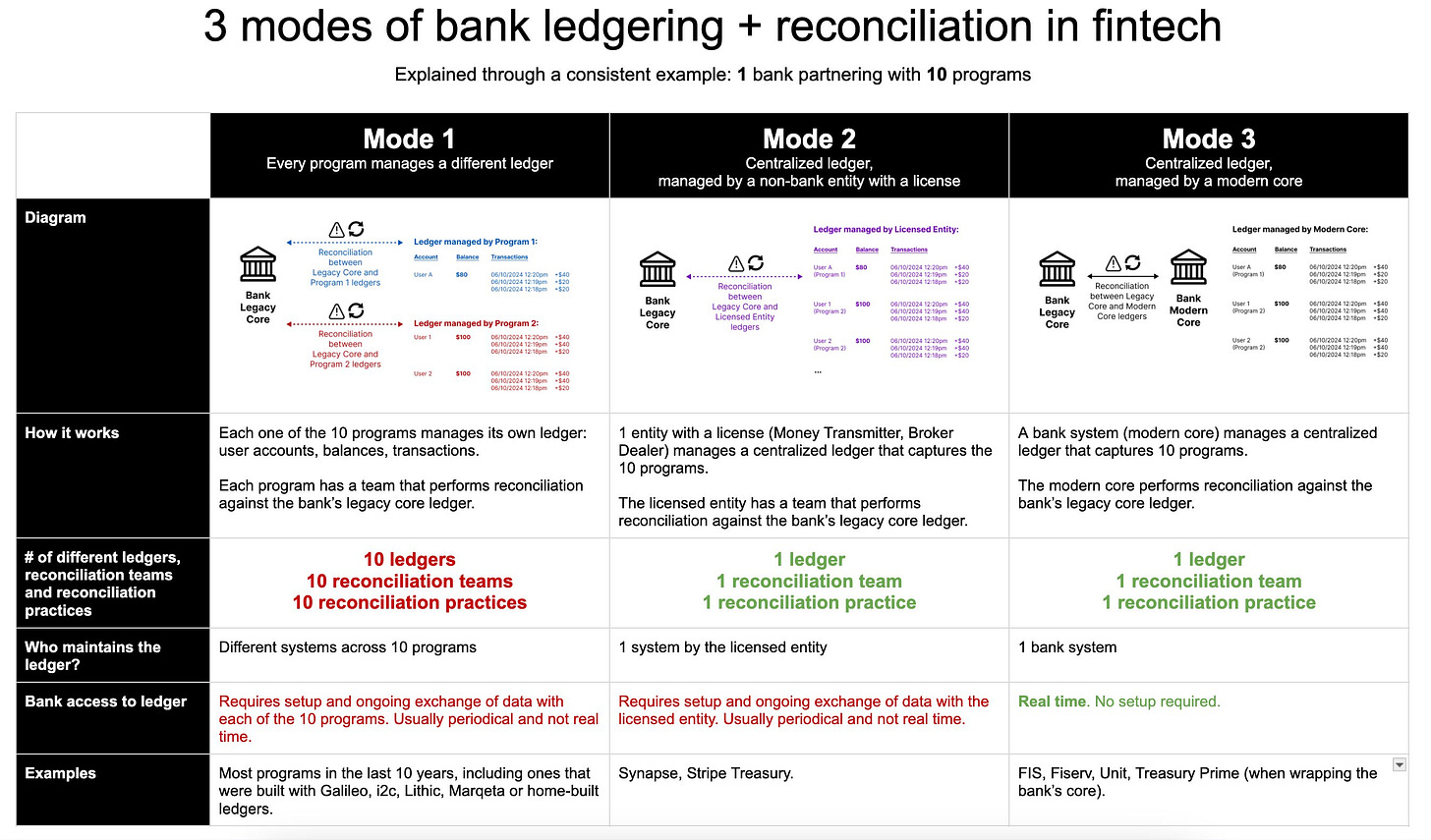

What is a general ledger a GL? Is that your ledger? Is that the bank's ledger? And then who do you talk to say our system's showing 10 and the actual number should be a hundred?

Sankaet Pathak:

So let's step back a bit.

So, what the banks on their side is the overall aggregate balance. So, the aggregate balance of let's say hundred million dollars. All of your users. What they don't give you is the user level balance, which is Lex has $50,000, Sankaet has $5,000 you don't really get that from them.

That's the stuff that in our case, Synapse is tracking and that is wholly reliant on the files we're receiving from the bank. So, if the files we receive from the bank are inaccurate, the balance of the underlying user would be inaccurate. So that's the first inconsistency.

Lex Sokolin:

The bank at a balance level, what they're keeping is the total amount of the ... Is this the FBO account, which is like the pooled account?

Sankaet Pathak:

Yeah. FBO, general ledger. People use that term interchangeably.

Lex Sokolin:

Got it. Okay. So, you're getting an omnibus account at a bank, Synapse. And then you Synapse are tracking all of the users, but then the bank also sends you all of the transactions. But the bank has no idea that the transactions are mapped to any people?

Sankaet Pathak:

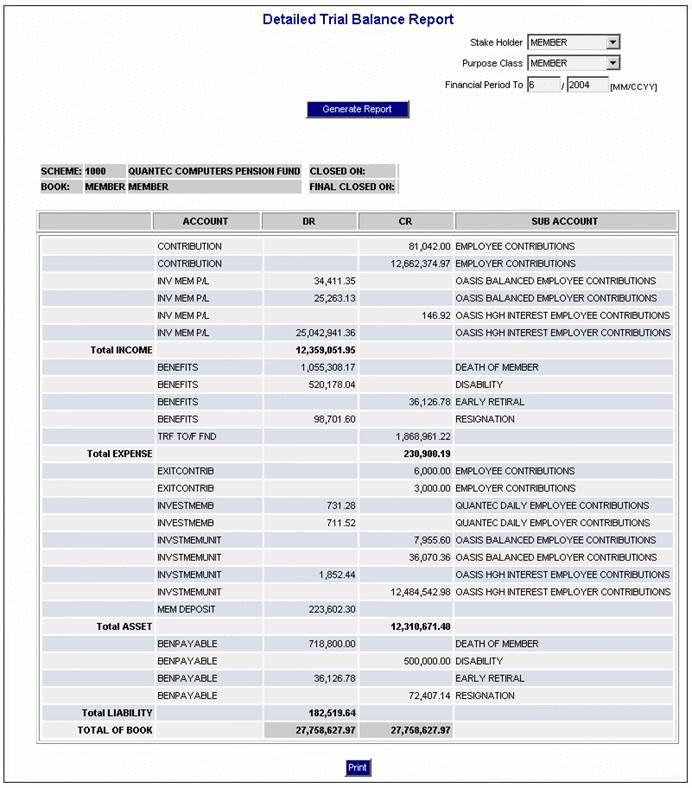

Yeah. They don't. Unless they rely on our system to reconstruct that, then they do, but otherwise they're not really keeping track of, okay, $50 was sent to this account number which belongs to Lex, so now Lex needs to update their balance. They would get all of that information end of day from us in something called a trial balance report.

So, they would still get that information back, but that was not primarily in their system of record because the account number to user association was sitting in our database. So, what account number belongs to what user is something that existed in our database?

Lex Sokolin:

It sounds messy, but this is not unusual.

I did a similar process on the investment management side between a custodian and a portfolio management system, and we were integrated into TD Ameritrade, we're integrated into BNY Mellon, we got CSVs on FTP files, and it was a total nightmare.

We had a team of I think two people in a 20-person team, so 10 to 20% of our staff would get in pre-market at five in the morning and then spend an hour and a half fixing what are called breaks.

And breaks are errors between the thing that's posted from the custodian and the thing that you're getting from the trading system. And this was every day you would have to pay somebody to do this because it was a known fact that you're going to have breaks between systems. In your case can you give an example ... Or maybe we zoom out and we say how much ended up being missing and what were the categories of the different breaks?

Sankaet Pathak:

I'll tell you what were the categories of breaks in real time and then I'll tell you what were the categories of breaks once we did a much more deeper dive investigation.

So, it seemed to us most category of breaks were around payments missing. So, a $50 deposit came in, we didn't receive it, hundred debit instruction came in, we didn't receive it. Those would be the breaks that would be tracked much more so in real time. And we thought the extent of the issues were by and large that.

Lex Sokolin:

The money goes into the thing and the money is in Evolve.

What does it mean for you to not receive it? What needs to happen for you to have received it? What is it that you didn't receive?

Sankaet Pathak:

Like a payment file on our SFTP that would give us the download of all the transactions that hit the GLs in last few hours.

Lex Sokolin:

What are possible causes for a payment to not be included there?

Sankaet Pathak:

We never got a very straight answer from them, but my sense was some filter, some search broke, and they were over time improving that. That's the only thing that makes sense.

Outside of that, I don't really know. Sometimes it was very obvious because ... We had alerts if we would not receive payment files at the time we were expected to receive those files.

So those were easy because you'd be like, "Hey, the 4:00 PM file was missed." And then they'd be like, "Oh, our cron job broke. Let us update that and we're going to resend it to you." The ones that always remained a mystery was how is it that payments were missing that actually had landed on the core in that timeframe?

Lex Sokolin:

In a different universe, this is not a big deal because this is just labels between systems. Like, "Oh, you didn't get the label in your system. That's okay because the money still hit the account." But we'll address that in a little bit.

So, you were talking about the large categories, the payments. What other kinds of breaks were there?

Sankaet Pathak:

It could be a small issue relatively speaking from a risk perspective if payments that were incoming credits were missing. But when you have incoming credits and incoming debits that are missing, then the issue you have is people have a hundred balance that is probably inflated because $50 have been withdrawn from it.

But then our system doesn't receive it so that balance stays where the user balance ends up being. So, I think that's the bigger issue in terms of financial risk.

Then the second piece that we found, which was in late August, early September 2023, was that Evolve and or TabaPay were both debiting some fees from the customer GLs. So from the FBOs instead of an operating account. So, they were taking money that was customer funds and deducting fees from it. When we investigated it, we found out that Evolve had instructed TabaPay to debit from this account.

TabaPay did not know that this was a customer account because Evolve had ... TabaPay was Evolve's vendor, not really our vendor. Evolve was giving us one pricing and behind the scenes what pricing they had with Taba, we didn't really know. So common sense would've dictated that any fees that Taba is going to charge will be charged to Evolve and then Evolve's going to invoice us with whatever markup that they had between their agreement and the agreement that we had with Evolve and they will bill that to us in an operating account. In turn, what Evolve ended up doing was they just gave Tabapay customer GL to debit what later we found out where I think network fees from that should have been coming out as a part of the invoicing system that we already had set up with Evolve.

So, we were receiving an invoice starting 2020. Before that we weren't even receiving an invoice because we didn't have a fully fleshed out fee schedule with Evolve.

But 2020 forward we were receiving those invoices, and we were paying those fees and then on top of that it turned out Tabapay was also debiting these fees coming out of the customer GLs. That ended up being the first bucket.

The second bucket we found is prior to us having a pricing model ... Because when I moved to Evolve from my last bank partner Evolve and Synapse had an agreement that says pricing is to be determined, which meant both ways interest we weren't receiving on deposits and a part of that deal was, hey, we're not going to give you interest. Let's figure out exactly what this is.

So right now, you keep deposits with us, we will give you free processing like how we had with large deposit customers. Banks usually already do that for pretty large deposit holders. So, they were like, "We're going to give you processing, TBD on pricing, right now TBD on interest and we will figure this out."

In 2020, that started to take more shape, so we knew exactly, okay, Synapse wants some deposit rebate because our fintechs wants some depository rebate. Our end users want some deposit rebates. And then obviously as a function of that, we would probably need to start paying Evolve for payment processing. Unknown to us before that agreement was even in place since 2017, which is when we started using Evolve,

Evolve was charging what they called account analysis charges on the customer GLs. Not even Synapse operating account. To a pricing schedule that was unknown to us to something that had no invoice for that they still have not been able to provide and that was the second big. So, the biggest things ended up being the payment processing issues, then these miscellaneous fees and then the final one was the migration, the mercury migration issue. So those ended up being three big buckets where you had breaks and issues starting to show up on the Evolve FBOs, Evolve GLs.

Lex Sokolin:

At a very simplified high level, it's not a problem with the labels if money stays in place, but because you have constantly money in motion, sometimes customer money in and out and then in what you describe fees withdrawn from customer accounts instead of operating accounts, which is a weird ... That sounds weird to me.

Sankaet Pathak:

For the record, that has not happened with any bank partner that we worked with, with the exception of Evolve. That is just nuts.

Lex Sokolin:

Right. So again, just for the benefit of the listeners, it's no surprise Synapse is in bankruptcy.

You have been collaborating with the bankruptcy proceedings, so you have your view of what all the numbers are.

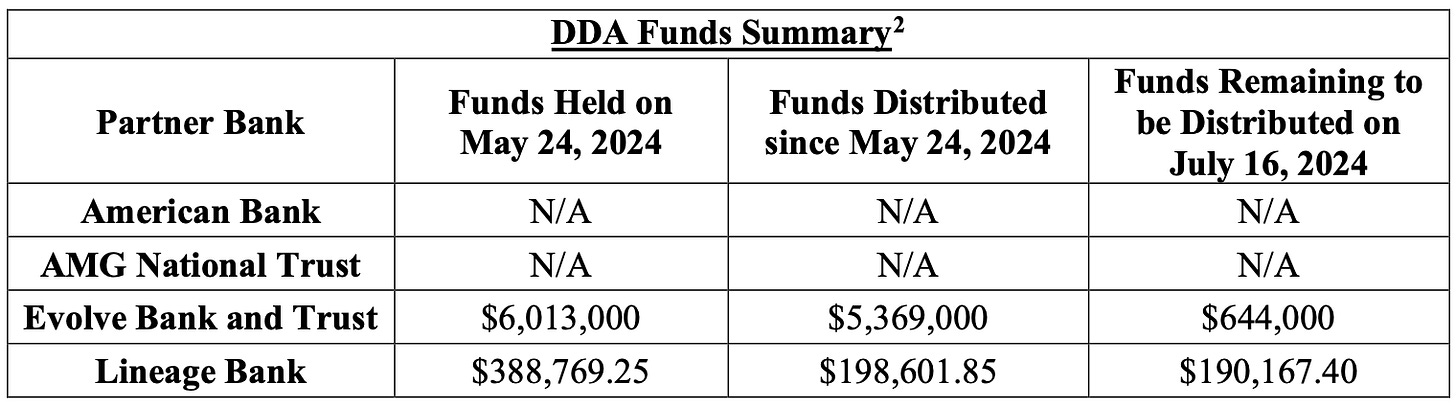

I think last I saw things in the media, it was somewhere between 90 million give or take, where it wasn't clear with whom the money sat. And so, you've described a couple of breaks and then you've also shared with me some information, but it's things like 12 million associated with these debits, 14 million associated with the TabaPay offset, something like 40 million associated with Mercury, another five million associated with wires. So, it sounds like you think that you can trace the 90 million, you think you know where it had gone.

Sankaet Pathak:

Yeah. And for the record, Evolve hasn't denied any single one of them.

So, they already know. What they're really trying to deny ... Not even trying to deny.

It seems like what they're trying to circumnavigate is their responsibility for it by lying about the account titling, which is these were DDA accounts, they weren't brokerage accounts. So, the bank is still responsible for making sure the accounts are fully funded. They haven't denied any of these for what it's worth.

Lex Sokolin:

There's different ways you can look at it.

You can also say tiny bank way over their head, relying on a core banking system which does the job but isn't really meant to be ... I don't want to get in trouble, but let's say a modern piece of banking infrastructure. It's not built for that. It's got a different purpose.

Sankaet Pathak:

And Lex, all of that is true except the integrity piece. If it was just that, a bank way over their head, tiny bank, bad technology, but the management says, "Yeah, we fucked up here and let us clean up," that'd be a different story, which is what we thought they were doing. So from September, as soon as we found out these issues, we notified Evolve because we knew that was the right thing to do.

And since then, we were working with them and we thought all along that they were going to resolve these issues. TabaPay thought all along that Evolve was going to resolve these issues, otherwise TabaPay would not have even entertained buying Synapse.

So, everybody thought these issues were getting resolved to only come to the day before the sale hearing lying about the bank has fully funded the accounts already and then do everything that they did after. I think at that point it's not as simple as a bad technology, way in over their head. I think at this point its deception and lack of integrity.

Lex Sokolin:

Before we get there, I think two things come to mind.

I would like to open up what happened with Mercury and just get your version of it and then just as an aside, the TabaPay transaction. That exit I think was in response to the rumors that things were going downhill, and that Synapse needed an exit, right? You guys at some point for sure were more valuable than TabaPay.

Sankaet Pathak:

In 2021 Citi had done an independent valuation of Synapse.

At that point, Synapse was valued at $2.5 billion and then couple of things happened.

We didn't do our series C, which we should have done. That was about a hundred million dollars that would've also gotten us out of Evolve because a part of that deal was buying a bank charter. We had one lined up. After that deal didn't close at that point, it was pretty obvious to me. I was like, "Look, I don't really see how ..." We're a high cash flow business, but we don't have a massive balance sheet, and I wanted us to have a large balance sheet as well. That one was risky.

Then second, I didn't see a path doing this for 10 years that I could be multi-billion dollars in revenue every year unless I own the bank.

So, at that point I was like, "Okay. This is not going to be a very large company, so it's probably better to sell." We were looking for buyers since then. Now what happened in September, which is when Evolve withheld about $50 million off payments from us, that sent the company down in a spiral.

Because at that point our revenue got cut in half or something and we went from being profitable to bleeding a lot of money. I had to pretty much do a layoff then.

And then we had I believe close to $10 million in the bank, maybe $8 million. Then I was like, "Okay. Well, now it's a fire sale. Now it's not just a sale. Now it has to be sold quickly."

And that's where you had deal value that TabaPay had come in. But we were fine with it because we were like, "It's a fire sale anyway. This thing's fucked all different ways so let's just get this done." But Evolve's cooperation was key in getting it done, which was represented to us that we would have. That was the sole reason ...

Because by the way, we didn't get into chapter 11. That was always the plan. We weren't going to do that. This is the first time I'll tell people exactly what the plan was after Evolve what they did.

I was going to fully shut down the company with about $8 million on the balance sheet and then sue Evolve for everything.

And I was convinced by Evolve that that was not needed because Evolve was going to do the right thing. So that was the whole reason why it didn't do it. The deal was supposed to be done in January. They dragged this out until May when we lost at that point, bled all of our cash so we could not sue them.

But that was my plan when the whole September thing happened. I was contemplating winding down all operations and then getting into a legal dispute with Evolve with some money in the bank so that I could afford to do that. But I was convinced by Evolve that that was not needed.

Lex Sokolin:

If I hear correctly, you were one of the hot embedded finance companies out there, over two billion valuation and then coming to the next round, it became difficult and then the more time passed, the more difficult it became, and then TabaPay was right there.

And so, it made sense to land the assets somewhere where there was already integrations and so on and potentially preserve the experience of the customers. And end of the day, it's all this stuff about companies is one thing, but they're people who whose lives were affected in a really profound way.

So, let's check off the last bit about Mercury so we have full context. So, 35 million at Mercury. What happened with the money with Mercury and how did everybody behave?

Sankaet Pathak:

So it's like I think 49 and that $49 million number was from Evolve. That was not even from us.

So that is the number that came from the independent investigation Evolve did after us.

Lex Sokolin:

That number is not like ... It's hard for me to figure it out because that number is not, the money's moved on and people have spent it, and the labels didn't anchor it in the right way.

How did something so chunky ... Just because at the end of the day it does go into the bank, and it does go into the Jack Henry system.

So, what happened there?

Sankaet Pathak:

I'll tell you what we found out and then I'll tell you what my hypothesis is as to what happened here because we never really got a root cause analysis.

So, we don't really know exactly what happened here. What we found when we were investigating the Mercury migration was that Mercury ended up migrating more dollars than they should have migrated.

Now when we started looking at why were they allowed to do it, it's because there was a separate FBO just for Mercury that Mercury was allowed to debit pretty much without questions.

This is essentially an incompetent management team and a technically unsavvy bank. So, what they did ... We had emails for this. Told us Mercury has uninterrupted high limits access. They can move the money, and they have a migration plan.

The issue ended up being that the FBO that Evolve had created and segregated funds of Mercury for had the wrong balance. So, a few weeks ago, Mercury's lawyer in the bankruptcy hearing said, "Well, Mercury had its own separate FBO account and has moved the money that was in the FBO account." He was right on technicality, but the FBO account was not funded accurately, so they ended up moving more money than they should have.

What we did is we took the trial balance report to all the balances of Mercury the day before the migration, and then we added all the payments that happened during the migration on top of the migration payments. And what you found is there were about $49 million more of Mercury payments that should have been debited from that FBO so that it did not go with Mercury. So that's at the core of what the issue is.

We thought the number was around 39, Evolve came back and the number was 49 by their investigation.

Now what I think the issue here ... Because we never really got a true RCA, and I think Evolve regrets sending me the $49 million email because now we have that on the record.

But anyways, what I think happened was during the migration phase, they were probably transactions on the user accounts that we should have received, but we didn't receive because Evolve was like migrating the account numbers from the FBO.

We had visibility to the FBO Mercury only Mercury had visibility to. And I think something got dropped there. So, for instance, Lex's account number with Mercury routes to this FBO account in the Synapse ecosystem that belongs to Mercury. A part of the migration was that account number is now going to point to not the FBO account inside the Synapse system, but to the FBO account outside of Synapse system for Mercury. And I think somewhere wires got crossed in that. So, you had tons of payments that were just missed.

And by the way, I know the numbers sounds very big, $49 million. Mercury had close to $4 billion in deposits. So, it's very conceivable that that much payment processing was easily going on in the system. Obviously, it wasn't conceivable that they're just missing. But my hypothesis is what they call a routing change, which is going from one FBO to another payments were dropped between that.

Now the plan that Mercury and Evolve had based on what Evolve had communicated to us was that they were going to go and identify those missing transactions, then they were going to send those missing transactions to Mercury to apply that on those customers accounts and recoup those funds back. Which Tabapay was okay with because with that whole plan, money would not have landed into the FBO and the FBO would not have been fully funded at the time of the close of the transaction, but it would've been fully funded eventually. So, our understanding was that's what Evolve was working on. But anyways, that's the whole Mercury issue.

Lex Sokolin:

Oh man, what a mess.

Yeah. It doesn't sound like setting up ... I imagine it was a commercial pressure to ... Once Mercury wanted to leave that they had to leave in a way that ... I'm sure they just reached out and went direct to Evolve and then the migration process had this issue as well.

Sankaet Pathak:

Yeah. The issue is that Evolve had been interfering with our business since ... First, I knew of was in 2020. Since 2020 they were trying to solicit our customers because I think they had decided that they wanted to, in quotes, the base layer themselves.

But usually what a bank does is they let their partner know and their partner just goes and finds another bank partner. They don't try to poach those customers. But I think what Evolve told Mercury ... Hypotheses again — Is, “hey, we're going to terminate your agreement with Synapse. If you want your account numbers and everything to still work, you have to go direct with us.”

Lex Sokolin:

Got it. And those account numbers would be account numbers that you provide to Evolve.

Sankaet Pathak:

Exactly. On the business checking account. Yeah. But the account numbers are theirs, so they can technically ... Which is what they did.

They ended up putting it on the new FPO, the new GL.

Lex Sokolin:

I think we have the outline of the situation. Knowing what now being an expert in all of the failure modes of banking ledgers, what would you have done differently to prevent the situation?

Because again, having a venture-backed company fail super painful.

Having low-income people that are using B2C fintechs because they can't get real banking accounts, for them it's a profound moment. And I know you empathize because you grew up as an immigrant kid and you understand what's going on.

So, what could you have done differently to prevent this with 2020 hindsight?

Sankaet Pathak:

I've said this to friends, and I'll say it publicly as well. My pain here is irrelevant. It really doesn't matter. I had made peace with that anyways when I was selling to TabaPay. That was not a great outcome. It didn't matter.

The piece that is most heartbreaking is the end users and the depositors and the pain they've gone through. So, I think that is the front and center and the most important thing, even for me.

I think what we could have done differently is what we started doing with other partner banks, which is have a dedicated routing number and a Fed feed coming directly to us. I think that would've technically avoided these issues.

So, I think with all of the operational issues we have Evolve, we had already learned that lesson. We were doing it differently. I just wish I would've been able to do that faster, move off Evolve faster, get this whole situation sorted out faster. I think those are the pieces that I had the most regrets on, which is I wish I had just moved faster than we ended up moving. But I think we already had the right lessons.

And I won't name a partner bank ... And this is how much of a full circle had gone on this. We had an issue with a new partner bank we were launching with where we had some pretty big breaks that were lingering for a few days and I let the bank partner know that we were not going to add any more users until that was resolved and they appreciated that. They were like, "That's great."

Hindsight's 2020, but I wish as soon as I found out this issue, I would've just did what ended up happening anyways, which is halt everything and be like, "Okay. This is the issue. Whatever happens, let's resolve it."

The thing I was trying to balance back then was pretty much what ended up happening.

People not having access to their funds, one.

Second, I was being told by Evolve that they were working on resolving the issue. That would've been an unnecessary escalation if I essentially did that.

And third, the whole idea of continuity with TabaPay, fintechs not having to be massively disrupted because I know how much our customer's business has relied on us being up and running.

All those three things were the convincing forces because of which I didn't do what now I believe I should have just done, which is no, this issue is open. Let's just make sure we stop right here and then resolve it before anything happens further.

So, I think that piece I wish I would've done back then. I don't know if that would've still avoided the situation. I think it would've just made the situation much more apparent in that time. And I think the rest of the time that I spent was trying to hopefully get a soft landing for everybody, which ended up not working out.

Lex Sokolin:

Was there anything that you did in retrospect that you think was a mistake in terms of whether it's building out the company or designing the software, that if you were to redo, you'd be like, "Okay. We should have grown slower because we grew so fast, we had to, in some places, have janky software or would've invested more in people to do the reconciliation in addition to the alerting service." Is there a thing you would design differently to address any mistakes you had in the business?

I also know that you guys did a brokerage cash management thing, which I think created more complexity and started moving stuff around. Is there anything in there that you think, "Okay. I shouldn't have done that."?

Sankaet Pathak:

I should not have scaled with a bank that we already knew had so many payment processing issues that weren't getting captured on the payment feeds we were getting. So, I think the way I'm now, I would've been like, "No, that's a pause. You cannot continue scaling with something like that." So that would've been the first big thing.

Second, yes, we did have reconciliation people, but the issue was we were missing payments consistently in payment files that could have only been found if someone manually downloaded the statements or activity feeds and looked at hundreds of thousands of transactions a day, which would've been close to impossible without having a very, very large footprint. So, I don't know if I'd still lean in that direction. I think what I would do is not grow as fast on top of technology issues that I already know exist. So, I think that's probably the biggest miss on my part.

On the brokerage side, yeah, I wish we hadn't even launched the whole brokerage suite service because Evolve has weaponized that as something that caused this or at least weaponized it to confuse people.

I think the facts are pretty clear. This is still a DBA deficit. Brokerage had no relationship with Evolve. Evolve even stopped sweeping into brokerage pretty much few weeks after the program started. So, by definition, this didn't even run for that long. But I do think it gave Evolve a way to weaponize something like this and confuse people. And I wish I hadn't even launched that with Evolve customers.

Lex Sokolin:

I'm sure lots of people are interested in the regulatory question and my personal bias is that regulation's not going to fix anything a priori. Often, it's finding something that didn't work and trying to put a bandaid on it. Was there a missing piece of regulation that would've helped? And then is the regulatory work that's happening now, the appropriate response to what was missing?

Sankaet Pathak:

I don't think anything's drastically missing in regulations.

I do think there are gaps in oversight. And I think some ideas that have been proposed, like the bank needs to do an independent daily reconciliation, aka you have to have the technology where you can actually do that is a good one. And being able to demonstrate that to your examiners on a regular basis when they come on site to actually examine you should happen. So, I think that's the piece that isn't happening as much based on my understanding that it needs to.

But then there are other things like banning the FDIC logo on a fintech website, trying to walk back past through and direct FDIC insurance.

I think they're missing the point. That's not what really happened here.

I think the issue here is holding a bank responsible for reconciliation. If you do that, the rest of the stuff around this resolves itself.

(You can see the full document here)

And again, I'm not talking about the UDAAP issues and things like that. Those are very real, but this is not like a UDAAP issue. This is a reconciliation issue.

So, I do think oversight and examination needs to be improved. That's something I can help them with. This is something I intimately know well, and I can help them with. I'm just surprised no one's really reached out for even a sit down about something like this.

Lex Sokolin:

Oversight of whom?

Obviously, you think the bank is playing a large part, but there are other players like Synapse is a player, Jack Henry is a player. So, oversight of whom do you think is appropriate?

Sankaet Pathak:

I have come full circle on this.

I think oversight that's most important and appropriate is the bank because that's a forcing function of everything else. Everything else has ripple effects.

Now, I will say one more thing. I do think it should be easier for another bank adjacent companies to also become some kind of a bank, aka they should be directly regulated.

And that was one of the things I was even an advocate for with the OCC when I was running Synapse. I had told them very clearly. We're happy to be regulated by a regulatory body. Something like OCC. But I do think that cannot just be, you still rely heavily on a janky bank and then you're also regulated by OCC. It should be because you're regulated by OCC, the Fed or the FDIC, you should have have access to the payment accounts that you get with the Fed or at least have an option to apply for those payment accounts that you get for the Fed.

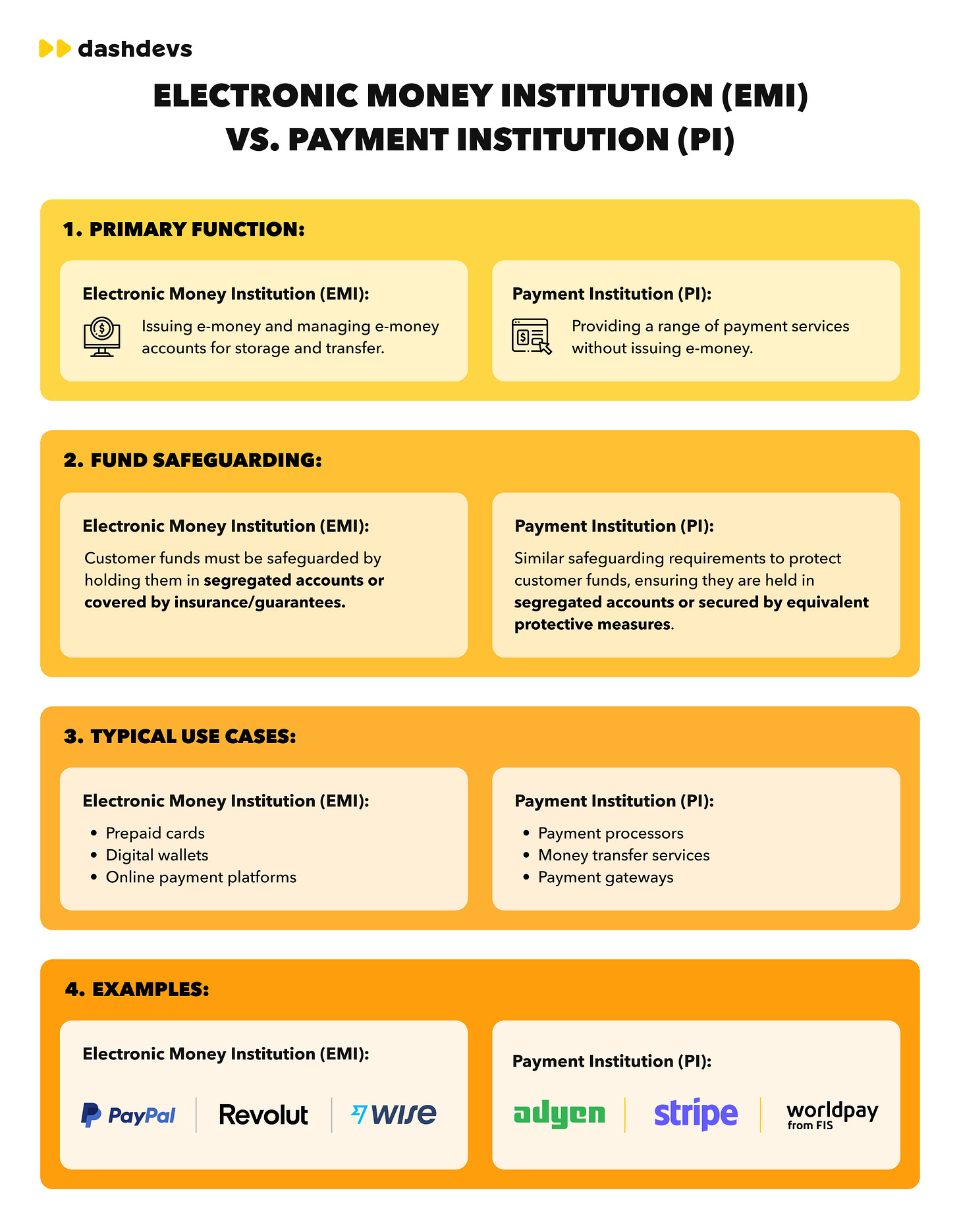

So, I do think the e-money license stuff in Europe is far more progressive than the stuff we have in the US.

I've come full circle on that. I think that needs to change. I still think the banking entity is the right entity to supervise, but I do think there are lot of adjacent entities that acting banks or some kind of banking entity as well, and they should be supervised.

Lex Sokolin:

For me, the entire episode is yet another explanation of why blockchains are important. But that's a lead to another conversation, I think.

Sankaet Pathak:

I agree with you. I think Stablecoin ... This issue ... And again, I want to be cautious about not over indexing on my experiences and the failures here.

So that's why I don't publicly been too outspoken by this, but I do think the self-custody Stablecoin stuff, there's probably a lot of merit in something like that in scaling that more than it's keeping all the money with the bank as a custodian.

Lex Sokolin:

The smallest claim you can make there is that you have a single source of truth you don't have to reconcile.

And this is at the heart of what's happened here. The last question I want to ask is, you've gotten a lot of personal flack through this and there are folks who went really deep into the details here and have been super critical. Jason, of course.

What do you think that your critics get wrong? What is it that they're missing?

If somebody's coming into this conversation with a preconception of what happened and maybe an adversarial point of view, what do you think their misunderstanding and what would you say to them?

Sankaet Pathak:

I've pretty much been on the cancel train since 2019, so I really don't care what people think of me. I would say what I think is true. So that piece, it doesn't faze me anymore as much. Sometimes it gets to you, but not mostly.

The piece that I do think I wish more people were more interested in diving deep into is all the reconciliation stuff. Stuff that I posted even before Synapse went down. A lot of that stuff. And now people are starting to talk about it because Yotta sued Evolve and all of that stuff. So now people are starting to talk about it. But I do think a lot of the focus ended up being how I was a monster, more so what actually happened. And that's fine. You can think what you want to think of me. I measure who I'm by, what my friends, family think of me. So, it's fine. People can think whatever they want.

But I do think it's such a missed opportunity to not really for so many months, hold everybody's feet to the fire, including mine, but do that with specific things around, hey, what is this? What is this? What is this? What is this? And most of that stuff is reconciliation stuff.

And you can ask me that question. You can ask Mercury that question. You can ask Evolve that question.

But I think not enough people pressed that much on it. People pressed more so on. Oh, what asshole raised $11 million right after his company shut down? And it's like, "Okay. You can have your opinions about it, but it's not helping the depositors." So, I think that's the piece that people missed, but I think now they're catching onto it I hope so I hope that happens more of. Including scrutinizing me. It's totally fine. You can ask me questions about it. That's fine too.

Lex Sokolin:

Thank you for spending this time with me to walk through the story and what happened. I think it's deeply educational for people building in the space. And I just hope that others who are listening got a lot out of this content and appreciate your openness to tell the story.

Sankaet Pathak:

Yeah. Thank you so much for having me, Lex.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post