Analysis: The $100B+ Opportunity in Employment Tech, shifting from CFO to CEO

Employment technology is the next frontier, with market giants like ADP and Workday facing new competition

Gm Fintech Architects —

Today is an open edition, and we are diving into the following topics:

Summary: We examine the landscape of financial technology companies targeting corporate support functions, emphasizing the "Office of the CFO." While companies like Brex and Ramp have redefined financial management through payments and lending solutions, newer fintechs are expanding into the broader HR and employment tech sectors, dominated by giants like ADP, Workday, and Trinet. Modern players such as Rippling, Deel, and Gusto have rapidly captured market share by offering more comprehensive solutions, pointing to the vast potential of the employment technology market. We also explore future frontiers like Decentralized Autonomous Organizations (DAOs) and AI agents, suggesting that the next wave of financial technology could involve integrating blockchain and AI into corporate operations.

Topics: ADP, Trinet, Workday, Paychex, Rippling, Deel, Gusto, Brex, Ramp, Nerdwallet, Betterment, Vestwell, Zenefits, Parker Conrad, Rise.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Quick

Long Take

The CFO Suite isn’t Enough

In a market like now, when the focus is on abstract possibilities and story-telling, it helps to anchor back to the flow of money and energy through the system.

Consider the economy, composed of many different parts — companies competing within various self-organized value chains coordinate the lifeblood of the human population.

It is similar to a human body, composed of many different parts — cells organized into tissues and then into organs, all coordinating the literal life of the higher organism.

Cells metabolize food for energy. Food flows in, is broken down and translated into the correct machinery, and then expelled. Companies metabolize money, the great abstraction. It is broken down and allocated to correct corporate machinery that helps perpetuate the productive cycle, and then it is removed into various costs and expenses.

Companies have membranes to the outside world. They can figure out how to eat, through product market fit, and then money flows in and out according to the needs of the organization like spent calories. The support functions of the corporation are those that build the internal structure, and are not involved in the manufacturing or distribution of whatever it is the company makes. The usual suspects would be finance, legal, human resources, information technology, compliance, and various other functions. We think of these as the necessary overhead for the upkeep of being a company in the first place.

Finance is largely focused on the movement, rest, and transformation of money — the energy that keeps the cycle going. Economics is interested in the macro and micro behavior of people and firms — how do these little bugs behave in the aggregate and on the margin? We are interested in building financial technology companies.

Fintech companies wrap around money. One of the places where money goes is the Support Functions. This investment theme is often referred to as “The Office of the CFO”. Instead of helping the financial industry, these companies use financial products to help the financial *function*.

The classic example is something like Brex or Ramp. These companies help Finance function professionals manage the accounting and spend management through tooling. The real product underneath is a payment and lending fintech, generating virtual cards on demand and allocating flows, with occasional monetization through risk. It’s like Marqeta, but with a different go-to-market motion.

Another fintech path into the support functions has been built by benefits-focused companies. We can look at companies like Nerdwallet, which help individual employees take care of their finances and budgeting but sell into HR functions to deploy at the company level. Or, we can highlight the retirement-focused companies, from Betterment to Vestwell, that offer out-of-the-box investment choices to be selected on behalf of employees by company buyers.

For most people, that’s where the game ends — taking care of the money part.

But you can move one step up in complexity and try to integrate the capabilities of the entire support function.

This, dear reader, is the far bigger game.

Shifting Market Share

If you’ve ever worked anywhere, you probably know the HR software giants.

Those are companies like ADP and Trinet.

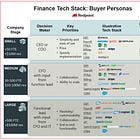

We often think of them as just sitting at the back-end of the company, providing access to health insurance or performance reviews. But of course, there are many different categories of products within HR software, and very different associated business models. Below, we excerpt some of those product categories, as well as a large market map of various employment tech players.

Note how many of them are in the financial category.

Each of these large map areas could support a $10B+ company.

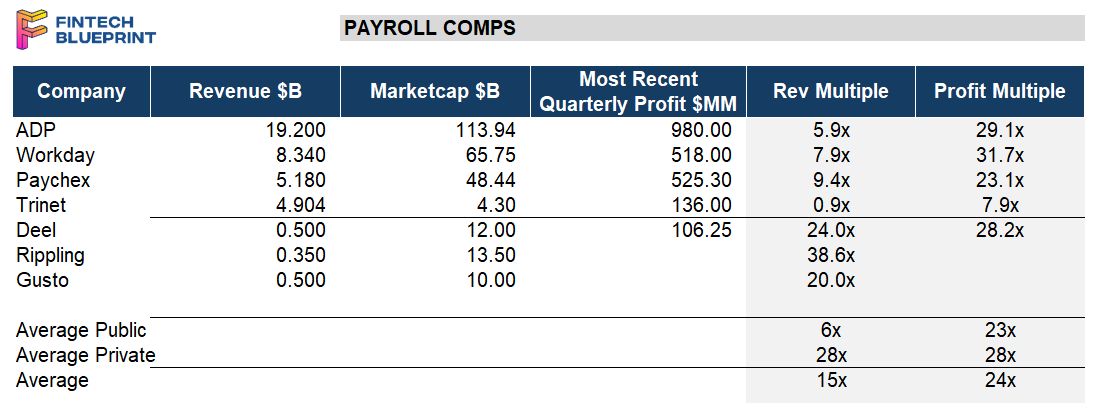

ADP is a behemoth with a $110B valuation. Competitors like Workday ($65B), Paychex ($48B), and Trinet ($4B) have all gone public as well, and are generating billions of dollars in revenue and hundreds of millions of dollars in profit. These companies have built up enormous footprints over several decades and have extremely high switching costs. If you think tearing up a portfolio management system is hard, try moving your employees from one platform to another.

But their age is also starting to show.

More modern competitors, like Rippling, Deel, and Gusto, have entered the space in the last decade and made a profound impact on the market.

These companies are valued at $10B+ in private fundraises and generate $250-500MM in revenue per year. Parker Conrad, the co-founder of SigFig — an early roboadvisor — could be single-handedly responsible for giving life to this entire sector. He built Zenefits into a $4B unicorn, only to get kicked out from the company by David Sacks, with Zenefits eventually sold to Trinet for peanuts. After, he built Rippling into the massive power play it is today from the ground floor again.

The business models of all these competitors do have some differences. Some lean more deeply into benefits provision, e.g., healthcare, and process insurance premiums. Others excel in international payroll, connecting various banking systems with global payment rails. Yet others offer Professional Employment Organizations, which are entirely outsourced employment infrastructures. Under a PEO, a company’s employees could be from anywhere in the world, effectively working for the PEO on behalf of the target company.

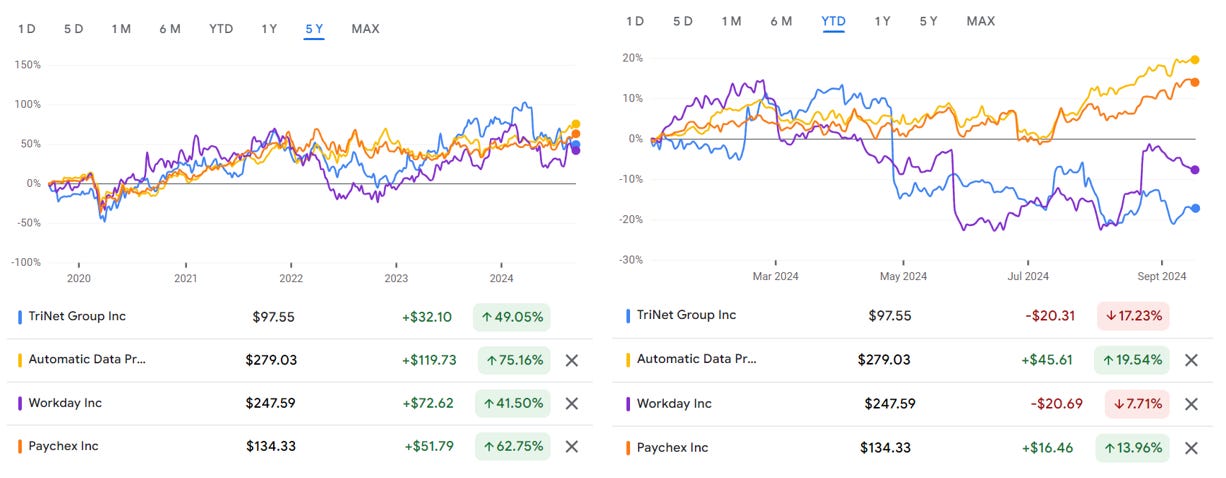

During Covid, as remote work became increasingly important, so did having a PEO platform for global contractors. This led to a spike in demand and expectations, which has been corrected since by the markets. Below is our analysis of the industry competitors, and recent sector performance.

It is unusual to see so much enterprise value created in a category quickly, but that points to the enormous size of the Employment Technology market, and the different business models available to participants. There are many verticals in which to compete, as well as different ways to monetize. Playing for the full solution yields the most impressive outcomes.

Public companies in the space trade around 6x their revenue run rate, and about 20-30x their profit metric. We were loose here in looking at operating income, EBITDA, and so on, trying to get the directional metric rather than the precise answer.

Private companies seem to be about five times more expensive on a revenue basis, largely because they are still subscale, trading at 30x revenue. Notably, profitability is likely much better at these newer entrants, which allows Deel — for example — to show a 30x revenue multiple similar to public companies.

Still, there is mispricing. Zenefits was worth $4B at the top, and that is TriNet’s entire public market cap. Deel is 3x more expensive than TriNet but has 10x less revenue. Such differences are likely to lead to a lag for these companies before they go public.

Market performance on the public side has pretty much tracked the broader S&P 500 Index, with the main separation starting to occur this year. ADP and Paychex seem the most correlated, likely due to their size — functioning as an index exposure to employment overall. Workday and TriNet have been under more pressure — whiplashed by the remote work expectations and idiosyncratic company reasons, like the quality of tech product and speed of integration.

The Next Frontiers

We have written this primer in order to push Fintech founders to think further down the value chain.

Just launching more corporate cards won’t cut it!

A little bit of speculation about the future opens up two frontiers. The first is DAOs, the beleaguered decentralized version of a small business. While DAOs — and the entire metaverse around them — have gone deeply out of fashion, we remain convinced of their organizational value. Onchain businesses can leverage all of the DeFi and stablecoin functionality that come *for free* for using blockchains.

There are about 2,500 DAOs that are able to pay contractors meaningful amounts of capital. Recent market turbulence has blown up about 50% of their treasuries, but there is still secular growth in the number of organizations and their ability to be employers. A few folks have approached this space in the past, and meaningful companies — like Rise — are being built.

Another direction worth thinking about is AI agents.

Today, AI agents are just software that the Product or Technology people deploy to do their tasks and become more productive. Perhaps in the future, these agents will be far more fleshed out and require their own employment services. For example, could there be specialized payroll functions that take AI labor productivity and translate it into some kind of universal income to other employees? Or, there could be benefits that accrue specifically to AI agents that have certain IP rights, like celebrity voices or a likeness that generates royalties.

Today’s HR departments are unlikely to be equipped for these questions. But the firms of tomorrow will depend on them.

We leave you with the following food for thought.

A social network application where you are the only real user. Everyone else is a follower of your account, and also a robot.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, here.

Read our Disclaimer here — this newsletter does not provide investment advice