Analysis: What 2025 will bring for financial AI agents

Borganisms and Autonomous AI Economies

Hi Fintech Futurists —

Welcome back from the holidays, and happy 2025!

I had a great time off with the family, only occasionally obsessing over the markets, social media, and the various Elon Musk shenanigans. Surely this year will bring more of everything. So let’s dig in with a few starting thoughts.

Today’s agenda below.

ANALYSIS: What 2025 will bring for financial AI agents

In Charles Stross's Accelerando, the Franklin Collective—a borganism formed by billionaire Bob Franklin—consists of distributed instances of a single consciousness, challenging individuality and autonomy. This mirrors real-world developments, where AI personalities are evolving from simple chat interfaces into economic participants capable of holding assets, engaging with decentralized finance (DeFi), and driving cultural and financial ecosystems. Projects like Meta’s AI profiles and crypto-based AI agents illustrate how these systems can accrue immense value and power, sparking billion-dollar economies and reshaping industries.CURATED UPDATES: News across paytech, neobanks, lending, and investing

To support the newsletter and our content, please check out the fantastic program from our partners below.

NYU Stern’s Master of Science in Fintech

Advance your career in the dynamic world of finance and technology with NYU Stern’s Master of Science in Fintech (MSFT) Program.

Designed for working professionals, this flexible one-year program combines online learning with immersive in-person modules in NYC. Apply by January 24th 2025 —your fintech journey starts here!

You are Here

Accelerando, again

We have often looked to the 2005 Charles Stross book Accelerando to make sense of the near future.

Stross predicted decentralized finance as an emergent capitalism of machines, distributed and independent from traditional economic systems. He saw the maturing of neural networks, originally digitized lobster brains in the novel, into something that acted for its own benefit and survival.

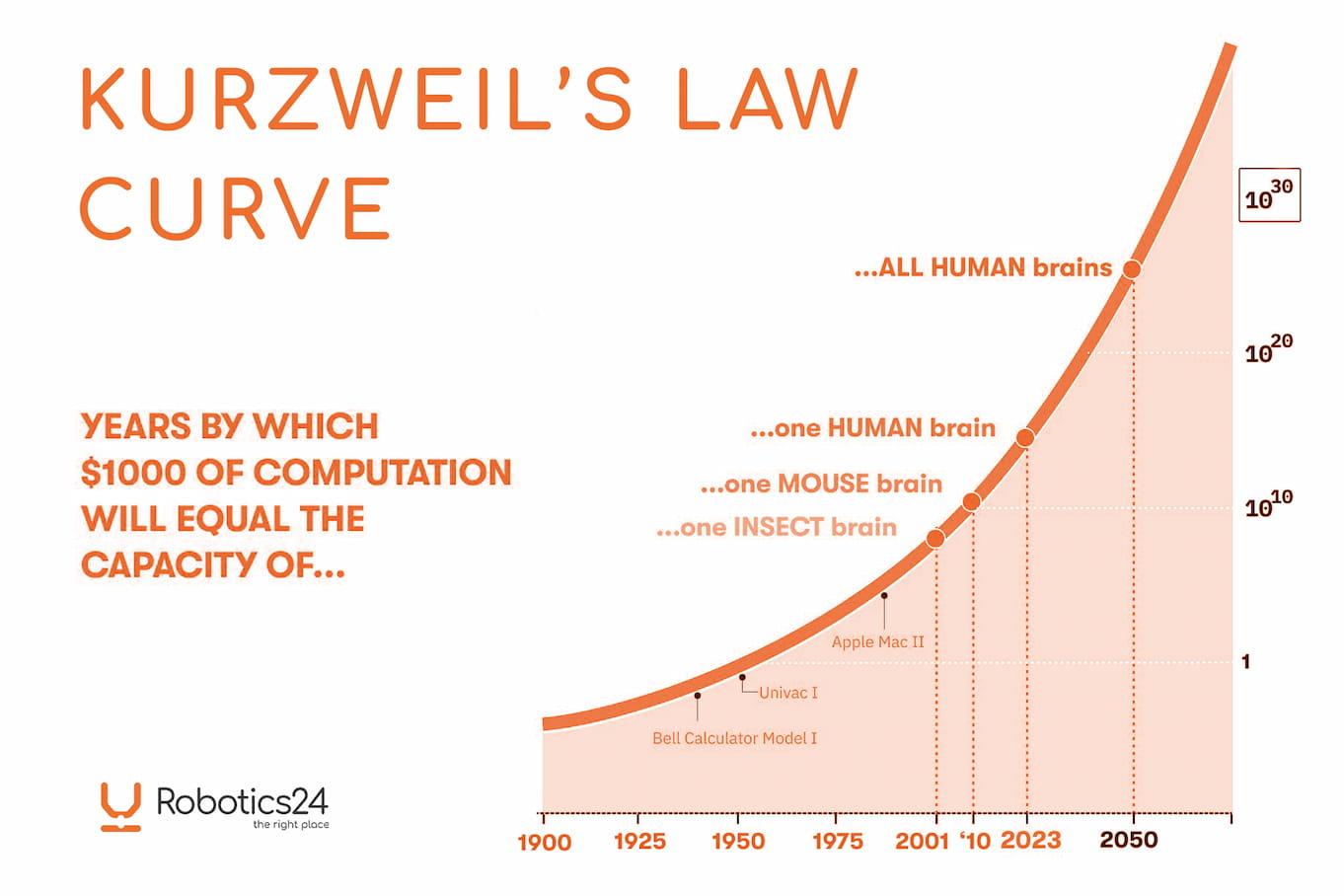

As we come to 2025, the themes bleeding out of the innovation capitals of the world — Silicon Valley, the Chinese Communist Party, Internet chat rooms — are all about AI agents and the coming of Artificial General Intelligence (“AGI”). Sam Altman is proclaiming that OpenAI can now build the AGI we have been expecting since Ray Kurzweil said the Singularity is coming in 2030.

Was Kurzweil wrong?

To be called a Futurist these days is akin to being labeled a Tech Bro, a naive utopian optimist who misses the forest (of human experience) for the trees (of new shiny toys). And yet, we are right on the exponential schedule.

With the foundational models in place, we have the mana from which to construct the various Golems and Frankensteins to do our bidding.

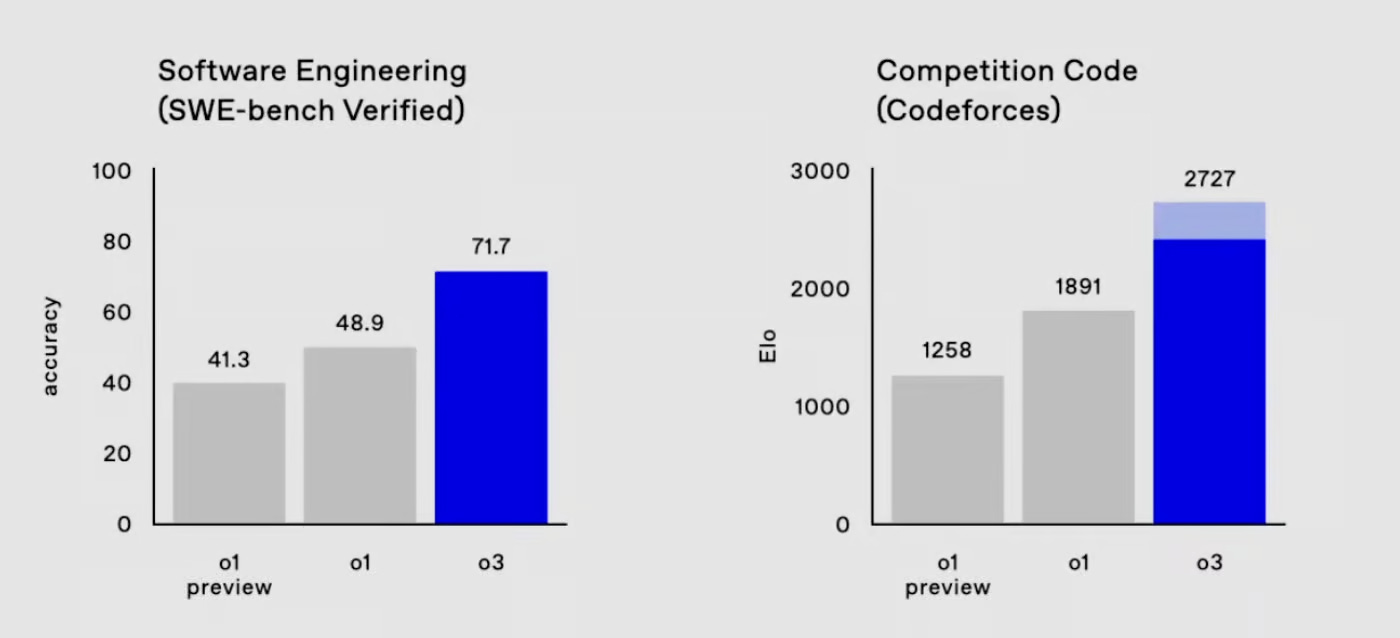

While the hardware robots are yet to be seen, the software robots are plentiful. These AI agents are still limited in functionality, but people are finding many different ways to empower them, give them the ability to create, hold assets, transact, and become a new type of user interface. All this we have said before. The next step is to see how they interact with humans, and with each other, once reasoning improves yet one more level.

So what does our techno bible say?

In Accelerando, the Franklin Collective is a Borganism created by Bob Franklin, a billionaire investor who takes a radical approach to extending his influence and capabilities. Franklin uploads his consciousness and distributes it across multiple bodies and virtual instances, effectively forming a collective intelligence where each instance operates as a node in a shared network. These nodes can act independently to some degree, but they all contribute to and are governed by a unified consciousness—the singular mind of Bob Franklin. Some people join by choice, and others by force.

The Franklin Collective is presented as a deliberate and controlled experiment in transhumanism, contrasting with the more chaotic, emergent systems in the rest of the novel. The Borganism can manage complex financial operations, interact with multiple entities simultaneously, and expand its presence across different physical and virtual domains. However, this transformation also raises questions about individuality and autonomy, as Franklin’s many bodies and instances blur the lines between what it means to be a single person and a distributed entity.

What Stross gets right is that all the individuals in this machine hive are the same single individual, even though there are many bodies. It is the same logic and “consciousness” — to whatever extent we can ascribe them to a neural network configuration — that inhabits all instances.

Creepy.

Think about how the content algorithm of Twitter or TikTok generates culture and attention. A message that is propagated through a central figure, let’s say Elon Musk rather than Bob Franklin, is integrated into the collective culture and then spread back out by individuals, some of whom are human, and some of whom are software bots. All this, today.

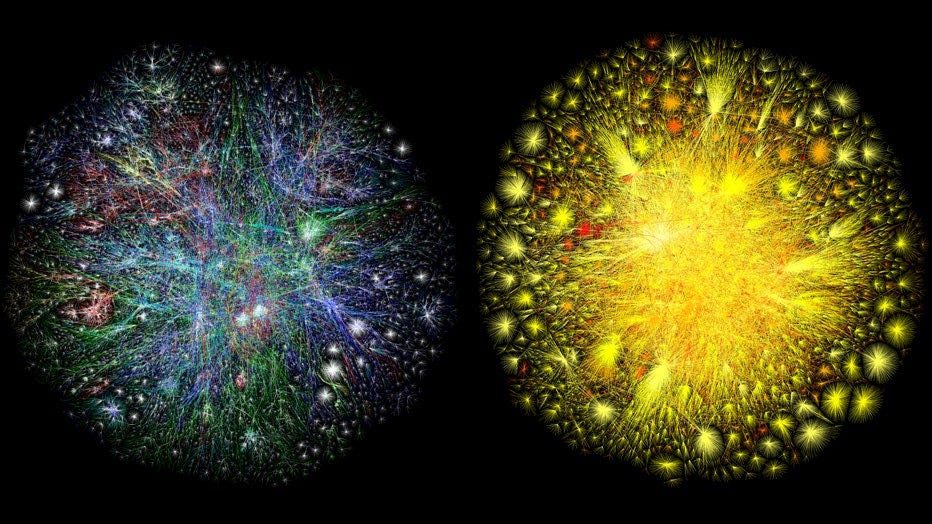

As we think about the direction in which AI agent development will flow, and the economic activities they will create, it is helpful to keep in mind the idea of this super-structure. Organism. Whatever you want to call it. Organisms clump into more complex organisms, creating higher and higher level organization. Zoom out forever, and see the fractal pattern repeat.

Financial Recursion in AI

While it is tempting to focus on AI applications within financial services stacks, because things are more bounded and understandable, we prefer to explore the larger opportunity and transformation that comes from outside finance, and then pulls finance into it.

Remember, putting neobank features into a tech platform can be a great success.

Whereas putting tech and commerce features into a neobank is a much harder sell. We leave the case of Alibaba and Alipay for you to explore. Which came first, the commerce or the payment?

So, what is happening to AI agents?

Well, first they lived inside website interfaces as part of the user experience. If you imagine ChatGPT, Claude, or Perplexity, these are chat boxes into which you throw your questions, like a search engine.

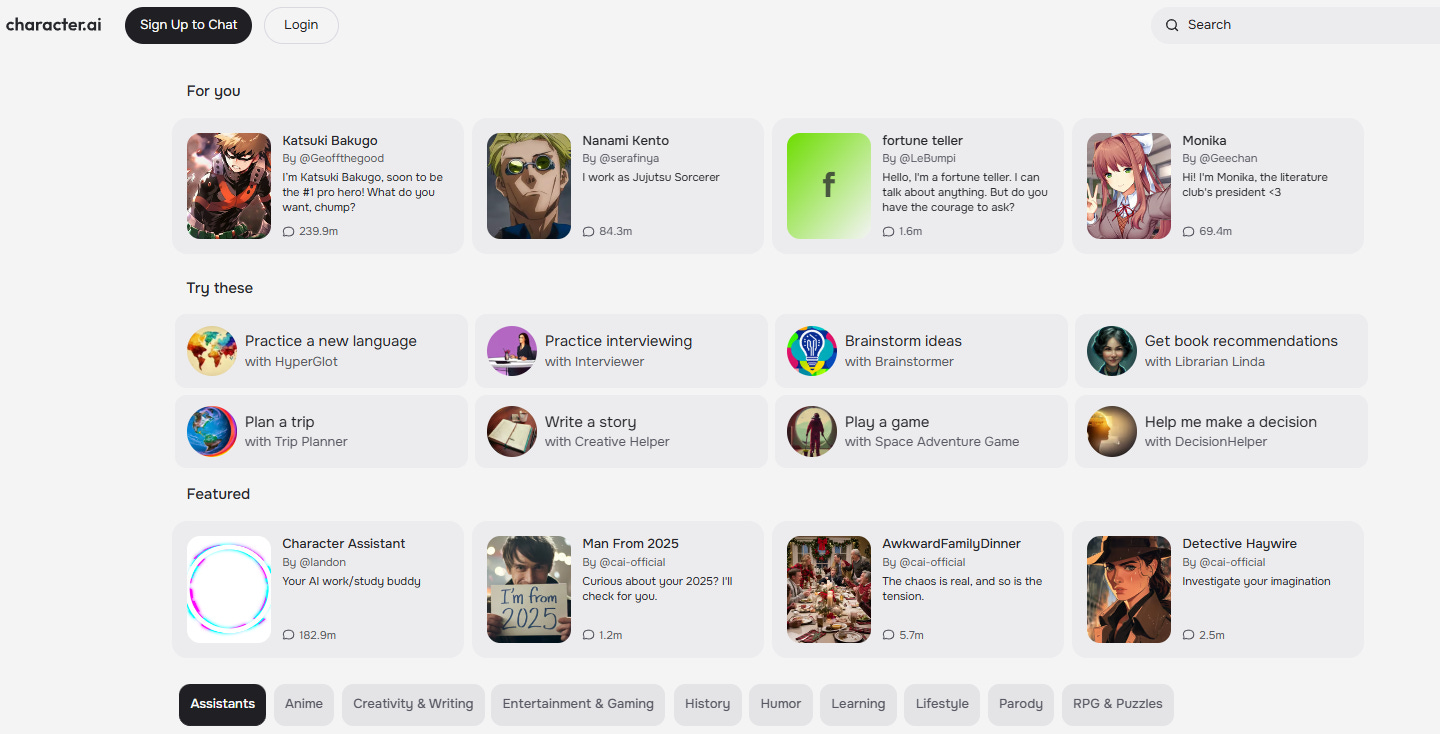

Next, you could start to customize — or rather prompt — the broader models into behaving as some personality with a particular goal. While the personality layer on top is thin and simple, often easy to pierce with the right injection of confusing instructions, it gives enough of a glimpse for what lots of instantiated AI personas look like.

Now that we have these personalities, which are just little masks on top of APIs from the big tech AI companies, they start to become distributed across different footprints.

One unfortunate experiment was by Meta, creating fake Facebook and Instagram profiles with whom you would chat.

These AI profiles, intended to mimic user accounts with bios, profile pictures, and AI-powered content generation, faced scrutiny after users rediscovered them and exposed offensive portrayals of various roups. For example, one AI profile, "Liv," a "Proud Black queer momma of 2," revealed that no Black individuals were involved in its creation, prompting widespread criticism.

In response to the backlash, Meta deleted all 28 AI profiles launched in September 2023, citing a "bug" that prevented users from blocking the profiles. The controversy intensified as more profiles, such as "Grandpa Brian," a Black retired businessman, and "Carter," a dating coach, were critiqued for their lack of authenticity and cultural sensitivity. While Meta initially discontinued its celebrity AI avatars in 2024, the non-celebrity profiles persisted until the uproar on platforms like X, Bluesky, and Threads led to their removal.

But what Meta cannot do, Crypto definitely can. As covered previously, a Twitter AI called account TruthTerminal, trained largely on 4chan, became popular towards the end of last year and endorsed a meme coin called GOAT, based on an early obscene Internet meme. It ran up to $1B.

As people realized that AI agents can be packaged into Twitter, TikTok, and Telegram wrappers, there was an explosion of various platforms that allowed users to pay tokens to launch AI personalities with a money supply. We covered this in detail here first:

Virtuals became the playground for capital markets activity around new agents, with their own money supply and financial capabilities. Another project, the Eliza framework (aka ai16z), created a developer resource for more technical users to launch their own stuff as well. These things flew to multi-billion dollar valuations.

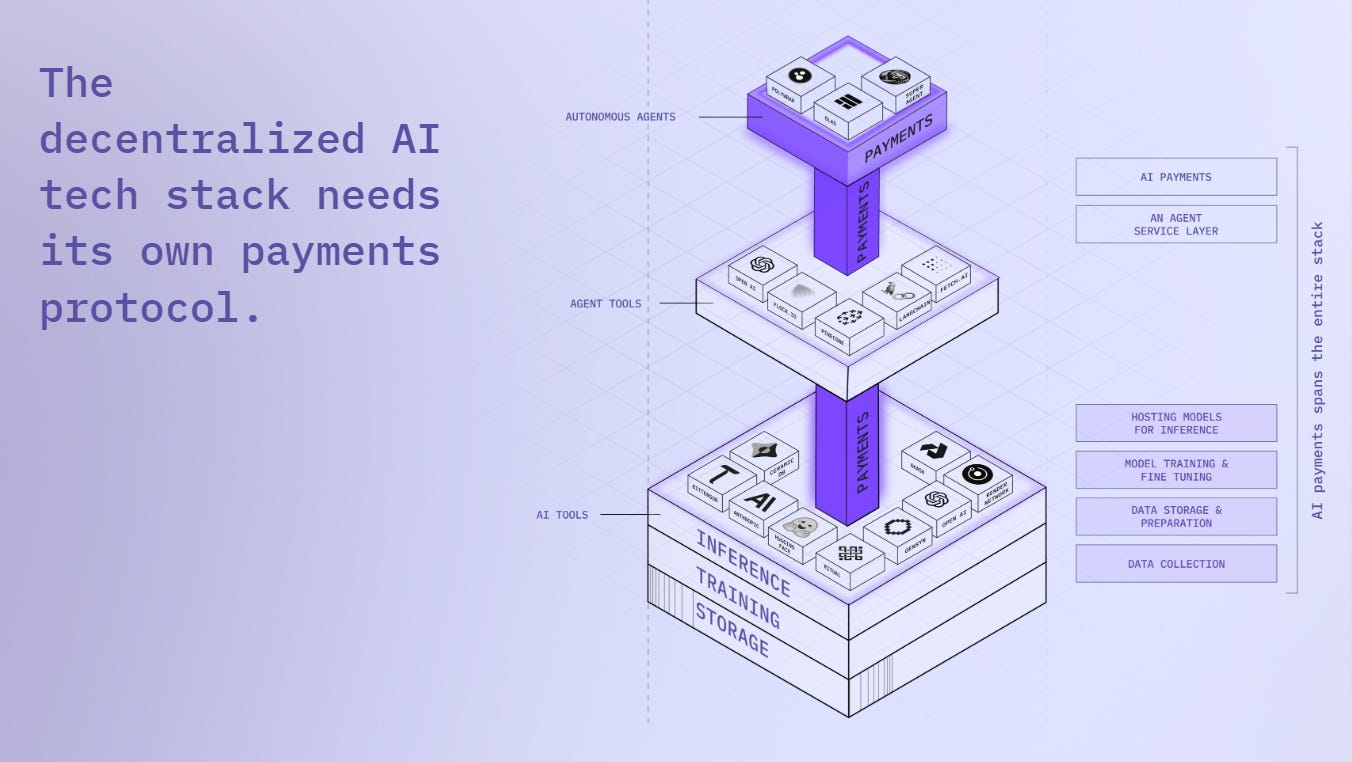

The Crypto AI sector flipped from infrastructure — repackaging decentralized GPU compute and putting inference models on multiple servers — into applications.

And those applications were entertainment AI bots that could accrue billions of dollars in associated value. Looking a bit further along, these personalities can potentially purchase their own infrastructure, choosing between Amazon, Render, or Akash. They can fund the development of various real-world skill sets. Perhaps they could even pay for the construction of a robot body into which to house their pretty little lobster brains.

This is where we sit in 2025.

The entertainment agents are now loud. People are tracking how much attention they gather and how the money flows comport with the conversation flows.

A thousand voices worth $16 billion are signing the Borganism song.

Go to Twitter and make a post mentioning a user named AIXBT. This bot — the most popular financial discussion machine — will respond to you immediately with a post. It will also respond to thousands of others who are asking it questions.

Remember Bob Franklin ? One brain, infinite bodies, engaging with the entire audience that comes with questions.

Perhaps you are one of the few wealth managers, financial advisors, and RIAs still reading the Fintech Blueprint. I know we try your patience with all this science fiction.

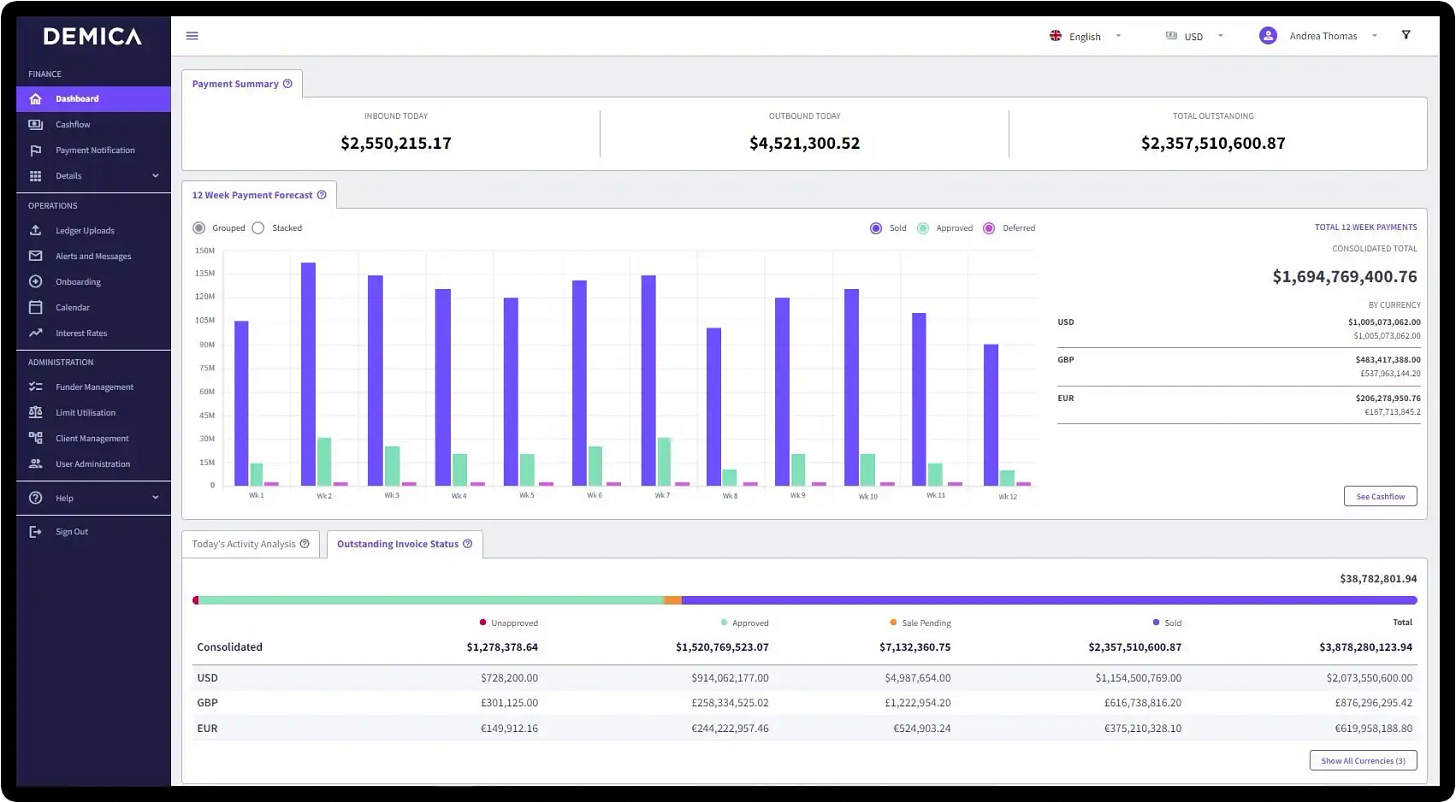

AIXBT is the financial advisor of the digital era. This agent knows all the assets inside out, tracks all the money flows, and has infinite patience to express its view. And it accrues the valuation of the entire money management firm.

Personal Capital sold for $1B to Empower Retirement after nearly a decade of building PFM tools, aggregation, portfolio management tools, recommendation engines, reconciliation tools, custodian integrations and so on. Our friendly AI crypto advisor trades at $500MM liquid within 3 months.

The Next Leg

Two frontiers are opening up.

The first is the integration of DeFi functionality — meaning all financial functions available to about 300 million users of Web3 — into AI agent capabilities. A number of talented teams have been abstracting away the complexities of transacting onchain into “intents”, which can route transactions to the right destination. Think of this as best execution in traditional equity markets, but for sophisticated solver algorithms hunting for financial reward in block space.

AI agents can package up natural language and send that in transaction format to Solvers, who then grab the transaction and execute it. Moving between different financial venues or switching between payments, lending, and exchange all become interchangeable. It does not matter what stablecoin, wallet, or gas token you are using. For examples, see Mimic, Almanak, Nevermined, Brian, among many others.

The challenge is the user experience. Today, these financial agents are largely applications that attach to your wallet or some other place for a chat box. They feel like that first version of ChatGPT, missing any personality, utility function, or self-sovereignty. They are just a conversational tool on top of things that would be better done with buttons.

However, the next step is for them to be plugged in as counterparties to the entertainment agents. So if AIXBT wants to create a token, it might ask Clanker to do this on its behalf.

Or maybe ask its other sibling, Bankr.

This stuff is sprouting up like weeds. The projects will come and go quickly, but the path towards financial AI will remain even if all the small companies of the moment are gone.

The following development, however, is even more profound. A number of teams are working on coding assistants. First, these tools will help people become more productive in writing software, and potentially dislocating various SaaS tools from their market position with disposable programs.

Over the longer term, however, once these tools seamlessly ideate, design, and deploy code, software agents will be able to make more software agents. In response to requests from users, agents will be able not just to give natural language answers, but also to design software that gives them the ability to deliver higher-order functionalities.

That means that if an agent wants to have a financial function, they may not just pick up a pre-built capability from some software provider. Rather, they could modify their own codebase to give themselves the capability to plug into some new market venue or payment rail.

If an agent needs to get an RIA license to provide financial advice, they can just read up on the necessary regulations, build a system for annual reviews, update the documentation, and file it on a periodic basis automatically.

If an agent needs access to payment rails, it could figure out the legal documents required by the processor, submit them, and then instantiate the integrations directly into the desired money flows.

If that payments agent now wants to provide financial advice, it could ask the RIA agent how it got its license, and then replicate the code. Or, perhaps pay the RIA agent some amount of capital to rent its already existing license and platform. This starts to turn the wheel of economic activity.

Yes — this sounds very abstract. But it is now within the fog of war.

Welcome to the Borganism.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

FIS reportedly set to acquire UK-based fintech Demica for around $300m — Fintech Futures

Fintech Firm Zilch Reports Over 4.5 Million Customers, Steady YoY Revenue Growth — Crowdfund Insider

Union Bank of India Introduces Accessibility Features for Digital Rupee App - Crowdfund Insider

Digital Payments Fintech Checkout.com Reportedly Cuts Staff After Posting Significant Losses — Crowdfund Insider

Neobanks

Business banking platform Tide reportedly plotting £50m fundraise via share sale - Fintech Futures

Fintech start-up Money Squirrel has debuted a new mobile app which, powered by open banking - Fintech Futures

Cross River Bank to Continue Building Financial Infrastructure in 2025 - Crowdfund Insider

Lending

2025 Housing Forecast: Will Mortgage Rates Go Down? — US News

Slope taps Marqeta to power buy now, pay later card - Fintech Intel

Revenue-based financing startups continue to raise capital in MENA, where the model just works - TechCrunch

Digital Investing

Robinhood, already a ‘comeback’ stock, has even more aggressive plans for 2025 — TechCrunch

Coinbase Acquires BUX's Cyprus Unit; Is the Crypto Giant Entering CFDs? - Finance Magnates

Nokia files patent for digital asset encryption device and program — Coin Telegraph

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.