Analysis: Why Bench Accounting collapsed despite $40MM in recurring revenue

Could it be the $50MM in debt?

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we discuss the collapse of Bench, a Canadian bookkeeping platform for small businesses, which went bankrupt despite raising $110MM+ in funding, including $50MM+ in debt. The company's high cash burn of $1.5MM per month and inability to automate services contributed to its downfall, compounded by leadership conflicts and strategic missteps after the founder was replaced. We explore the lessons from Bench's failure — sustainable growth, focus on core value propositions, and disciplined financial management in fintech ventures.

Topics: Bench, Employer.com, Bain Capital, National Bank of Canada, Brex, Ramp, Intuit, Revolut, Shopify (Tobi Lutke), Uber, SoFi, Zenefits, Rippling, KPG (Kelly+Partners Accountants).

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

If you are building a startup or investing, check out this online event below.

Join 1000s of investors & startups at the Early-Stage Virtual Conf on Jan 30!

128 VCs, Family Offices, & angels committed to 1:1 Speed Pitch meetings with startups during the event alongside panels on VC trends 2025, how Family Offices invest in VC funds and startups, & best fundraising practices.

Long Take

Fintech for the CFO

Fintech is such an ambiguous term these days.

For some of you — those working in banks — it is the new technology. For others — those working in crypto — it is the old technology. Maybe it means making the financial industry better. Or maybe it means making anything that touches money and commerce better. We think Fintech risks becoming the “Facebook” of financial software.

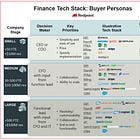

There is a category of Fintech that focuses not on the financial industry, but on the financial function within companies, managed by the CFO. Most of the financial products there have to do with payments, banking, and lending, and the software category is largely defined by automating large amounts of workflows and integrating various systems.

It is a curious category, because it balances on the edge between (1) selling financial products to small businesses, and (2) building SaaS platforms with a subscription fee. One of those is a business strategy that takes advantage of being in the financial industry. The other is a business strategy that looks like any generic Web 2.0 company, just targeting a kind of customer sitting in a particular organizational function.

Entrepreneurs in this space also seem to be sort of schizophrenic about it. It’s a bit cooler to do fintech than SaaS, and so you see Brex and Ramp using their CFO dashboards as a way to sell card issuance, payment processing, money movement, and various other banking-adjacent financial products. Others position their companies like a financial service, but in reality are just moving numbers around in a data environment.

We’ve previously covered these ideas in detail here:

Let’s return to this world in the context of Bench, a well-funded Canadian accounting platform that has recently made a splash in the news by abruptly going bankrupt and thereafter being acquired by a previously-unknown PE roll-up.

The platform is sort of a PFM (personal financial management) for small businesses that converts into tax filing services. The starting value proposition is bookkeeping, in the way that Mint used to track your transactions. Whereas PFM is a nice-to-have in the consumer world, it is a must-have in the corporate world. For small businesses especially, this is headache, a cost, and a requirement.

The company’s job isn’t easy either.

The underlying data aggregation is difficult, and building logic on top of data aggregation is expensive and time consuming. Small businesses have millions of different requirements and particularities. And monetization can be challenged — but first, let’s explore the recent personal dynamics.

VC and Founder Drama

To be honest, the news popped up on our radar when the founder drama became public and various Silicon Valley types began to flame each other over who is at fault. Here is the post that sparked the entire debate:

The founder alleges that wrong-headed investors pushed him out and took over the company, which in turn drove it into the ground.

There are many cases we can point to where something comparable happened, like Uber, SoFi, Zenefits. Each of these companies had brash fast-moving founders who were criticized — some for creating inhospitable cultures, others for cutting corners, and paid the price by being ousted from their own creations. Mike Cagney of SoFi followed SoFi with Figure, a very successful digital lender focused on the HELOC space. Parker Conrad of Zenefits, replaced by non other than Trump crypto-AI-czar David Sacks, built Rippling, a huge success. And Travis Kalanick had made enough money.

So it this what really caused the company to fail?