Analysis: Will Revolut’s Gamble on Investment and Stablecoins Pay Off?

Revolut’s new investment app targets eToro and Robinhood with €8.5B AUM.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we discuss the ongoing pendulum swing between financial consolidation and decentralization, highlighting how companies like Revolut are navigating this cycle. Revolut is expanding its services through ventures such as a standalone investment app and a potential stablecoin, targeting high-fee products like CFDs and aiming to compete with eToro and Robinhood. With 45 million users and $2.2 billion in revenue, Revolut’s growth strategy mirrors the earlier consolidation playbooks of JP Morgan and Ant Financial. The company’s investment app, with €8.5 billion AUM, reflects its push to diversify amidst declining interest rates, leveraging opportunities in brokerage and asset management. However, the key challenge remains balancing diversification with market volatility and future interest rate drops.

Topics: Apple, JP Morgan, Ant Financial, Robinhood, Revolut, Coinbase, Wealthfront, SoFi, eToro, Trading 212, Interactive Brokers, BitMEX, Bitstamp, Binance, Kraken, PayPal.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

Spinning Around.

There are two sides to the pendulum.

The first is Apple, JP Morgan, and Ant Financial. It is the fully consolidated super-app, heavily bundled platform, financial monolith.

Here are the exhibits. First, JP Morgan’s consolidation history.

A screenshot of some of Apple’s apps.

The value proposition is that everything is in the same place. The provider of “everything” gets to enjoy huge scale and monopoly rents, as feature providers compete to reach the platform's customers.

Over time, this structure ossifies. Its monolithic approach strains under pressure and falls apart. The forces of consolidation meet the forces of unbundling, decentralization, and democratization.

What was together is now apart.

Everything unbundled!

In fact, we shouldn’t have systems at all. Let’s have blockchain protocols that are completely permissionless and have robot software. Anarchy wins.

And so on.

But of course, some of those independent feature apps grow up into champions within their verticals. Robinhood, Coinbase, Revolut, Cash App, Wealthfront. And once they reach sufficient scale, then it is the JP Morgan motion all over again. Can we consolidate all of these financial features into one useful super app to rule them all?

Here is SoFi.

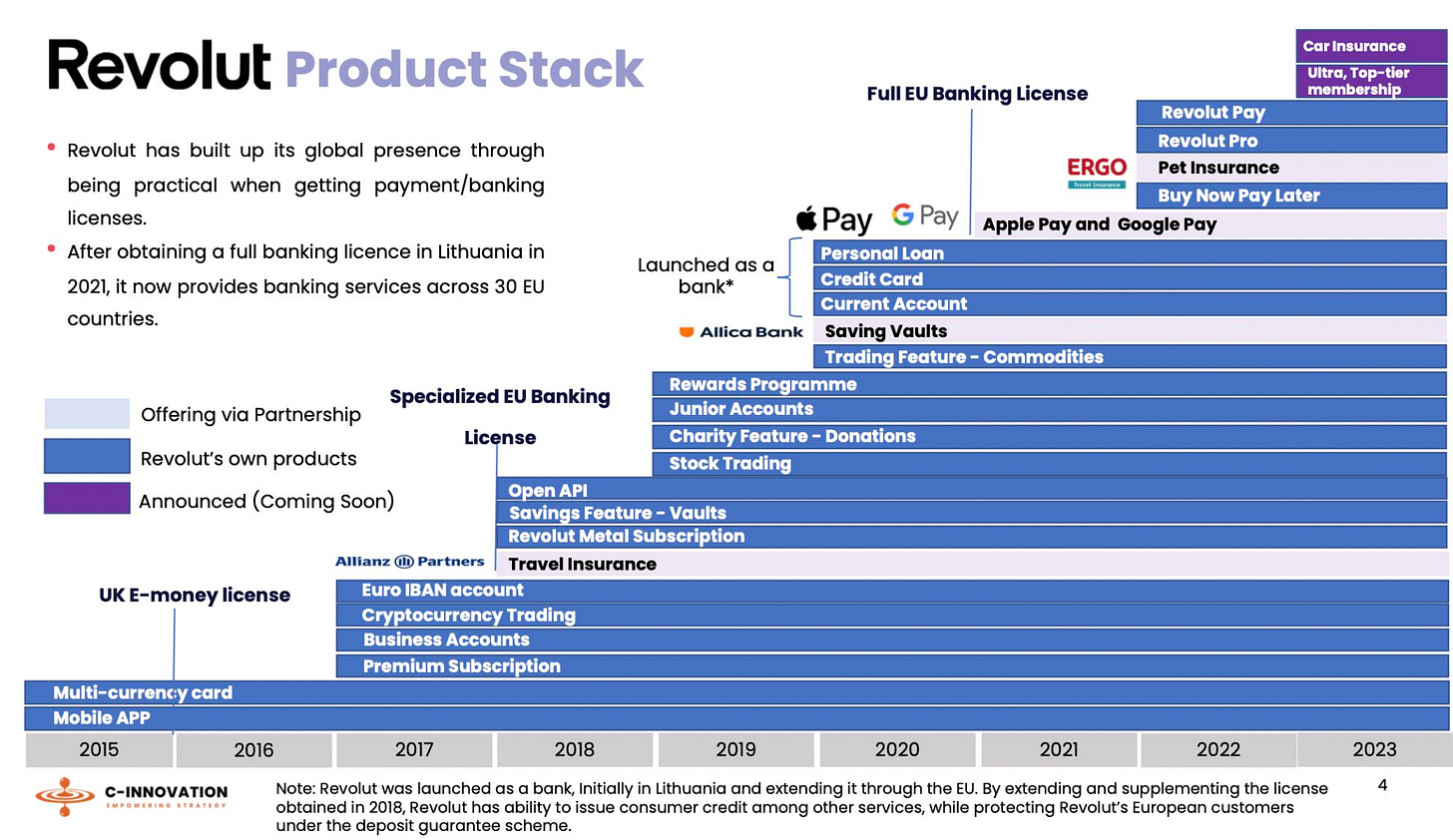

And here is Revolut.

You can see how this goes. There is no stable equilibrium. Once you have sufficient scale — let’s say over 1 million users — the natural thing is to offer more products and cross-sell them to those customers.

We recently dove into Revolut’s annual results, walking through the math. You can find the prior analysis here.

Here are the key charts for reference.

The company has over 45 million users, of which 10 million are in the United Kingdom. Revenue is running at $2.2 billion and around $400MM of profit. And there are more products to come, as features continue to consolidate around the neobank.

Revolut’s Gambles

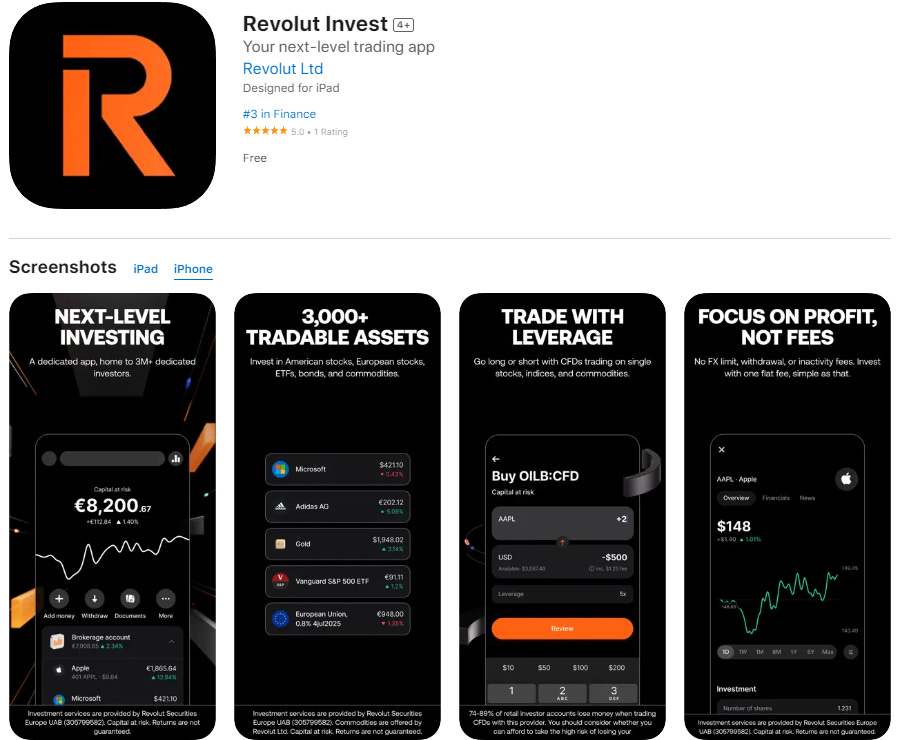

The first notable development is the launch of a separate Revolut investment app.

Bloomberg reports that Revolut will be competing directly with eToro and Robinhood in its next iteration of investment services, starting in Greece, Denmark, and other European countries.

The European brokerage opportunity is still pretty open, despite the presence of Trading 212 and Interactive Brokers. Part of the challenge is that Robinhood’s bread and butter business model — selling order flow — is not legal in most of the continent.

Trading 212 has £3.5 billion in AUM, including its 5.1%-yielding cash account, and generates about $120 million in revenue or 2.5% of assets. Revolut is showing up with €8.5 billion in AUM and 3 million active users. Unlike the prior bundled investment feature set within the neobank app, users of Revolut Invest do not need to also be customers of the Revolut bank.

In addition to regular stock and fund trading, the app will also ship with access to CFDs, or Contracts for Difference. These are derivatives that you use to bet on a particular direction for an asset. Such synthetic assets are often used when a company doesn’t have access to the real underlying assets, but wants to facilitate markets.

In fintech, eToro is one of the biggest platforms for CFD trading.

eToro has about $10 billion in AUM and generates $600MM+ of revenue from its 4 million active users, with 45 million registered users. That is a monetization rate of about 6% on captive assets. Revolut is making $100-150MM from its brokerage activities, which looks more like a 1-2% monetization rate. That’s a lower fee, and better for the customer.

In crypto, instead of CFDs and derivatives, the relevant product would be “perpetuals” or non-expiring options. These allow for directional bets on particular assets at very high leverage, like 100x. The product was pioneered by BitMEX, and is particularly profitable for the house because traders have a tendency to blow up, thereby losing their collateral. The entire Ethena synthetic dollar protocol has been built on using the long bias in perpetuals to fund idiosyncratic market yield.

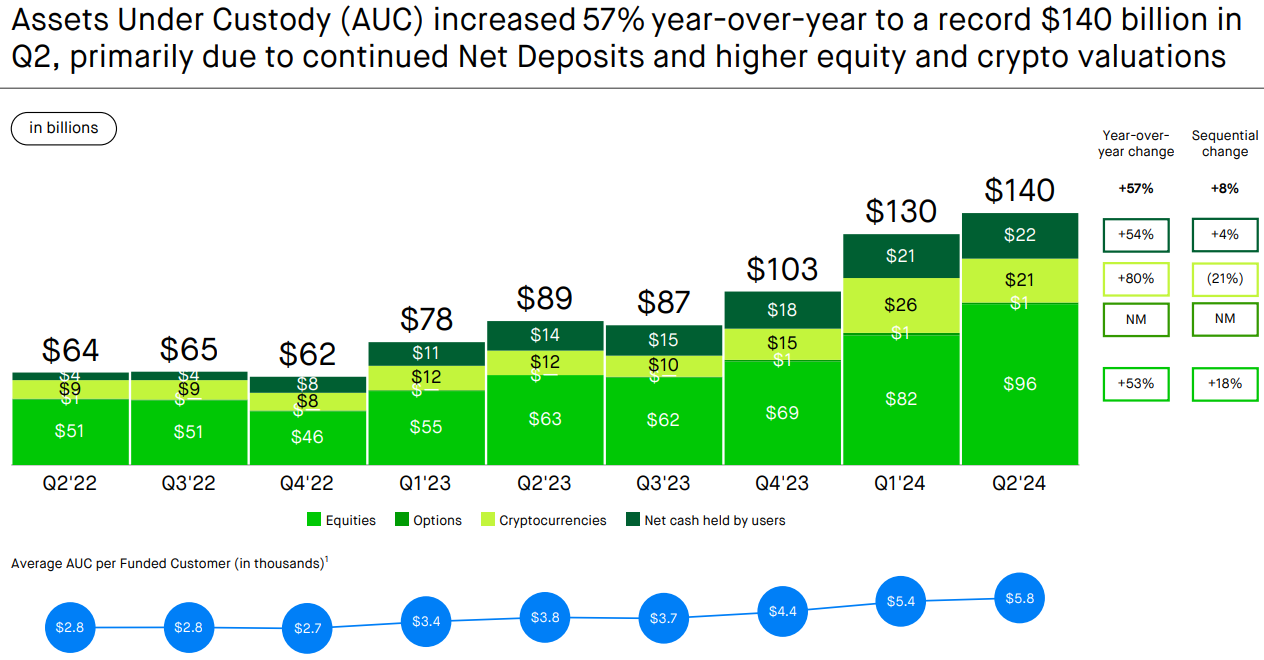

One reason you would sell these higher fee derivative products is to crank up your revenue when facing headwinds on the banking side. For example, take Robinhood.

While it has $96B of assets in equities, there is $20B of assets in crypto and $1B in options. And yet, revenues for Options in Q2 2024 are $182MM, compared to $40MM for equities and $80MM for crypto.

We are not exactly sure of the math — how do you get $800MM in revenue per year from $1B in Options assets? But clearly, it is Robinhood’s most important business. Even with a more conservative analysis, Options revenue is nearly 6% of the relevant dollar value. That compares to an average monetization of $3B revenue on $140B of assets, or 2.1%.

You can see why Revolut would want to diversify into this product.

At the same time, the personalities of a banking customer and a financial gambling customer are quite different. You may not want the savings account right next to the options casino.

Speaking of savings accounts — those generate net interest, which is the difference between what you pay a user and what you get from holding financial instruments on the balance sheet. Net interest is about to go way down.

This is the path of interest rates. The immense amount of easy money that fintechs have made over the last 18 months is about to get slashed as the Fed cuts begin to stimulate the economy. It’s notable that Covid led to large user-base expansions for these companies, and the post-Covid rate hikes helped the large remaining fintech companies to reach profitability.

As interest rates head down, it will be increasingly important to diversify the revenue base. We expect volatility to increase and markets to grow, which is what feeds the brokerage and asset management business lines. As a result, we are not shocked to see Revolut giving investments an additional push, and putting high-fee products into the mix.

Here is a quick model showing two cases: