Blueprint: BlockFi and FTX structure a $240MM acquisition; Klarna's $6.5B 85% down round; $200MM into BNB exchange Unizen

Hi Fintech Futurists —

Happy Monday! Before we jump into today’s Short Takes, we wanted to kindly remind you of the 25% discount off the premium subscription.

Right now, as a free subscriber you have access to these Monday Short Takes, the Thursday Digital Wealth newsletter, and Friday podcast conversation without transcripts.

By upgrading for $24/month $18/month, you will unlock instant access to additional letters:

Tuesday’s Web3 Short Take with expert curation and in-depth analysis on Web3

Wednesday’s thorough and rigorous research on key Fintech and DeFi developments without shilling or marketing narratives

Annotated & value-packed transcripts for the Podcasts

Full Archive starting in 2019, covering 50+ brands and 15+ themes in Fintech and DeFi

Monthly Greatest Hits Reports on various topics such as stablecoins, DAOs and more

Get your premium subscription on a 25% Discount to the most value packed Fintech & DeFi Newsletter on the market, aiming to help you find and build the next unicorn.

You have only 2 days left to take advantage of this special offer below. Thanks always for your support.

Today’s agenda below.

CRYPTO: FTX Reaches Deal To Acquire BlockFi for up to $240M (link here)

BNPL: Fintech Klarna reportedly raising at a $6.5B valuation, giving new meaning to the phrase ‘down round’ (link here)

DEFI: Unizen ‘CeDeFi’ smart exchange secures $200M investment from GEM (link here)

Long Take: Should Robinhood, Voyager, and BlockFi sell to FTX -- a view on the industrial logic (link here)

Podcast Conversation: Embedding financial workflow automation in digital banking platforms, with Monite CEO Ivan Maryasin (link here)

Short Takes

CRYPTO: FTX Reaches Deal To Acquire BlockFi for up to $240M (link here)

FTX and BlockFi got to a deal last week — the exchange will acquire the distressed lender for up to $240MM, including a $400MM revolving line of credit. Whether BlockFi goes for the full $240MM will depend on whether it hits performance triggers. Rumours are circulating that the acquisition will lead to further BlockFi layoffs, but both BlockFi CEO, Zac Prince, and FTX CEO, Sam Bankman-Fried (SBF), have denied these claims.

The sale could potentially go for considerably cheaper, with the lower end pegged at $25MM, as reported by CNBC. As we’ve covered in detail in our Long Take, BlockFi has been hit hard by the recent market volatility of the crypto markets. They experienced around ~$80MM in losses due to overcollateralised loan exposure to 3AC, who recently filed bankruptcy. But also, leverage is down in the market and leverage is BlockFi’s whole business model

Looking closer at the deal, the combination of the call warrant and subordinated revolving credit facility (RCF) are a form of mezzanine finance — a mixture of debt and equity financing that allows the lender to convert debt to equity interest if the firm defaults. If FTX is able to convert this RCF into equity at a discount to the market, then it may potentially lead to high dilution of shareholders. Additionally, if the valuation raises above $240MM then FTX would be able to exercise its option and acquire BlockFi at a discount. This is the pleasure of financial structuring.

There are a several motivations for the acquisition: (1) BlockFi gives FTX the lender’s technology stack, allowing them to expand their offering and capture market whilst others are trying to keep their boats afloat, (2) it is a cheap means of customer acquisition that is adjacent to its core exchange business, and (3) SBF is able to protect customers and their funds from further default, easing the blow on retail investor perception of the crypto markets. There are likely more sales on the way for those with capital — Voyager announced on Friday that they had suspended all trading, deposits and withdrawals.

BNPL: Fintech Klarna reportedly raising at a $6.5B valuation, giving new meaning to the phrase ‘down round’ (link here)

As we covered previously, Fintech valuations have corrected in 2022, falling from 25x forward revenue to a more timid 4x. Klarna is one such victim, with the Swedish BNPL firm now rumored to be valued at $6.5B as it looks to raise $650MM, about a seventh of its $45B valuation this time last year.

From an operating perspective, Klarna started the year off strong, growing its US user base by 65% in 2021 to 25 million consumers, bringing total users to 147 million globally, with revenues rising 30%+ (reminder that $45B valuation /$1.6B ARR = 30x). Yet in May, Klarna laid off around 700 people or 10% of its workforce, reportedly due to macro and geopolitical factors. This follows a wider BNPL trend post-pandemic, with competitor Affirm’s stock price down to $17 from its 52-week-high of $176. Lending revenue isn’t SaaS revenue, and the new valuation would suggest a much more bank-like outlook on the company. Blitzscaling is dead.

Klarna needs the new cash to survive. In 2021, they had a net loss of SEK 7B, or about $700MM. Of the loss, SEK 4B was a credit loss. As people have less savings, they are more likely to default on their BNPL program — about $6B in “loans to the public”. This year is likely uglier than the last. Looks like Afterpay timed their $29B sale to Square in August last year very well!

DEFI: Unizen ‘CeDeFi’ smart exchange secures $200M investment from GEM (link here)

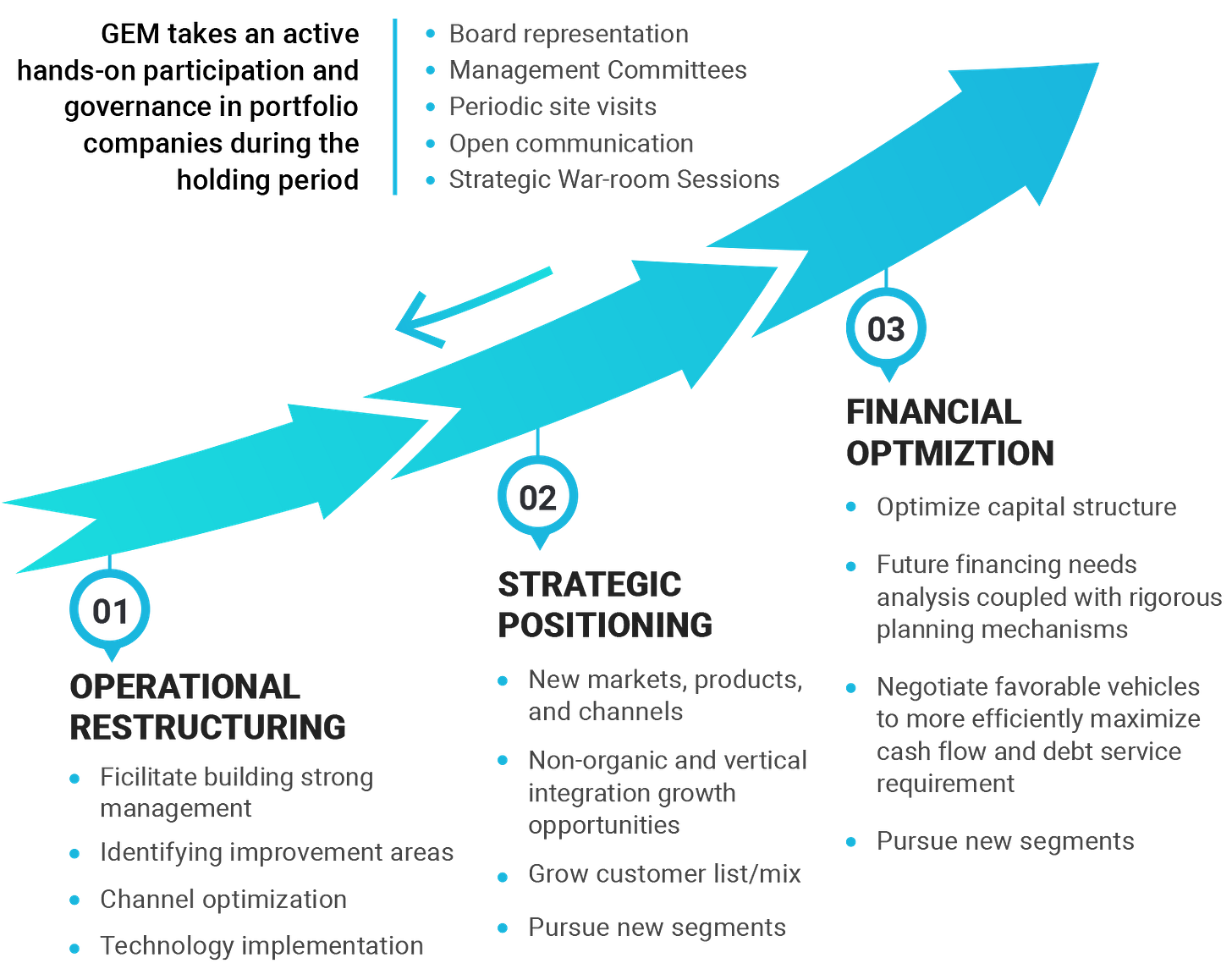

Here are some names with which we are not familiar. Unizen, an exchange that uses BNB chain, has raised $200MM from Global Emerging Markets (GEM) in a capital commitment deal where Unizen receive a portion of the funds upfront, and the rest upon meeting certain milestones.

GEM is a $3.4B investment group with a hands on private equity buyout approach — a strange partner to play such an active role in the crypto world. It also has a strategy called GEM Digital, which looks like it structures and invests in utility tokens. Maybe this is house money from prior wins being reinvested in a highly structured term sheet?

Unizen markets itself as a blend of CeFi and Defi (CeDeFi) and is built on the BNB chain, which is the blockchain created by Binance. It acts as a portal into both centralised exchanges and DeFi applications on multiple networks, bundling consumer transactions to make them cheaper and taking on DeFi-related risks themselves. That sounds like counterparty risk.

There’s also, of course, a token. $ZCX token provides holders with lower trading fees, echoing the tokenomics of Binance’s BNB coin. It also lets holders invest in emerging crypto projects that come through Uzen’s incubator, ZenX Labs. We are interested in any well-funded player integrating into Binance infrastructure, as well as the meta-trends of capital formation. But this transaction looks far too much like something out of 2017 with initial exchange offerings and recursive loyalty tokens.

Long Take: Should Robinhood, Voyager, and BlockFi sell to FTX -- a view on the industrial logic (link here)

Last week we looked at how FTX and Alameda are spending their balance sheet, supporting crypto broker Voyager with a $500MM revolver and crypto lender BlockFi with a $250MM loan. Read through to grok the numbers behind the headlines.

We examine potential strategic rationales for these loans in the context of FTX strategy, as well as the underlying cause of distress for those companies, such as the Terra and 3AC fallout. We also think about Robinhood, and what it would add to the FTX equation.

Embedding financial workflow automation in digital banking platforms, with Monite CEO Ivan Maryasin (link here)

In this conversation, we chat with Ivan Maryasin, the co-founder and CEO of Monite, an embedded finance startup that is automating back-office accounting for SMEs.

Earlier this year Monite raised $5M (€4.4M) in a funding round led by Point72 Ventures. Ivan lived for a time in Boston and San Francisco, working for different startups and going to school before settling in Berlin. A natural entrepreneur, Ivan began his first marketing consultancy at age 16, and he founded Monite after witnessing first-hand the pain points that SMEs are facing with finances, whilst leading growth for Penta, one of the key German B2B neobanks and realized small businesses struggle a lot more with admin and accounting than they do with banking

Rest of the Best

Here are the rest of the updates hitting radar.

AI: April taps AI to help personalize and autofill tax filings

INSURTECH: ReSource Pro acquires TowerIQ

INSURTECH: Stoïk raises €11 million

INVESTING: American Century Investments selects Marstone to provide digital wealth management platform

INVESTING: Rental investment platform Doorvest raises $50 million in debt financing

INVESTING: China’s ICBC and Merchants Bank to stop digital investment service after June

ROBOADVISOR: Wealthsimple review 2022

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth newsletter issue, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to the Podcasts with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive convering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Exclusive monthly ‘Greatest Hits’ reports with an overview of various Fintech and Web3 topics to give you a well rounded perspective on a particular issue