Blueprint: BloombergGPT; $400MM round for DMI Finance; LayerZero valued at $3B

Hi Fintech Futurists —

Hang in there, today’s agenda below.

AI: Introducing BloombergGPT, Bloomberg’s 50-billion parameter large language model, purpose-built from scratch for finance (link here)

LENDING: DMI Finance raises $400 million from Japan’s MUFG Bank (link here)

CRYPTO: Blockchain interoperability firm LayerZero Labs valued at $3B after $120M funding round (link here)

LONG TAKE: Consolidation logic for fintechs and SPACs, starting with Acorns and GoHenry (link here)

PODCAST CONVERSATION: The psychology of entrepreneurship and reimagining collaboration behind Web3 analytics, with Flipside Crypto CEO Dave Balter (link here)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Join us at Fintech Nexus USA — we will be there. The event brings together top minds in fintech to cover topics like digital banking, fraud, blockchain, embedded finance, fintech investing, and more. 5,000 attendees will engage in 20,000+ double opt-in meetings this May 10-11 in NYC. It’s the can’t-miss event of the year!

👉Use promo code “FinBlue” and get 15% off today

Short Takes

AI: Introducing BloombergGPT, Bloomberg’s 50-billion parameter large language model, purpose-built from scratch for finance (link here)

Bloomberg have launched their take on ChatGPT - BloombergGPT - a generative AI model specifically geared towards financial services. Known as a large language model (LLM), it will draw on Bloomberg’s data troves to support natural language processing tasks in the space, such as question answering, sentiment analysis, news classification and lots more. Despite ChatGPT’s extensive knowledge, BloombergGPT fills the gap in the financial services market, where the unique terminology and inherent complexity merit a domain-specific model.

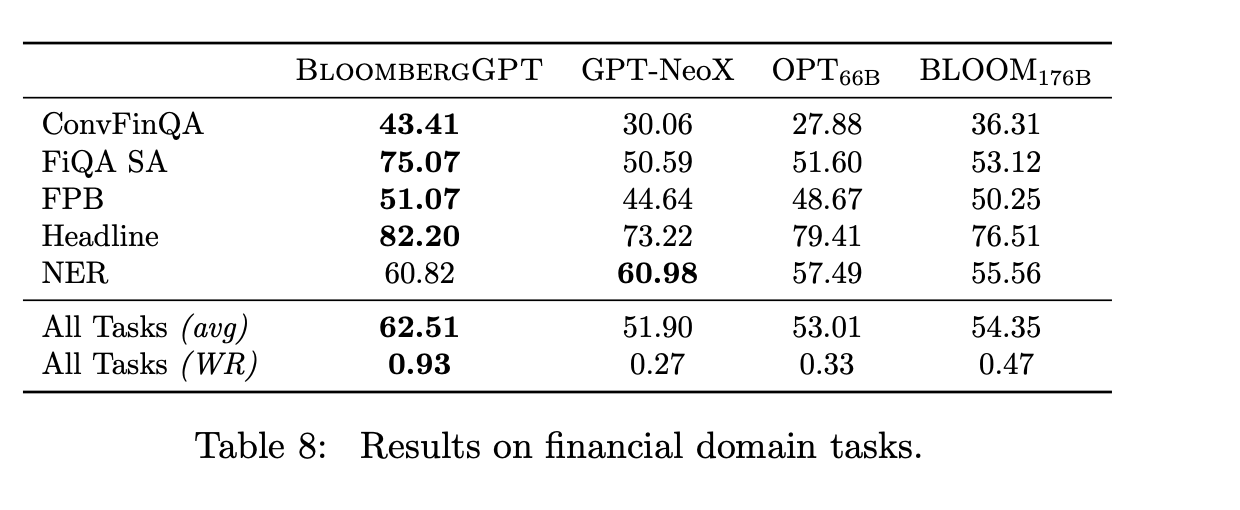

The model works by drawing on Bloomberg Terminal’s extensive data stores, spanning over forty years. Using a 363 billion financial token dataset of English financial documents, it was augmented with a 354 billion token public dataset (financial news sites, company filings, press releases etc.), creating a cumulative training corpus of over 700 billion tokens. A segment of this corpus was used to train a decoder-only casual language model, which was then tested on a suite of Bloomberg internal benchmarks, NLP tasks from popular benchmarks and NLP benchmarks specifically for finance. The model significantly outperformed other open models on financial tasks and was as good, or better, than general NLP benchmarks.

While the model is not currently publicly available, nor is there an API to access it, the use cases are far reaching. A few examples we can think of include automated market report generation, creation of SEC filing drafts, quick company due diligence and so much more. In terms of value this product brings to Bloomberg, a friendly reminder than OpenAI’s valuation currently sits at $20B.

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

LENDING: DMI Finance raises $400 million from Japan’s MUFG Bank (link here)

Indian digital lender DMI Finance has raised $400MM in an equity investment round led by Mitsubishi UFJ Financial Group, Inc., through its subsidiary MUFG Bank, Ltd. DMI's total funding now sits at $800MM+ and its customer count is over 10 million. The company plans to underwrite $2.5B+ in the coming fiscal year across its product offerings: corporate lending, digital lending, and housing finance.

On the corporate lending front, DMI provides secured loans to real estate and non-real estate corporate borrowers across India, offering project finance, structured and mezzanine debt, and bridge financing. Its digital lending business offers consumption loans, personal loans, lines of credit, and MSME (micro, small and medium enterprises) loans. Its house financing product offers home loans and loans against property, while its asset management business comprises two platforms, including an offshore fund that focuses on listed Indian performing credit and an India AIF that focuses on structured debt and equity in real estate companies.

DMI posted impressive financial results in the year ending March 31st, 2022 — the company's financial assets rose from $670MM in 2021 to $800MM+ in 2022, primarily driven by a surge in loans, indicating that DMI is heavily expanding its lending business and increasing its exposure to credit risk. The company's cash increased from $30MM to $84MM in 2022, with interest income growing from $85MM to almost $100MM. Still, the company's profitability / comprehensive income for the year was only $15MM.

The Indian lending landscape has faced significant challenges in democratizing access to credit, with MSMEs facing a credit gap equivalent to 30% of India's GDP. But with the emerging digital lending startups, the country has witnessed a CAGR of 39.5% over the past ten years, with the space worth $270B in 2022 and expected to be worth $350B in 2023. DMI has a sizeable market opportunity as the Indian economy and demand for credit continues to grow. We also note that regulatory oversight will increase as digital lending equalises in market share with traditional lenders, requiring fintechs to invest in cybersecurity and customer data protection.

CRYPTO: Blockchain interoperability firm LayerZero Labs valued at $3B after $120M funding round (link here)

LayerZero Labs, an omnichain interoperability protocol, has raised $120MM in its Series B funding round from 33 investors, valuing the company at $3B. The LayerZero protocol enables developers to build inter-chain applications, such as cross-chain DEXs, multi-chain yield aggregators, and cross-chain lending, without intermediate or middle-chain bridges.

The LayerZero system relies on a Oracle and a Relayer to facilitate message transfers between on-chain endpoints. Each chain in the LayerZero network has one LayerZero Endpoint, which serves as a user-facing interface comprising of on-chain smart contracts. This endpoint allows users to send messages via LayerZero.

To enable the transfer of messages between different blockchains, a User Application (UA) sends a message from blockchain A to blockchain B. The message is routed through the endpoint located on A, which then notifies the designated Oracle and Relayer assigned to the UA of the message and its intended destination blockchain. The relayer submits a proof for a transaction, while the oracle is responsible for broadcasting the block header on which the transaction occurs. This mechanism provides a strong guarantee that a transaction is valid.

Public blockchains are digital ledgers, but their infrastructure serves a self-contained ecosystem. As such, the siloed nature of blockchains limits the adoption and usefulness of DeFi due to fragmented capital and market venues. To enable interoperability between different networks, blockchain bridges strive to deliver (1) instant guaranteed finality; (2) unified liquidity; and (3) native assets. These three properties comprise the Bridging Trilemma. LayerZero's infrastructure is able to resolve the Bridging Trilemma using their product Stargate, an AMM that operates on top of the LayerZero protocol. It allows users and dApps to transfer native assets cross-chain while accessing the protocol's unified liquidity pools with instant guaranteed finality.

Long Take: Consolidation logic for fintechs and SPACs, starting with Acorns and GoHenry (link here)

Today we are diving into the Acorns acquisition of GoHenry, and the rationales for consolidation in the neobanking and micro-investing industry.

Podcast Conversation: The psychology of entrepreneurship and reimagining collaboration behind Web3 analytics, with Flipside Crypto CEO Dave Balter (link here)

In this conversation, we chat with Dave Balter, Co-Founder and CEO of Flipside Crypto, which provides business intelligence to blockchain organizations.

Dave has served on multiple executive teams for global organizations and previously invested in startups as a venture partner for Boston Seed. He’s an angel investor in companies spanning data science, edtech, software, and more.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH - Apis Partners leads €29M (US$31M) Series A funding for African fintech Peach Payments

PAYTECH - Finix: New Features and Payment Solutions for Merchant Businesses and Online Marketplaces

CREDIT - Rocket Mortgage launches a credit card to help you save for or pay off a home

INVESTING - Introducing Investment Plans on Public

CRYPTO - Gemini Preps Overseas Derivatives Exchange to Offer ‘Perpetual Futures’

BANKING - ClearBank nearly triples YoY income to £58m in 2022

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.