Blueprint: Coinbase offers DeFi yield to non-Americans; FNZ raising $1B for wealthtech rollup; Mambu banktech gets $266MM at $5B+ valuation

Gm Fintech Futurists — our agenda for today is below.

DEFI: Coinbase makes it easy to earn yield with DeFi (link here)

DIGITAL WEALTH: Wealth Management Platform FNZ Seeks to Raise $1 Billion for Expansion (link here) and FNZ adds Swiss software firm to wealth tech platform (link here)

BANKING: Banking technology platform Mambu raises $266 million (link here)

LONG TAKE: What Goldman's institutional financial cloud on Amazon means for embedded finance (link here)

PODCAST: Investing in real estate, crypto, and startups using your retirement account, with Rocket Dollar CEO Henry Yoshida (link here)

If you want to go deeper in Fintech & DeFi, check out premium features below.

Visit our carefully curated Sponsors:

Join Fintech Meetup (online, March 22-24) to get business done! Meet hundreds of Fintechs, Banks, Credit Unions, Community Banks, Neobanks, Networks, Solution Providers, Tech Companies, Retailers & Merchants, Investors etc. 30,000+ double opt-in online meetings, 500+ orgs already signed up!

👉 Get your ticket now and start planning for 2022!

Perpetual Protocol is a decentralized perpetual futures contracts exchange on the cutting edge of finance and technology. Traders use it to permissionlessly trade the most popular products in Web3. Builders create new protocols and projects on top of it. Liquidity providers use it to earn yield on their capital.

👉 Learn more at perp.fi

Short Takes

DEFI: Coinbase makes it easy to earn yield with DeFi (link here)

Coinbase is launching an integration with the DeFi ecosystem by helping its customers earn yields from their Coinbase account. Eligible customers in over 70 countries are now able to earn yield on DAI held in their account.

DAI is a stablecoin pegged to the US dollar, collateralized by assets that a user contributes into a Vault based on smart contracts published by MakerDAO (see our foundational podcast here). A minimum collateral ratio is maintained by the Vault, which functions similar to a margin lending account, liquidating the collateral in cases when the value falls below the collateral ratio. The Vault issues DAI as leveraged purchasing power, which can then be used to go long, short, or to be invested elsewhere.

Further downstream are platforms like Aave and Compound, which are colloquially called “money markets” and intermediate leverage. Users can supply their DAI to “provide liquidity” to the platform and, in return, are rewarded with a variable interest rate based on supply and demand. In the case of Coinbase, DAI is supplied to Compound, which for example provides APY returns between 2.83% and 5.39% in October. For convenience, Coinbase is abstracting some of the underlying mechanics — DAI will still be available on Coinbase at any time, and Coinbase will cover the gas fees required for accessing DeFi protocols and their yields. This is a large saving for small accounts, given that Ethereum gas fees at the moment can run into several hundred dollars. However, if one uses DeFi protocols on ETH adjacent chains, like Polygon, then those processing fees are trivially small.

You might remember the SEC trying to recently block this Earn product. Well, consider yourself protected from having non-zero interest rates! The service is available in the United Kingdom, Germany, and Spain, but not in the United States. It is raw nonsense that American consumers are banned as a result of regulatory posturing. And further, such positions are impractical and unenforceable — a user can download the Coinbase or a MetaMask wallet, and access the DeFi protocols themselves. Overall, we see this move from Coinbase as a great development, bringing the DeFi asset class to mass market. A variety of fintech/DeFi superapps will come next.

DIGITAL WEALTH: Wealth Management Platform FNZ Seeks to Raise $1 Billion for Expansion (link here) and FNZ adds Swiss software firm to wealth tech platform (link here)

FNZ, a wealth management platform, is looking to raise $1 billion to power its global expansion, following a recent acquisition of Appway, a client onboarding and servicing firm. The firm offers a platform-as-a-service offering, which can be used by financial institutions to power their technology, investment operations, and asset servicing in their wealth management business. FNZ is currently used by over 150 banks, assets managers, and life insurers to support over $1.5 trillion in assets, largely outside the United States.

There is an interesting roll-up strategy here. The company agreed to acquire Fondsdepot Bank, a German trading and custody platform, last month, acquired New Zealand investment platform Hatch in October, and took over State Street Corp's wealth manger services business in April. Another acquisition — that of Appway — will strengthen the ability for financial institutions to develop customer propositions. We are reminded of the strategic path of companies like Tegra118, spun out of Fiserv, and now part of InvestCloud.

Investment bank Lazard is supporting FNZ with fundraising for future acquisitions, suggesting that FNZ is a private equity roll-up play for disjointed and fragmented back-office and client onboarding advisor and asset manager tech, more so than bleeding edge roboadvice / digital asset usecases. Another notable key takeaway is how much more bundled the bank/investments platform tech is outside of American borders, where the regulatory distinctions between banking and investments have created lots of subscale legacy technology duplicating functionality between the trust, depository, and investment management lines of business.

BANKING: Banking technology platform Mambu raises $266 million (link here)

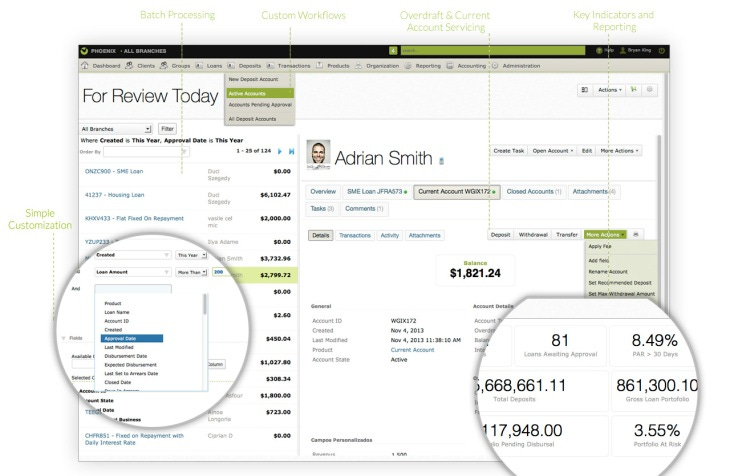

FT Partners has another hit on their hands, helping banking platform Mambu raise €235 million at a nearly €5 billion valuation. The company provides a more modern banking infrastructure, powering a 200 enterprise customer footprint with over 50 million end users. This type of business nicely dovetails with the discussion from last week, linked further below in this newsletter, about Thought Machine and the Goldman/AWS partnership.

Platforms like Mambu have been able to scale up in part due to the rise of neobanks like N26 and Oaknorth, banking-as-a-service providers like Solaris Bank, and digital lenders like CapitalBox. Such digital storefronts offer new venues for distribution, which in turn requires new platforms to underpin the things being distributed. It would be nearly impossible to unseat the banking platforms that power orthodox finance, but new digital footprints have different requirements, and therefore choose different underlying providers, prioritizing real-time processing and API quality. We’ve previously suggested to look at the shape of customers to understand the market.

There are some other learnings we can get out of the Mambu site, such as looking at its go-to-market motions. The company works with system integrators and third party consultants as the path to market, leaning into ecosystem compatibility. We think this is a core requirement of any platform trying to go after middle office automation and aggregation. The tech build is so insanely expensive and endless, that building out a sales organization at the same time is pretty much impossible.

Rest of the Best

Here are the rest of the updates hitting our radar:

AI: SoftBank and BlackRock back Clarity AI (link here)

BNPL: Affirm spinout Resolve raises $25M in Insight Partners-led round to grow B2B buy now, pay later offering (link here)

CLOUD: Accounts payable automation startup Tipalti raises $270M, quadruples valuation to $8.3B (link here)

CRYPTO: WhatsApp launches cryptocurrency payments pilot in the US (link here)

CRYPTO: Visa announces new crypto consulting service for merchants and banks (link here)

NEOBANKS: Brazilian fintech Nubank is now publicly listed in the US and Brazil (link here)

NFTs: New DAO Buys Ross Ulbricht's Ethereum NFTs to Help Free Him (link here)

NFTs: UNICEF Launches NFTs on Ethereum to Help Connect Schools to Internet (link here)

NFTs: Lucien Smith is releasing SEEDS, a collection of 10,000 NFTs living on the Ethereum blockchain (link here)

Blueprint Updates

Discussion: What Goldman's institutional financial cloud on Amazon means for embedded finance (link here)

Can Goldman leverage their brand to disrupt the embedded finance market and how could they transition to a Web3 model?

In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

Podcast Conversation: Investing in real estate, crypto, and startups using your retirement account, with Rocket Dollar CEO Henry Yoshida (link here)

In this conversation, we chat with Henry Yoshida – Co-Founder & Chief Executive Officer, Rocket Dollar. Prior to Rocket Dollar, Yoshida was the co-founder of Honest Dollar, a robo-advisor retirement platform that was acquired by Goldman Sachs, as well as a founder of MY Group LLC, a $2.5-billion assets under management investment firm. Henry shares his industry expertise as a speaker at several industry conferences, as well as having been featured or quoted in the Wall Street Journal, TechCrunch, Bloomberg Businessweek, and Financial Times. Henry has a passion for helping people be the best that they can be and contributes as a member in several financial and technology industry organizations. He graduated from The University of Texas at Austin and has an MBA from Cornell University.

More specifically, we touch on Henry’s career at BoA Merrill Lynch, his role at building a multi-billion dollar RIA business, how he started a digital retirement account platform called Honest Dollar which was sold to Goldman Sach’s neobank Marcus, the inception of Rocket Dollar, we talk IRAs and 401ks and how important these are for the current Gen-Z market, and so so much more!

“There was also a very sort of fundamental shift in the way regulators worked with record keepers in the management of these retirement plans. So, this will lead into the story of Honest Dollar, and what I do today and sort of what shaped me and my views and my career that there were hundreds of millions, maybe billions of dollars spent to sort of almost automating retirement plans at the corporate level, which then of course, percolated down to the individual participant. And that was actually the part that I didn't like. And I think that this sort of whole revolution of democratization of investments, DeFi and so forth is really somewhat of a manifestation that the large players have spent a lot of money to try to keep people within these walls, that I think was packaged and marketed as a way to say, "This is beneficial to you because it prevents you from shooting yourself in the foot."”

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

Want to discuss? Stop by our Discord and or reach out here anytime.