Long Take: Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?

Hi Fintech futurists --

This week, we look at:

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Announcements

Want to dive deeper into DeFi? Check out the MetaMask crypto wallet, and in particular its decentralized exchange aggregator feature that allows you to get the best price from Uniswap, AirSwap, and many other DEXes.

Are you a financial institution trying to deploy blockchain-based financial products? ConsenSys Codefi provides the core modules of digital assets, markets, payments, and compliance to stand up any blockchain-based institutional financial application.

For developers of decentralized apps, nothing beats Infura. A secure and stable Ethereum node infrastructure accessible through APIs, the team just launched Infura transactions, which helps builders simplify development related to Ethereum gas costs.

Long Take

Negative space. It is a key approach artists use to figure out how to see the world more accurately.

When looking at something straight on, your mind characterizes the image as a collection of objects. Here's a vase with flowers. Here's a banana, and that's an apple. Here's a table, which is brown. That categorization leads people draw caricatures -- whatever the object is in the mind's eye -- rather than translate the visual information directly into a rendering. Interpretation and stereotype hinder our ability to see the underlying truth.

If instead you look at the negative space, you will see what is not the object. And if you draw everything that is not the object, the remainder is the object itself.

We are now in a narrative world of embedded finance. Here and there, and everywhere, are news about various Developer-first financial products. From large companies like Green Dot, Affirm, and Stripe; to chunky acquisitions like Finicity and Plaid; to growing players like Galileo and DriveWealth, financial APIs are a popular trend with serious venture backing. Get your financing in front of the customer in their world, or so goes the idea.

But let's pause for a moment on the negative space around these companies. And maybe we can learn something new in the process.

Who is Doing the Embedding?

For whom is all this embeddable code?

Let's start with the launch of Stripe Treasury.

The offering is a full on banking, payments, and capital programming environment that connects to Goldman Sachs, Barclays, and Citi. It also pulls on Stipe's own underwriting and payments products. Here's what we can glean about customers.

The website makes multiple references to the word "platform". You can see in the prompt above, the call to action of "embedding financial services in your marketplace or platform." Scrolling down the site to the contact form, we see another categorization of "limited number of platforms that serve US-based businesses." The case study of Shopify is case in point -- the tech platform of Shopify generates an abstracted financial account for businesses that use Shopify to distribute their goods and services. In turn, Stripe is providing that financial infrastructure to Shopify.

What is a platform or marketplace? Hold that thought!

Here is Affirm, the buy-now-pay-later checkout cart. The company is going to be a popular IPO in the US, with an enterprise value up to $10 billion.

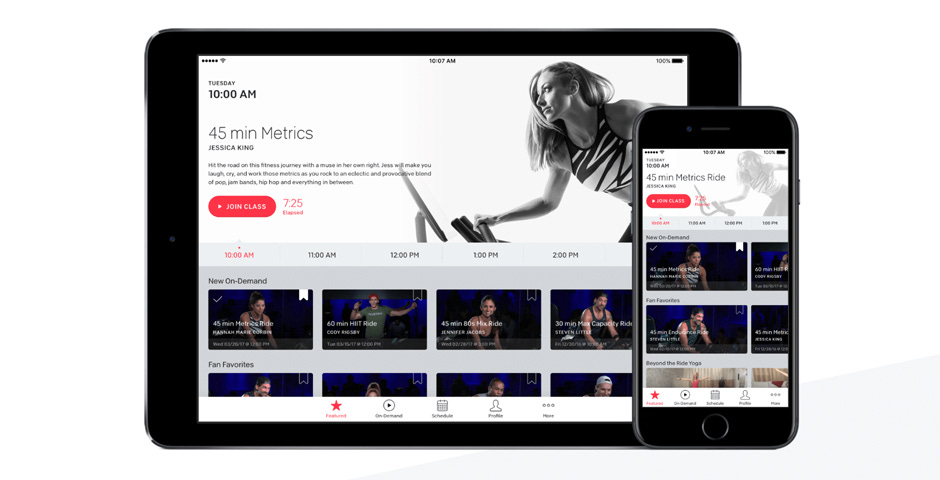

So far so good! The value proposition is an embedded "monthly payments" button inside of a retail mobile experience. There have always been credit options attached to retailers -- think about a Walmart-branded credit card.

But here is that magic word again: platforms. And notice that the platforms are ahead of "brands". The first part of the qualifying journey to sell embedded finance here is to check whether some particular merchant experience is networked correctly, meaning, it uses the right web infrastructure. Affirm wins when it plugs in a technology network as a distributor of its lending product. It is not there to give a loan to some particular business as a one-off decision.

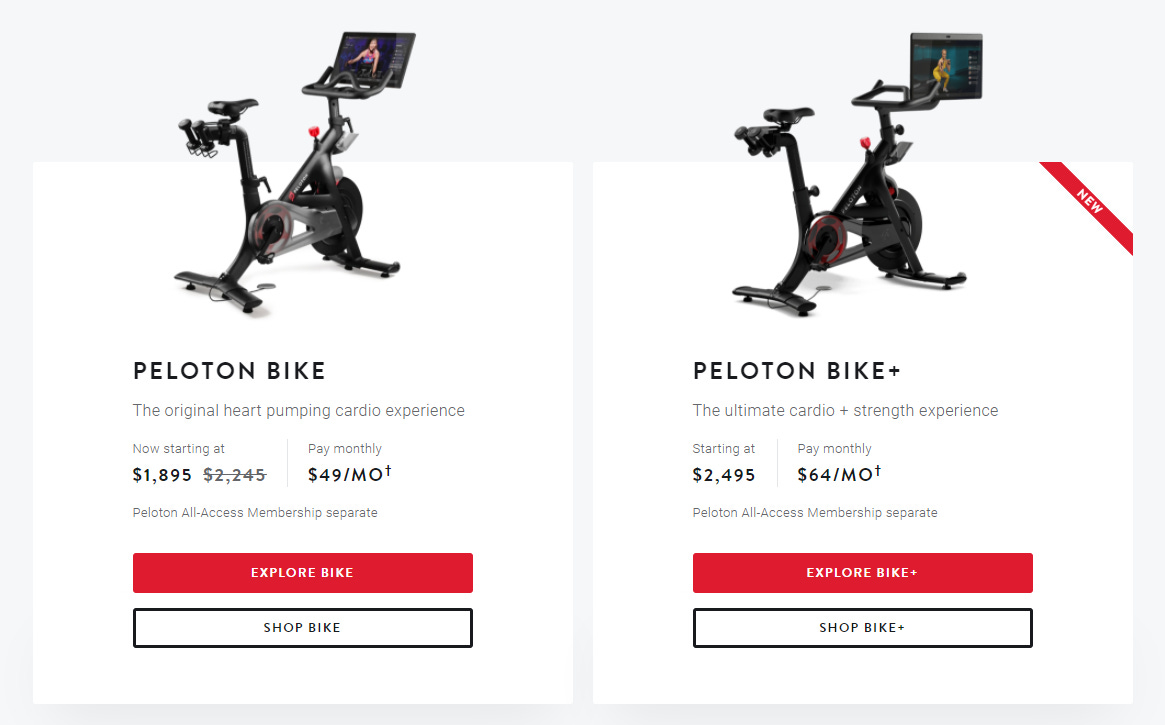

In that context, it is then notable that almost a third of Affirm's revenue comes from financing Peloton bikes -- an $1,895 pleasure. Peloton is a brand, right?

Yes, and No. If all you were getting is the physical object of a bike, why would it be 10x times more expensive than the actual physical object? If you were only getting the bike, why would Peloton's marketing process compare its cost against your total gym cost, and show you pictures of instructors, community, and a video platform that looks suspiciously like YouTube?

Peloton is a networked business which gets positive returns to scale from more users and instructors. It's no Zwift of course, but we can make the gesture of thinking about it as a fitness platform rather than as a seller of hardware.

Let's transition to Green Dot, the original bank powering big tech company bank accounts starting with Apple, and now including Google. There has been a lot of banking-as-a-service focus since PSD2 regulation in Europe, BBVA and Santander's soul searching to grow market share, and a spate of start-ups offering integrated bank accounts. But Green Dot was there at the beginning. What does it sell, and to whom does it sell?

The product targets businesses, and integrates the full banking experience, from money movement, to cards, compliance, and cash deposits. As for the target customer, we see Uber, Apple, Stash, Wealthfront, Turbotax, and a massive retailer. Uber and Apple are platforms: drivers/riders, users/applications. Stash, Wealthfront, and Turbotax offer point solutions (i.e., solve particular use cases) to customers. But again, note that Green Dot is selling into these user aggregators to tap into their marketing footprint. You could think of them as modern financial brands. As for the retailer, that's a classic marketplace.

We can go on with very many examples. Let's end with an investments API, powered by broker/dealer DriveWealth.

The company serves Fintechs, Registered B/Ds, RIAs, financial incumbents, global brands, and HSA providers. The main services is about offering fractional, API-enabled trading of securities. So if you are Revolut, or MoneyLion and want to add investment capability to compete with Robinhood, DriveWealth is your solution. If you had asked us about these customer segments 5 years ago, we would have flagged RIAs and broker-dealers as obvious choices.

The emergence of Fintechs as user aggregators has also pushed traditional financial institutions into a competitive dynamic. We think what DriveWealth targets here is not global bundled banks, but the 10,000 smaller local banks and credit unions all across the US. But most interesting to us is the Brand segment. There is some weird positioning about helping the brand reward its customers with ownership of brand stock. A sharper answer would be to echo the Affirm and Stripe language, and focus on the downstream customers of the brand. But you can already see some edges of that in the highlight of credit and payments products.

As we said in the beginning, embedded finance is here and there, and everywhere.

Core Takeaway for the Sector

We looked at the customer pitches of embedded finance companies. Whom do they want to persuade to purchase their APIs? Which developers are they trying to hook into reading their product documentation?

By looking at the negative space -- i.e., these customer pitches -- we can figure out what these companies really are. And here is the full picture.

The ideal customer is a modern platform or marketpace, like Shopify, Amazon, Google, or Ant Financial. The story of eBay and PayPal comes to mind, with the latter growing up on the economic activity of the former. Find a growth vector for digital commerce, and power up integrated financial products that make that growth possible.

One year, that growth may come from eBay. Another year, it may come from Peloton. Therefore, your strategy is to integrate into a broad portfolio of all the technology options that businesses have for selling to their customers. This is why plugging into networks is more valuable than plugging into Brands. But if you do plug into brands, make sure they are networked. And if they are not networked (e.g., Wealthfront), make sure they are at least spending deeply on growth.

End of the day, embedded finance is middleware in the distribution value chain. As we see in the diagram above, the capital itself still sits in licensed and regulated entities. The balance sheet of the financial firm matters. That balance sheet itself sits on top of technology providers that enable the manufacturing process, such as core banking or trade order management software. The API provider then aggregates capital providers and intermediates them into the digital economy. It is easier for Goldman to strike a deal with Stripe than with each of Stripe's customers.

This specialization will lead to better B2C customer experiences. People will have more options at checkout, and merchants will have more options for their own financial management. But it is also a re-ordering of the commercial order. The largest financial API companies will be as sticky as the core banking systems deep underneath. Furthermore, as we replace the traditional financial accounts with blockchain-based finance, the traditional capital providers may fall away entirely. The connectors into commercial activity however, will remain.

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.