Blueprint: Kids go neobanking with GoHenry acquiring Pixpay; Flutterwave fraud allegations in Kenya; Aave's multichain stablecoin proposal

Hi Fintech Futurists —

You are the best, today’s agenda below.

DEFI: DeFi Giant Aave Wants to Launch Its Own Stablecoin

PAYTECH: Flutterwave denies money laundering and fraud allegations following accounts freeze by Kenyan court

NEOBANK: GoHenry acquires French fintech Pixpay to drive European expansion

Long Take: Can balanced regulation for the crypto markets emerge after crash? (link here)

Podcast Conversation: Powering a BNPL platform with a global lender network, with ChargeAfter CEO Meidad Sharon (link here)

To go deeper into these topics, including a weekly Long Take, a Web3 digest, and annotated podcast transcripts, click subscribe and explore the additional benefits that come with a premium membership.

Short Takes

DEFI: DeFi Giant Aave Wants to Launch Its Own Stablecoin (link here)

Aave has launched an ARC (Aave Request for Comments) governance proposal that could lead to the creation of Aave’s own collateral-backed stablecoin, GHO, if approved by the community. Aave is a leading DeFi lending protocol, with $6.6B in total value locked (i.e., collateral) and about $1B of marketcap in the native AAVE token. The protocol allows users to lend or borrow crypto without centralised intermediaries through its platform.

GHO will be a collateral-backed stablecoin pegged to USD. It works by allowing users to mint GHO against their supplied collateral at a specified collateral ratio, backing it by a diversified set of crypto assets based on what users have supplied as collateral. GHO is also burnt when a user repays a borrow position or is liquidated. All interest payments accrued by minters will go straight to the AaveDAO treasury.

Aave are also introducing the idea of Facilitators — a protocol or entity that is able to trustlessly generate and burn GHO. Facilitators will need to be approved by Aave governance and may take up different strategies for the generation and burn of GHO, with the Aave protocol acting as the original Facilitator.

Here are two notable features. First, GHO can be distributed across networks using Aave v3 portals, which are approved bridges on different chains. You can think of this as having bank accounts in multiple banks and multiple countries, per the Transferwise model, and just balancing assets between them.

Another novel feature is that users staking AAVE for the safety module will be able to mint GHO at a discount, which incentivises users to stake — see this spreadsheet where you can look into the GHO borrow interest rate discount. If the initial ARC proposal passes, a recommended starting interest and discount rate will be proposed, both of which are subject to change via governance.

There is well deserved stigma in the market currently against stablecoins. But this model looks quite a bit like Maker’s DAI to us, which has been resilient. We also see GHO leveraging the multi-chain infrastructure to take a share of stablecoin volume on L2s. The tokenomics flow back to the Aave treasury, which is both a clever design as well as a potentially risky bundling. End of the day, issuing stablecoins is an attempt to reintroduce more leverage into the system.

PAYTECH: Flutterwave denies money laundering and fraud allegations following accounts freeze by Kenyan court (link here)

Flutterwave, an institutional-focused cross-border payment fintech, has denied involvement in the fraud and money laundering claims put to it by Kenya’s Assets Recovery Agency (KARA). Seven firms have been suspected as acting as conduits for card fraud in banks, hidden in the guise of merchant services, for a total of $52MM. The funds were linked to 62 accounts, which had been blocked by the country’s pinnacle court, that had activity within Flutterwave. Additionally, KARA is accusing Flutterwave of operating in Kenya without a valid license from the Central Bank of Kenya.

The accusation details that accounts on Flutterwave received funds from specific foreign entities. The funds were then transferred to accounts belonging to six companies, rather than as settlement to merchants. There is reportedly no evidence that the merchants received settlements. All accusations are being refuted by Flutterwave, which commenced its own investigation, with records being provided to KARA to prove their innocence. The fintech’s AML practices and operations have been audited by a Big Four firm.

Flutterwave works with businesses to facilitate cross-border payments using its APIs, and helps non-African companies expand their operations across the continent. Clients include Uber, Flywire, and Booking.com, and Flutterwave recently became Africa’s most valuable startup after raising $250MM at a $3B valuation. There’s a lesson here about using shared infrastructure; if found guilty, Flutterwave is potentially damaging operations of their customers that need access to markets.

Reminder that all large banks face significant money laundering and fraud challenges, and if anything, this is a sign of scale.

BANKING: GoHenry acquires French fintech Pixpay to drive European expansion (link here)

GoHenry, a UK-based provider of prepaid debit cards and financial education for children has acquired Pixpay, their French counterpart. Launched in 2012 to allow parents to allocate and control their children’s bank accounts, with saving insights in-app, GoHenry expanded into the US in 2018 and grew to 2MM+ users and $42MM in revenue between the two markets. Pixpay focuses on kids from ten to eighteen and has 200,000 users across France and Spain, with plans to move into Italy and Germany.

Consumer fintech for kids is still quite … a young sector in Europe, even though in the US teen-banking fintech Step raised $100MM in funding. GoHenry raised $40MM in December 2020, and has been looking for a way to expand into Europe. The acquisition of Pixpay, for an undisclosed amount, takes them there. At this time, the two companies will not be integrated, with Pixpay retaining its branding, leadership and HQ.

As financial education becomes increasingly commonplace and digital finance is more adopted as a channel, firms like GoHenry will growing in popularity. Unfortunately it is hard to be profitable when serving this demoraphic, if your business model is based on AUM or deposits or trading. But subscription based services have the potential to thrive if they reach scale, or if they retain the relationship as the clients age and mature.

Long Take: Can balanced regulation for the crypto markets emerge after crash? (link here)

We look into the regulatory torrents swirling around the current market cycle, and how it has created opportunities for regulators to focus on stablecoins, yields, KYC/AML, and related topics.

We spend some time understanding the words of “democratization” and “decentralization” to establish the values of the space as something to preserve, memetic value aside. We then try to parse some elements of MiCA against what we see as priorities in making the markets better.

Powering a BNPL platform with a global lender network, with ChargeAfter CEO Meidad Sharon (link here)

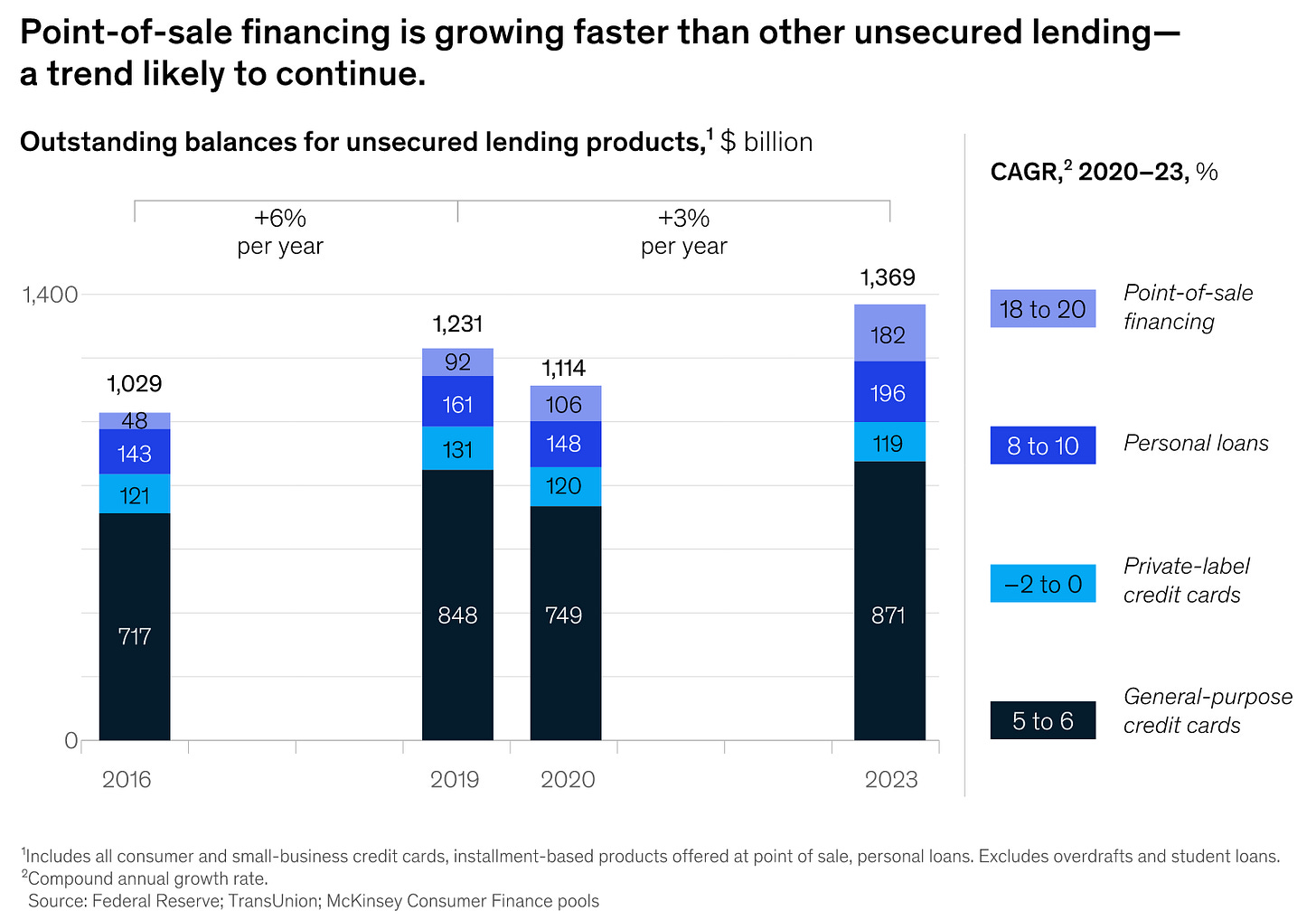

In this conversation, we chat with Meidad Sharon, the CEO and founder of the award-winning retail finance SaaS network platform ChargeAfter, the first global network to provide a complete solution to Point-of-Sale financing from multiple lenders.

Meidad is a long-time high-tech industry veteran, with over 15 years of experience scaling global payments and SaaS businesses with a people and customer-first approach. As well as, demonstrating how simple payment processing and fraud prevention solutions can meet complex needs, and lead to maximum profitability and a seamless end-user experience.

Rest of the Best

Here are the rest of the updates hitting radar.

EMBEDDED FINANCE: UK fintech Sonovate secures £165m securitisation deal

FUNDS: Sequoia China raises $9 billion amid hopes crackdown is easing -source

INVESTING: MarketWolf is a trading-first platform for new investors

PAYTECH: a16z leads $6.5M seed round for Adaptive, a construction software and fintech play

PAYTECH: Forever21’s parent company sues Bolt but settles for becoming a shareholder

INSURTECH: Coalition raises $250 million

INSURTECH: 3 Of The Latest Insurance Trends To Keep An Eye Out For

INSURTECH: Orus raises €5 million

INSURTECH: Life raises $120 million

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth newsletter issue, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to the Podcasts with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive convering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Exclusive monthly ‘Greatest Hits’ reports with an overview of various Fintech and Web3 topics to give you a well rounded perspective on a particular issue

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinons of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here any