Blueprint: Nigeria CBDC 13MM wallets; Card networks to acquire $200B volume tech; StellarFi auto-pay improves credit

Don't miss the generative AI deep dive

Hi Fintech Futurists —

Hang in there, today’s agenda below.

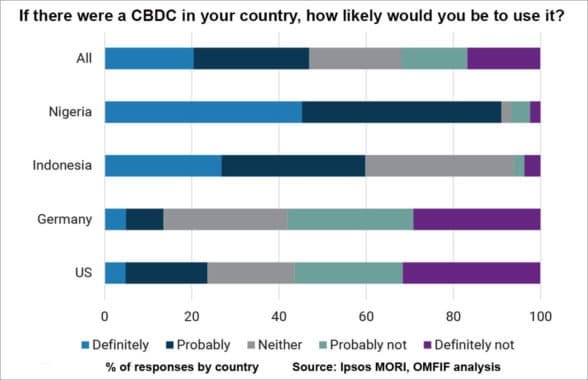

CBDC: Digital Currency Usage Soars in Nigeria on Cash Shortages

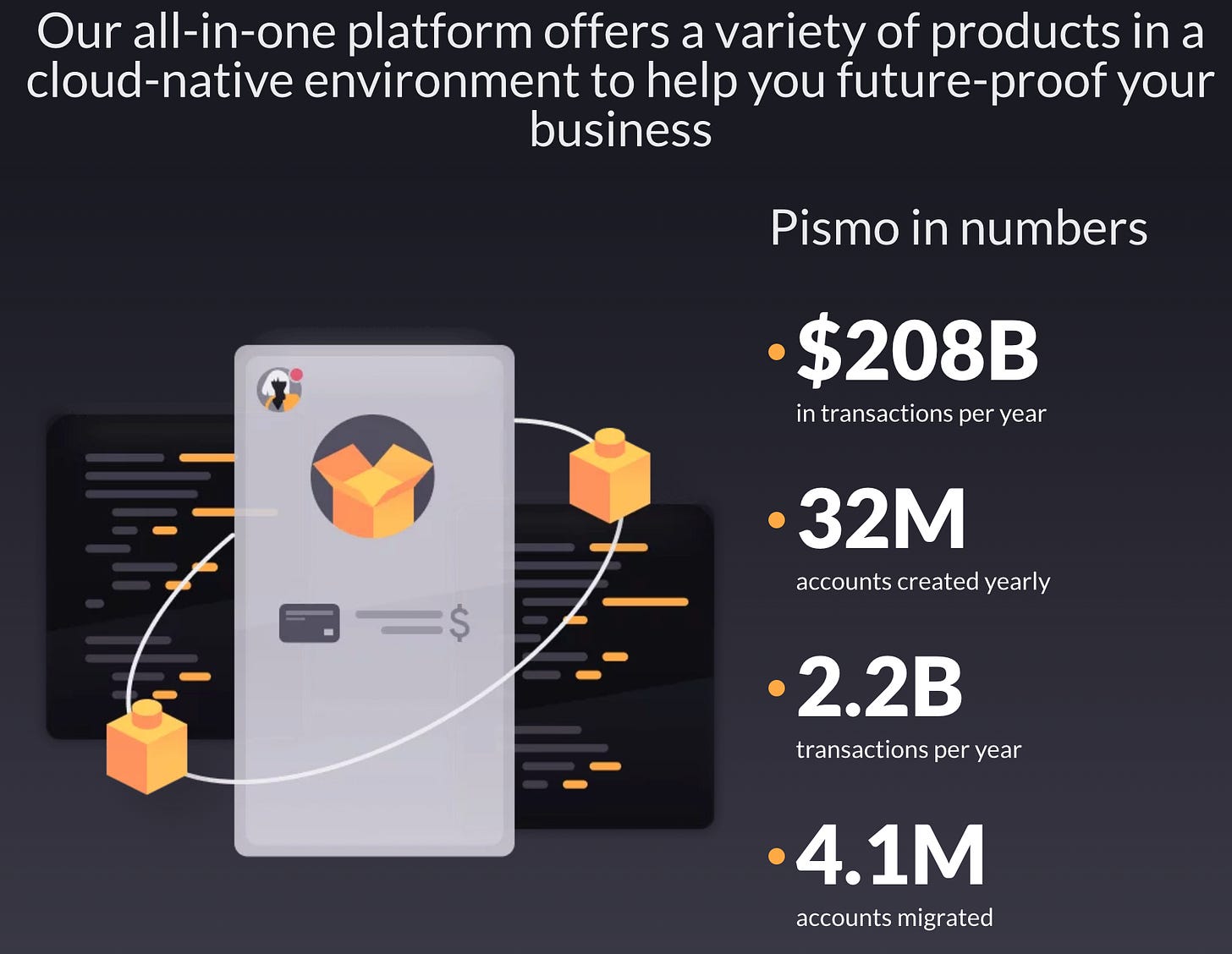

PAYTECH: Mastercard, Visa Are Among Firms in Talks to Buy Fintech Pismo

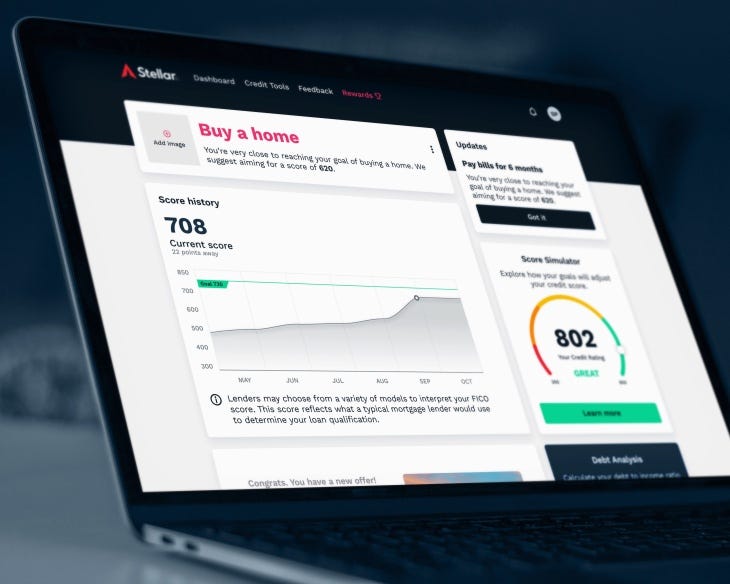

CREDIT: StellarFi lands $15M to help people build credit by paying bills, rent on time

LONG TAKE: The impact of Generative AI in financial services on jobs, investing, and services (link here)

PODCAST CONVERSATION: Building a sovereign, privacy-first, programmable, economic infrastructure, with Anoma Co-Founder Christopher Goes (link here)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Join us at Fintech Nexus USA — we will be there. The event brings together top minds in fintech to cover topics like digital banking, fraud, blockchain, embedded finance, fintech investing, and more. 5,000 attendees will engage in 20,000+ double opt-in meetings this May 10-11 in NYC. It’s the can’t-miss event of the year!

👉Use promo code “FinBlue” and get 15% off today

Short Takes

CBDC: Digital Currency Usage Soars in Nigeria on Cash Shortages (link here)

The adoption of eNaira, the digital version of Naira issued by the Nigerian central bank, is on the rise — jumping 12x to 13 million wallets since October. The value transacted is up 63% to 22 billion Naira ($48MM) in 2022 as well, though average transaction volume per person is relatively low at around $4.00. For context, there are 213 million people in Nigeria, suggesting that 6% of the population is now utilising the CBDC.

It is rare we see real data around national digital currencies, so what are the reasons for adoption?

Nigeria’s recent demonetisation policy led to a shortage of bank notes, and the central bank has been attempting to replace old bank notes with new ones in the hopes of curbing inflation and removing excess liquidity. This has led to a cash shortage in the latter end of the year, heightened by the high usage of cash in the country — 90% of transactions in Nigeria are made with cash. Digital cash gives the central bank tighter control over the economic levers in the country.

Currently only 3.4B of the 10B eNaira minted so far is in circulation. Adoption has been boosted by the demonetisation policy, and the government’s use of eNaira in welfare programs, contributing to 4 million of the new e-wallets. There is large growth ahead, given that Nigeria will be the third most populous country in the world by 2050, and it is an early early adopter of CBDCs.

Our view is that (1) CBDCs offer governments a way to digitize and control their currency, but come at the expense of the banking system and the ability of banks to lend. In some places, especially where financial services infrastructure is less developed, this is a cost worth paying. And, (2) distributing CBDC through welfare programs is essentially a mandatory mechanism for adoption. We hope these instruments will eventually be usable across Web3.

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

PAYTECH: Mastercard, Visa Are Among Firms in Talks to Buy Fintech Pismo (link here)

Payments networks Visa and Mastercard are looking at acquiring Pismo, a cloud-based payment and banking platform based in Sao Paulo. Goldman Sachs is working with Pismo on the deal, with a target valuation of around $1B. Pismo has already attracted $100MM+ in investments from SoftBank Latin America Fund, Amazon, Falabella Ventures and Redpoint Ventures, and has captured clients like Itau Unibanco and Banco BTG Pactual.

Pismo provides a range of solutions across core banking, corporate banking, card issuing, digital wallets and digital lending. The products are hosted on the cloud and packaged via APIs to help banks, fintechs, and marketplaces. The platform can scale, seeing $208B in volume, 32MM accounts created, and 2.2B transactions per year. Note that a $1B exit for 30 to 100MM accounts would imply $10-30 in enterprise value per account for an underlying banking platform — which seems fairly realistic, if perhaps a bit expensive.

The card networks always want to expand geographically, bolster product functionality, and deepen ties with its customer banks. To that end, owning more of the technology network that connects banks and cards in Latin America seems consistent with strategy.

👑Related Coverage👑

CREDIT: StellarFi lands $15M to help people build credit by paying bills, rent on time (link here)

Austin-based StellarFi closed a $15MM Series A round, bringing total funding to $22MM, led by Acrew Capital and joined by all seed investors. StellarFi helps people improve their credit score without taking on debt. It does this by charging a subscription to users — either $4.99 or $9.99 — to manage their recurring payments and bills. StellarFi then ensures that bills are paid on time, and reports the on-time payments to the top four credit bureaus (i.e., Experian, TransUnion, Innovis and Equifax).

By doing this, the company is able to serve customers without a credit check, deposits, or any interest. Users have an average credit score of 580 upon signing up, and on average increase their scores by 26 points in the first month. The next step is to develop a marketplace that aggregates lenders for its customer base, as part of a lead generation business model.

This is a simple solution, effective in its reporting directly to all four of the top credit bureaus. However, companies like Experian already do have native similar products with Experian Boost, where users can get credit for paying rent on time.

Further, we are somewhat skeptical about the subscription revenue and the lending marketplace, as both are subject to some of the negative dynamics seen by companies that have been trying to target this space for year. For a detailed dive on how difficult it is to dig out of the hole, check out Jason Mikula’s take on Dave and MoneyLion below:

👑Related Coverage👑

Hype vs. Reality: The impact of Generative AI in financial services on jobs, investing, and services (link here)

In this report published for Premium Fintech Blueprint subscribers, we look at the hype and realities of Generative AI as applied to financial services and try to make sense of this emerging world.

We looked at:

(1) whether employment is really in danger or whether we should expect productivity gains,

(2) the role of chatbots and natural language engines relative to human relationships, and

(3) potential implementations in the capital markets.

Podcast Conversation: Building a sovereign, privacy-first, programmable, economic infrastructure, with Anoma Co-Founder Christopher Goes (link here)

In this conversation, we chat with Christopher Goes - the Co-Founder of the Anoma Project, a member of the Anoma Foundation Council, and Research & Development Lead at Heliax.

He is also Co-Founder of the proof-of-stake validator Cryptium Labs and the blockchain R&D company Metastate, and formerly led on the design and development of the Inter-Blockchain Communication Protocol (IBC) at Tendermint. He switched to designing distributed ledger technology by building Zchain, one of the most used explorers for ZCash and the Wyvern DEX protocol which powers NFT marketplaces like OpenSea.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH - Advent launches sale of French biometrics firm IDEMIA -report

PAYTECH - Equals Group expands into Europe through Oonex acquisition

BANKING - Postal Bank Gains After China Mobile Buys $6.5 Billion Stake

BANKING - StanChart Sells Jordan Unit to Arab Jordan Investment Bank

INFRASTRUCTURE - United Fintech splits Cobalt into separate FX and digital asset ventures

AI - Oscilar emerges from stealth to fight transactions fraud with AI

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.