Blueprint: Silicon Valley Bank deposits including USDC are saved, equity wiped

Also Signature Bank, Silvergate, and understanding the math

Hi Fintech Futurists —

Still hanging in there? What a weekend, week, month, year, decade.

We are going to spend the Wednesday long take digging into the SVB failure and the follow on impact on Signature (R.I.P.) and USDC (ugh), and who knows what else will float up in the next two days.

Today we’ll give a preview of some of our thinking and hit up on a couple of other points that floated up to the radar.

BANKING: Silicon Valley Bank and the black swan of interest rates and digitally connected customers

LONG TAKE: Why is Silvergate failing in the best time for banks? (link here)

PODCAST CONVERSATION: Reinventing the credit card as a Fintech super app (link here)

FINANCING: Banyan wants to unlock financing for a (more) sustainable future (link here)

REST OF THE BEST

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Hi everyone — next week, Lex will be at Fintech Meetup in Las Vegas for the conference. If you are interested in connecting there for any reason, including to vent about banking, shoot us a note here.

Quick Take

BANKING: Silicon Valley Bank and the black swan of interest rates and digitally connected customers

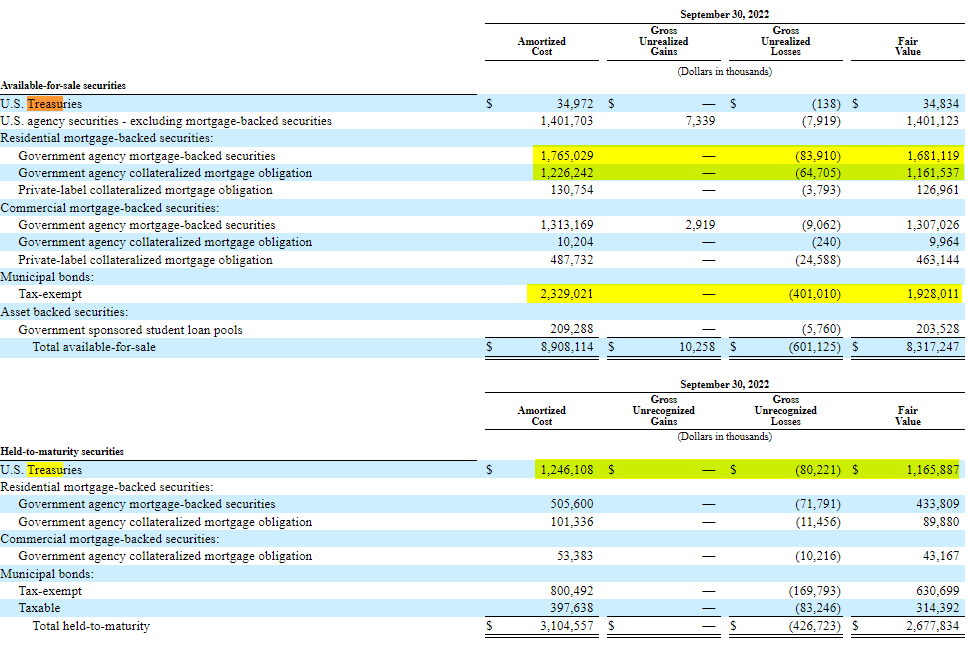

Last week we covered the failure of Silvergate Bank, and how its balance sheet got crushed by exposure to interest rate increases, while simultaneously needing to cash out deposits because its customers, i.e., crypto companies, were all correlated and many were in distress. Here’s Silvergate’s balance sheet — even in September of last year you can see the large difference between book and mark-to-market value.

How quaint this problem seems now, one weekend after.

The United States has seen and, so far, seems to have averted a full blown banking crisis. The casualties are Silicon Valley Bank and Signature Bank, both now taken over the government running a temporary bridge bank to give depositors back their assets with a government backstop. Like Silvergate, SVB had a lot of mark-to-market losses hiding behind accounting practices that were incompatible(?) with a rush of customers trying to withdraw all at once. Unlike Silvergate, SVB seems to have had an appetite for mortgage backed securities.

Here’s the accounting problem — the available for sale securities don’t look so bad:

But the “held to maturity securities” are showing a much bigger hole. Remember, the fixed income asset class generally goes down in value when interest rates go up. And interest rates have been cranked up to “fight inflation”.

The net result is that SVB’s management and equity holders are wiped out, while depositors are backstopped. Those leaning more hard libertarian are calling “moral hazard” here, saying depositors should have lost money instead.

We align with Bill Ackman’s view, which weighs the costs and benefits of nuking all these businesses and customers against the precedent of “nationalizing” banking. Guess, what! The USD is already nationalized, we just happen to delegate lending to banks through the fractional reserve system, which seem to crack at the seams.

There’s also a group of people calling out venture investors for trying to get a bailout for their industry, while having called for de-regulation of other industries in order to benefit their portfolio companies. We agree that nobody is special — not tech, not crypto, not investment banks, and not your neighborhood family owned laundromat. But look, let’s be kind to people who were clearly in distress, even if they don’t always display the same empathy for others.

Back to SVB — founded in the 1980s, the bank found its niche serving the burgeoning tech scene in the Bay Area. It underwrote lending to tech companies, collateralized by venture assets, and was able to avoid more stringent regulatory requirements by remaining a regional bank. Note that this underwriting isn’t what caused the problem in the end. The pandemic also ballooned SVB’s assets as tech valuations grew, and made it systemic in places beyond the US, like in the UK and in the crypto ecosystem.

In the UK, SVB had to become a subsidiary bank in its own right after surpassing the threshold of £100MM insured deposits, where deposits had nearly reached £7B, serving up to a half of the UK’s innovation-centric companies.

The bank’s niche exposed them to startups dependent on a close network of venture investors. Less risky companies than Silvergate or Signature were serving, but still, super concentrated. Secondly, the bonds and MBS, which we already covered. Once Silvergate fell, and SVB tried to raise capital to cover their impending hole, the bank was deemed as the next one to go down. VCs told portfolio companies to withdraw quickly and $40B+ in withdrawals was initiated — leading to a bank run which would require SVB to sell its “held to maturity” assets at deep discount to cover.

Some of this was visible to careful observers.

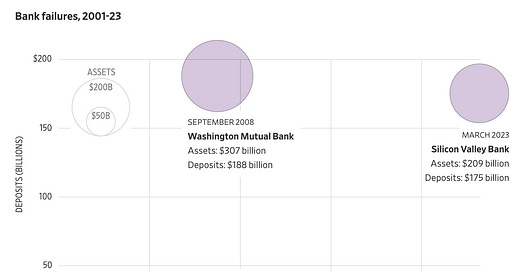

It is worth noting that this is the largest US bank failure since 2008.

So where are we today, on Monday the 13th? The US business has the goverment backstop. In the UK, HSBC bought SVBUK — a balance sheet of £8.8B — for just £1.

But there is also other systemic risk. The stablecoin USDC, of which there is $40B+ of float, was held in part at SVB, with $3.3B getting stuck over the weekend. Signature bank — now in government hands — is also on the list. Reminder that USDC is collateralized by bank deposits, which were represented to be as safe as safe gets.

For the bold-hearted, there was a trading opportunity as USDC de-pegged below $0.90 and then repaired back to par. Follow on effects were also seen everywhere USDC is used as collateral, like DAI.

We will spend more time on trying to pull apart these implications in the Long Take. To be honest, the systemic inter-relationship of this complex system, caused in large part by the nosebleed interest rate increase after more than a decade of free money, has taken many by surprise. Things are unlikely to be completely over.

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

Long Take: Why is Silvergate failing in the best time for banks? (link here)

Let’s review last week’s analysis. What can we learn from the macro and fundamentals about fintechs, banks, and crypto banks to understand what happened?

We looked deeper at Silvergate, whose bonds have been downgraded by Moody’s after the company questioned its ability to continue as a going concern, and Coinbase, Paxos and others pulled out their deposits.

Podcast Conversation: Reinventing the credit card as a Fintech super app (link here)

In this conversation, we chat with Siddharth Batra, Co-founder at X1 Card.

Sid was previously a Director of Engineering at Twitter, responsible for leading the group of teams working on Advertiser & User experience products through which Twitter Ads makes $2+ billion in revenue. Sid has also been a Fellow at Lightspeed Venture Partners, and a Co-Founder at Mine, a web and mobile application that enables people to manage, visualize and share their purchase history.

Rest of the Best

FINANCING: Banyan wants to unlock financing for a (more) sustainable future (link here)

Banyan has raised $25MM, bringing total funding to $42MM, led by Energize Ventures to streamline the funding process for sustainable initiatives. Sustainable infrastructure is a key focus in our culture, but the financing process is largely manual. That’s true for much of project finance.

Deals within the sustainability space can come from a range of sources, which means there is a need to coordinate investments and due diligence. Banyan hopes to solve this with a purpose-built project finance software, which allows banks, financiers and developers to track and automate finance transactions using a unified system. Savings are purported to be “1,000 hours per loan processed” by digitising the loans, automating data ingestion, risk monitoring, and contractual compliance.

There is a huge amount of funding going into this critical space, and it is a novel workflow to automate. McKinsey estimates a $3.5T investment gap per year in renewable infrastructure to meet net zero targets by 2050. The US recently released the Inflation Reduction Act (IRA), injecting $369B of government money into the sector. Software can makes these investment processes more efficient while measuring impact.

Here are the other updates hitting our radar.

PAYTECH - Aussie paytech Till Payments lands $46m Series D funding

OPEN BANKING - Weavr acquires Comma to bring open banking to embedded finance

INVESTING - ORCA, India’s First One-Stop Platform for Learning, Analyzing, and Investing in Capital Markets, Launched

INSURANCE - Insurify to acquire Compare.com

INVESTING - FinEdge's DiA platform is creating a generation of better investor

WEALTHTECH - Wealthtech Platform Masttro Raises $43 Million From FTV Capital, Citi

WEALTHTECH - Another Year, Another Timetable for UBS-Broadridge’s Promised Wealth Platform

EMBEDDED FINANCE - Synctera raises $15M to help companies launch embedded banking products in Canada

AI - Growfin’s AI-based cash collection SaaS expands further to US and Asia

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.