Blueprint: Solana's crypto phone ambition; SumUp raises $624MM @$8.5B; Ebay enters NFT sector via KnownOrigin acquisition

Hi Fintech Futurists —

You are the best, today’s agenda below.

CRYPTO: Solana is making a crypto phone with help from former Essential engineers (link here)

PAYTECH: SumUp raises $624M at $8.5B valuation, with its payments and business tech now used by 4M SMBs (link here)

NFTs: eBay acquires NFT marketplace KnownOrigin for an undisclosed sum (link here)

LONG TAKE: Learning to notice the shape of Liquidity, and its impact (e.g., stETH, Celsius, 3AC) (link here)

PODCAST: Growing startups through revenue-based funding, with Arc Co-founder Nick Lombardo (link here)

To go deeper into these topics, including a weekly Long Take, a Web3 digest, and annotated podcast transcripts, click subscribe and explore the additional benefits that come with a premium membership.

In partnership with:

Every publishes essays analyzing and explaining new ideas in productivity, strategy, Web3, and the creator economy. It's published by a collective of thoughtful and experienced operators in tech like Li Jin, Nathan Baschez, and Nat Eliason who are dedicated to creating writing that will help you reach your goals and better understand the world.

We are big fans of their writing. Check it our below. 👇👇👇

Short Takes

CRYPTO: Solana is making a crypto phone with help from former Essential engineers (link here)

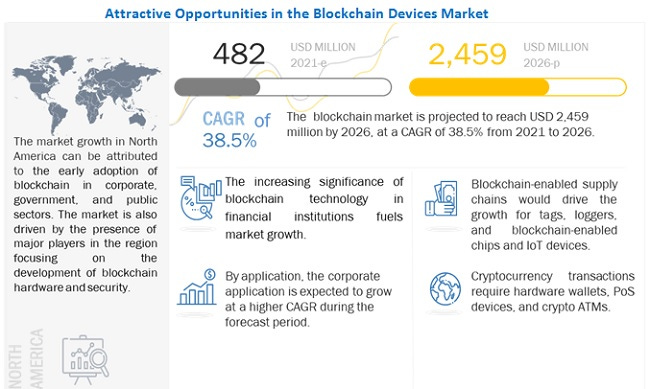

Remember when hardware crypto phones were a thing, and also you could fold them like a pizza? Or the Facebook phone? Us neither. With that context, last week saw Solona and Osom announcing Osom OV1 — rebranded to Solana Saga — a mobile phone designed for dApp performance on the Solana blockchain. Preorders are now available for $1,000, and the phone is expected to ship in the first quarter of 2023. The device features 512GB storage, 12GB RAM, a 50-megapixel camera, and the latest Snapdragon 8 Plug Gen 1 chip.

Solana now has over $3B in total value locked (TVL) on its dapps, steadily moving towards Ethereum and its EVM compatible brethren, sitting on $49B TVL. It recently overtook Ethereum for daily NFT sales volumes, and its NFT marketplace, Magic Eden, raised $130MM last week. Magic Eden, along with crypto wallet Phantom and crypto exchange Orca, have all partnered with the effort, setting a chassis for integration with the main applications of the blockchain.

We do like the push from Solana to make Web3 more accessible and hardware is absolutely part of that push because it simplifies key management. But we look back at HTC's Exodus phone, as well as efforts from the likes of Samsung and Sirin Labs, that hit the market years ago with a focus on crypto and had little mainstream success. Since then dapps have come a long way, establishing usage patterns outside the core hardware wallet, and Saga may provide a more useful offering than previous handsets. But if this is successful, we expect Apple and Google to blitz into Web3 to behead a competitor.

Another way to think about it is whether a Web3 OS is yet ready to take on the Web2 OS (i.e., iOS). If the totality of Web3 functionality outcompetes the regular phone, then there’s a shot for a new device in the home. If not, then the software should just be integrated into the Web2 OS for now, unti that is the case. The end point is the same no matter who builds it.

PAYTECH: SumUp raises $624M at $8.5B valuation, with its payments and business tech now used by 4M SMBs (link here)

SumUp, the SMB point of sale paytech, raised $624MM at a $8.5B valuation, half in equity and half in debt, in a round led by Bain Capital Tech Opportunities. The company has now raised €1.5B over the past 10 years, with the majority of this being in debt. That in turn suggests they have cashflow.

Once a hardware Square competitor solely offering dongles to transform smartphones into payment terminals, SumUp has sice expanded its offering to counter the effects of the pandemic on its core product — in-store payments. Acquisitions include the likes of Payleven (a "Square clone"), Tiller, and Fiverstars, a customer loyalty startup.

This has turned the fintech become a SMB fintech consolidator, with circa 4 million SMB clients across 35 markets. About 10% of these businesses are using SumUp's business banking service, also making it one of the biggest SMB-focused neobank distributors on the market. Revenue is up 60% annually over the past two years, with PoS payments still comprising the majority, but the other streams becoming meaningful for diversification. They are targeting a market segment and their broader needs, not just financial products, and this is reflected in adoption and growth.

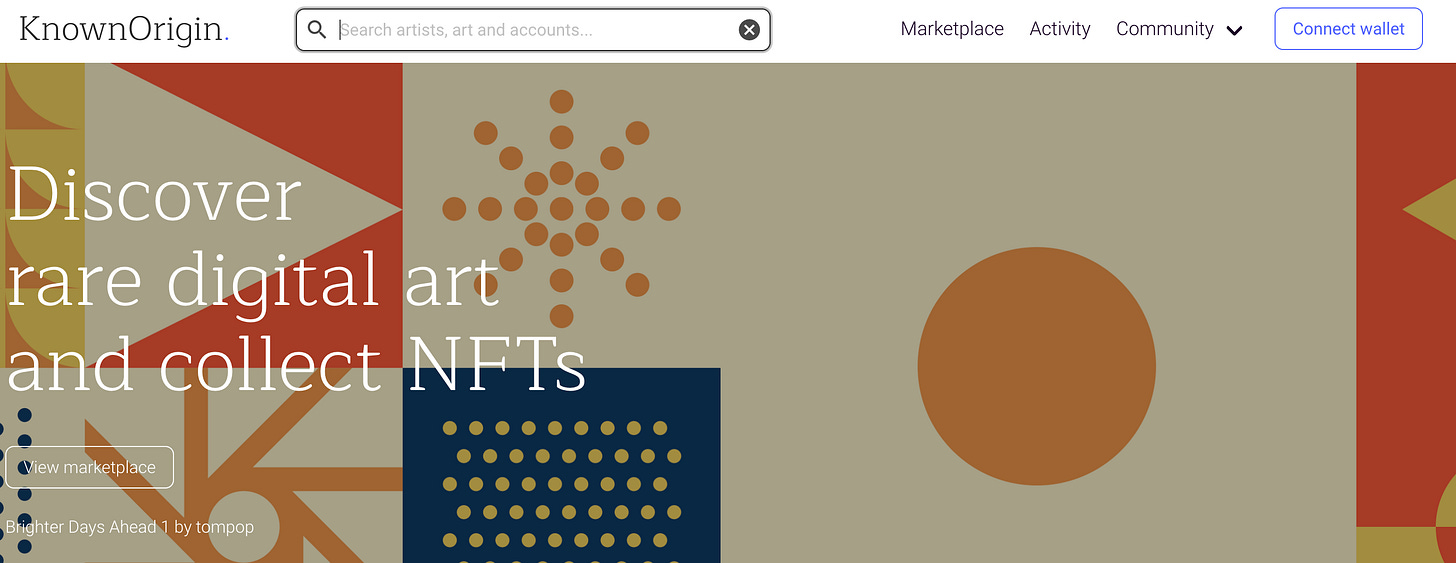

NFTs: eBay acquires NFT marketplace KnownOrigin for an undisclosed sum (link here)

Ebay has acquired NFT marketplace KnownOrigin for an undisclosed amount. You could even say … for an unknown amount! Ebay will be acquiring the entire company, including IP and team, with the three co-founders joining the firm.

KnownOrigin provides a platform for artists and creators to sell and collect NFTs, and is 12th largest NFT marketplace by trading volume, with $8MM in all-time trading volume. Those numbers are a rounding error compared to OpenSea's $30B in volume since inception (network effects!), but the move is not about revenue. Rather, it is an inexpensive way for Ebay to expand into NFTs and acquire the technology needed to move quickly.

This isn't Ebay's first foray into NFTs. Last month Ebay launched a collection of NFTs alongside OneOf, a "green" NFT platform. The "Genesis" NFT collection is made up of 3D NFTs of animated iconic athletes from Sports Illustrated covers. Prices range from $10 to $1,500 and over 2.9k items have been sold so far. We interpret this as Ebay testing the waters of NFTs, although the collection has largely gone under the radar.

Will Ebay actually rival OpenSea, LooksRare, and Magic Eden? We anticipate there will be push back from Web3 natives for using a traditional Web2 company, and there is not a great deal of evidence of companies making the jump from one generation of platform shifts to another. That said, perhaps there is a new wave of Ebay users that could become introduced to Web3 via Ebay, in the way that PayPal offers Bitcoin trading.

But we might have to wait. NFTs have collapsed with the rest of the crypto market — monthly trading volume is $826MM, down from $4.5B in September of last year.

Long Take: The novel political challenges in Solend and MakerDAO from market pressure (link here)

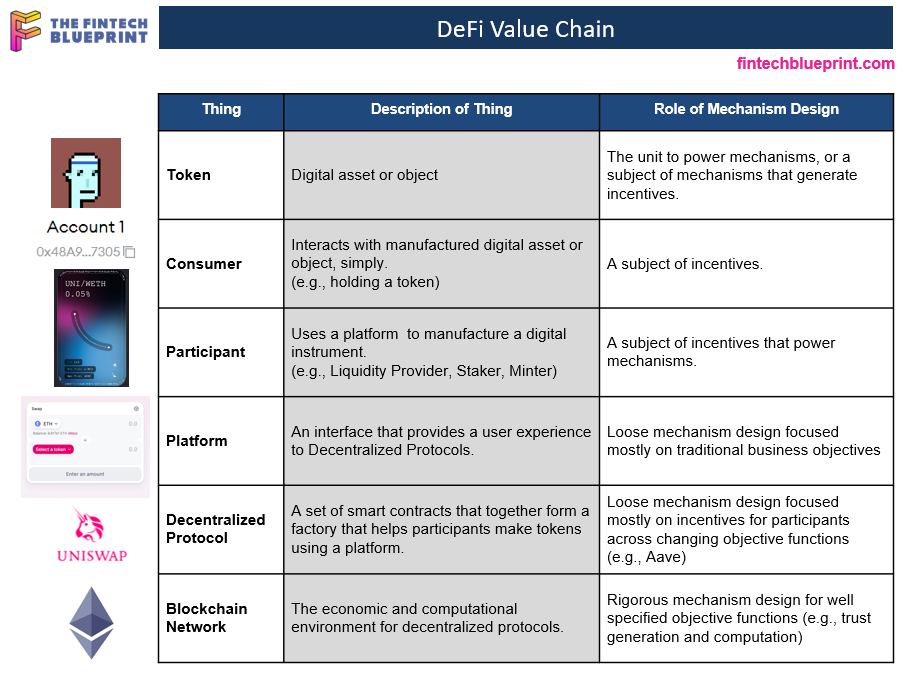

This week we look at political issues emerging within DAOs, and highlight the difference between mechanistic protocols and digital human organizations.

In particular, we discuss Solend and the attempt to seize a large position to prevent a particular market outcome, despite that position having sufficient margin. We also look at the attempt to restructure MakerDAO by its founder into voter parties and functional component DAOs, using delegation of a large economic stake. Both cases provide interest views into voter behavior and governance design issues.

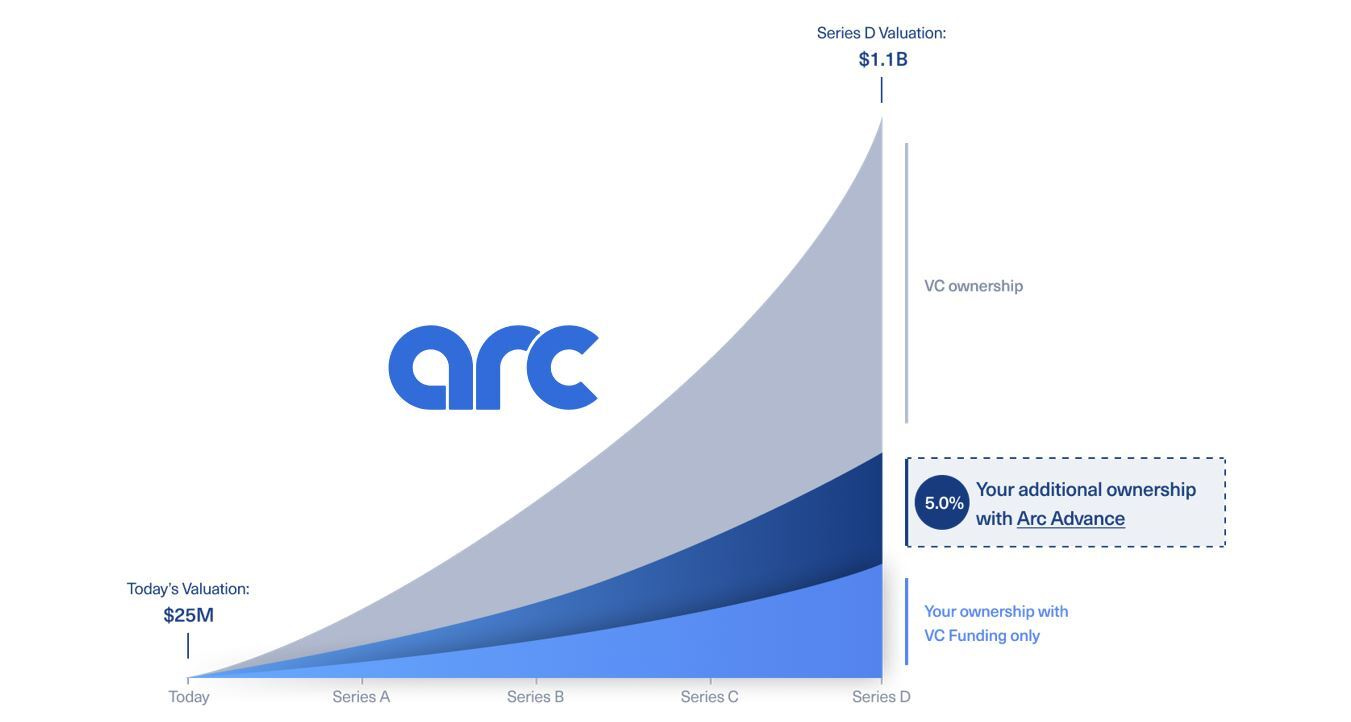

Growing startups through revenue-based funding, with Arc Co-founder Nick Lombardo (link here)

In this conversation, we chat with Nick Lombardo, co-founder of Arc Technologies.

Nick previously worked in private equity in New York where he experienced firsthand the limitations of traditional capital raising. In 2021, Nick and the other co-founders of Arc teamed up with Y Combinator and met with hundreds of software founders in the SF Bay Area and realized that they all shared a common pain point – startup funding is costly and distracting.

Rest of the Best

Here are the rest of the updates hitting radar.

AI: Applied AI: AI-Powered Insights — The Future of Commercial Underwriting

AI: All-Star Roster of Investors Backs Predictive Technology Startup Bento Engine

AR: Apple Quietly Released One of The Most Impressive AR Room-mapping Tools

PAYTECH: Personio raises $200 million

INVESTING: Ledger Investing raises $75 million

INVESTING: Instinet Launches Digital Private Investment Platform

ROBOADVISOR: NerdWallet Signs $120M Deal for On The Barrelhead

LENDING: Ghana’s fintech Fido raises $30M to roll out new products and expand across Africa

INSURTECH: Insurtech startup Wefox seeks funding at more than $5 billion value

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts