Blueprint: UK & Singapore partner on fintech bridge; Arbitrageur attacks Aave after breaking Mango Markets; No-code fintech platform Taktile raises $20MM

Hi Fintech Futurists —

You’ve got this. Weather is bad, but you know what to do.

Today’s agenda below.

INSTITUTIONAL: Agreement with Singapore opens new fintech market for UK businesses (link here)

DEFI: Aave Feeling the Squeeze Even After Failed Attempt by Mango Hacker (link here)

INSURTECH: SaaS Startup Taktile Nets $20M to Expand FinTech Services (link here)

LONG TAKE: The mistakes we made analyzing FTX, and how to correct them (link here)

PODCAST: Adam Nash, Daffy CEO & former Wealthfront CEO, on using technology to improve people's financial lives (link here)

Let’s get into it!

In Partnership

Fintech Meetup Ticket Prices increase Friday at Midnight! Don’t miss these ticket prices! Fintech Meetup is the big new fintech event that delivers measurable ROI. Make connections, see the latest tech, and hear from industry experts! Plus 200+ sponsors, 30,000+ double opt-in meetings, exhibit hall, and more! At the Aria, Las Vegas March 19-22.

Short Takes

INSTITUTIONAL: Agreement with Singapore opens new fintech market for UK businesses (link here)

The UK is forging a new agreement with Singapore to boost trade and innovation between the fintech sectors. The partnership is detailed in a Memorandum of Understanding (MoU) for the UK-Singapore Fintech Bridge, which looks to accelerate investment and growth. These deeper ties build on a co-operation agreement between the FCA and the Monetary Authority of Singapore (MAS) in May 2016. Other areas of recent partnership include a June 2021 MOU on financial services regulatory cooperation, the Digital Economy Agreement in February 2022, and the Free Trade Agreement signed in 2020.

The UK has been particularly susceptible to the deteriorating economic environment and inflation, and has made unforced fiscal mistakes while also being pressed by Brexit’s unfavorable economic realities. Despite this and recent political turmoil, the country’s fintech sector continued to attract investment, with $9.1B in 1H 2022 alone, marking a 24% increase from 1H 2021, and more than the rest of Europe combined. For comparison, European investment in fintech, excluding the UK, is down 2% over the same period. Singapore ranks sixth for fintech investment globally, often see as leading the way for South East Asia.

The deal ensures regular talks between regulators and business, sharing information on emerging trends and working together to boost investment opportunities. The UK currently ranks second in the world for fintech investment, lagging only behind the US with $25B, and with total global investments in 1H 2022 reaching $59B — surprising numbers given valuation pressures, which we attribute to more mature company stage.

We are excited to see bridges being built that align the regulatory patchwork, and allow companies a clear operating framework. The FCA has been hot and cold on the fintech depending on the political priorities of the day, but we admire its principles-led approach in general. Investment pace is going to cool, so anything reducing friction to creativity is a positive.

DEFI: Aave Feeling the Squeeze Even After Failed Attempt by Mango Hacker (link here)

Eisenberg, the arbitrageur behind Solana’s Mango Markets attack last month who managed to make away with over $100MM, has tried taking on Aave. Aave is a much bigger protocol, with $3.6B in value, compared to the approximately $115MM on Mango Markets.

As context, Eisenberg and team managed to pull $114MM from Mango Markets by exploiting an oracle into inflating the value of a token by threefold. This allowed them to obtain three times the collateral, and withdraw assets. The entire thing overwhelmed the insurance fund, and was done “transparently” in that Eisenberg admitted to the manipulation and described its mechanics. The DAO subsequently voted to let him keep $47MM, if he returned the other $67MM — enough to stop Mango from going insolvent.

Interestingly, 44% of people polled thought Eisenberg’s actions were justified, under the rationale that “code is law”; the arbitrageur only performed actions allowed by the protocol’s code. However, to us, intent matters — attempting to break the thing in a black-hat way at the expense of other market participants is market manipulation, which is pretty illegal even if you are just playing around with market structure. That market participants revere a very clever manipulator says more about the participants than about the actions themselves.

As it relates to Aave, Eisenberg was not successful, but did injure the protocol. Eisenberg took a loan for $40MM denominated in CRV on Aave, with $50MM in USDC as collateral. He then sold the CRV token on an exchange, and used the proceeds to borrow more CRV, continuously repeating the cycle until he had a large short position on CRV. The goal was to liquidate Curve founder Michael Egorov by pushing the CRV price below $0.29, given Egorov has a $48MM CRV loan on Aave. Egorov managed to avoid this by topping a large amount of collateral.

All in, Eisenberg lost $10MM and Aave was left with $1.6MM in bad debt. While the attack was not successful, it *has* prompted the Aave community to put forward a range of proposals to increase the protocol’s financial stability, including implementing six token freezes and adjusting the cap on how much users can borrow. These financial game attacks are expensive learning lessons, but we hope the patterns discovered become woven into the fabric of DeFi market infrastructure.

Interested in Sponsorship?

To learn more about how to support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

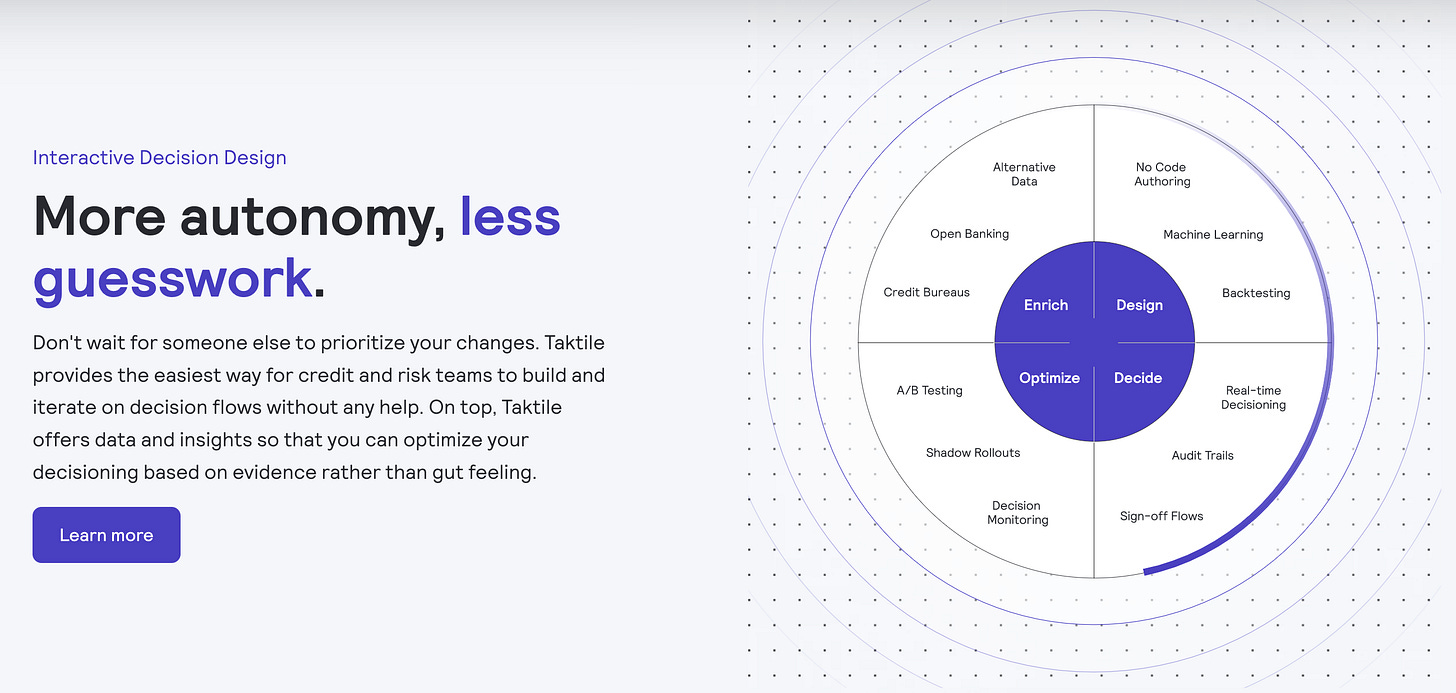

INSURTECH: SaaS Startup Taktile Nets $20M to Expand FinTech Services (link here)

NY-based Taktile raised $20MM in Series A funding, with Index Ventures and Tiger Global leading the round, and total funds raised at $25MM. Taktile works with fintechs in insurance and lending to help them automate decision-making processes with regards to underwriting customers.

Tactile offers a no-code interface that non-technical employees can use to evaluate and adjust decision flows and underwriting criteria. The platform can back-test changes and analyse impact, allowing risk-management professionals to simulate different frameworks before implementing them in code.

The prior alternative, in the example of a customer applying for a credit line, is a hard-coded rule-set built into an application — this makes it difficult to adjust without constant developer support. Taktile instead allows senior decision makers, e.g., a company’s head of risk, to be able to “design, evaluate and deploy decision flows”.

Privacy concerns can be managed by hosting the algorithms in the country of choice for a particular financial institutions, with data being processed locally, to ensure compliance with regulation. Taktile also provides off-the-shelf data integrations and various predictive models within their system. The fintech has seen 4x growth this year.

We like the application of no code tools to the hard parts of manufacturing financial products.

Long Take: The mistakes we made analyzing FTX, and how to correct them (link here)

We attempt to diagnose the mistakes made in thinking about FTX by the industry and ourselves. How was everyone tricked into such a disastrous opinion? What made investors drop real diligence and write enormous checks into the company?

We talk about the distinction between public and private information, as well as confirmation bias and the traps we all fall into confusing the map for the territory. Additionally, we should the difficulty of diagnosis specific outcomes arising out of complexity, even when you know the component pieces.

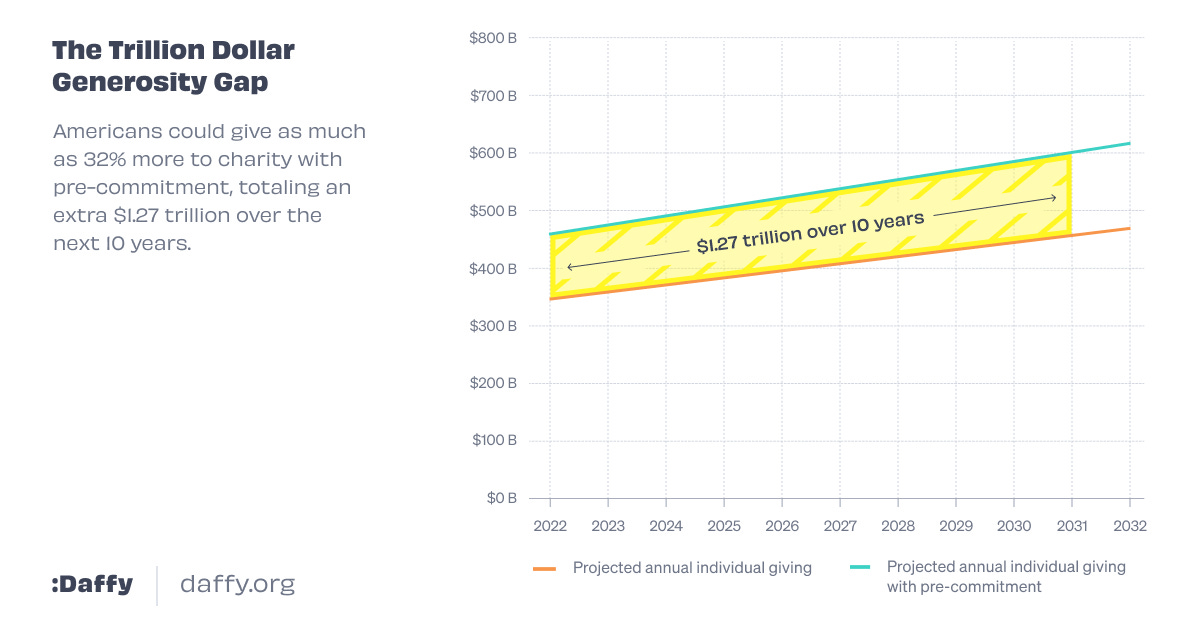

Podcast Conversation: Adam Nash, Daffy CEO & former Wealthfront CEO, on using technology to improve people's financial lives (link here)

In this conversation, we chat with Adam Nash, the co-founder & CEO of Daffy – a new fintech platform focused on charitable giving.

Adam has served as an executive, angel investor, and advisor to some of the most successful technology companies to come out of Silicon Valley. He is currently on the Board of Directors for Acorns, the country’s fastest-growing financial wellness system, and Shift Technologies (Ticker: SFT).

Rest of the Best

Here are the rest of the updates hitting radar.

NEOBANK: ClearBank becomes latest UK fintech to turn a profit

NEOBANK: Wise issues first eco card

OPEN BANKING: Tink launches Balance Check for smoother direct debts

INSURTECH: Airbnb improves insurance offering for hosts

INSURTECH: Rhino to acquire Deposify

INVESTING: Snappy Kraken Expands Convos Texting Platform to Broker/Dealers

VR: Virtual reality investment doubled in China in 2021 as Beijing boosts support, government says

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions