Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Adam Nash, the co-founder & CEO of Daffy – a new fintech platform focused on charitable giving. Adam has served as an executive, angel investor, and advisor to some of the most successful technology companies to come out of Silicon Valley. He is currently on the Board of Directors for Acorns, the country’s fastest-growing financial wellness system, and Shift Technologies (Ticker: SFT).

Adam has previously served as President & CEO of Wealthfront. He has held executive and technical roles at Dropbox, LinkedIn, eBay, and Apple. Adam also serves as an Adjunct Lecturer at Stanford University, where he teaches “Personal Finance for Engineers.” As an angel investor, Nash is well known for being an early investor in Firebase (sold to Google), Opendoor (Ticker: OPEN), Figma, Gusto, and over 90 other startups. Adam holds BS and MS degrees in Computer Science from Stanford University, as well as an MBA from Harvard.

In Partnership

Fintech Meetup delivers results! Kick off 2023 with new deals, partnerships and business opportunities. Meet with anyone for any reason using our incredible tech-powered meetings program that connects 3,000+ attendees to 30,000+ double opt-in meetings. Plus amazing content, networking events, and an exhibit hall with 200+ sponsors! In person at the Aria, Las Vegas March 19-22.

Premium Membership discount

Our ultimate goal is to keep you on the forefront of Fintech innovation so you don’t get left behind. That’s why we created the Fintech Blueprint Newsletter years ago.

We’re pleased to see that over 54,000 Fintech leaders have joined us since then.

You’re now on a free membership plan of the Fintech Blueprint, which limits your exposure to the top notch content we produce 5 times a week.

We are running a Black Friday campaign to give you the opportunity to take full advantage of the Fintech Blueprint Experience at a 33% discount!

Get your Premium subscription now for a third off the price and stay ahead of the shift that’s coming.

See you inside ✌️

👑See related coverage👑

[PREMIUM ANALYSIS]: Long Take: The mistakes we made analyzing FTX, and how to correct them

Digital Wealth: Roboadvisors lost 20% this year on average

Timestamp

1’30”: The formative experience behind Adam’s career & starting at Apple in its heyday

9’59”: The building experience during the internet boom that lead to roles at eBay and other leading Web2.0 companies

13’22”: The evolution of consumer sentiment towards E-commerce at eBay

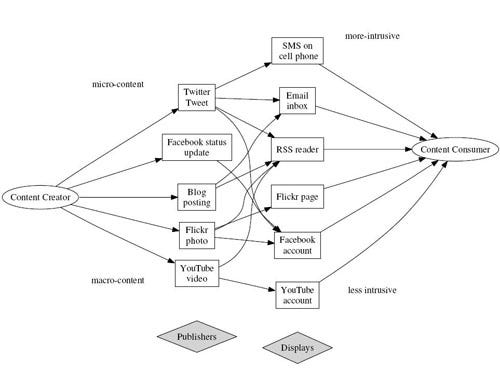

18’43”: Embedding software in Web1.0 to initiate the possibility for engagement & what this meant for product at LinkedIn

25’21”: The Web2.0 approach to building software & the initial hypotheses around extending the Silicon Valley method to financial services

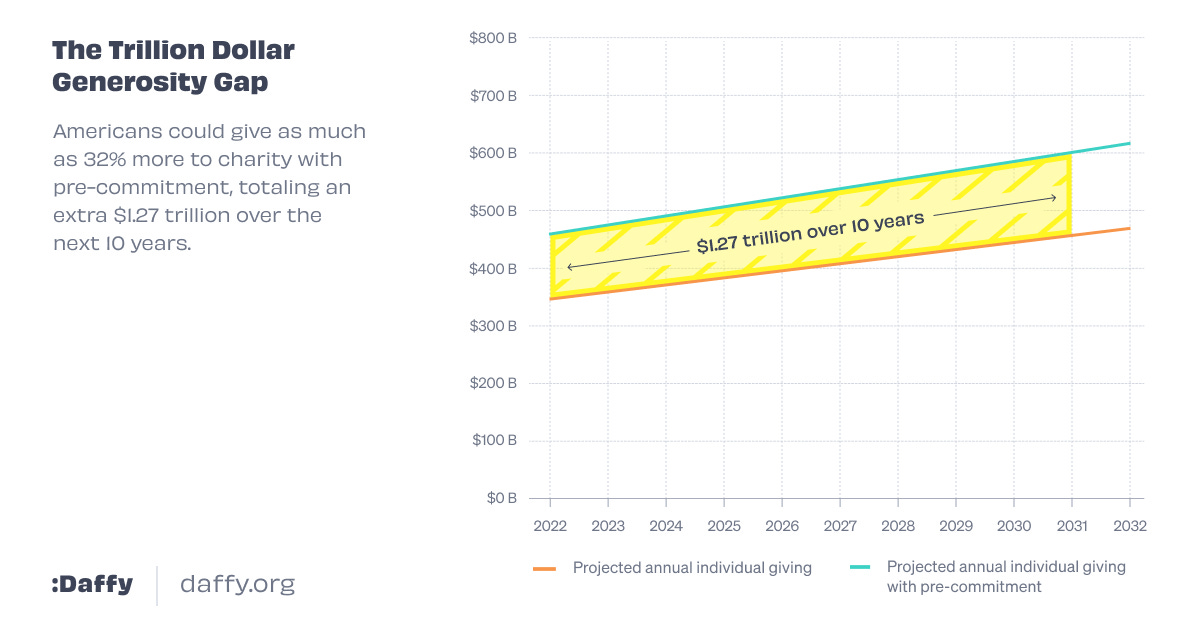

32’36”: Daffy – the idea, what drove its inception, and what the future looks like

37’40”: The art of giving via a Fintech app – the methodology of how to make generosity a major driver of Daffy’s user journey

41’37”: Channels to use to connect with Adam and/or to learn more about Daffy

Sneak Peek:

Adam Nash:

I've been thinking a lot about the transition from Web 1.0 to Web 2.0 lately, particularly because I see some of the same transitions potentially happening in fintech, which gets to my current company, Daffy. But going back to Web 2.0 and what was going on at LinkedIn, basically Web 1.0 had happened and in many ways had been phenomenally successful despite the dotcom bust. I mean, eBay, Yahoo, Amazon, if we want to throw Google in there, were doing really well and making real money and had grown into really phenomenal businesses.But there had been a couple problems along the way with Web 1.0 that had really challenged the economics of the industry. One was it turned out that content was particularly hard to scale. You could certainly get a few articles written up and write content, but the idea of hiring hundreds and hundreds, or thousands of writers started looking cost prohibitive to the businesses that were being discussed.

And then the second problem was user acquisition in terms of…

If you would like to access the full transcript, subscribe below.

Postscript

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions