Building Company Playbook #3: Creating a B2B fintech go-to-market strategy

And the differences with the B2C path

Gm Fintech Architects — Our agenda is below.

Summary: Today we continuing our Build It Series to discuss B2B company creation. In particular, we are interested in the differences in go-to-market strategy, the roles of sales and marketing teams, and ways to organize yourself around the sales and customer success process. We also discuss the difference between selling Cost vs. selling Revenue, frameworks for short and long sales cycles, and the importance of persuasion. We review several different companies, from IBM to SigFig, as examples of deploying these strategies.

Topics: sales, marketing, entrepreneurship

Tags: Envestnet, FIS, Jack Henry, SigFig, ASX, Digital Asset Holdings, IBM, Salesforce

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

Building It

We have logged two actionable playbooks in this series.

The first focused on understanding opportunity and picking a market —

The second explored a marketing-driven B2C approach —

Many of you, however, are not going to be chasing consumer sentiment and the whims of retail user acquisition. Instead, you want to focus on selling to businesses at larger check sizes. We will also assume that you have moved past the services / consulting stage, and are in particular interested in productizing your offering, and scaling up something repeatable and made of software or capital.

To get the main things right, you will still need to deeply understand the motivation of your customer, and the profile of what exactly they are purchasing. Based on what the relevant decisions are and how they are made, you would design a go-to-market organization that targets the generation of a lead funnel that converts into qualified leads and then paid customers. You would think about customer success and retention metrics as a key lever.

Marketing programs may look much more like industry-level or ecosystem-level efforts, focused on catalyzing the use of your product — if formulated as a network or platform or infrastructure. Grants, capital, market-making or developer tooling may be your way of generating and stoking the demand needed to make your product the default choice. Integrations and partnerships, as well as relationships with consultants and system integrators, become paramount as well.

Value Proposition

There’s a common framing for start-up founders that we’ll summon. And that’s to figure out whether your solution is a “life-saving drug” or a “vitamin”. The first is a must-have for your target customer, they’ll literally die if they don’t get it. Think about a core banking system for a bank (e.g., FIS) or a checkout cart for an eCommerce website (e.g., Shopify and Stripe). The latter is a nice-to-have, and the target company can live just fine without it.

So, for example, if you are selling a new client portal to an upmarket private bank, that’s a nice-to-have, and likely you’ll die during the sales process while their portfolio management provider does a Copy/Paste on your idea into their conglomerate systems.

But, on the other hand, a good vitamin is a good vitamin. We shouldn’t make light of a $40B annual revenue market. Even if real medicines are 10x the opportunity.

Another common refrain is to ask whether you company is creating a “product” or a “feature”. So, for example, if you have created an analytics engine that’s really useful if you attach it into trading software, you’ve probably created a feature. But we think this rule of thumb is actually quite unhelpful, or at least not very crisp thinking. Because what really matters here are (1) your goals, (2) timing and difficulty to copy, and (3) future state and industry structure. Maybe you are happy just to race towards an acquisition with a snappy and clever incremental improvement.

Many start-ups are just arbitrage. You apply new technology to an old problem. Often, the old problem has old technology already serving it, and those old technologies are organized into oligopolies. Your arbitrage is to race them — can you create a feature hook that leads to switching behavior at the lower end, and then can you scale up from feature to platform faster than your older competitors can copy and replicate your innovation as a feature.

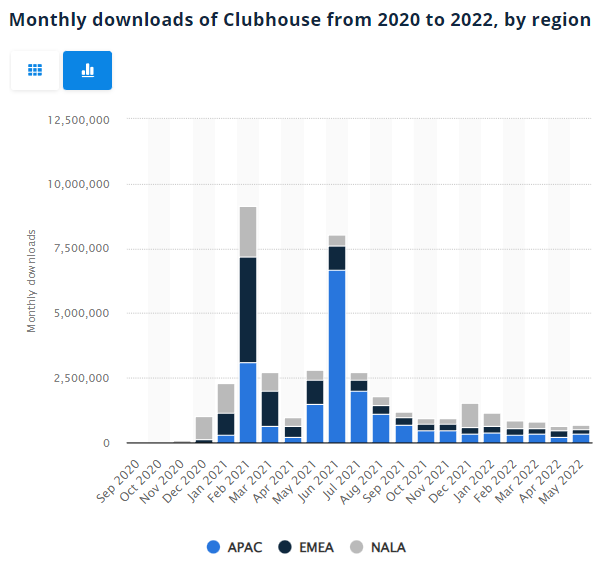

In relationship to Clubhouse taking on Twitter, for example, it did not work out for Clubhouse as every social network integrated voice chat. Voice chat became a feature, and Clubhouse did not out-race the industry.

You can think about Yodlee inside of Envestnet and Galileo inside of SoFi as companies that straddled B2B feature land for a while — each being worth $500MM to $1B based on organic revenues of $100MM+ — and then consummating the arbitrage by being acquired by a larger platform. That larger platform can be a dominant customer that wants its economics back (i.e., SoFi), or it can be an older generation tech player that is expanding its offering.

So it is by horizontal expansion that you can escape being a feature, by becoming a feature the entire industry uses. This is the lesson of embedded finance.

Ok, if we want a more fundamental distinction, let’s talk about whether your solution is above or below the line — does it *generate revenue* or does it *lower cost*. Now we are talking. Do you think that cost-saving solutions are vitamins or life saving drugs? Do you think that saving 20% in process XYZ is a product or a feature. If you have the choice of positioning what you are doing, always, always, and always again, position as what you are doing to generate revenue for your client.

Square generates revenue for merchants. Goldman Sachs generates revenue for its institutional clients. Lenders provide funding to borrowers. Be the front-office.

Or don’t! You can proudly build infrastructure and let others build distribution. Even better, find ways to build infrastructure that generates revenue for your clients — e.g., Sardine doesn’t just help companies get accounts through compliance checks, it also underwrites the advance money movement, leading to revenue generation for the companies it powers. Or ChargeAfter, and other BNPL players, powering up banks to do more lending.

Sales pitches that lower cost — a more efficient trading engine, automation of workflow processes — can work if they plug into an end customer experience story. But if you are only selling cost savings, there’s a good chance to get stuck in purgatory. One example of this is positioning enterprise blockchain as a cost-saving exercises to make “markets better”. We haven’t seen much enterprise blockchain traction displacing public chains as a result. For retails users, the public chain is about revenue and value generation, not cost savings.

The last distinction we want to make is that for Fintech companies and DeFi projects, there is a big difference between a software-only business and a business that requires capital to be put at risk. For example, if you are selling CRMs to financial advisors, probably you are just selling software. Whereas if you are promising to make markets for new trading pairs, or putting raising a balance sheet for novel forms of insurance, your actual product is manufacturing financial instruments.

Don’t get confused or mixed up about what you’re doing.