DeFi: $225MM airdrop from Solana's liquid staking derivative protocol Jito

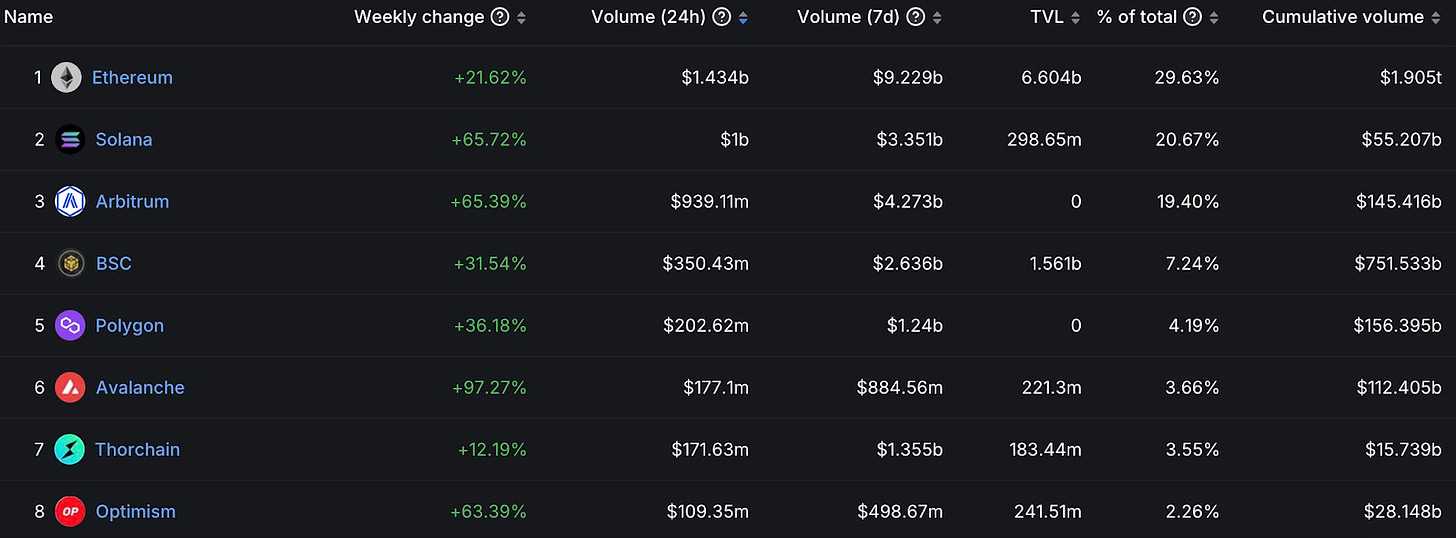

Solana's daily DEX volume is over $1B, second only to Ethereum, and more than BNB and Polygon combined.

Gm Fintech Futurists —

Today we highlight the following:

DEFI: Jito Airdrop Hands Out $225 Million to Solana Users (link here)

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

DEFI: Jito Airdrop Hands Out $225 Million to Solana Users (link here)

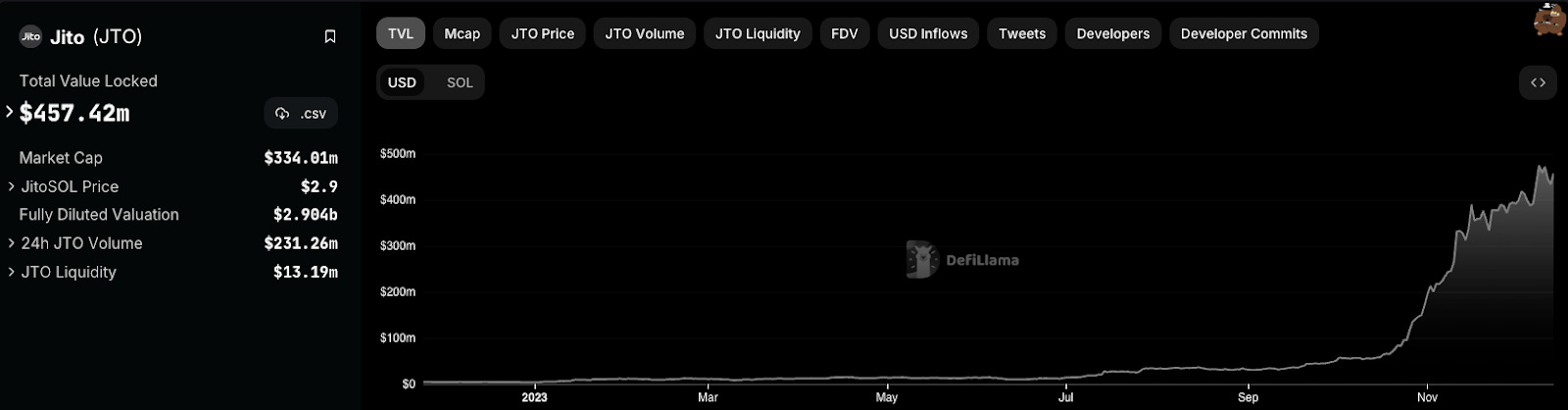

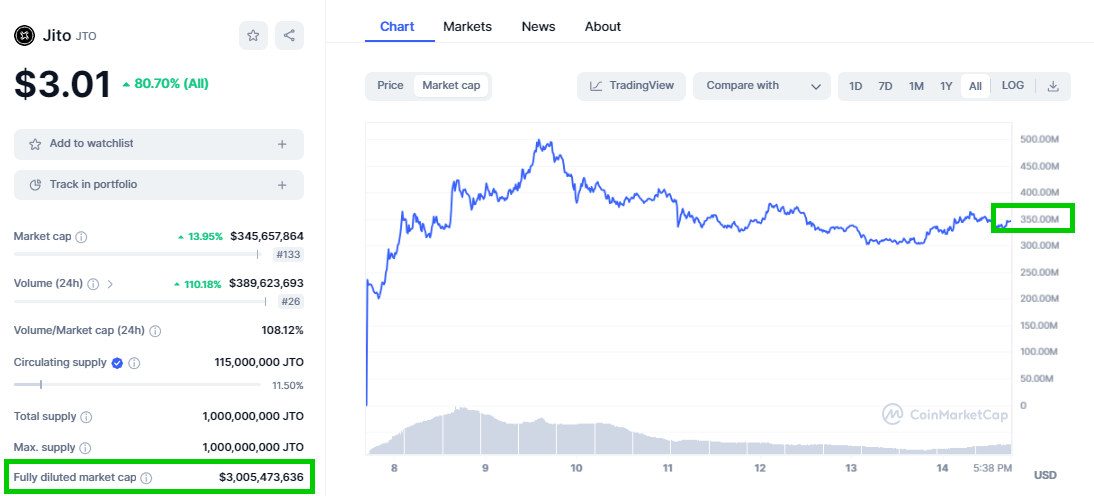

Solana-based Jito has airdropped $225MM worth of JTO (10% of the total supply) to its users two weeks after announcing its governance token. As far as speculative activity rewarding early adopters, this is pretty massive, rivaled perhaps by decentralized exchange Uniswap and NFT platform Blur. The fully diluted marketcap of the project now floats at nearly $3B.

Jito is a liquid staking platform, akin to Lido on Ethereum, where users can stake Solana’s native token, SOL, and receive a liquid staking derivative (LSD), JitoSOL, in return. Similar to the Ethereum process, SOL is staked by or delegated to validators who maintain and secure the network in return for SOL emissions. Malicious and dishonest behavior is penalized by slashing the staked SOL.

Unlike other liquid staking derivatives projects, the Jito Stake Pool delegates SOL solely to MEV-enabled validators. MEV is the maximum profit validators can make by including, excluding, and changing the order of transactions in a block. These validators auction off blockspace in return for MEV rewards, which are then redistributed to the staking pool as APY. Using this mechanism, JitoSOL holders accrue MEV rewards in addition to staking rewards.

In short, this adds more yield to the equation.

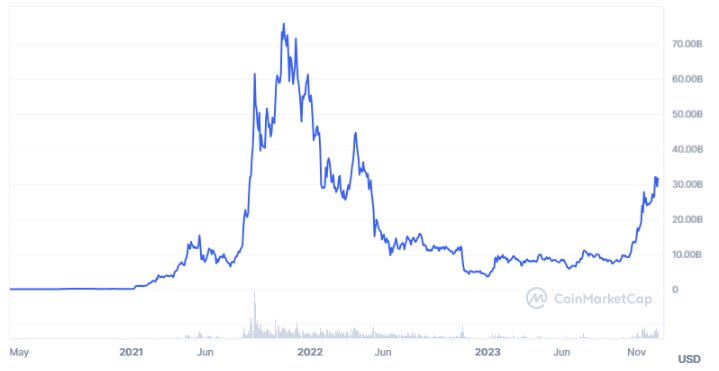

As of today, total value locked (TVL) in the protocol sits at $435MM, across 97,000 individual stakers and 82 participating validators. To compare, Lido has a 46x multiple in TVL ($20B), yet its governance token, LDO, only trades at a 6x multiple to JTO. This likely reflects positive market sentiment towards the current hype about Solana, the MEV capture boost. SOL has witnessed a 280% price increase in the past 90 days to a $30B marketcap, far outpacing ETH’s 40% growth over the same period.

Taking a closer look at Solana, the protocol recently processed over 51MM daily transactions — the highest since December 2021 — and daily active addresses have doubled in the past month to 565,000. Daily DEX volume is over $1B, second only to Ethereum, and more than BNB and Polygon combined. Its modular blockchain design, rather than the composable one in the EVM ecosystem, has attracted developers looking for a high performance environment. Jito’s airdrop alone has added almost $225MM in liquidity to Solana DeFi, showcasing the net positive value creation that airdrops bring to protocols.

Airdrop hunting season has arrived again.

Pyth Network recently airdropped $77MM PYTH, Blur launched a season 2 airdrop, Starknet released airdrop plans, and LayerZero confirmed that a token is on the way. For Web3 enthusiasts, take this as a friendly reminder to sample as many new protocols as you can. For dapps and protocols, this is a reminder that Jito had only raised $12.1MM until now, yet its governance token commands a $330MM market cap, 24.5% of which is with the core contributors.

A word of warning, however. During Solana’s 2021 rise to a $70B marketcap, the DeFi story was also very strong, with nearly $10B in locked assets. It turned out that 70% of those assets came from 3 protocols that re-hypothecated their own, self-issued tokens, creating the impression of high usage, while actually performing accounting shenanigans that collapsed later. Pressure and financing from FTX and other market makers to grow also led to a growth-hacked NFT market. The current cycle is less manipulated, and the developers that have remained are less mercenary, but buyer beware.

👑 Related Coverage 👑

Reach 200,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

Institutional Crypto Brokerage Nonco Secures $10m of aggregate new capital in Seed Round, Led by Valor Capital Group and Hack VC - Businesswire

DeFi and Digital Assets

⭐ M&G Investments leads $30 million raise for GFO-X - The Block

Yearn.finance pleads arb traders to return funds after $1.4M multisig mishap - Coin Telegraph

Bitcoin staking protocol Babylon raises $18 million in Series A funding - The Block

Blockchain Protocols

⭐ Cronos, Partner of Crypto.com, to Start Layer 2 Network With Matter Labs - CoinDesk

Total Value of Cardano DeFi Ecosystem Nears $450M Amid Layer 1 Push; ADA Rockets 17% - CoinDesk

NFTs, DAOs and the Metaverse

⭐ Pudgy Penguins Reveal 'Pudgy World' NFT Game Rollout Plans - Decrypt

⭐ Decrypt Media Inc. and Rug Radio Merge to Create Global Web3 Publishing Company - Decrypt

Axie Infinity NFTs Can Soon Evolve Like Pokémon—Here's How - Decrypt

Blockchain media authentication app eyes news journalism as primary use case - Coin Telegraph

Donald Trump, FIFA and Megadeth NFTs, trading volume nears $1B: Nifty Newsletter - Coin Telegraph

Animoca Brands’ $11.88M Boost to Transform Mocaverse - NFT Plazas

⭐ Shape your Future

Go deeper with the Fintech Blueprint. Our premium subscription grants access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, monthly digital roundtable discussions with industry insiders.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups on the most important topics and companies in fintech.