Blueprint: $1B valuation for MEV project Flashbots; $30MM to Link to avoid interchange fees; L'Oréal digital makeup NFTs

MEV is one of the most important and technical topics in Web3

Hi Fintech Futurists —

You are the best, today’s agenda below. Chin up everyone!

CRYPTO: Flashbots Seeks to Raise $50M at $1B Valuation: Report (link here)

PAYTECH: Link raises $30M to help merchants accept direct bank payments (link here)

NFTs: L'Oréal’s NYX Makeup Brand to Launch DAO, Ethereum NFTs to ‘Redefine Beauty’ (link here)

LONG TAKE: JPM's frank $175MM M&A mistake and the dangers of synthetic humans (link here)

PODCAST CONVERSATION: Combining payments infrastructure for merchants, digital lending, and DeFi, with Stronghold CEO Sean Bennett (link here)

Here’s that handy upgrade button to access the Long Takes — a rigorous view on the future of our industry. Level up your Fintech and DeFi knowledge. 👇👇👇

In Partnership

Fintech is more digital than ever.

Read Persona's Strategic Guide to Identity Verification to learn how to give your customers best-in-class online verification experiences that optimize for conversion while also helping your business manage risk.

Fintech Meetup: Deadline to Get Tickets is Feb. 24th!

Don’t miss Fintech’s Big Q1 Event that will power your whole year. 3,000+ Attendees. 250+ Speakers. 200+ Exhibitors. 30,000+ Double Opt-in Meetings. Aria, Las Vegas March 19-22 ($219 rooms!). Get Ticket & Book Room Now!

Short Takes

CRYPTO: Flashbots Seeks to Raise $50M at $1B Valuation: Report (link here)

Flashbots, the foundational MEV crypto firm, is aiming to raise between $30-50MM at a valuation of $1B, despite a particularly poor 2022 for crypto funding. The firm is “reverse-pitching” investment funds, where investors are called to persuade Flashbots why they should accept an investment. Paradigm, a leading crypto investment fund, is already leading the round as a follow on to the seed-stage fundraise in 2020.

MEV — Maximal Extractable Value — is one of the more technical and important topics in crypto. In traditional markets, you have high frequency trading firms arbitraging transaction through physical proximity to various exchanges. In crypto markets, it is the structure of transaction ordering within blocks that plays a similar role.

Certain savvy firms can arbitrage on-chain trading opportunities by restructuring, excluding, or including transactions within a block during its production to create profit. Flashbots facilitates this market by providing an off-chain marketplace of block-building for on-chain traders and validators. Its objective is to reduce the impact of inefficient block structuring and to streamline MEV. Over $687MM has been extracted from transaction reordering on Ethereum since the start of 2020.

Notably, Flashbots is typically seen as a public good in the Ethereum ecosystem. More recently, it has been criticized for its censorship of transactions related to Tornado Cash in order to comply with OFAC sanctions, given Tornado Cash was sanctioned for money laundering. Block-level capital markets have the power to move what is an isn’t executed, even in a “permissionless” system.

We think MEV is here to stay at least for the short to medium term, reducing some network inefficiencies and capturing a profit. The potential of the space coupled with Flashbots’ dominant market position — over 5x more blocks being processed than their nearest competitors — could justify their “reverse-pitching” process and valuation. We can also expect various Web3-native mechanisms around this in the future, from tokens to DAOs to direct integration into multiple chains.

👑Related Coverage 👑

We first covered Flashbots in May 2021 here — Long Take: Marqeta's $300MM of revenue & Ethereum's $20B in ann. transaction fees highlight opportunity and industry structure

PAYTECH: Link raises $30M to help merchants accept direct bank payments (link here)

Link, a fintech start-up that helps merchants accept direct bank payments — thereby bypassing network interchange fees — has raised $30 million in funding. The round was led by Valar Ventures for a $20mm Series A, while Tiger Global led the $10MM seed round.

Link's platform allows US merchants to accept direct bank payments from customers, bypassing the need for credit or debit card processing. The economic benefit for merchants, who are subject to interchange fees of over 3%, is profound. By integrating Link into their existing purchase flows, merchants generate and share payment links with customers, who can then pay by bank transfer directly into a merchant’s business account.

Link will also take on the customers’ credit risk, guaranteeing the funds for the merchant, whilst using algorithms in the background to identify suspicious transactions. The company claims it can reduce chargebacks and churn, while providing coverage of 95% of US bank accounts. The platform currently supports payments from over 2,000 banks in the United States, out of about 6,000 or so in total.

Merchants reportedly paid $25B in network fees last year, and Link has managed to attract several billion in annual payments volume. Estimates put the digital payments revenue pool at $20T by 2026. It is predicted that this year account-to-account transfers will make up 20% of global e-commerce payments. The flipside is that interchange revenue is the secret revenue source in many neobank footprints — think about the beautifully colored card. We think Visa and Mastercard are very hard to disrupt, especially if you aren’t Plaid.

👑Related Coverage 👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

NFTs: L'Oréal’s NYX Makeup Brand to Launch DAO, Ethereum NFTs to ‘Redefine Beauty’ (link here)

NYX Professional Makeup, a brand owned by L'Oreal, has built an Ethereum-based DAO that allows customers to create and trade NFTs of “makeup” products, named GORJS. These NFTs will symbolize ownership of a virtual product, such as a virtual lipstick or eyeshadow, and attract creatives to work on an avatar makeup market in the metaverse, which can go far beyond the physical to include surreal elements facilitated by their digital nature.

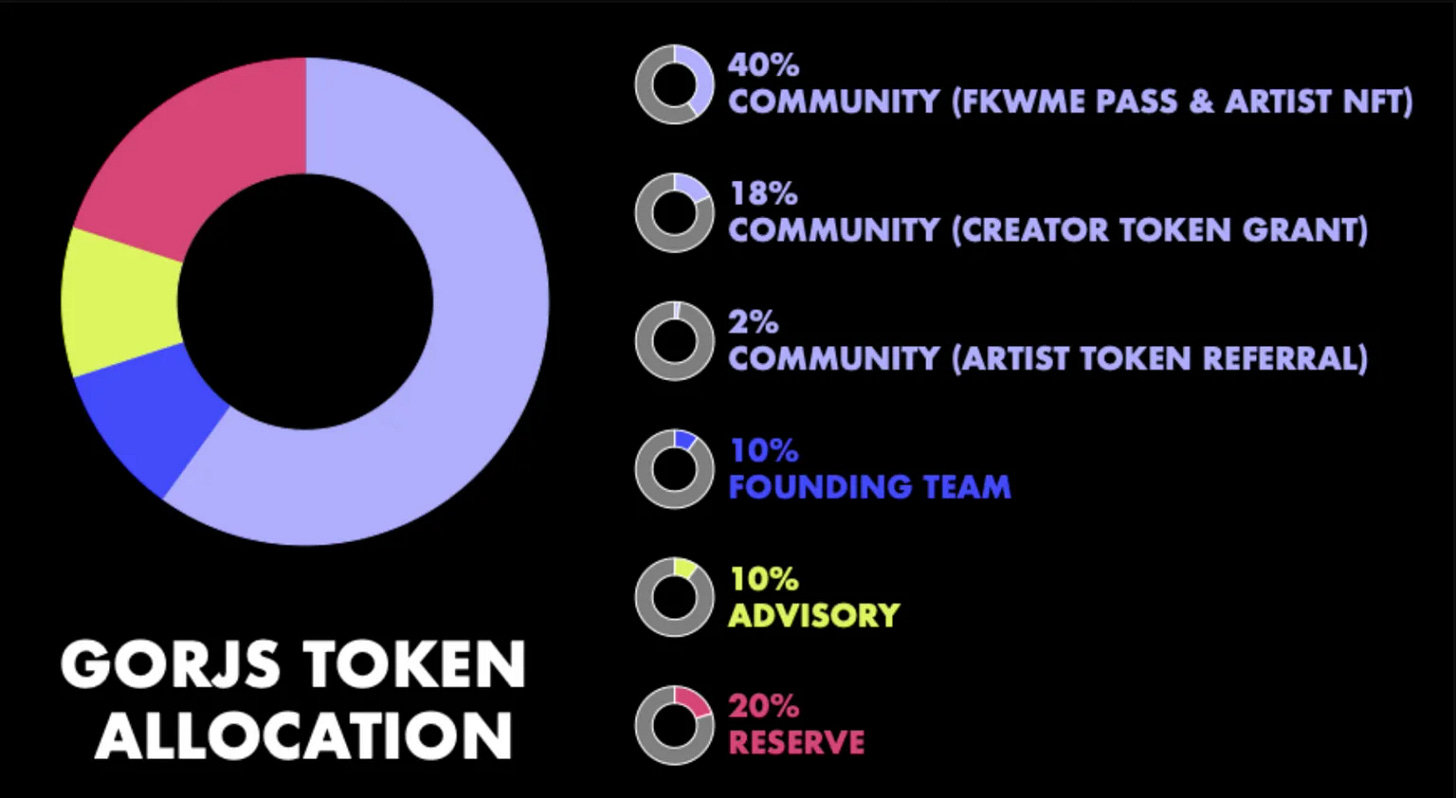

FKWME NFT passes will go live to the public on the 1st February at 0.19 ETH each. These NFTs earn a daily yield of soulbound (untradeable) GORJS tokens, which can be used for DAO governance, as well as providing allowlist access for future NFT airdrops and sales. The GORJS token will be capped at 100MM and used to vote on proposals and projects. Other ways to earn GORJS include artist referrals to grow the community.

The project aims to create a community of artists and use a token to guide DAO governance. Soulbound tokens are not tradeable, which has two important implications: (1) less likely to be a security, and (2) less liquid, therefore disincentivizing actors that would participate solely for financial gain.

L’Oréal has been consistently interested in a metaverse play, with investments in Digital Village through Bold, its VC arm. The beauty giant also filed 17 trademark applications last year relating to NFTs and blockchain. Fashion and beauty will continue to be stables in the virtual world, and L’Oréal has begun establishing themselves and testing out the opportunities. We think these ideas connect strongly to the themes of digital identity, social belonging, and group labor — far beyond makeup.

👑Related Coverage 👑

Long Take: JPM's frank $175MM M&A mistake and the dangers of synthetic humans (link here)

Today we are going cover JP Morgan spending $175MM on Frank, the … frankly fraudulent … financial aid fintech.

We look at the topics of student lending, the cost of acquiring customers, and explore why JPM would want to own this asset. The interesting bit, however, is trying to figure out how Frank faked 4 million accounts. This connects to the current trends in generative AI, and in particular the attempts of building out synthetic humans at scale — people who seem real, but aren’t. Those may populate video games and the metaverse, but also fraudulent sales of neobanks.

Podcast Conversation: Combining payments infrastructure for merchants, digital lending, and DeFi, with Stronghold CEO Sean Bennett (link here)

In this conversation, we chat with Sean Bennett, Co-founder and Chief Technology Officer at Stronghold. Based in San Francisco, Stronghold is a financial technology platform that enables real-time payments, foreign exchange and cross-border clearing and settlement leveraging next-generation financial infrastructure delivered via APIs.

Stronghold, recently named as Forbes Fintech 50 company, works with businesses like IBM and Lyft to make payments quicker and easier while maintaining regulatory compliance and interoperability between payment systems. Sean is a renowned technology expert in the digital currency space, having designed and executed some of the first distributed cross-border transactions of sovereign currencies.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH: India’s PhonePe tops $12 billion valuation in new funding

LENDING: P2P lending platform PeopleFund raises $20M Series C extension led by Bain Capital

ROBOADVISOR: Schwab Robo Clients Receive $52 Million For Allocation Disclosure Failures

INSURANCE: Liberty Mutual considers $1 billion Latin America sale

WEALTHTECH: Broadridge renews digital wealth platform alliance with IGM Financial

WEALTHTECH: Advisor-Finder Zoe Financial Launches Wealth Platform

WEALTHTECH: Global WealthTech Solutions Market: Empowering Investors with Innovative Technology

VR: Gorilla Tag Made $26 Million In Revenue On Quest App Lab

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions

🙏😭😭