DeFi: Are Bitcoin & EVM inscriptions a valuable asset, or just spam exploiting a vulnerability?

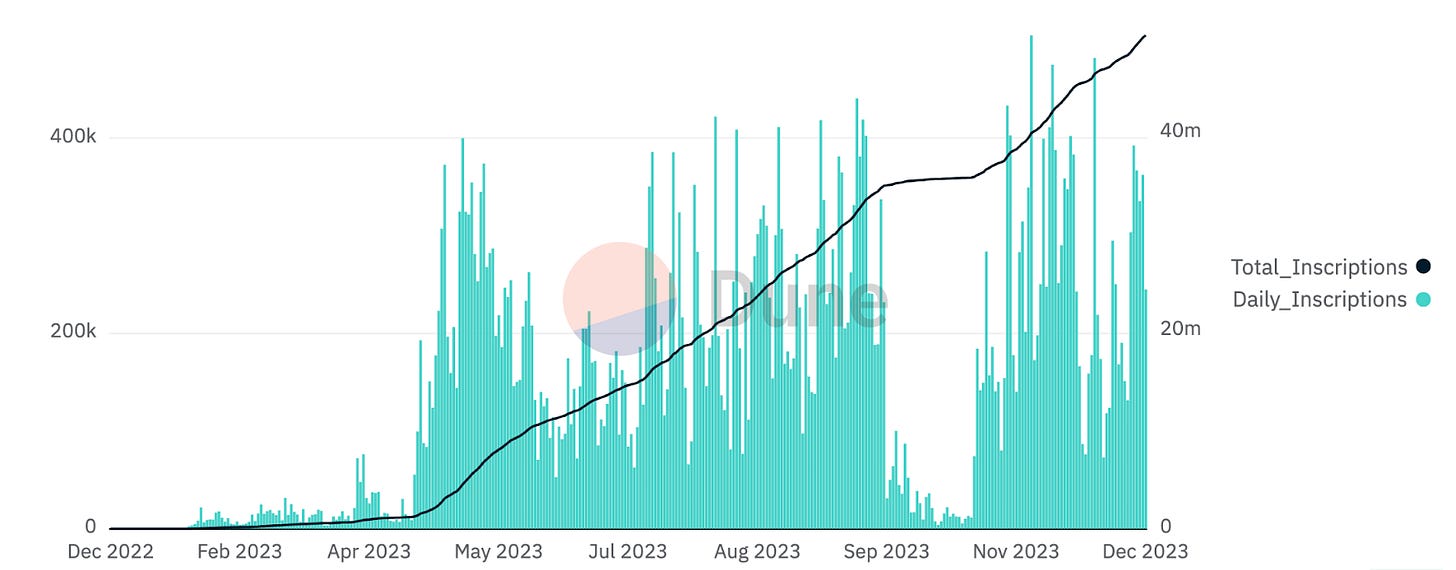

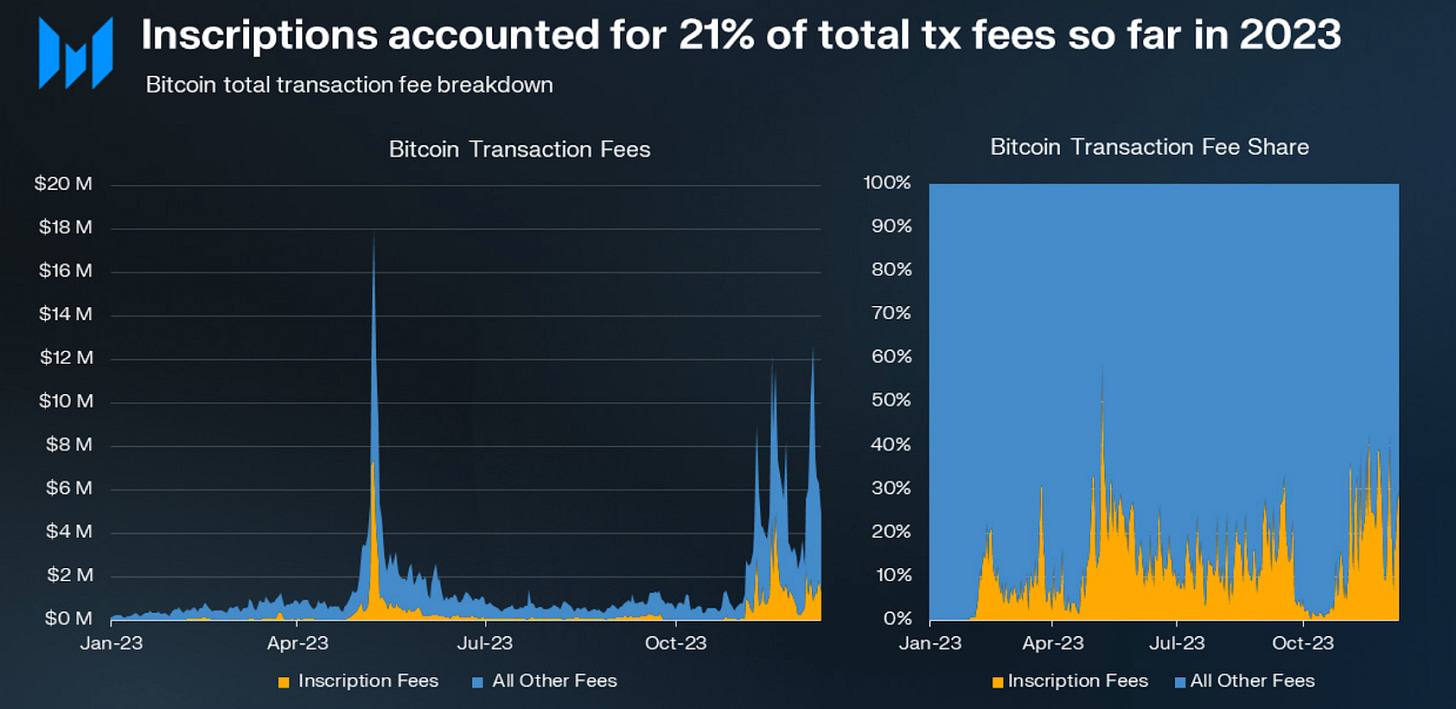

The rise of ordinal inscriptions, which have now reached a total of 50 million, has generated $193MM in fees

Gm Fintech Futurists —

First an update on our holiday schedule. Our team will be taking a break for the holidays from December 23rd — January 7th. We will return in the new year with fresh insights. Happy Holidays!Today we highlight the following:

BLOCKCHAIN PROTOCOLS: Ordinals Are Driving Up Bitcoin Fees — But That May Be Good For The Network (link here)

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

BLOCKCHAIN PROTOCOLS: Balancing Bitcoin's Original Vision with Ordinals’ Innovations (link here)

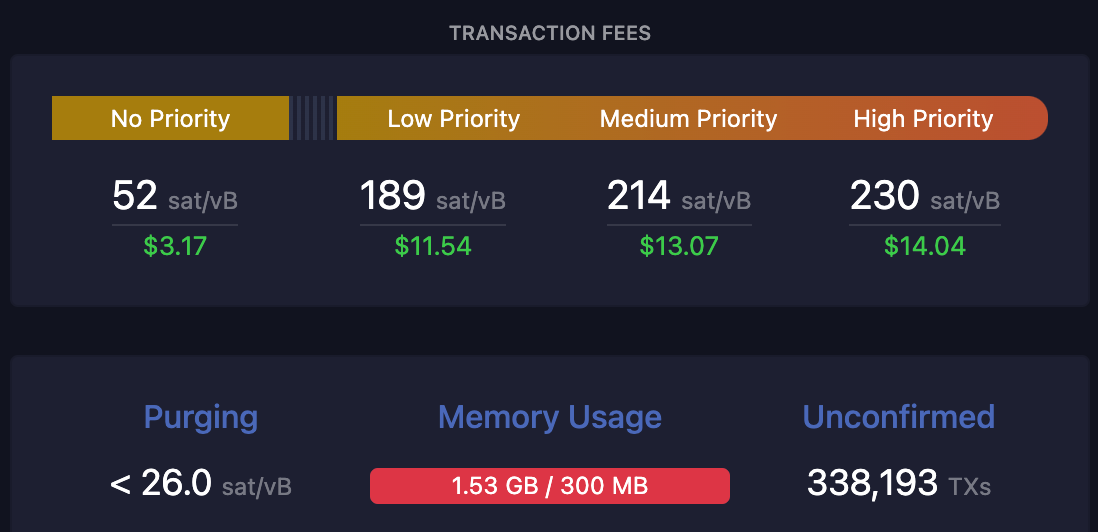

Over the past year, we have seen a wave of new types of transactions in the Bitcoin ecosystem. This has been an exciting extension of chain functionality at first, but is now a real problem — BRC-20s, Stamps, Runes, and recursive inscriptions have started to fill up Bitcoin's mempool (waiting area for transactions), leading to an increase in transaction fees.

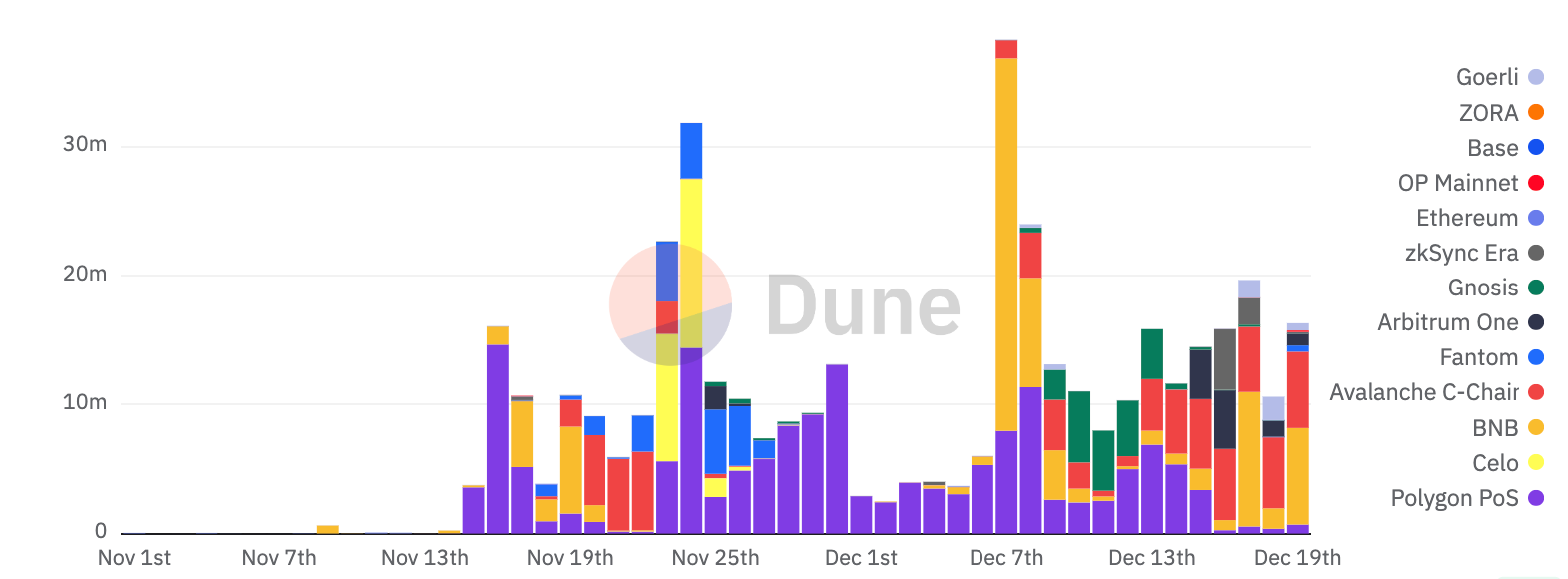

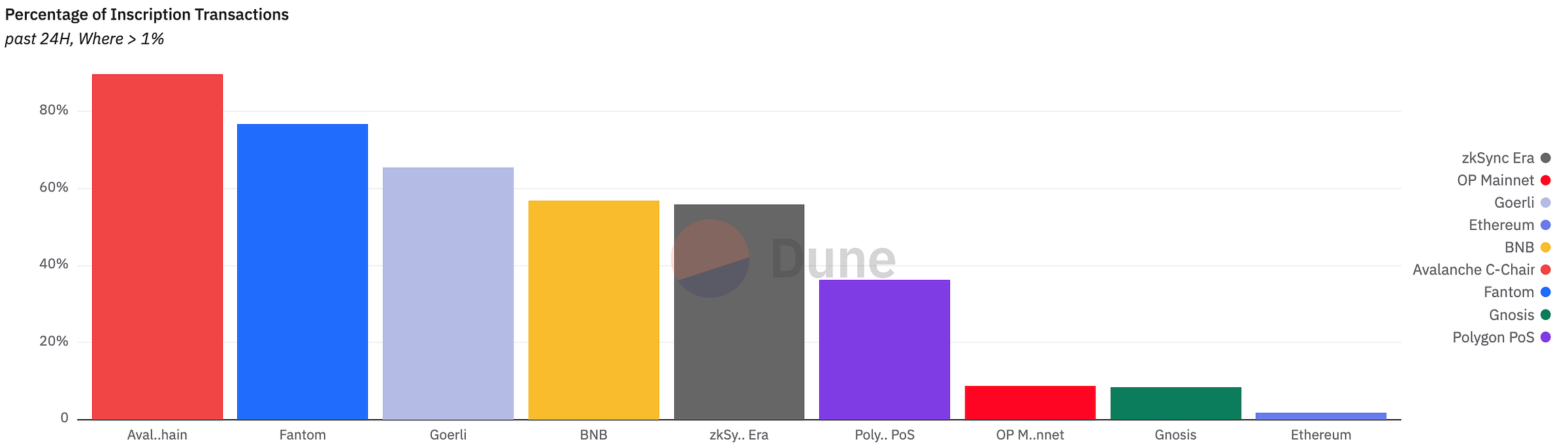

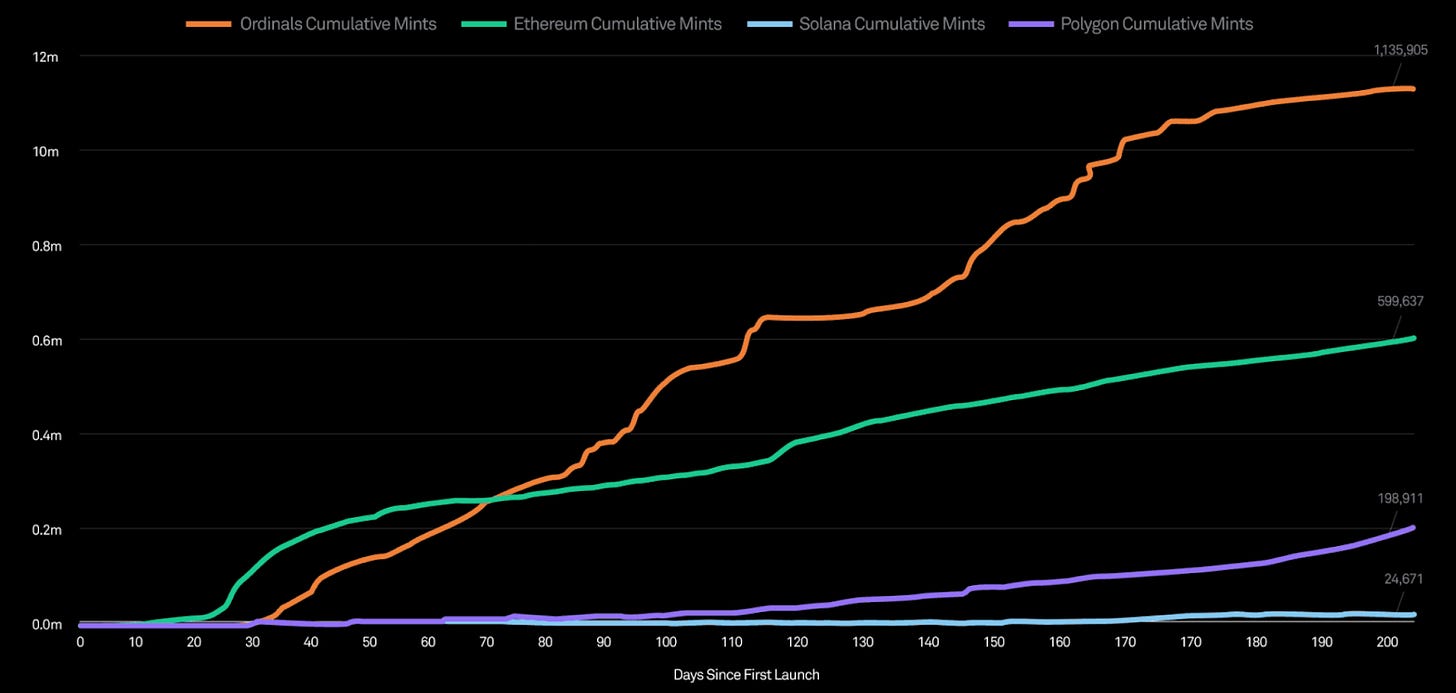

Currently, there are 337,000 unconfirmed transactions, with the average transaction fee fluctuating between $10 and $40. The rise of ordinal inscriptions, which have now reached a total of 50MM, has generated $200MM in fees. Moreover, inscriptions have spread to other EVM chains, and have been responsible for over 70% of transactions on many of those chains recently.

Before delving in, let’s define terms.

Ordinal inscriptions are digital assets created on the Bitcoin chain by adding arbitrary data and metadata to satoshis, the smallest Bitcoin denomination (where 1 BTC = 100MM satoshis). The inscription tells a Bitcoin node how to interpret the metadata, determining whether it represents an image, text, video, audio, etc. Ordinals, stemming from Casey Rodarmor’s Ordinals Theory, allow us to label and track each satoshi in the Bitcoin supply, which is often referred to as the UTXO set.

A UTXO, or Unspent Transaction Output, refers to the amount of a Bitcoin that is left over, following a specific transaction. When a user receives a transaction, it creates a UTXO that they can spend in the future, essentially preventing double spending. The aggregation of all UTXOs is known as the UTXO set, which is continually maintained by every Bitcoin node.

Creating and transferring BRC-20 tokens — an inscription of text describing a fungible token, rather than image or non-fungible token — requires a lot of space on the blockchain. Whereas a regular transaction is around 400 bytes, inscriptions can be up to 4MB in size.

Further, BRC-20s create new permanent transaction sets that cannot be removed, potentially impacting Bitcoin's decentralization. This is because Bitcoin nodes now require more physical storage to handle the increasing data load. Also, Polygon Developer Jarrod Watts has noted that unless you have your own indexer to keep track of all inscription transactions, you'll have to rely on a centralized API to access this information. And if you purchase an inscription token, you'll likely depend on a centralized service to display the indexed data to you.

Inscriptions have also led to congestion issues and potential DDOS concerns on other networks such as Ethereum, Polygon, Avalanche, Celo, Solana, and others. When introduced to other chains, the token standards are assigned their own names, such as Ethscriptions on Ethereum. Ethscriptions, for instance, are cheaper than regular transactions because they store data on-chain using Ethereum transaction calldata, not smart contracts.

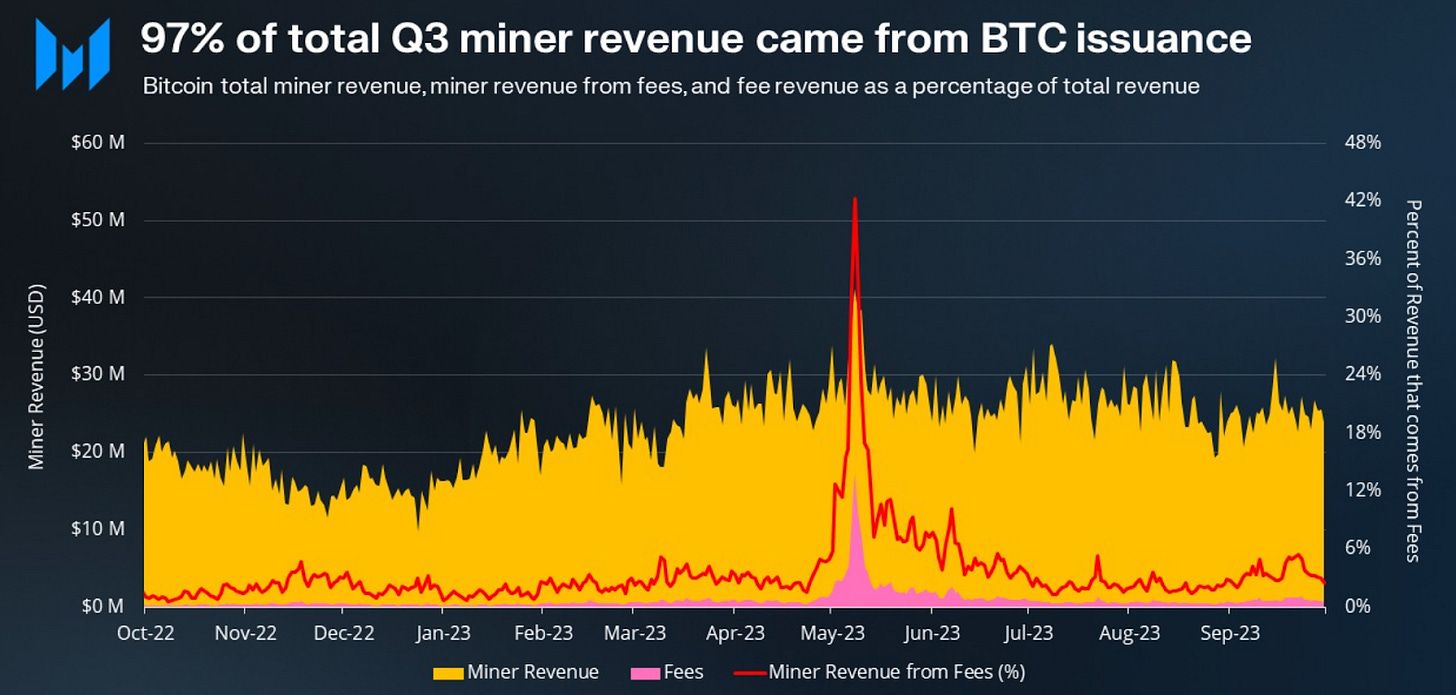

These tradeoffs that have sparked another divide in the Bitcoin community. Some argue that inscriptions are fundamental for Bitcoin's long-term security model, as miners will rely more on fees as the block reward decreases over time. Ordinal inscriptions could offer a consistent source of these fees.

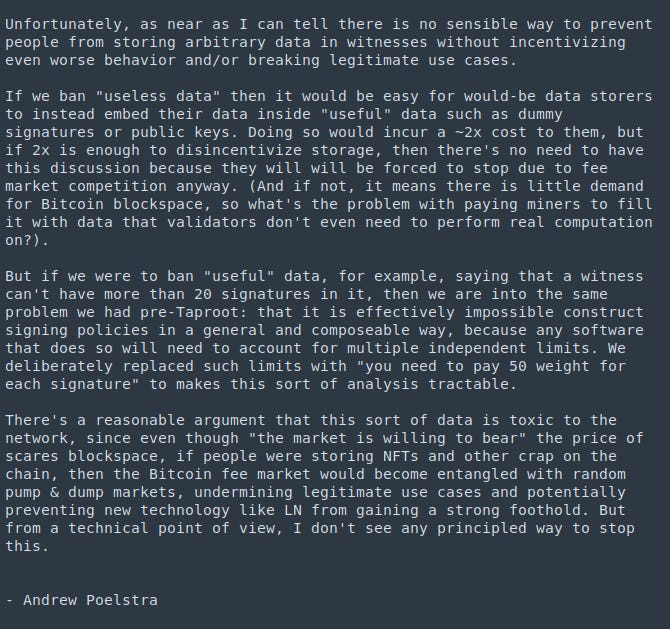

Others, however, argue that Bitcoin Ordinals are exploiting a vulnerability, allowing inscribers to circumvent data size limits (see here to read about recursive inscriptions), thereby spamming the blockchain. They perceive Ordinals as a form of DDOS attack on the Bitcoin network. And shouldn’t miners avoid activities that lead to more centralization and network congestion, even if they are profitable?

This debate among purists and Ordinals advocates is not ending any time soon. Previous disagreements about the block size led to the splintering of chains and various factions creating their own forks. We are also intrigued by the rise in Taproot transactions, which offer more compact transactions, and the emergence of new L2 Bitcoin projects this year as a result of the increased fees and block space usage — see Stacks and the upcoming sBTC and Nakamoto Release, as well as ZeroSync exploring rollups on Bitcoin.

Regardless of the chaos, it is good to see innovation on Bitcoin.

👑 Related Coverage 👑

Reach 200,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Lolli Raises $8MM Series B To Expand Its Bitcoin And Cashback Rewards To Enterprises - TechCrunch

Court Approves $2.7B Binance-CFTC Settlement, CZ To Pay $150MM Fine - Decrypt

Coinbase Plans to Challenge SEC Denial of Crypto Rulemaking Petition - Decrypt

DeFi and Digital Assets

⭐ Andalusia Labs Raises $48MM Series A To Improve Digital Asset Risk Infrastructure - TechCrunch

⭐ Web3 Tax Services Firm Tres Finance Raises $11MM In Series A Financing - The Block

Wynd Network Raises $3.5MM From Polychain, Tribe And More For Decentralized AI Project - Blockworks

Fyde Treasury Raises $3.2MM in Seed Funding - FinSMEs

Coordinape Launches ‘CoLinks’ Professional Social Network For Crypto - The Defiant

Manta Pacific Adopts Celestia, Embraces Native Ethereum Yield - Blockworks

Frax Votes To Move $20MM Of Stablecoin Collateral Into Treasury Bills - The Defiant

Blockchain Protocols

⭐ The Interchain Foundation Puts Aside $26.4MM To Grow Cosmos Ecosystem - Blockworks

EthereumPoW Core Team To Disband and Usher Decentralized Governance - The Defiant

Arbitrum Suffers ‘Partial Outage’ Amid Traffic Influx - Blockworks

Frame Announces Funding Round and Airdrop for NFT Community - The Defiant

NFTs, DAOs and the Metaverse

⭐ Farcana Raises $10MM For NFT Esports Shooter That Pays Out Bitcoin - Decrypt

Ledger, Yuga Labs & Flooring Protocol Are Reimbursing Hack Victims - nftnow

Immutable Debuts Passport Gaming Wallet In 'Gods Unchained' And More - Decrypt

Solana Phones With Unclaimed $Bonk Sell For Up To $5K On eBay - nftnow

Ubisoft's 'Champions Tactics' Ethereum NFTs Generate Millions After Free Mint - Decrypt

⭐ Shape your Future

Go deeper with the Fintech Blueprint. Our premium subscription grants access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, monthly digital roundtable discussions with industry insiders.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups on the most important topics and companies in fintech.

This will be the standard for Bitcoin DeFi:

https://forum.hypercore.one/t/bitcoin-interoperability/283