GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Coinbase’s Base App and the Race for Crypto’s Super App

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). For $3 per week, you get institutional-level research delivered to your Inbox.

In Partnership

Persona is a digital identity platform that has stopped over 75 million AI face spoofs in 2024 alone. Fight fraud and convert users, whether you’re processing loans, issuing credit cards, automating account openings, or any other use case. Make sure to check out Persona below.

DIGITAL ASSETS: Coinbase’s Base App and the Race for Crypto’s Super App

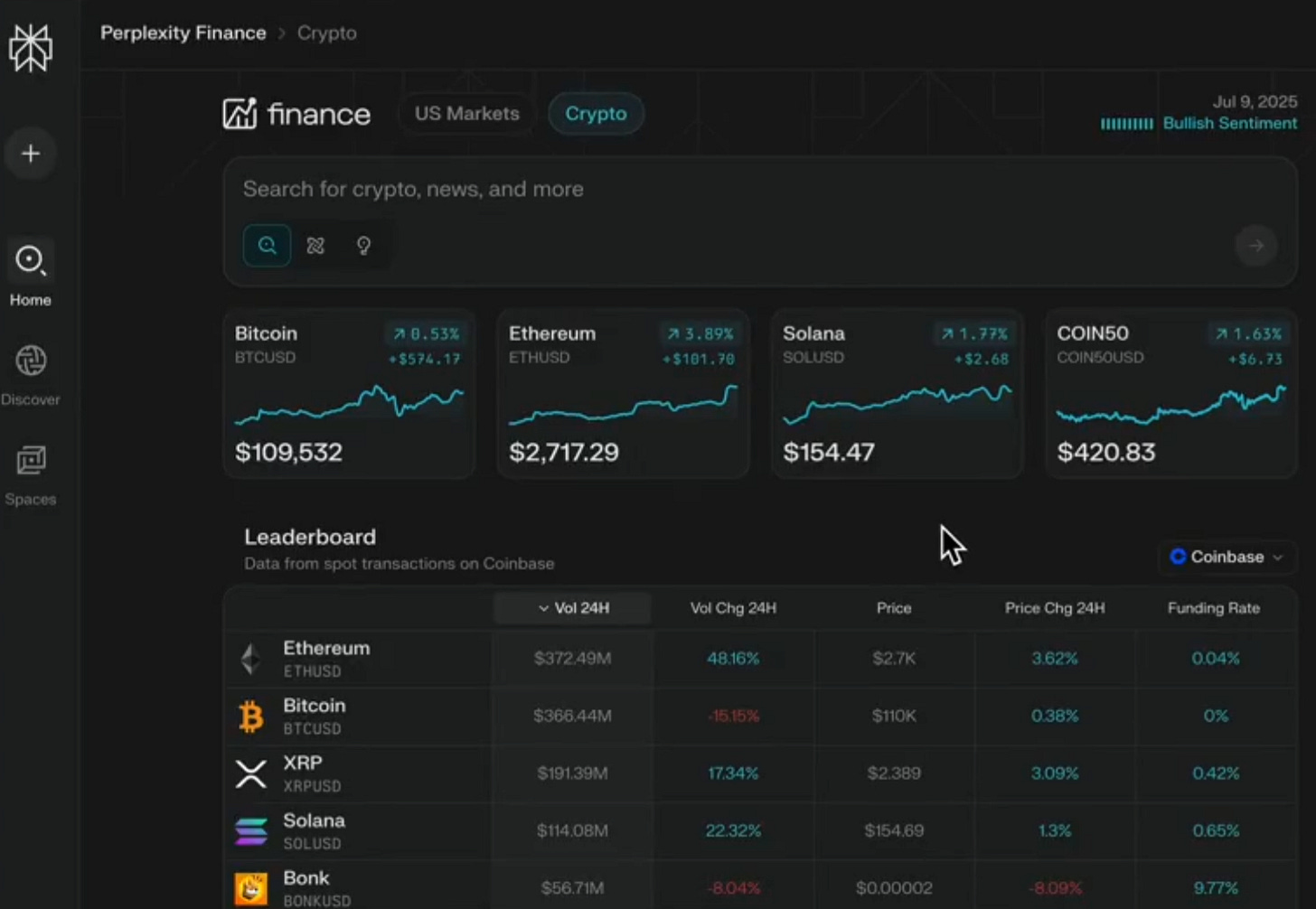

Coinbase has launched the Base App, a rebranded and expanded version of its Wallet. What started as a self-custody product is now positioned as a financial super app: a single interface for trading, payments, social feeds, on-chain identity, and embedded apps.

This is all built on Base, Coinbase’s Layer 2 blockchain.

The rebrand comes with several structural upgrades. The app integrates a Farcaster-powered social feed, USDC payments, DeFi access, and support for “mini apps” — third-party applications that launch inside the wallet without needing separate downloads.

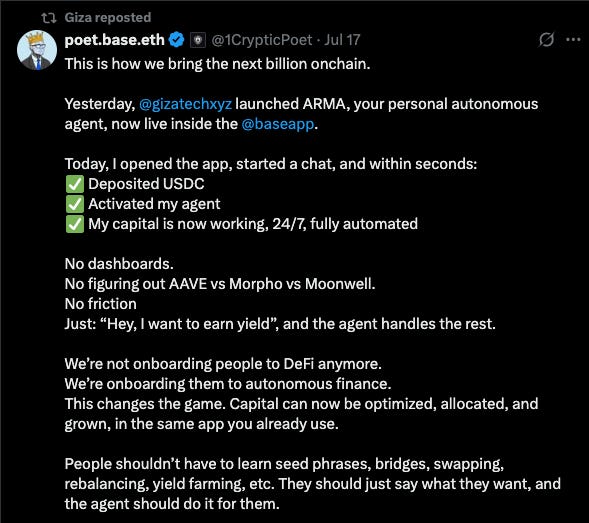

Coinbase is also threading in encrypted messaging and AI-driven financial assistants, starting with projects like Giza, Elsa, and Arma, which can interact directly with users' financial assets. The AI financial assistants are particularly interesting, enabling users to effectively manage their assets without DeFi know-how and by meeting users where their capital already sits.

The app’s design recalls the ambitions of Web2 super apps like Alipay and WeChat, which merged social, payment, and mini-program ecosystems, but with different starting points.

Alipay began as an e‑commerce payment tool within Alibaba and evolved into a comprehensive financial platform offering wealth management, credit scoring, insurance, and loans to over 1.3 billion users globally (with 660 million monthly active users in China). WeChat, by contrast, started as a messaging app and transformed into an all-purpose social and payments hub. With WeChat Pay embedded for peer-to-peer transfers, in-store payments, and access to 1.3–1.4 billion monthly active users, it supports a wide range of mini-programs for services like shopping, transport, and utilities.

But where Alipay and WeChat operated within closed ecosystems dictated by state-controlled rails, Coinbase’s Base App leverages an open blockchain infrastructure. This gives Coinbase both the flexibility of an open platform and the monetization advantages of a closed one — it owns the underlying chain, sequencer, and custody infrastructure.

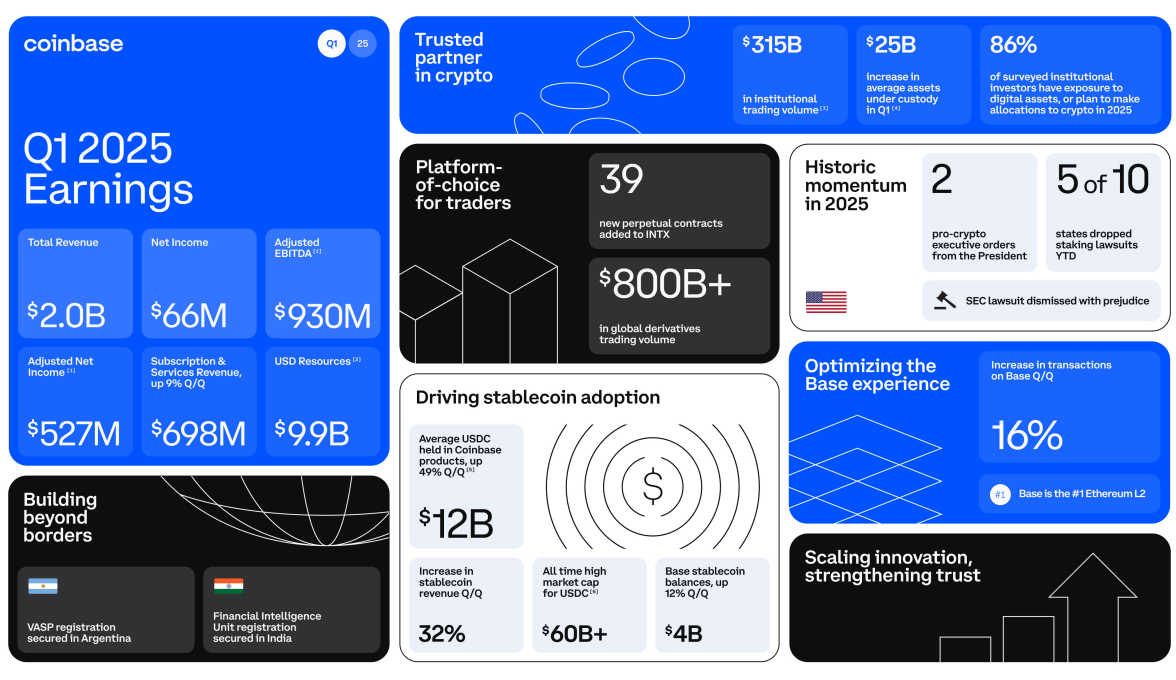

That ownership is translating directly into revenue. Although Coinbase doesn’t yet break out Base-specific earnings, its “Other Transaction Revenue” line — which includes Base sequencer fees — reached $68 million in Q1 2025, nearly doubling from the prior quarter. That’s still a fraction of Coinbase’s $2 billion revenue in Q1 2025, which is down 19% from the previous quarter, indicating that this will be the company’s future strategic focus.

While the sequencer revenue is important, the strategic upside is broader: controlling the wallet interface atop Base offers Coinbase the ability to capture user flow directly, bypassing third-party wallets and building distribution inside its own rails

This also reshapes Coinbase’s customer funnel. The company reports over 108 million verified users across its exchange and wallet ecosystem, but historically, Coinbase Wallet adoption lagged well behind the exchange. By repositioning the wallet as a social and financial app, the company aims to grow that wallet user base — and critically, convert passive exchange users into active on-chain participants. If Coinbase can move even a fraction of its non-crypto native user base into the Base App, the sequencer and wallet flywheel could make the Layer 2 a meaningful driver of both revenue and retention.

The strategy underscores a broader shift: crypto infrastructure players are beginning to resemble Web2 fintech distributors like Ant Financial, Revolut, and Cash App, which built defensible businesses by bundling payments, investing, and social features within a single interface.

Coinbase’s approach — owning the chain, the app, the identity layer, and now the social graph — mirrors that playbook, but re-architected for an on-chain environment where the infrastructure itself is part of the product. This positions Base as Coinbase’s version of a financial operating system, designed to capture user activity across finance, identity, and communication.

Whether fintech challengers like Robinhood or Revolut will pursue similar paths remains uncertain. Robinhood is experimenting in the space: its recent launch of tokenized U.S. stocks on its EU platform and hints at broader crypto integration suggest some strategic alignment.

But Revolut does not yet have its own blockchain. Without direct infrastructure control, they would either need to integrate deeply with existing L2s or form alliances with infrastructure providers, potentially at the cost of margin or user ownership.

Meanwhile, the addition of AI-native agents like Giza, Elsa, and Arma within the Base App points to an emerging layer of conversational finance — where tasks like swaps, payments, or asset management can be executed via chat-based interfaces. This transitions the user experience to interaction with personalized agents that can operate on-chain on behalf of the user — a potentially transformative shift in how financial services are consumed, particularly on-chain. Rather than users having to grasp how self-custodial wallets and transactions work, agents can be given the funds and autonomy to manage a user’s personal tasks without the associated legwork.

Coinbase’s Base App is not just a wallet refresh. It is an attempt to define what a crypto-native super app looks like — one that combines the transactional speed of Base’s optimized Layer 2, social infrastructure via Farcaster, and programmable AI agents. Whether it succeeds will hinge not just on feature set but on distribution: can Coinbase migrate the tens of millions who still think of crypto as something that lives inside an exchange account into a fully on-chain financial experience?

In that sense, Coinbase is not just competing with Robinhood or Revolut. It is trying to become crypto’s equivalent of WeChat — with the chain, the interface, and the capital stack all under one roof.

We love the idea experiment and hope that users do as well.

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Analysis: 2025 Market Analysis and Investment Thesis

In this article, we analyze macroeconomic, crypto, AI, and fintech trends through Q2 2025.

High interest rates persist despite inflation fears, but rising debt levels and political shifts suggest continued fiat debasement, benefiting Bitcoin and stablecoins. In crypto, Web3 integration by fintechs like Stripe and Robinhood has revived tokenized securities, while memecoins and high-FDV altcoins fade amid regulatory and market exhaustion. AI remains a growth engine, with infrastructure and application players seeing rapid revenue gains and M&A activity, though neocloud debt issues could pose risks. Fintechs are maturing into software-driven super apps and increasingly adopting blockchain infrastructure, with 12–24 months of strong IPO and M&A activity expected.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Crypto custody startup BitGo confidentially files for US IPO - Reuters

Mastercard Hails U.S. Crypto Law as Breakthrough for Stablecoin Integration - CryptoRank

Some big US banks plan to launch stablecoins, expecting crypto-friendly regulations - Reuters

US bank lobby challenges crypto firms’ bids for bank licences - CoinTelegraph

Crypto sector breaches $4 trillion in market value during pivotal week - Reuters

Spiko Raises $22M Led By Index Ventures - Financial IT

DeFi and Digital Assets

⭐ DeFi Development Nears $200M Solana Treasury - CoinDesk

GENIUS’ ban on stablecoin yield will drive demand for Ethereum DeFi — Analysts - CoinTelegraph

dYdX acquires Pocket Protector app in push to social trading as volumes fall 95% - DLNews

Blockchain Protocols

⭐ Ether Machine, backed by crypto giants, set to raise over $1.6 billion in Nasdaq debut - Reuters

Linea confirms airdrop amid waning interest in layer 2 tokens - DLNews

Robinhood just bought his firm. Now this crypto founder is going all-in on ‘decentralised AI’ - DLNews

NFTs, DAOs and the Metaverse

⭐

SocialFi project fantasy.top ditches Blast for Coinbase’s Base after fee revenues drop over 90% - DLNews

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.