DeFi: Cross-chain oracle network Supra raises $24MM; NFT platform IYK raises $16.8MM

Supra has introduced initiatives like DORA, an oracle protocol, and HyperNova, a trustless bridge designed to address cross-chain bridging.

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Gm Fintech Futurists —

Today we highlight the following:

PROTOCOLS: Cross-Chain Oracle Network Supra Raises $24MM (link here)

NFTs: IYK Raises $16.8 Million to Power Token-Enabled Fashion With NFTs (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Fintech Meetup Delivers Results! Fintech Meetup (March 3-6) is the best place to find new business, partnerships and opportunities. Attendees & sponsors say Fintech Meetup is “the highest ROI event” with reasonably priced sponsorships, tickets, and rooms. Meet everyone for any reason across every use case over 45,000+ double opt-in meetings, and Network with 5,000+ attendees.

PROTOCOLS: Cross-Chain Oracle Network Supra Raises $24MM (link here)

Supra, a cross-chain oracle network, has secured $24MM in funding from Animoca, Coinbase Ventures, HashKey, Prosus Ventures, Razer, and Valor Equity Partners, among others. The company has introduced initiatives like DORA, an oracle protocol, and HyperNova, a trustless bridge designed to address cross-chain bridging.

There is a phenomenon known as the “blockchain oracle problem,” which states that smart contracts lack direct interaction with data and systems beyond their native blockchain. This makes sense because blockchains by their very design are only aware of what transpires on their own chain. Oracles, which connect blockchains to external systems in order to access data from the real world, come into play to address this gap, acting as a conduit to source, verify, and transmit external (off-chain) information to smart contracts within the blockchain. Practically speaking, an oracle can function as a bridge for moving data and assets between blockchains.

Supra's base is IntraLayer, a vertically integrated Web3 stack that unifies blockchains by merging oracles, bridges, and smart contract platforms into one platform via a hub-and-spoke model. By deploying a dApp on Supra, the dApp is immediately enabled as a cross-chain application. For example, integrating an Ethereum dApp's smart contract with IntraLayer allows connectivity with smart contracts on Aptos, Avalanche, Arbitrum, and other chains within the framework.

As for the oracles, Supra offers DORA, a distributed oracle agreement solution incorporating consensus algorithms and aggregating representative value price data from Byzantine Fault Tolerant (BFT) algorithms. BFT means the network will continue functioning correctly even if some validators crash or deviate from the protocol (such deviant validators are called Byzantine). For a complete outline of Supra's oracle architecture, see here.

As DeFi evolves, it embraces a multi-chain future, yet the current go-to method for transferring assets across different chains -- multisig bridges -- falls short of the ideal. They consist of staked bridge nodes, which sign and aggregate events on a source chain, relaying them with the signatures of their agreement to a destination chain for corresponding actions. However, this shifts security reliance from the source chain's Layer 1 to the bridge nodes. In comparison to L1 blockchains, multisig bridges have a lower number of validators, which reduces the level of 'decentralized trust' in the system. In other words, such network exposures are susceptible to hacks. And on top of that, bridging is quite time-consuming, causing users to anxiously await unnecessarily risky operations to complete.

With the growing number of users exploring different networks, we are witnessing cross-chain transaction developments via oracles, account abstraction, intent-based architectures, Flashbots's SUAVE, and features like MetaMask's Snaps. Supra is working on a bridgeless solution via its HyperNova protocol, which directly verifies the source chain's consensus. Verifying the consensus involves aggregating public keys from block attestation and validating the aggregate signature. This verification is essential when interacting with other chains to guarantee the accuracy of the information being transferred from the source chain.

While we believe no single company will achieve an instant breakthrough, as different networks have varying architectures and consensus mechanisms to consider, each progressive development contributes to a cumulative effect. This opens the door to more dependable price discovery, resulting in tokenized assets with live data feeds, on-chain asset management, cross-chain gaming, decentralized identity aggregation, and interoperable CBDCs. All of which we see as part of the bright new future of financial services.

👑 Related Coverage 👑

In Partnership

Trends in Digital Lending for 2024: AI, Automation, Embedded Finance and more

👉October 10 at 2pm BST (9am ET)

As we begin to look to 2024, we can expect new technology to continue to have a profound impact on digital lending. This webinar features a panel of leading experts who will discuss some of the major trends for the next year.

Topics include:

Why AI/ML models will become more important and how to deploy them quickly

How open banking can help drive underwriting efficiencies

How innovative lenders are using automation in their credit decisions

What new opportunities are provided by embedded lending

How to navigate the new normal of high cost of capital

NFTs: IYK Raises $16.8 Million to Power Token-Enabled Fashion With NFTs (link here)

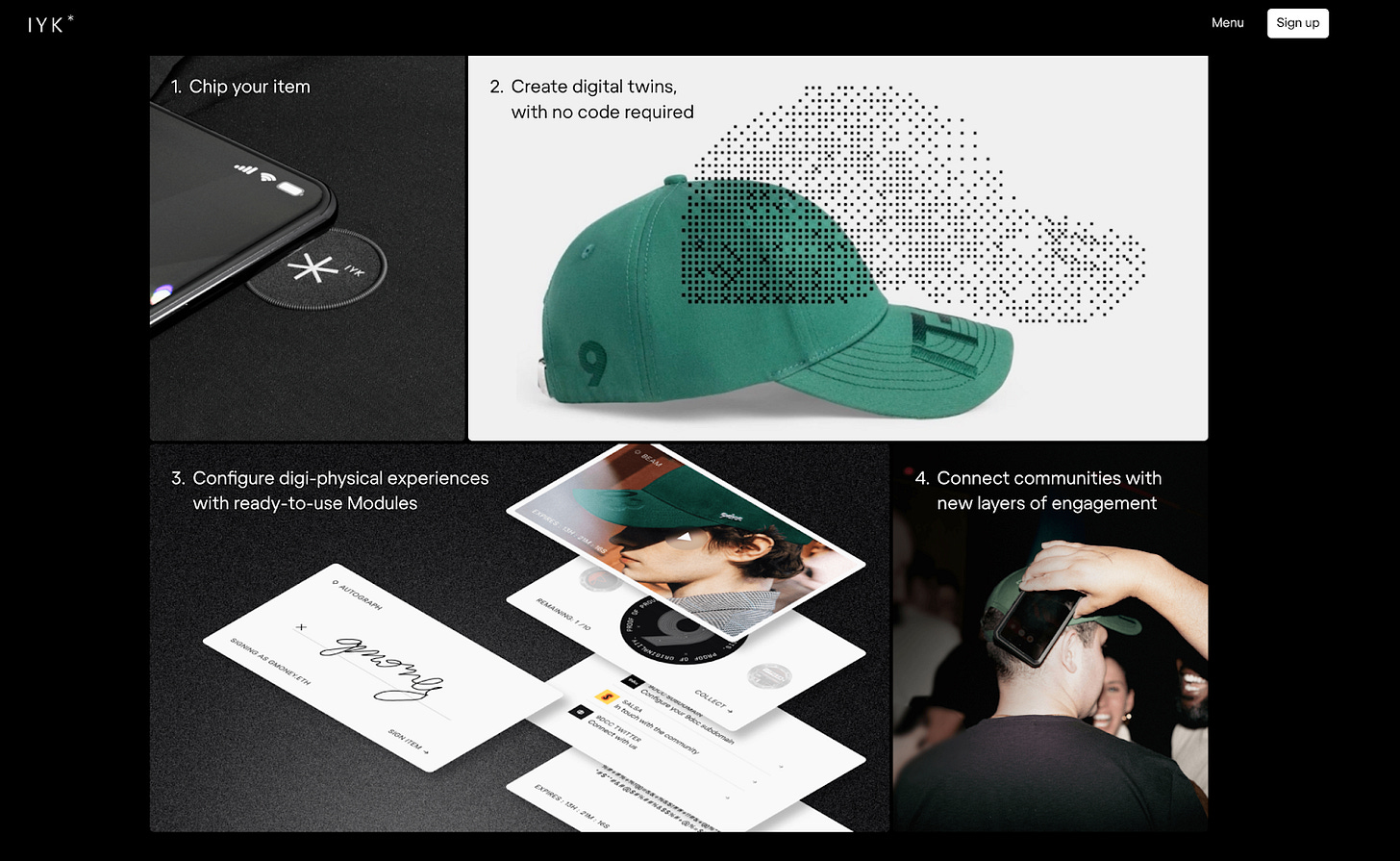

NFT infrastructure startup IYK has raised $16.8MM in seed funding from investors including a16z, 1kx, Lattice Capital, Art Blocks founder Erick Calderon, and other high profile investors and crypto influencers. IYK’s offering is centered around deepening fashion brands’ relationships with their customers by merging the digital and physical worlds. Using a combination of their platform and near field communication (NFC) chips, brands can connect each piece of clothing with tokens or NFTs. For example, consumers could scan the chip on a smartphone to redeem an on-chain certificate of authenticity, or the (chip embedded in the) clothing may grant access to exclusive events.

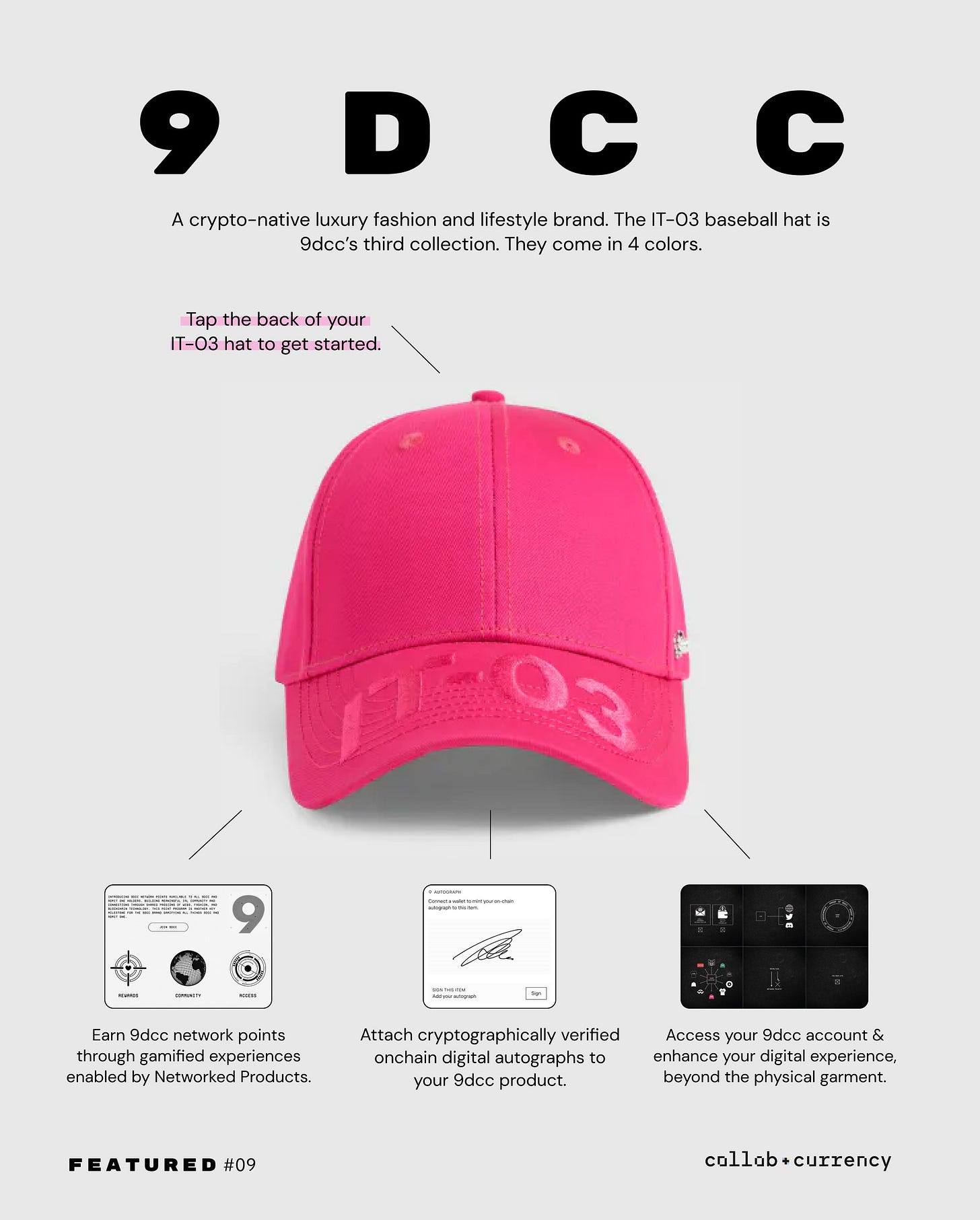

IYK has already worked with clothing leaders like Adidas and Billionaire Boys Club, and Web3 companies including Coinbase and Pudgy Penguins. Each brand can take a slightly different, though resonant, approach. Adidas created collaboration experiences to develop 512 t-shirts, each of which were assigned an NFT with an “Alter Ego”. 9dcc, a clothing brand created by crypto influencer Gmoney, leverages the technology for authenticating its pieces, as well as providing owners with access to a loyalty program. Meanwhile, MNTGE partnered with IYK to give consumers access to a digital twin of the physical clothing which can be used in the metaverse.

The IYK platform does not require a specific application or device, removing any friction for brands and consumers alike. Each chip can be customized to enable a broad range of features, and typically uses the familiar double-click activation on iPhones to activate its NFC capabilities. On Thursday IYK launched a self-serve model to order the NFC chips so that they can be embedded as each brand prefers. A smart move for a company that intends to become a platform.

On the surface, the technology is simple -- attach chips to clothing and allow consumers to redeem on-chain benefits linked to the piece. But the beauty lies in being able to develop differentiated products and deeper brand connections. Fashion brands like Supreme rose to fame by focussing on exclusivity, releasing limited clothing editions to intensify the feeling of scarcity. With NFC chips attached to tokens or NFTs, clothing can now act as your pass into communities, a tally of your brand engagement, an undeniable proof of authenticity, or even a lottery system for highly sought-after prizes. The possibilities for brands are infinite, and those that are able to leverage the technology effectively will be able to empower and engage consumers. While the base NFT market may appear to be struggling, with monthly trading volume is down 81% since the start of 2022, IYK’s capabilities open up an entirely new horizon for the NFT space.

👑 Related Coverage 👑

Reach 190,000+ Builders and Investors

To support The Fintech Blueprint and reach our 190,000+ Substack and LinkedIn subscribers, contact us here.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ CMCC Global Raises $100MM For Hong Kong-Based Blockchain Companies - CoinDesk

IMF Says Unregulated Crypto Could Lead To An "Alternative Financial System" - The Defiant

Anchorage And Eaglebrook Link Up In Bid To Boost Crypto SMA Access - Blockworks

LayerZero And Conflux Partner To Build Blockchain-Based SIM Card Ecosystem For APAC Region - Crypto Daily

DeFi and Digital Assets

⭐ Savings DAI Surpasses $1B TVL, But DAI Remains In Decline - The Defiant

Manifold launches $50MM MEV-optimized LST - Blockworks

Contango Launches Decentralized Perpetuals Leveraging Aave - The Defiant

How Blockchain Capital Invests And Spencer Bogart On The Future of Crypto And DeFi - The Defiant

Helium Hotspots Go Live In Bid To Turn Miami Network Profitable - Blockworks

Aave Poised For Multi-Chain Governance Overhaul - The Defiant

Blockchain Protocols

⭐ Blockchain Developer OP Labs Delivers ‘Fault Proofs’ Missing From Core Design - CoinDesk

HeLa Labs Launches Stablecoin-Powered Layer One Blockchain Network - GlobeNewswire

Stellar, PwC Publish ‘Framework’ To Judge Emerging Market Blockchain Projects - Cointelegraph

NFTs, DAOs and the Metaverse

Boss Beauties Announces Acquisition Of BFF - nft now

Ledger And Sotheby's Team Up For Digital Art Exclusives - Decrypt

Mark Zuckerberg and Lex Fridman Record Podcast in the Metaverse - nft now

MoMA Launches 'Postcard' NFT Art Project - Decrypt

⭐ Shape your Future

Curious about what is shaping the future of Fintech andDeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands