DeFi: Vitalik Buterin publishes paper addressing blockchain privacy; MetaMask now usable outside EVM blockchains

Last August we mentioned: "We can also imagine the splintering of Tornado Cash into a thousand clones, forked and displayed on decentralized front ends"

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Gm Fintech Futurists —

Today we highlight the following:

PROTOCOLS: Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium (link here)

DIGITAL ASSETS: MetaMask To Be Usable Outside The EVM Ecosystem With Snaps Launch (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Fintech Meetup Ticket Prices Go Up Friday! Fintech Meetup (March 3-6) delivers tangible ROI. Attendees say it’s the “highest ROI event out there!” Join 45,000+ meetings, See 175+ incredible speakers, Network with 5,000+ attendees and Enjoy 100+ co-located events.

PROTOCOLS: Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium (link here)

Vitalik Buterin, in collaboration with a team of researchers from Chainalysis, the University of Basel, and a relatively new protocol called Privacy Pools, has published a paper that aims to tackle the challenges surrounding privacy and regulatory compliance within blockchains using Privacy Pools. The protocol is a forked successor of the now-sanctioned coin mixer, Tornado Cash. Our previous discussion on the future of Tornado Cash mentioned: "Of course we can also imagine the splintering of Tornado Cash into a thousand clones, forked and displayed on decentralized front ends." Privacy Pools has since been formed and dubbed “the Tornado Cash sequel.”

As you know, every interaction with a smart contract is permanently recorded on the blockchain, potentially linking individuals to their public keys through transaction analysis. The immutability of these transactions has led to the rise of privacy protocols like Tornado Cash, allowing users to deposit and withdraw funds using different addresses, effectively concealing the connection between deposits and withdrawals on the blockchain. However, legitimate users had limited options to disassociate themselves from potential illicit activities. While Tornado Cash did introduce a compliance feature to validate the source of withdrawals, its reliance on a centralized intermediary hindered its widespread adoption.

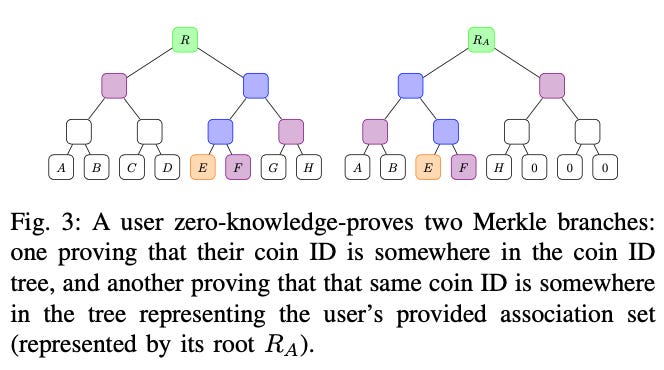

Privacy Pools offers a different approach: instead of relying solely on zero-knowledge proofs to connect withdrawals to prior deposits, users can showcase their membership in a specific group of deposits called an "association set." This set is defined by users through a shared Merkle root as a public input. In simpler terms, Privacy Pools enable users to prove where their withdrawal could have come from, either by confirming its connection to a set of deposits (membership proofs) or showing it has no links to certain deposits (exclusion proofs).

Importantly, Privacy Pools doesn't directly confirm that an association set is a subset of previous deposits. Instead, users must provide two zero-knowledge proofs: (i) a proof that their transaction exists in the total pool of transactions (i.e., a Merkle branch into the root of the total set of coin IDs), and (ii) a Merkle branch into the proof that their transaction belongs to the association set root.

As we previously mentioned in our Tornado Cash long take, and as Simon Taylor highlighted in his newsletter, there's a need to restructure anti-money laundering (AML) tools within blockchain ecosystems, pushing governments to establish their own guidelines for issuing some form of on-chain warrant as a legitimate basis for compromising a user's privacy. Privacy Pools is one such example of this gradual restructuring. Another example is Zcash, a privacy-focused blockchain-based payment network that employs ZK-SNARKs for shielding transactions. Silent Protocol, which enables pseudonymous privacy for dApps via its own framework, EZEE (Economical Zero Knowledge Execution Environment), could also be a player in this space. We envision a time when autonomous blockchain-powered identity and data management solutions will become the optimal choice for preserving and showcasing data privacy. In the meantime, we are pleased to see another creative attempt at enhancing both individual privacy and regulatory compliance in the blockchain space.

👑 Related Coverage 👑

In Partnership: Webinar for fintechs, software platforms and marketplaces

How Managing Global Fund Flows Makes International Expansion Much Simpler

👉 September 21 at 11am ET

Join us for an insightful, 30-minute webinar where we explore how marketplaces, fintechs, and software platforms can drive market expansion and transform the way customers manage global fund flows

In this 30-minute session, we will discuss:

• Key global money movement challenges that hinder market expansion

• How platforms can unlock new market opportunities and build new revenue streams

• Best practices from industry experts on how fast-growing companies like Public.com and Ramp are expanding their operations to international markets

DIGITAL ASSETS: MetaMask To Be Usable Outside The EVM Ecosystem With Snaps Launch (link here)

Web3 wallet MetaMask has introduced "Snaps," a new feature aimed at expanding MetaMask's reach to non-EVM blockchain networks. There are now 34 Snaps available, all created by third-party developers and audited by ConsenSys. A day after MetaMask’s announcement, Coinbase Prime launched its own Web3 wallet.

In simple terms, think of Snaps as customizable mini-apps inside MetaMask that users can install. Technically, they're JavaScript programs that run in an isolated environment, but we digress. They "wake up" in response to messages or events and shut down when idle. For example, the Sui Wallet Snap would wake up if you were buying NFTs on the Sui network or performing a transaction on one of Sui's dApps.

If you're wondering why this matters - Web3 wallets are designed to be interoperable, allowing users to interact with various dApps and blockchains. This eliminates creating separate wallets for each network, simplifying the user experience. Until now, MetaMask and other Web3 wallets have served only EVM-compatible blockchains like Binance Smart Chain, Polygon, and Optimism, mainly due to Ethereum's dominance, developer familiarity with the EVM, and interoperability. However, with Snaps, users can interact with non-EVM blockchains, including Cosmos, Solana, Tezos, Starknet, Sui, and 29 others.

MetaMask is also constructing a system that incorporates smart contracts to facilitate its registration approach, allowing users and auditors to participate in vetting new Snaps.

Snaps eliminates the friction that has long deterred potential users of non-EVM blockchains from joining the ecosystem. As for MetaMask specifically, Snaps intertwines with MetaMask's recent Software Developer Kit (SDK) offering, which integrates gaming protocols. With Immutable and Polygon forecasting up to 100MM Web3 gamers by 2025, MetaMask wants to capitalize on all those extra transaction gas fees. Since multi-chain interoperability expands the utility of all networks, this little “feature” could change the trajectory of non-EVM-compatible blockchains, and certainly enhances the utility of the MetaMask platform for its 30MM+ users.

👑 Related Coverage 👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 185,000+ Substack and LinkedIn audience of builders and investors, contact us here.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Franklin Templeton Joins Spot Bitcoin ETF Race - CoinDesk

⭐ Binance.US CEO Has Left, Crypto Exchange Cuts 1/3 Of Workforce - CoinDesk

Coinbase To Integrate Bitcoin Lightning Network In Bid To Drive Adoption - Blockworks

Coinbase And Aave Form Coalition To Promote Tokenized Assets - The Defiant

Crypto Exchange Bitget Establishes $100MM Pot To Fund Ecosystem Growth - CoinDesk

BaFin-Licensed Crypto Custodian Finoa Will Offer Regulated DeFi - CoinDesk

Offchain Labs, Espresso Systems Link Up On Transaction Ordering Tech - Blockworks

DeFi and Digital Assets

⭐ MetaMask ‘Sell’ Feature Enables Ethereum Users To Cash Out - The Defiant

⭐ You No Longer Need 32 ETH To Stake On Coinbase Cloud - Blockworks

⭐ FTX Can Begin Selling Its Digital Assets, Bankruptcy Court Rules - Blockworks

CFTC Fines Opyn, ZeroEx And Deridex - The Defiant

Squid Enables One-click Cross-chain Swaps On Cosmos - Blockworks

Crypto Safekeeping Specialist Fireblocks Introduces Non-Custodial Wallet Service - CoinDesk

Blockchain Protocols

⭐ Hello Holesky, Ethereum’s Newest Testnet - CoinDesk

Ether Turns Inflationary As On-chain Activity Slides - The Defiant

NFTs, DAOs and the Metaverse

⭐ Animoca Brands Raises $20MM For Metaverse Project Mocaverse - CoinDesk

Arcade Facilitates $1.1MM Loan Against Supreme T-Shirt Collection - The Defiant

⭐ Shape your Future

Curious about what is shaping the future of Fintech andDeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands