DeFi: Goldman & BNP Paribas invest $95MM in Fnality, blockchain-based wholesale payments

Out of the fintech players, Wise is the standout disruptor in the FX market, but the next decade will provide even more cost-effective and rapid alternatives

Gm Fintech Futurists —

Today we highlight the following:

DIGITAL ASSETS: Tokenized Cash Fintech Fnality Raises $95MM Led By Goldman And BNP Paribas (link here)

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

DIGITAL ASSETS: Tokenized Cash Fintech Fnality Raises $95MM Led By Goldman And BNP Paribas (link here)

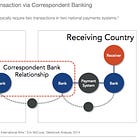

Fnality, which is building tokenized versions of major currencies collateralized by cash held at central banks, raised $95MM in a Series B funding round led by Goldman Sachs and BNP Paribas. This is a big deal — traditional FX transfers are expensive because currencies have to flow through the global correspondent banking system. A tokenized alternative would allow for a new payment infrastructure to function.

Global banks collaborate to fulfill their clients' orders, establishing direct relationships for major currency pairs. However, less frequently traded routes often involve multiple intermediary banks, resulting in increased costs and delays. Additionally, settlement risk, in which one party to a currency trade fails to deliver the currency owned, can result in significant losses and undermine financial stability.

“Almost 50 years after the Herstatt bankruptcy, nearly a third of deliverable FX turnover remains subject to settlement risk, according to new data from the 2022 BIS Triennial Survey. While this share is unchanged from the 2019 Survey, settlement risk has increased in absolute terms in line with the growth in FX turnover. That is, $2.2 trillion was at risk on any given day in April 2022, up from an estimated $1.9 trillion in April 2019.” - Bank of International Settlements (BIS)

Out of the fintech players, Wise is the standout disruptor in the FX market, increasing its share of US consumer FX volume between 2019 and 2021, and outperforming Moneygram, Western Union, and Paypal's Xoom. Looking ahead, the next decade will provide new competition, particularly as financial primitives like stablecoins and their surrounding infrastructure mature, introducing even more cost-effective and rapid alternatives.

DeFi, with its blockchain-powered, Payment versus Payment (PvP) transactions, ensures simultaneous execution of trade legs, eliminating credit risk during settlement. These “atomic” transactions are more reliable — at least theoretically — than the traditional rails, which depend on counterparty fulfillment. In addition, transaction costs will continue to decrease with scaling solutions like zero-knowledge rollups like Taiko and zkSync.

Fnality, a promising contender backed by many major banks, is built on the R3 Corda blockchain and operates through jurisdictional Fnality Payment Systems (FnPS), such as the Sterling FnPS, US Dollar FnPS, and Euro FnPS. These systems use a settlement asset for real-time wholesale payments with near-instant peer-to-peer settlement, collectively forming the Fnality Global Payments network. Fnality’s 'single pool of liquidity' concept is compelling because it enables real-time PvP capability and atomic Delivery versus Payment (DvP) transaction settlement. This allows participants to manage their cash and collateral portfolios from one central source, eliminating fragmented capital allocation.

Several proofs of concept have already been implemented, including a cross-chain FX settlement with Finteum which was executed in under 10 seconds; a DvP ‘repo’ settlement with HQLAX; and a tokenized securities issuance in partnership with Nivaura, which settled payments for a digital asset with central bank-backed currency. Many of these initiatives started in the 2019 “digital asset” and “enterprise blockchain” narrative cycle.

JPMorgan has also been implementing cost-effective cross-currency payments through initiatives like JPM Coin, and thereafter Onyx, which facilitates the transfer of dollars and euros globally. And while Fnality and JPM Coin may not introduce groundbreaking tech compared to Uniswap, they play a crucial role in meeting the institutional demands for robust payment infrastructure in cross-border transactions in emerging markets. These markets require a reliable on-chain cash asset with the credit risk characteristics of central bank money. Hence Fnality is important not only for establishing trust and transparency but also for implementing necessary regulatory safeguards.

👑 Related Coverage 👑

How to Reach 200,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ JP Morgan’s Onyx Teams Up With Avalanche To Streamline Portfolio Management - The Defiant

Standard Chartered Investment Arm Launches Tokenization Platform - CoinDesk

Infura Taps Microsoft And Tencent For Decentralized Web3 Infrastructure Network - The Defiant

Coinbase Launches On-Chain KYC Verification To +100MM Users - The Defiant

DeFi and Digital Assets

⭐ Blockchain.com Closes $110MM Raise - CoinDesk

⭐ Crypto Futures Funding Rates Normalize After Bitcoin Drops To $35.6K - CoinDesk

⭐ Tokenization Firm Superstate Gets $14MM Investment to Bring Traditional Funds On-Chain - CoinDesk

New Stablecoin Issuers Embrace On-Chain U.S. Treasuries As Collateral - The Defiant

Crypto Giant OKX Goes Live With Off-Exchange Derivatives Trading - CoinDesk

Sushi’s ‘Smart Pools’ Hope To Boost LP Efficiency - Blockworks

dYdX Tokenomics Scrutinized As Staking Goes Live - Blockworks

Blockchain Protocols

⭐ Comparing Layer 2 Launches: An On-chain Analysis Of Liquidity Providers - The Defiant

⭐ Chip Company Ingonyama Raises $20MM In Seed Round - CTech

Blockchain Startup Kinto Plans 'First KYC'd' Ethereum Layer-2 Network After Raising $5MM - CoinDesk

Terraform Labs Acquires Data Company Pulsar Finance - The Defiant

NFTs, DAOs and the Metaverse

Disney Reveals NFT Platform With Dapper Labs, Including Star Wars and Pixar - Decrypt

MakersPlace & Transient Labs Debut Digital Provenance Tech For Physical Art - nftnow

National Hockey League Comes Around To Digital Collectibles, Using Sweet Platform - CoinDesk

🚀 Level Up

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, monthly digital roundtable discussions with industry insiders.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands.