Long Take: Visa, Worldpay, and Nuvei settling transactions using stablecoin USDC on Solana

Understanding the importance of the financial and commercial networks involved

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Today we discuss the evolving landscape of networks in the financial and commercial sectors, focusing on the integration of traditional and emerging payment systems. We highlight the recent strategic move by Visa to facilitate transactions via Circle's USDC stablecoin on the Solana blockchain, involving acquirers Worldpay and Nuvei. We mention the significance of this integration in enhancing cross-border efficiency and transaction speeds, given Solana's high throughput capabilities, despite some concerns about its growth strategies and occasional system outages. Financial networks must adapt and integrate with emerging technologies to meet growing commercial demands and foster a resilient innovation ecosystem.

Topics: Visa, Circle, USDC, Wordplay, Nuvei, Ripple, XRP, stablecoins, payments technology

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Networks

That’s the magic word.

What does it really mean? Why is it such a coveted business strategy? What makes a network defensible?

Let’s give into the urge to talk about self-similarity and the recurring fractal patterns at the macro and micro levels. Simply, individuals comprise a whole — whether that is a collection of atoms, molecules, organs, organisms, firms, or societies. The relationships between the individuals determine the shape of their combination.

Those relationships could be functional, like the signals between neurons, or they could be more abstract, like the sharing between people in a social media network. Economies, comprised of productive agents working together through a complex system to make and consume things, and markets, composed of buyers and sellers maximizing utility across time and goods, are all examples of networked organisms.

Payment systems are the capillaries of the financial animal.

Individual nodes attach to the network to support its function. Buyers and Sellers make a market. The more buyers there are, the more sellers will want to join the market. The more sellers there are, the more buyers will want to join the market. These are called two-sided network effects, and they are as true for Robinhood and Coinbase as they are for Amazon and Shopify.

Once you have a network, it is very hard for a node to leave. Other networks may be of smaller scale, with a smaller set of customers. Game theory pushes everyone to stay in the best venue.

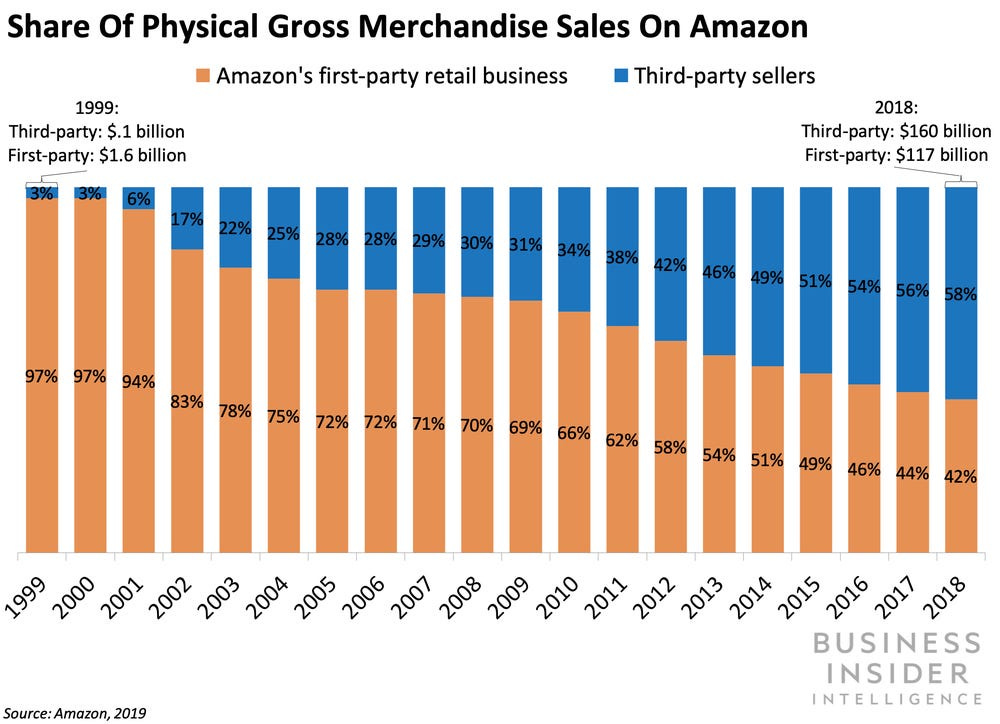

In much, though not all, of payments, we are looking at commerce as the engine for value transfer. A buyer of some good will want to join some network where there are many sellers of that good — Amazon sells not just one brand, but many, including those delivered by third party sellers leveraging its supply chain.

However, note that the commercial network is not the same as the financial network underpinning money movement. The money network is composed of institutions that are able to hold money — banks, largely — and the various payment processing interfaces representing buyers and sellers. Most of the time, these networks align. But some of the time, they don’t.

Imagine going into an open air market with amazing stuff that you want, but in a country where you don’t have a bank account and where they do not take your credit card. Or, imagine trying to use Ant Financial as your primary cash and payment account in a Western context that doesn’t accept Alipay. Your commercial demand is there, you are in the right economic network, but your financial network is not plugged in.

This is a problem to be solved. However, note that one demand pool supersedes the other. Commerce is the most important, because it reflects human needs, while financial capabilities are layered on top of that. Some company must map and acquire all of these merchants selling great things to plug into payment systems, creating payment networks, which in turn connect to the money at rest in banks.

This brings us back to reality.

Visa has just announced something of a watershed moment in connecting networks to networks. The company will settle transactions in Circle’s USDC stablecoin for acquirers Worldpay and Nuvei on the Solana blockchain. Yes, that sounds like a bit of world salad. So let’s pull it apart.

Our Parties

First, we have Visa. If you want to refresh yourself on the company, check out the below. In our podcast with the company, we have opened up these topics several times, and the discussion of Plaid’s aborted acquisition articulates the overall strategy.

Visa’s imperative is to be everywhere transactions happen, no matter what commercial or financial network that happens on. To that end, it is integrated into various card issuers and acquirers — tech and financial entities representing either the bank behind the buyer or the bank behind the seller / merchant. Each of those have their own network effects of course.

The important names here are Worldpay, part of the FIS family, and Nuvei. These two companies power the money movement behind the scenes and will have preferences as to how that money movement is funded. One approach is to user the cross border interbank payment system, paying wire fees and waiting for money to hop across borders. Another approach is to use a geographically-independent digital asset, like the USDC stablecoin from Circle. Here’s the key bit —

When consumers use Visa cards to make a purchase at any of the millions of Visa-accepting merchant locations around the world, they can experience the convenience of nearly instant payment authorizations. But what they don’t see is that the funds used for their purchase need to move between their bank (the issuer) and the merchant’s bank (the acquirer). This is where Visa’s treasury and settlement systems enable the clearing, settlement and movement of billions in transactions a day, making sure the correct amount in the preferred currency is received from the issuer and sent to the acquirer.

This process happens seamlessly between nearly 15K financial institutions and across more than 25 currencies globally.

So how big are these acquirers?

Nuvei is a $3.5B marketcap public company with approximately $50B of quarterly payments volume. On this, they generate $300MM of revenue per quarter, or a bit more than $1B+ of revenue per year — a 60 basis point take rate.