DeFi: Portal Network raises $34MM for a SWIFT-like network of decentralized exhange

The system of bridging is plagued by intricate and inefficient processes, high centralization, and the expense of synthetic asset replication

Hi Fintech Futurists —

Quick reminder before we dive into today’s newsletter. As a member of The Fintech Blueprint community, you receive a $500 discount off tickets to Fintech Meetup, taking place March 3-6 in Las Vegas. This is the largest meetings program in fintech PLUS Lex will be moderating a session on the state and future of crypto and DeFi.

👉 Get your tickets here before next Monday to qualify for the meetings program.

Today we highlight the following:

PROTOCOLS: Portal Network Raises $34MM To Bypass Bridge hacks - Will It Also Unify Modular Chains?

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

PROTOCOLS: Portal Network Raises $34MM To Bypass Bridge hacks - Will It Also Unify Modular Chains?

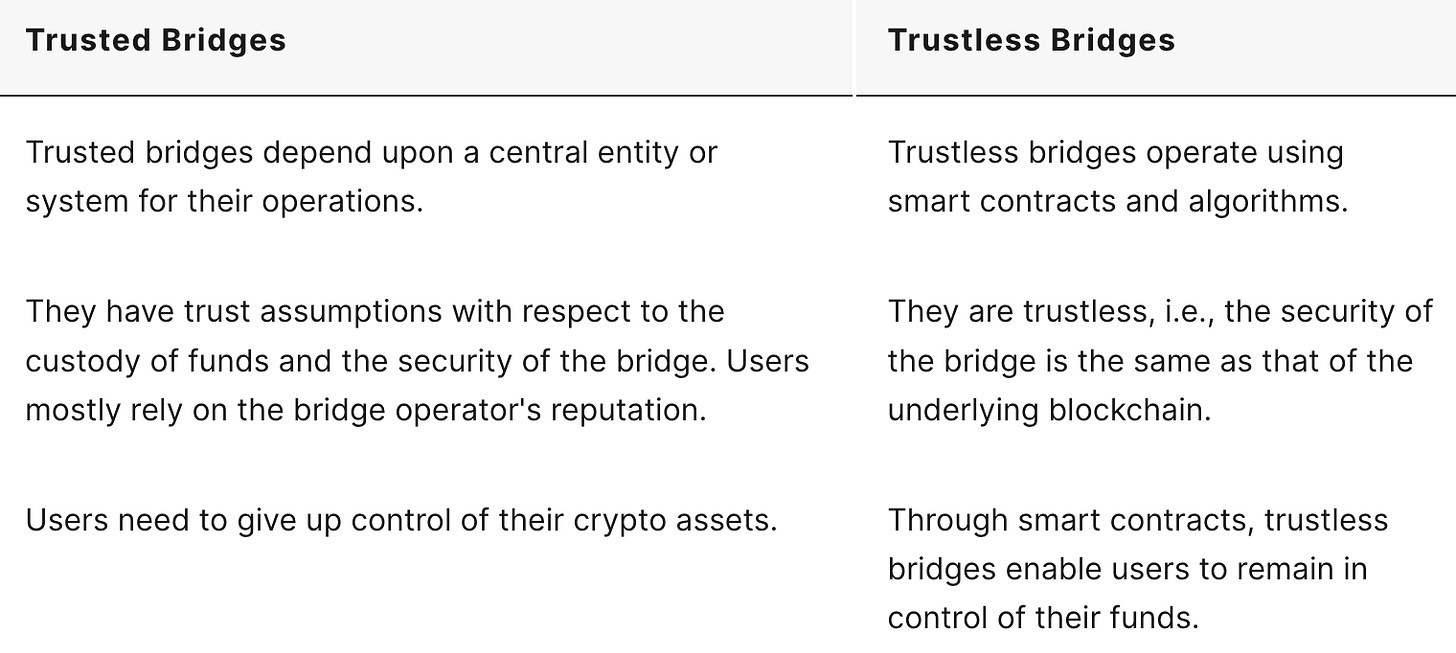

Decentralized Exchanges (DEXes), which were supposed to reduce the risks associated with Centralized Exchanges, actually introduced new challenges. With the introduction of multiple chains, users wanted to move tokens from one chain to another. Thus we found ourselves with cross-chain bridges. The system of bridging is plagued by intricate and inefficient processes, high centralization, and the risks of synthetic asset replication.

In 2022 alone, bridge hacks led to $2B+ in losses. Besides security concerns, which we touch upon in our Wormhole analysis, cross-chain bridges also tend to fragment liquidity across blockchains and single-chain DEXes. More specifically, in what is known as a lock-and-mint mechanism, a bridge locks up native assets from the origin chain and issues an equivalent amount of wrapped tokens (e.g., WBTC for “wrapped BTC”) on the destination chain, which essentially act as IOUs for retrieving the underlying asset on the origin chain.

Portal Network aims to provide a more secure infrastructure by enabling peer-to-peer (P2P) swaps of crypto assets across blockchains, and eliminating the need for wrappers, bridges, or centralized custodians. The idea is gaining popularity: Portal Network has raised $34MM in seed funding from Coinbase, Arrington Capital, OKX, and Gate.io.

Note that Portal Network is completely different to Portal Bridge, which is a cross-chain bridge, an important and ironic difference.

The Portal Network will function as the Staking and Swapping Layer, Interoperability Layer, and Execution Layer, with actual settlements occurring on designated settlement chains. For instance, a user might swap 18 ETH in exchange for 1 BTC on the Bitcoin chain, but the settlement would ultimately take place on Ethereum, which is the settlement layer in this case.

Portal's standout feature is its agnostic exchange contracts, allowing for the creation of multiple DEXes using a single protocol. This is known as Multi Chain Layer-2 AMM (MC-LAMM), which is essentially an Omnichain DEX. The non-custodial Portal wallet integrates with MC-LAMM, addressing concerns associated with custodial trusted bridges. If you’d like a more technical explanation, see here.

We recognize that this is pretty technical, so let’s put things into perspective by considering Cosmos’s Inter-Blockchain Communication (IBC) protocol. IBC enables interoperability with other Cosmos chains. However, this inherent modularity leads to fragmented liquidity across Cosmos chains. While IBC lets users move assets between Cosmos chains, these assets can't be used interchangeably unless they follow the same IBC channels. This means that Cosmos app-chains struggle to attract as much liquidity as more general-purpose L1 chains. Portal's MC-LAMM addresses this issue while providing incentives to drive volume and liquidity.

We are excited to see any new methods for cross-chain communication that do not rely on trusted bridges. That said, adding layers on top of layers, and coordination mechanisms, also adds risk and execution complexity. We are reminded of SWIFT, and how that network uses messaging to coordinate money movement across the many banks around the world.

Other projects in this space include Nomad, which takes an optimistic approach by assuming every message request is true and delegates the verification task to off-chain Watchers, as well as LayerZero and Chainlink’s CCIP. However, Portal takes a more forward-thinking approach. As more and more chains move toward a modular architecture, the challenge of building rollups on the different Data Availability layers (e.g., Celestia) will lead to a further fragmentation of liquidity. In essence, Portal is offering a potential solution to an impending issue.

👑 Related Coverage👑

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ How AI And DePIN Will Change Web3 - CoinDesk

Tether Reports Profit Of $2.9B In Q4 Attestation, With $5.4B In Excess Reserves - The Block

Celsius Network Starts $3B Payout After Emerging From Chapter 11 Bankruptcy - The Block

DeFi and Digital Assets

Vector Reserve Introduces ‘Liquidity Position Derivative’ - The Defiant

Jupiter Exchange Debuts $WEN On New Token Launchpad - nft now

dYdX Chain Enables Liquid Staking for DYDX Token - The Defiant

OKX Starts Inscription Support For Atomicals, Stamps, Runes and Doginals - CoinDesk

Blockchain Protocols

⭐ Binance Labs Invests In Bringing Ethereum Restaking To BNB Chain - The Defiant

⭐ Smart Contract Platform Axiom Raises $20MM In Series A Round - Cointelegraph

Gevulot Raises $6MM In Seed Funding For Blockchain Focused On Zero-knowledge Proofs - The Block

Immutable zkEVM Launches Early Access Phase On Mainnet - The Defiant

Squid Secures $4MM To Fuel Competition In One-click Transfers Between Blockchains - DLNews

NFTs, DAOs and the Metaverse

⭐ Magic Eden Reveals Rewards Program, Cross-Chain Wallet & Open Source Protocols - nft now

Musée d’Orsay Teams With Agoria for First Web3 Art Exhibition - nft now

Vermilion Studios Secures $7MM Funding For Innovative Social Party Game, Forgotten Playland - Bitcoin.com

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, digital roundtable discussions.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.